REIT Rankings: Single-Family Rentals

In our REIT Rankings series, we introduce and update readers each of the residential and commercial real estate sectors. We rank companies within the sectors based on both common and unique valuation metrics, presenting investors with numerous options that fit their own investing style and risk/return objectives. We update these rankings every quarter with new developments for existing readers.

We encourage readers to follow our Seeking Alpha page (click "Follow" at the top) to continue to stay up to date on our REIT rankings, weekly recaps, and analysis on the REIT and broader real estate sector.

Single-Family Rental Sector Overview

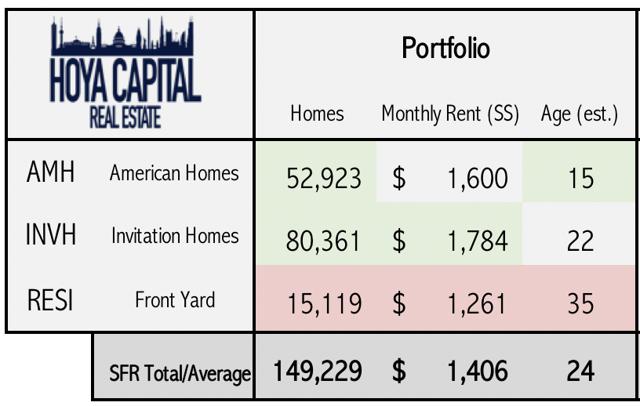

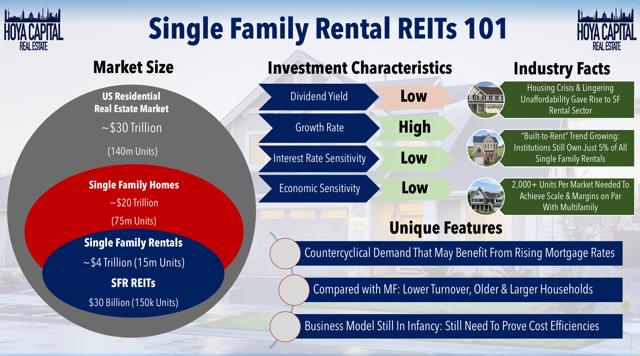

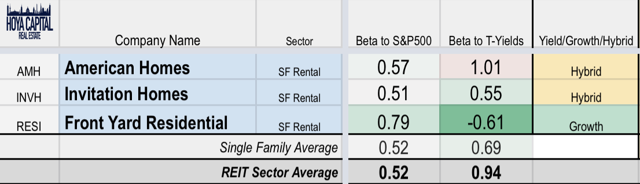

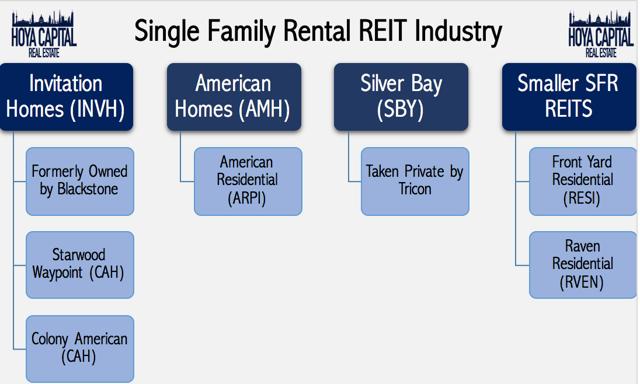

Single-Family Rental REITs comprise 2% of the REIT ETFs (VNQ and IYR). Within the Hoya Capital Single-Family Rental Index, we track the three largest SFR REITs which account for roughly $20 billion in market value: American Homes 4 Rent (AMH), Invitation Homes (INVH), and small-cap REIT Front Yard Residential Corp. (RESI). Not included in our index is micro-cap REIT Raven Housing (RVEN) and Canadian firm Tricon Capital Group (OTC:TCNGF), which also owns a large portfolio of US SFRs.

