Dear readers,

Here, we are re-posting an article published for our marketplace service in case the holdings or our portfolios changes are of interests to some of you.

This article provides a summary of our Mar-1 Aggressive Growth Portfolio (“AGP”) maintenance together with our outlook forward. As usual, plz do not hesitate to reach out to us with any questions or comments via SA message or you can directly email us too.

Lucas and Grace

Founders of Envision Early Retirement

____________________________________________________________

For new members, we maintain our AGP regularly at the beginning of each month and we update the model portfolio right away after that. We then provide a commentary article like this one shortly afterward to detail the changes we’ve made, our key thoughts, and our outlook.

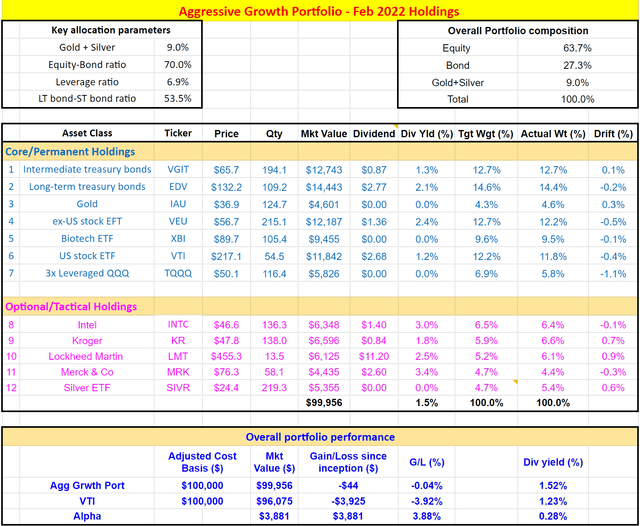

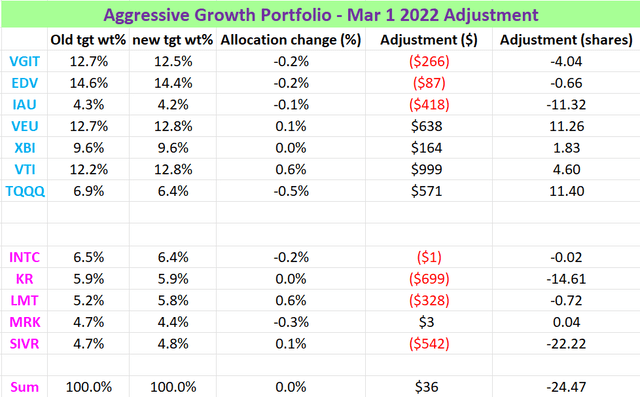

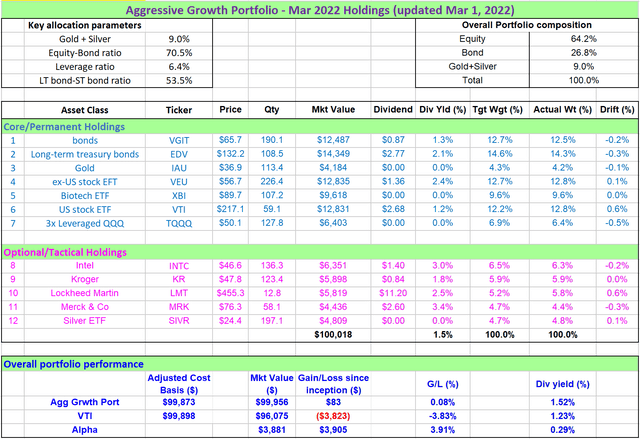

Chart 1 below provides a snapshot of the portfolio before the maintenance, chart 2 a snapshot of the portfolio adjustment that we made, and chart 3 the portfolio for the incoming month from March 1 to the 31st.

We first provide a brief summary of the changes here and will then provide more in-depth commentaries and our outlook in the next few sections.

- We performed our maintenance between 2pm and 4pm Eastern Time (we live in Richmond, Virginia) on Mar 1, and all the prices information was taken during that time.

- As of that time, the overall market lost about 3.9% since Feb 1, while our AGP gained about 0.1% when adjusted for dividends, creating an alpha of almost 4%.

- The outperformance this month was largely thanks to our balanced approach of including gold and high-quality tactical stocks. Gold and silver glitter during uncertain times like the past month. Our tactical picks (especially LMT) posted large price appreciation while at the same time paying high dividends.

- Our detailed transactions are in chart 2. As you can see, we are net sellers of treasury bonds, gold and silver, and some of our tactical holdings (more on this later). Overall, we are also a net buyer of the overall market – both the US overall market and ex-US market - because our yield spread show bonds have become less attractive relative to equity now than on Feb 1.

