Travelers (TRV) reported earnings today, a 2 cent miss on earnings and a beat on revenue. Market reaction was negative, and misses the point: management is systematically raising rates, which will improve margins over time.

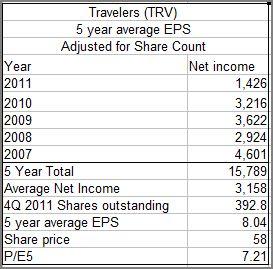

Meanwhile, here's a snip from my workbook:

Ben Graham suggested buying quality, dividend paying stocks when their P/E5 was less than 15. Travelers is trading for less than half that multiple.

The company has been buying back shares at discounted prices, reducing share count an average 7% per year. The result, as shown, is that when assessing normalized earning capacity by looking at historical results, it's important to adjust for share count.

I added to my exposure today and will add more if the stock continues to decline.

Disclosure: I am long TRV.