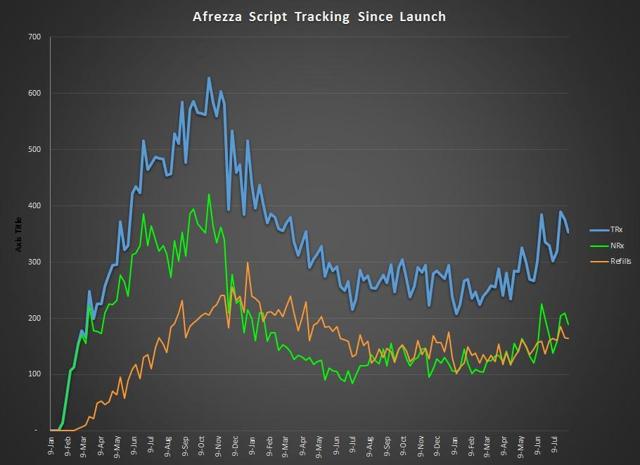

MannKind (NASDAQ:MNKD) has had an interesting week. The company reported its Q2 numbers on Monday after the close, and for the first time gave guidance on sales. Today the script number from Symphony were published, and the result were scripts in the mid 300s. This is down from last week, which was down from peak sales two weeks ago.

Chart Source - Spencer Osborne

Chart Source - Spencer Osborne

I have long stated that the rise in sales in Q2 is good progress to see, but that we did not yet have the cost data to assess what that progress means. A few pieces of my commentary on that matter are quoted below. From "MannKind - Afrezza Scripts Remain Above 300 As Company Announces New CCO," published July 14:

Improvement has been seen in recent weeks, but the big question is whether that improvement is being seen with a similar number of reps. Investors should be familiar with the term "the cost of doing business". Did we see these improvements by increasing the sales force by a big percentage? If that is the case, the value of expansion may not justify the results. Did we see these moves on a sales force of a similar size? If so, then perhaps the company has figured out a system that can lead to growth. I suspect that we investors will find it hard to obtain that information.

From "MannKind: Afrezza Scripts Stable At A Bit Above 300 - Will Ads Help?," published July 21:

One big question savvy investors may be asking is the amount of effort to deliver the numbers we are seeing. A year ago the contract sales team had about 45 members and delivered 235 scripts. The current direct-hire sales team numbers at about 100 and the sales were 320. I am certain that MannKind is monitoring the cost side of the equation and performing a cost/benefit analysis. In my opinion it is likely that what is happening on such an analysis is very frustrating. Seeing year over year growth of 37% is great in a vacuum, but what we really want is to grasp the cost of that added revenue.

And from "MannKind: Afrezza Sales Spike, Giving Cautious Optimism," published July 31:

The caution here is how the growth is happening. Management indicated that it was increasing sales reps. It will not be until the next call that we can really assess the effectiveness of the average sales rep vs. the revenue derived.

When MannKind offered up its quarterly results, we were able to better assess the cost side of the equation. Selling and marketing costs increased from $7.65 million in Q1 to $11.47 million in Q2. That is an increase of 50%. The company increased script count by 23% and cartridges by 24%. Net revenue increased by about 29%, while gross revenue increased by 60%. If you dig into the numbers, the cost of growth in Q2 was quite expensive. In fairness, marketing campaigns and new sales reps require time to deliver a good ROI.

In my opinion the older packages of Afrezza that contained fewer cartridges have worked their way out of the system, and as we move forward we will see the average cartridges per script get more steady, though we should reserve some growth if MannKind is able to drive new script growth. The reason for this is that the titration pack contains more cartridges than other packs.

