As the economy improves and loan standards ease, loan growth offers profit opportunity for small and midsized banks like BBCN Bancorp (BBCN).

BBCN Bancorp is the former Nara Bancorp, founded in 1989 and headquartered in Los Angeles, California. The bank operates 44 branches, mostly in California, and 5 loan offices, primarily in the West. The bank's focus is on commercial markets and California accounts for 60% of BBCN's loan portfolio.

The key drivers supporting future growth for BBCN include:

- Additional growth in commercial demand in its core California market.

- Expansion into new markets including Seattle and Chicago.

BBCN's niche market.

BBCN is a specialty bank catering to Korean Americans residing in the United States. The bank's market is similar to competitor Wilshire Bancorp (WIBC), which I discussed here,

Korean Americans are the 7th largest immigrant group in the country and the market serving them is growing. Over 1.3 million people of Korean descent live in the United States thanks to a 27-fold jump in immigration since 1970.

California offers the largest concentration of Korean Americans and the Golden State expects travel to and from Korea will climb 6% this year, resulting in Korean tourism spending growth of 8.7%, or nearly $1 billion. California expects this trend to continue, with Korean travel climbing 24% over the next three years.

Some of the travel increase will be tied to the Korean Free Trade Agreement signed by the U.S. in 2012. Currently, trade between the two countries is roughly $100 billion and the agreement is likely to spark new Korean oriented businesses in California, supporting financial services demand.

BBCN is targeting other geographic markets too.

BBCN has been in the important Korean-American New Jersey and New York markets for years. Bergen County towns, including Palisades Park, are heavily populated with Korean Americans. From 2000 to 2008, the percentage of Palisades Park residents who were Korean climbed from 31% to 44%. And, many Koreans - some 70,000 - live in Queens, New York too.

BBCN, recognizing an opportunity to serve this community, operates a branch in Fort Lee and another in Edison, New Jersey. The bank also operates 5 branches in New York City.

Last year, the bank acquired Pacific International, a bank serving Seattle's Korean market through 6 branches and 1 loan office. BBCN expects the Pacific deal to add $0.02 to 0.04 per share this year.

The bank is also acquiring Foster Bancshares in Chicago, which immediately makes BBCN a market share leader for the windy city's Korean market. The deal also gives it exposure to the Washington, DC, market.

The acquisition of Foster, the 9th largest U.S. bank serving Korean Americans, adds $412.6 million in assets, including $326.9 million in loans. It also gives BBCN $357 million in deposits and 8 branches. An additional branch is located in Virginia. After the deal is completed, BBCN's asset will increase to $6.2 billion and the bank will operate 54 branches. Importantly, the deal was accretive and is expected to add $0.07-$0.08 cents per share to 2014 earnings.

"As the logistical hub to commerce, finance and trade in the Midwest, the Chicago market represents a large and solid base from which we see longer term opportunities to grow our franchise. In addition, we are excited to be expanding our banking footprint into the D.C. metropolitan area, a region that represents one of the fastest growing populations of Korean-Americans in the country," said Chairman Kevin Kim when the deal was announced.

The following chart shows BBCN's post-merger footprint.

By the numbers.

During Q2, BBCN generated net income per share of $0.29, or $22.7 million. That was 30% better than Q1 and 45% ahead of the prior year.

Net interest income was up 4% quarter-over-quarter thanks in part to a $100 million increase in average loans outstanding tied to its acquisition of Pacific International. Non-interest income was led by a 22% lift in SBA loan sales, which produced a net gain of $33.8 million in the quarter versus $25.7 million in Q1.

The bank's efficiency ratio was 47.34% in Q2, well below its peer average of 63.11%. BBCN's return on average assets and return on average equity improved to 1.54% and 11.58%, respectively. That outpaces the national average, which clocked in at 1.12% and 9.9% in Q1, respectively.

BBCN results have been weighed down - just like the entire industry - from challenging spreads tied to anemic yields and increased competition. Specifically, the bank continues to navigate anemic loan yields in commercial real estate, one of the bank's biggest markets.

That said, loan production was in line with Q1 at $208 million, with 75% of those loans being for commercial real estate. $42.7 million were small business association loans, for which demand historically picks up in the final two calendar quarters of the year - suggesting upside in the back half of this year.

Interestingly, the loan production total for the quarter would have been larger, but $40 million in loans expected to close in the quarter didn't close until July. This suggests Q3 got off to a solid start.

Outside of commercial real estate, 22% of the remaining new loans were commercial and industrial loans and the small remainder of new loans were consumer. Across the C&I loan portfolio, 31% are for wholesale businesses in a nod to potential upside tied to the Free Trade Agreement.

Overall, the bank finished the quarter with $5.8 billion in assets and $4.5 billion in loans, up 5% year-to-date.

