Alleged inability to organize a chook raffle will be mentioned in this week's

Resource Sector Digest.

(Vol. 107 - September 25, 2017)

Brought to you by Itinerant and The Investment Doctor.

Before we start, please take a moment and consider our cordial invitation to join Itinerant Musings for exclusive access to actionable research on mining and energy stocks.

In case you missed out on previous editions of this newsletter, simply click here, here or here to catch up.

Setting The Scene

A couple of weeks ago, while discussing McEwen Mining's (MUX) recent PEA on the Los Azules project, and also Bear Creek's (OTCQX:BCEKF) latest study on the Corani project, The Investment Doctor quipped on the Itinerant Musings chat board:

And as if on cue, last week's news release by Western Gold and Copper (NYSE:WRN) delivered another instance seemingly confirming the good Doctor's observation. In this particular case, the company delivered an update on the Casino project up in the Yukon, including a "Pricing Review" of the 2013 feasibility study of this open pit bulk mining project. And lo and behold, the review confirmed the feasibility study's base case after-tax IRR of 20.1%.

Apparently, this confirmation was arrived at using current commodity prices. And that's a claim worth taking note of, as the original FS used price assumptions of $3/lb copper; $1,400/oz gold - that's considerably higher than current metal prices of $1,300/oz gold and $2.90/lb copper.

We also found this presentation given by CEO Mr. Paul West-Sells back in June re-iterating his view that the Casino deposit was economical at prevailing commodity prices, showing results of yet another price review using $1,250/oz gold and $2,50/lb copper - resulting in an IRR of 21.7%.

So, in essence, we are presented with three data points for the Casino project IRR. Each one uses a different price deck ranging from $1,250/oz to $1,400/oz gold, and $2.50/lb to $3/lb copper. And all of them arrive at an IRR of just over 20%.

We reckon The Investment Doctor has a point.

Drill Result Summary

- Marathon Gold (MGDPF) has drilled a hole through the guts of the Leprechaun deposit on its namesake Valentine Lake property. Not unexpectedly, the results were spectacular and included 3.42g/t over 181m.

- Vendetta Mining (OTCPK:VDTAF) reported the discovery of another high-grade zone at its Pegmont zinc project in Queensland, Australia. This project is fast shaping up as the premier developed zinc project, and we are already keen to see the next resource update before the end of this year.

- Torex Gold (OTCPK:TORXF) continues to hit high grades in the Sub-Sill zone at the El Limon-Guajes Mine in Mexico. A 40m step-out hole returned 41.4g/t over 19.3m.

- Osisko Mining (OTCPK:OBNNF) reported the usual impressive results from Winfall proper, and also from the Lynx zone. Just a stone's throw to the South Bonterra Resources (BONXD) and Beaufield Resources (BFDRF) both reported promising drill results on their respective sides of the fence.

- GT Gold (GTGDF) continued to affirm its "darling of the hour" status with more high grade drill results from the Saddle project in the Golden Triangle of BC; 5.84g/t over 20.71m should keep the market interested for now.

- Balmoral Resources (BALMF) has discovered yet another new zone at the Bug Lake project not far from the Detour Lake gold mine. The company has received a permit to drill 19 additional holes to test this discovery.

- Victoria Gold (OTCPK:VITFF) reported results for the first 11 holes to be drilled at the Spinach target on its Dublin Gulch project, only half a kilometer from the Olive-Shamrock deposit. Reported intercepts are relatively close to surface, and have decent grades over good thickness.

Wheelings And Dealings

McEwen Mining has closed a $46.6M bought deal at a price of $2.25 per share. Existing shareholders were less than impressed selling the stock off to a 52-week low. New shareholders are presumably equally unimpressed as shares are already trading 10% below the placement price.

Asanko Gold (AKG) has expanded its property holdings around the Asanko mine in Ghana. The acquisition from AngloGold Ashanti (AU) drew the following comment on the Itinerant Musings chat board:

Falco Resources (OTCPK:FPRGF) will be spending C$22.5M on relocating various facilities currently owned by Commission Scolaire Rouyn-Noranda. These facilities are currently located on land required to develop the company's Horne 5 project.

Falco Resources (OTCPK:FPRGF) will be spending C$22.5M on relocating various facilities currently owned by Commission Scolaire Rouyn-Noranda. These facilities are currently located on land required to develop the company's Horne 5 project.

Sandstorm Gold (SAND) has amended its gold stream on the Bachelor Lake mine owned by Metanor Resources (MEAOF). Sandstorm will collect another 12,000 ounces under the existing 20% stream, and then switch to a 3.9% NSR which will also include the junior's Barry project in the Urban-Barry camp. We wonder if this deal might be a pre-cursor to another transaction, and note the prominent stake Kirkland Lake Gold (KL) has recently acquired in Metanor.

