The Daily Short: Monday March 23rd, 2015

Good Morning Gentlemen and welcome to the first ever publication of The Daily Short. My name is Dlerac LeGarre and I will be your curator and guide to this free look into the operations of a money manager. The Daily Short is a daily financial experiment {M-F} that will only profit from the downward move of an asset price. The Daily Short scans the market for the best shorting opportunity of the day, and passes it along to you, our readers.

Further, we track the life of every trade featured in our articles and present the results every Friday.

At the Daily Short we only look at one side of the market, which allows our readers to gain a unique decision making perspective.

GREK - Global X FTSE Greece 20 ETF AMEX

News:

1. ) Decoding the European Central Bank's Quantitative Easing Paradox by Jeffery Rosenburg

2. ) Emerging Market Taper Tantrum Possible, IMF's Lagarde Warns by Dimitra DeFotis

3.) Greece dodges bankruptcy as Eurozone grants bailout extension by Stephanie Johnson

Technicals:

1. ) Macro Trend: 50 day simple moving average

- The current price of GREK at 10.75 is below the 50 day moving average of 12.32

- Trading Significance: A moving average is simply a slowly updating summery of a dataset. Don't put to much faith in this statistic as it can mislead, but be wary to trade against its direction.

2. ) Oscillator: The Williams %R [15 day]

- The current Williams %R is -74.4

- Trading Significance: The Williams %R is a moving oscillator which measures the current price from the highest price in moving window, which for us is 15. An extremely high or low Williams %R is usually present in a "quickly moving" asset.

3. ) Micro Mean Reversion: Money Flow Index [15 day]

- The current Money Flow Index is 14.84

- Trading Significance: The Money Flow Index or MFI is a volume weighted RSI (relative strength index). The weak MFI with GREK, implies money is flowing away from this asset.

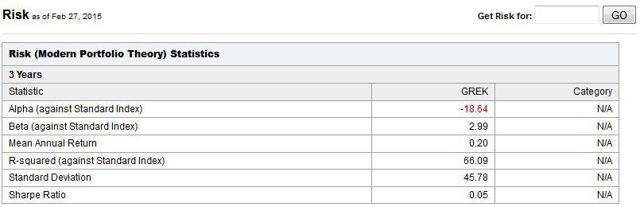

Fundamentals: (complements of Yahoo Finance)

The fundamentals all seem to be supporting a bearish case, except the mean annual return ( a lagging indicator).

Suggested Trade:

| Entry Date | 3/23/2015 |

| Entry Price | $10.75 |

| Exit Stop Loss | $11.51 |

| Exit Time Loss | 4/24/2015 |

| Exit Profit | $9.66 |

Current Book:

"Demystifying the Chinese Economy" by Justin Yifu Lin