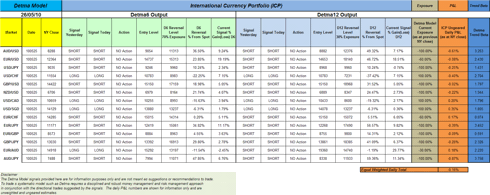

The Detma model remains long USD, long JPY and short EUR. No fundamental analysis was required for this positioning. Being a systematic model it just follows the price action. If the trends turn out to be fizzers, then they are forgotten and cast aside. If the trends turn out to be meaningful, as is the case now, then volumes of writings and analysis appear justifying the positions. In the meantime, isolated completely from all of this, the systematic models just continue to tick away.

The Detma model trend Beta chart shown above shows the movements away from the average trend of the last twelve months for each currency traded by the model. To better indicate the speed of some of these trends, yesterday's measurement is compared to the measurement at the beginning of the month. Any Beta measure over 2.5 is extremely "overcooked". The implications are that this trend is likely to either mark time, or reverse in on itself, to bring the Beta measure back down towards 1. If the Beta goes to zero it implies a reversal in trend.

The trend Beta charts for the EURUSD and AUDUSD above show that for daily measurements since 1 September 1995 (3,795 days)both of these currencies have had a trend beta > 3 on only 7 occasions. That equates to a probability of occurrence of around 0.18% - well inside the 3 standard deviation level of confidence.

Frank

Disclosure: Nil positions