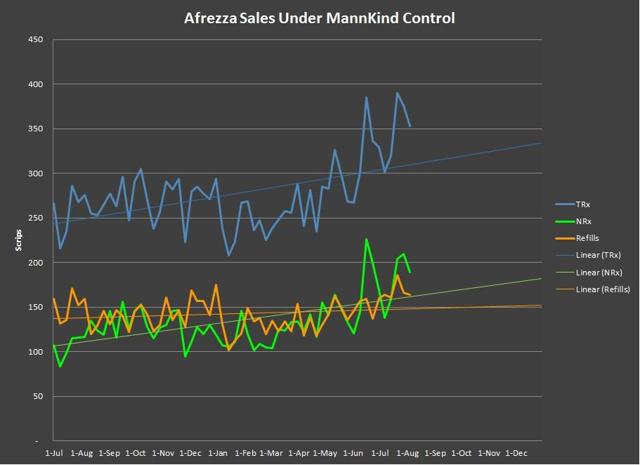

Overall sales while Afrezza has been under MannKind control have had a more modest pace than the street would like to see given the cash situation at the company. Q2 was the best quarter to date, and Q3 is pacing ahead of Q2. Progress is happening, but the speed of progress keeps questions in the minds of savvy investors that dig into the numbers.

Chart Source - Spencer Osborne

Chart Source - Spencer Osborne

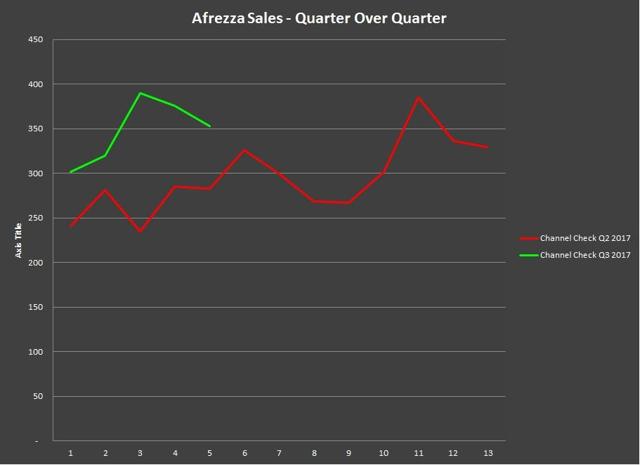

On a quarter over quarter basis we are seeing sales in Q3 continue to deliver positive results. The comparison has the current quarter pacing 31.4% better than what was delivered in Q2. We know that Q2 script growth over Q1 was 29%. The low end of MannKind sales guidance requires a growth rate higher than we are currently seeing. The good news is that growth is happening, and that it appears that the company will be able to deliver more scripts in the current quarter than ever before. The caution will continue to be assessing the cost of growth.

Chart Source - Spencer Osborne

Chart Source - Spencer Osborne

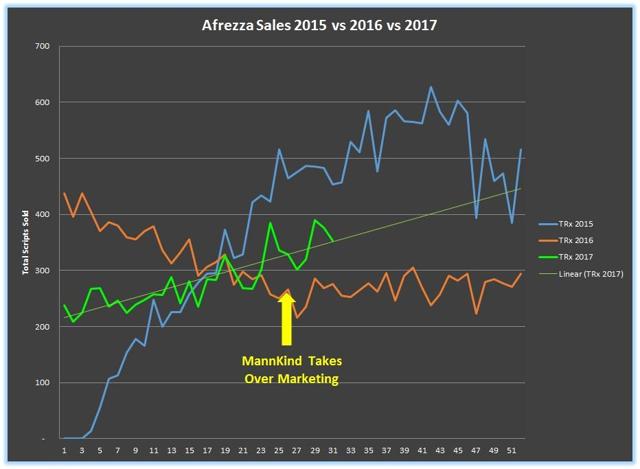

On a year over year basis the performance remains in positive territory. This is essentially an assessment of MannKind vs. MannKind with the caveat that it was a smaller contract sales force vs. a larger MannKind employed sales force. Sales in Q3 of 2017 are pacing 35.91% higher than sales in Q3 of 2016.