Other News

Tahoe Resources' (TAHO) latest news release included a carrot and a stick for investors. The carrot consisted of an increase of the gold production guidance for the present year, and news about the loss of the permit to export concentrate from Guatemala represented the stick. The market chose to focus on the carrot.

Alio Gold (ALO) is moving forward with the Ana Paula gold project in Guerrerro State, Mexico. The company has received the Change of Land Use permit for the future mine, and is evaluating financing options for the project. Furthermore, the company has started construction of the underground decline and has started a surface drilling program on the property.

Mr. Frazer Bourchier is moving from Nevsun Resources (NSU) to Detour Gold (DRGDF) remaining in his role of COO in his new company. His open pit experience at Bisha should serve him well at the Detour Lake mine, and hopefully the search for his successor won't disrupt work on the Timok PFS for Nevsun.

Wesdome Gold (OTCQX:WDOFF) also announced a management re-shuffle with three executives departing, and only one being replaced. The market rewarded the company with a 10% pop on the day.

First Mining Finance (OTCQX:FFMGF) released results for a PEA on the Springpole project in Ontario. Economics look highly attractive on the surface, sporting a 26.2% after-tax IRR, and an NPV of $1.1B for an initial capex of just $703M. The market shrugged; perhaps it has woken up to the fact that this project is located under a lake. The budgeted $32M might get the dykes built and the water pumped out, but we submit it will take more than the planned couple of silt entrapment curtains to get this project permitted, if at all.

Nevada exploration company Gold Standard Ventures (GSV) has released a maiden resource estimate for the sulphide mineralization at North Bullion, and the oxide mineralization at Sweet Hollow on its Railroad Pinion project on the Carlin trend. The indicated portion at Sweet Hollow is small at 90,100 ounces but comes at a decent grade. The company seems to suspect a large system at North Bullion, but further drilling will be required to confirm this suspicion.

Cardinal Resources (CRDNF) also updated the resource estimate for its Namdini gold project in Ghana. 4.6M ounces in the indicated category, plus 3.3M in the inferred category are the sort of numbers majors will be looking for. The market has treated shareholders well, and Itinerant Musings subscribers have earned their original investment back six times over by now.

Primero Mining (PPP) (PPPMF) issued more bad news on various corporate matters. Due to continued difficulties with ramping San Dimas back up the company had to revise gold production guidance once again. And with AISC guidance of $1,200/oz to $1,300/oz, this gold won't generate much free cash flow either. Perhaps also of note is the language used with regards to the sale of the Black Fox mine to McEwen Mining. Both companies have recently been using wordings suggesting a possibility the deal might not close after all.

Fortuna Silver (FSM) informed markets of its positive construction decision for the Lindero project in Argentina. With regards to funding the project the company stated:

"Initial capital of $239 million is going to be comfortably funded from our approximately $190 million cash position, available lines of credit and projected cash flows."

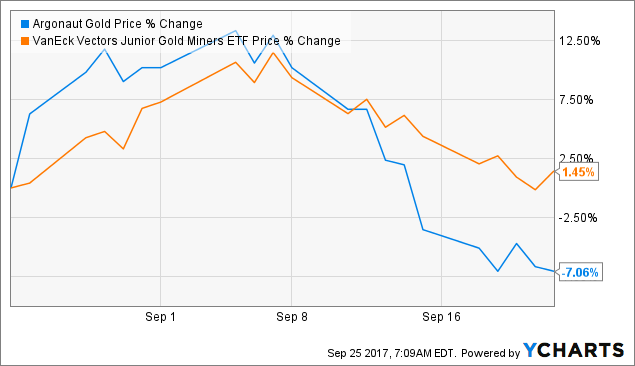

Argonaut Gold (OTCPK:ARNGF) had a good week. It started off by an announcement of the first gold pour at San Augustin, and was followed by another news release summarizing a successful year of brownfield driling in a comprehensive resource update. CEO Mr. Pete Dougherty assured investors that these resource updates will "extend the mine lives at both El Castillo and La Colorada." The market had expected more.

Pretium Resources (PVG) reassured investors that all was proceeding according to plan at the Brucejack mine, and steady state production could be expected by year-end. The company also believes the precarious working capital position will be resolved by the end of this quarter.

And with this last item, we have run out of news worth reporting in this place. We bid our farewell, as always in great hope to see youse all next week, when The Investment Doctor will be taking care of the next issue of this newsletter.

And Before We Go...

Please consider a subscription to Itinerant's Musings, with exclusive access to our small and mid-cap ideas, a lively community, and regular commentary and outlook on metal prices. We'd love to have you on board.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.