The bank also finished Q2 with $4.5 billion in deposits. The deposit mix remains favorable for cheap funding costs with non interest earning deposits representing roughly 26% of total deposits in Q1, up from 25% exiting 2011. As a result, deposit costs have shrunk to 0.61% from 0.86% during the period. Potentially, there's more room to grow given 42% of deposits remain in CDs.

The biggest demand in CRE loans came in hospitality and retail sectors. Those two sectors represented 39% of BBCN's CRE portfolio exiting Q1.

That loan growth was mostly offset by a higher rate of pay-offs in the quarter. In Q2, $140 million were paid off, up from $78 million in Q1. However, the uptick in rates suggests the refinancing cycle is near its end so that drag should disappear as we move further into the year.

Also, the bank continues to do a solid job on maximizing loan yield despite the competitive market. During the quarter, the average loan yield on new loans came in at 4.71%, up 19 bps from Q1. That helped support net interest margins, which were flat in Q1 at 4.49%. Core net interest margins were a solid 3.86%. Both outpace the national average of 3.21% in the first quarter.

Credit quality remains solid. Nonperforming loans total 2.21% of total loans, or 1.87% of total assets and net charge offs of $2.3 million were just 0.21% of total loans in the quarter, down from nearly $4 million a year ago. For comparison, the industry average net charge offs were 0.84% in Q1.

Non-interest expense should benefit going forward as the quarter was impacted by branch consolidation and lease terminations.

California's rebound is good for loan demand.

While BBCN is working to expand its geographic reach, it remains tightly tied to the California market. That means economic activity in California will continue to have an outsized affect on the bank's results. Luckily, the state's gross domestic product is approaching pre-recession highs, boosting demand for commercial and industrial loans and real estate.

GDP growth has supported a return of jobs in the state, which has dropped California's unemployment rate from a peak north of 12% to 8.5% in June. In Los Angeles County, June's unemployment rate was 10.2%, down from 11.1% a year ago.

According to the latest Allen Matkins/UCLA Anderson commercial real estate survey, commercial markets are expected to improve further over the coming three years. The May 2013 report suggests accelerating commercial building until 2016 and 2017. Importantly, declining vacancy supports multi-family construction in Los Angeles, according to the survey. That would be welcomed news for BBCN given its heavy CRE focus.

The final word.

The bank's forward price to earnings ratio is 12.76 times and its trailing price to earnings ratio is 14.5 times.

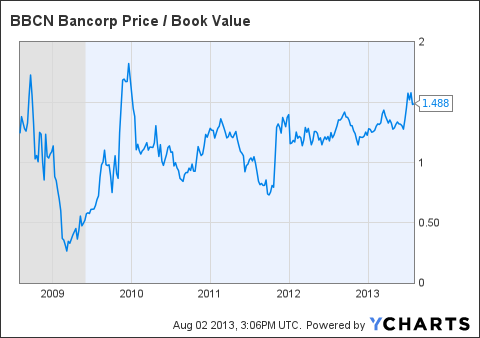

Its price to book value is just shy of 1.5 times. That's a bit on the high side since the recession low. But it suggests investors may have an opportunity as shares dip in August following their recent run higher.

BBCN Price / Book Value data by YCharts

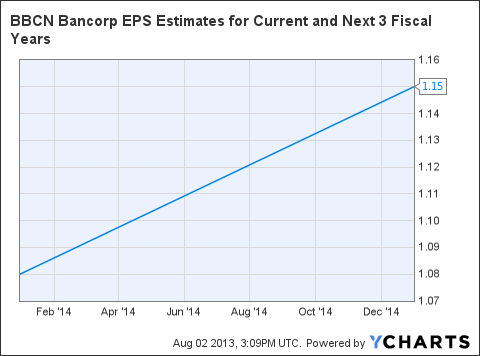

As for earnings growth, year-to-date results have encouraged analysts who have taken their earnings per share forecast for BBCN up to $1.08 and $1.16 for 2013 and 2014, respectively, from $1.04 and $1.13 60 days ago. If the bank can execute on its new mergers, there could be additional upside heading into year end.

BBCN EPS Estimates for Current and Next 3 Fiscal Years data by YCharts

That would be good news for investors given the bank redeemed its TARP capital allowing it to reinstate its dividend in Q4.

The bank's strength over the past few quarters supported a 50% increase in its dividend to $0.075 per share this quarter, giving shares a dividend yield of 2%.

Overall, California's recovering economy and the potential to grow assets in new markets including Chicago and Seattle position the bank nicely.

The specialty Korean American niche should help commercial demand too, particularly as trade with Korea ramps up following the Free Trade Agreement. Combined with solid credit quality, improving loan demand should help BBCN return more money to shareholders, suggesting now may be a good time to buy shares.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in BBCN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.