Chart Source - Spencer Osborne

Chart Source - Spencer Osborne

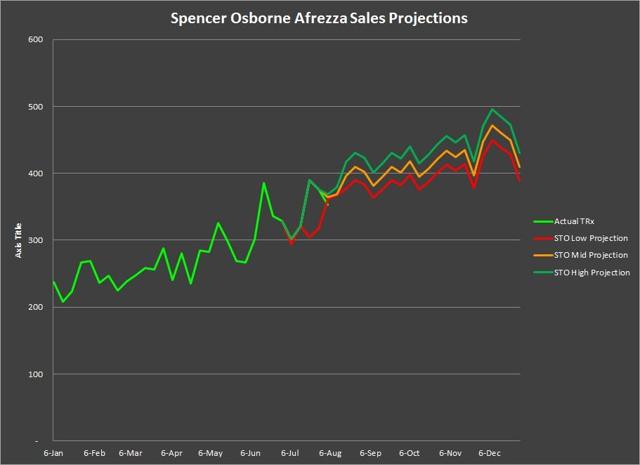

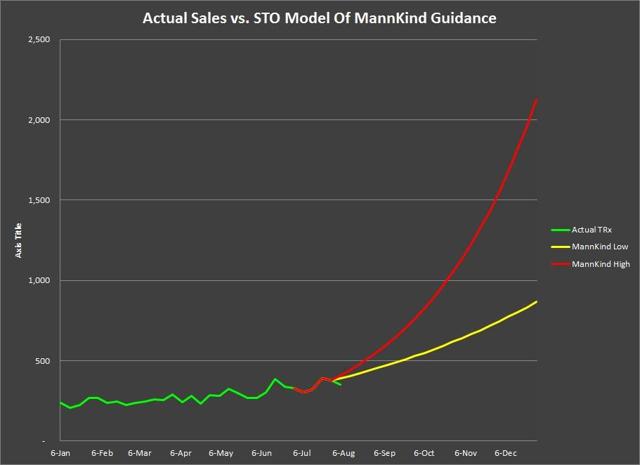

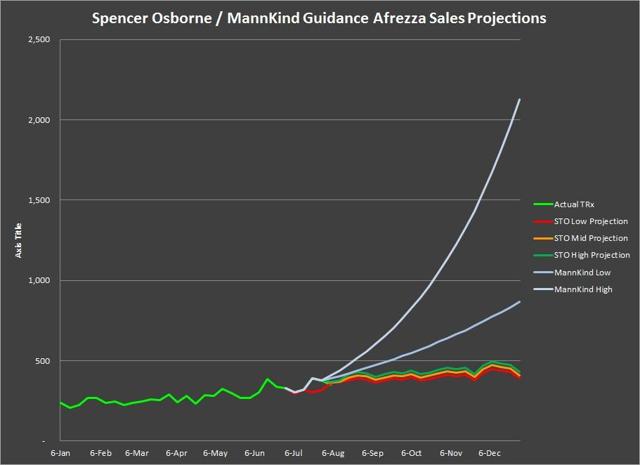

Projections in this article series will now get much more interesting because MannKind has now offered up some sales guidance. As readers know, I have outlined my own projections for the remainder of the year. MannKind offered some script revenue guidance. The company guides that Net revenue will be between $6 million and $10 million for the second half of 2017. I took that guidance and translated it into sales using the most recent net sales per script figures. I did adjust my guidance slightly upward last week.

The sales of Afrezza are tracking within my model and below the model I estimate is needed to meet MannKind guidance. The charts below will now include my model, my MannKind Guidance model, and a combo chart with both.