- For those of you who have been rebalancing your portfolio using a similar calculator as shown in chart 2, you know that a final check is always to see whether all the adjustments dollar amounts add up to 0. Because your money has to be conserved. And in this case, the adjustment amounts added up to a positive $36 (so we were lucky this time that $36 magically showed up in our account) It is due to some round of errors (buy-sell spread, et al). It is completely negligible for any sizable portfolio and such rounding off errors will even things in the long term. For example, if you recall, last time when we maintained our portfolio, about $13 disappeared on us due to such rounding off errors.

- Again, in case you have not noticed, each of our model portfolios has THREE tabs. The first tab shows the portfolio itself, the second tab shows the return tracking since February 1st (the launching date of our service), and finally, the third tab shows the performance of the portfolio since May 2021 (when we started writing and publishing our portfolio strategy on seeking alpha).

- Finally, you do not have to exactly match our allocations to the second digits. We do not do that ourselves. We set a minimum $ amount threshold and only execute adjustments above that amount. These small issues even out in the long run won’t hurt your performance.

Chart 1 – the AGP portfolio before the maintenance

Chart 2 - the portfolio adjustment that we made

Chart 3 - the portfolio for the incoming month from Mar 1 to March 31.

Cost basis adjustment

A quick note about our cost basis adjustment. You can skip this part if you are familiar with it already. But for new members - we adjust the cost basis due to dividends on a monthly basis (i.e., every time we maintain our portfolio) – regardless of whether the dividends are actually paid or not. We adjust them by the amount ACCRUED. For example, our AGP had an average dividend yield of 1.52% from Feb 1 to now. So this time we adjust the cost basis by 1/12 of 1.52% because we have been holding the portfolio for a month and so we’ve accrued 1/12 of the potential dividends (which reduces the cost basis of our initial $100k investment to $99,873 as you can see in chart 3). This is mostly for the sake of bookkeeping simplicity – so we do not have to keep track of the dividend dates of all the securities. At the same time, it also makes good sense for a few reasons:

1. We do not do automatic DIRP. We collect our dividends and reinvest them manually or spend them.

2. We are long-term holders to that the dividends can indeed be understood as accrued income even if we have not received them yet. Every additional day that we hold onto our securities, more income has been accumulated and our next payday also becomes closer.

3. Lastly, when you hold a dozen or so holdings that pay regular dividends, you pretty much constantly receive dividend payments every month (or even multiple payments every month), which again makes the monthly adjustment a sensible idea.

Additional thoughts and outlook

Going forward, we’d like to share the following thoughts:

- Leverage. We are maintaining a low level of leverage and low TQQQ weight because of the elevated volatility. As you can see from chart 2, even though we’ve added TQQQ, but its allocation weight has actually decreased from 6.9% to 6.4%. Our view is that the currently high volatilities are unlikely to subside in the near term due to several key uncertainties: the Russian geopolitical situation, Fed rate decision, and inflation data. And we won’t turn up our leverage till volatilities begin to quiet down.

- Silver-gold trade. As communicated to our members on Feb 23, the gold-silver price ratio was near the historical peak at that time and offers a good setup for a silver-gold trade play. We are glad that both gold and silver price have appreciated nicely over the past month (our IAU holding is up 6.6% and SIVR holding a whopping 10.9%). But the gold-silver price now is still very attractive for silver. That is why while we are holding the allocation to precious metals unchanged at 9%, and we are also holding our silver allocation unchanged. Again, you do not need the silver position if you do not want to. The AGP portfolio will work without the silver position. More details are in this article if you are interested.

- Lastly, Lockheed Martin (LMT). As communicated to our members on Feb 27 when its price was at $409, we strongly cautioned our members to DO NOT sell and take your profit now. This is the time that we have been anticipating ourselves for almost 3 years. And we are going to the profit its chance to run. The good part is that its price has gone up to $455 when we were rebalancing our AGP (almost by 12%). More details about LMT is in this article if you are interested.

The bad part is that we had to trim a few shares as dictated by our allocation model. As you can see in chart 2 above, even after we increased its allocation from 5.2% a month ago to 5.8% now (more than 10% increase) – the maximum bump as dictated by our allocation model, we still had to trim a few shares. Its price has just gone up too much too quickly. The reason is that our model shows that the overall market has become more attractive now, so we had to allocate more towards the US overall market and the ex-US market.

In the end and above all, we are disciplined investors. We only exercise our judgment within the guardrails provided by our own proven methods.