On Thursday, the Bureau of Economic Analysis released its first estimate of Q1 real GDP growth. The report showed that the US economy contracted at a 1.4% annualized rate in the first quarter, which immediately surfaced the idea that a recession was a genuine possibility.

Of course, economic growth has been in a declining trend for going on 13 months, but it took a negative GDP number for the economic reality to sink into the conventional wisdom.

It is true that the -1.4% number overstates the magnitude of the economic slowdown, but all the efforts to explain away the contractionary reading miss the more important point.

It is not the level of growth that matters, it is the direction. More specifically, it is the inflection points that cause a paradigm shift in investor psychology and turn bull markets into bear markets.

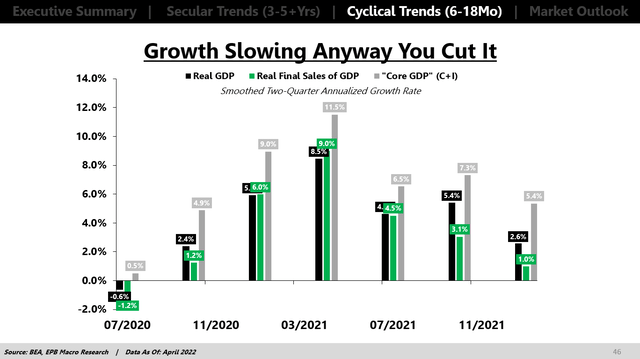

Whether we look at real GDP growth, real final sales of GDP growth, or core GDP growth, the message is the same: economic growth is declining. The inflection point in the economy happened last summer.

The absolute growth rate is different based on how many items you want to remove from the GDP calculation and what growth rate formula you use, but the takeaway and translation to asset markets is the same.

When economic growth is slowing, recession risk is by definition on the rise, which necessitates an increasingly defensive posture.

Of course, we'll need to keep watching the leading indicators of growth to know where we are heading from here and if another inflection point is on the horizon...

As a quick reminder, this is your last chance to subscribe to the premium EPB Macro Research service before the price increase.

On Monday, the price will jump from $799/yr to $999/yr.

If you're interested and want to learn more about how these inflection points in economic growth can help you prepare for major market events, then try a two-week free trial today so that you can lock in the $799 rate forever.