Chart Source - Spencer Osborne

Chart Source - Spencer Osborne

Chart Source - Spencer Osborne

Chart Source - Spencer Osborne

Chart Source - Spencer Osborne

Chart Source - Spencer Osborne

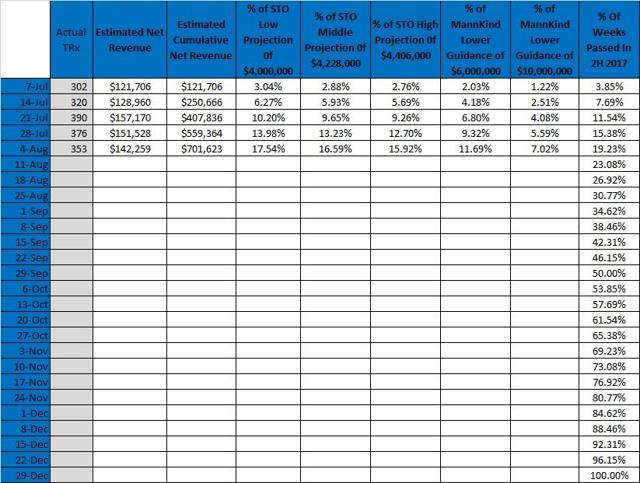

In my years of covering equities I often see investors that are unwilling to set realistic expectations and hold themselves accountable. MannKind offering guidance actually will force investors to assess this company in some fashion. In the first half of the year the company brought in $2.7 million in net revenue from Afrezza sales. The second half guidance is at $6 million on the low end and $10 million on the high end. To simplify this, I will use dollar figures and weeks. The second half of the year has 26 weeks. Thus far we are 5 weeks into the second half of the year. That means that we are 19.23% into the guidance period. My estimated net revenues have MannKind achieving 11.69% of the lower guidance of $6 million, and 7.02% of the higher guidance. I will also include the dollar figure for my low, middle, and high projections, which are $4,000,000, $4,228,000, and $4,406,000 respectively. What investors want to see is the percentage of net revenue compared to guidance be close to the percentage of weeks that have passed in the second half of the year. The bigger the spread between these numbers, the more sales have to increase in subsequent weeks in order to hit the projection or guidance.

Chart Source - Spencer Osborne

Chart Source - Spencer Osborne

Looking at the cash situation is not a fun exercise for many investors. That being said, it is critical that any investor keep a close eye. Cash has been a sticking point and overhang on this equity for quite some time. I have updated my cash tracking chart to reflect the latest numbers that were made available in the conference call earlier this week. My cash estimates have been very close over time.

I estimate that MannKind finished the week of August 4th with approximately $35.3 million in cash. This month is critical because we have not yet been able to confirm that the $10 million due to Deerfield has been extended from August 31st of this month or October 31st. I have assumed that MannKind will qualify to extend the payment until December 31st in my cash projections.

As most readers know, Deerfield requires that MannKind have $10 million cash on hand at the end of August, the end of September, the end of October, and the end of December. My estimates are tracking such that MannKind could fall outside compliance with Deerfield at the moment they pay the company $10 million in October. For this reason, it is my belief that the company will seek to use an equity solution to pay down the debt due. Further, I suspect that the company may try to use preferred shares to accomplish this task.

By any reasonable assessment, the bottom line is that a cash infusion is needed pretty quickly. I am oft asked what would make me more bullish on this company. My answer has been consistent. If MannKind could get 1 years worth of cash in its coffers, it could attempt to strongly market Afrezza in a manner that allows the potential for growth. I would need to see 1 years worth of cash, and a sales trajectory that points to wider adoption of the drug within a short window of time. This equity has bullish and bearish moments like any equity, which makes it attractive to active traders.

With the script and cash discussion complete, it is time to look toward some other news items. Maxim Group has now initiated coverage on MannKind with a $4 price target. That represents a substantial perceived upside from the current trading price of $1.20. Maxim analyst Jason Kolbert states that it has arrived at its price target because, "Afrezza could shift the paradigm in diabetes management and with the inhalable insulin now in the hands of a very capable management team, the focus is on execution."

This new coverage is positive, but will likely cause great debate among the bulls and the bears. Having not seen the full report, I can make no comment on the methodology or model used by Maxim to arrive at its target, nor the time-frame in which the analyst feels that such a price target can be achieved. Some will speculate that Maxim may be waiting in the wings to handle a stock offering, but that is simply speculation.

I always tell readers that I am realistic. The biggest reality check I see with this equity is the severe overhang related to cash. The second biggest reality check I see is how long this product has been on the market and how slow any sales traction is. The company has expressed that it feels a possible label change could be a huge catalyst. Managements hopes that the FDA will consider creating a new category of insulin as "ultra fast". A new label would certainly help the sales team in its job. It would help doctors and patients use the product better. It could even help get better insurance coverage, which could cut down heavy rebate activity. Label news is expected in September, so investors will want to be aware of that binary event as it could see the stock make a decent short term move on that news. Stay tuned.