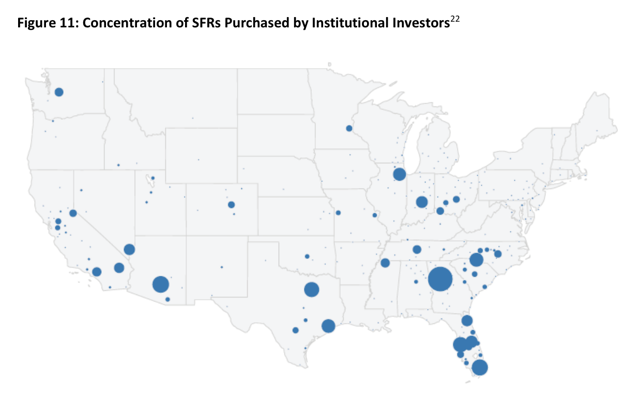

These three SFR REITs own roughly 150k single-family homes and currently focus on markets that have experienced the strongest economic growth during this recovery, most notably in the Sunbelt and western regions. Many of these markets were hit particularly hard by the housing bubble, which allowed institutional investors to buy distressed properties in bulk. The key evolution in the SFR business over the last several years - and a trend that we expect to continue - has been the focus on achieving market-level scale and density rather than broader geographic diversification. The two major SFR REITs are among the only institutional operators that hold portfolios which combine both scale and diversification.

SFR REITs own a mix of affordable and middle-tier homes, generally, in the "starter home" category that have seen the most limited amount of new home construction given the poor economics for homebuilders. Relative to apartment REITs, SFRs have an older resident base with a larger household, benefit from lower average resident turnover rates, but need to expend more per unit on an annual basis, particularly if the unit turns over.

Density within markets is critical for SFR REITs. The industry has experienced a continuous wave of IPOs and consolidations over the past three years as these REITs recognized that, with the stabilized ownership model, market density was essential to achieving efficiencies in leasing, acquisition, and maintenance. We estimate that 500-1,000 units per market are needed to achieve minimum scale, but that 2,000 units or more are needed to reach a "critical mass" whereby the REIT can localize operations within that market and achieve cost efficiencies on par with apartment REITs. INVH owns nearly 5,000 homes per market, while AMH owns 2,000 per market. The small-cap REITs and private portfolios, let alone funds and firms focused on on-off acquisitions, have an uphill battle to achieve the necessary scale, as they have few local markets with at least 500 units.

Single-family rental REITs are one of the youngest REIT sectors, emerging in the wake of the housing crisis. As home prices plummeted, large private investors purchased distressed homes and non-performing loans by the thousands, often sight-unseen from other financial institutions and foreclosure auctions. Through spin-offs and IPOs, a handful of these portfolios were spun into REITs, beginning with AMH in 2013. Initially, the business model depended on the continual acquisition and sale of distressed housing assets, and REITs used foreclosures as a primary source of new home acquisition. The business model ultimately evolved into a stabilized ownership model more akin to typical apartment REITs. AMH is leading the next evolution in the business model, in which the lines between homebuilder and single-family renter operator begin to get blurred: the in-house and external development of new "build-for-rent" homes.

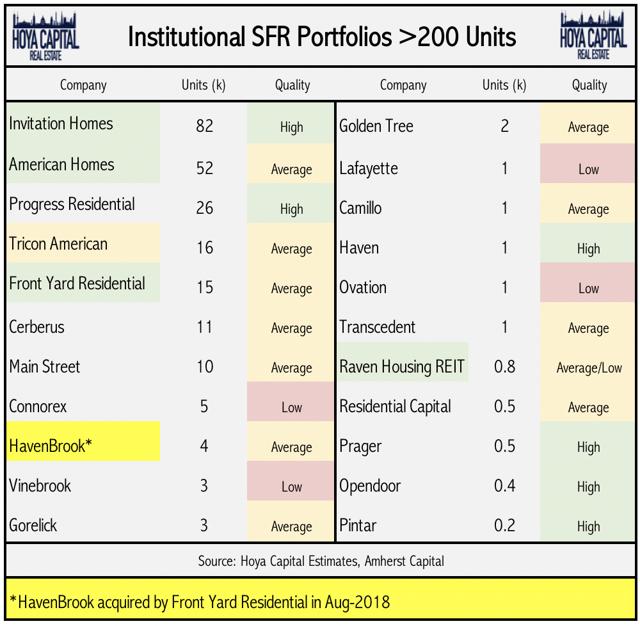

A highly fragmented market, the average SFR owner manages just 1-2 properties. Relative to apartment markets, this fragmentation makes it more difficult to acquire a substantial number of units to achieve scale. That said, there are several dozen institutional-quality portfolios and, considering the importance of scale, we expect continued consolidation among these portfolios and could see one or more additional portfolios covert into publicly traded REITs over the next several years. Three of the five largest SFR portfolios are operated as publicly traded REITs.

The Bull and Bear Thesis on SFR REITs

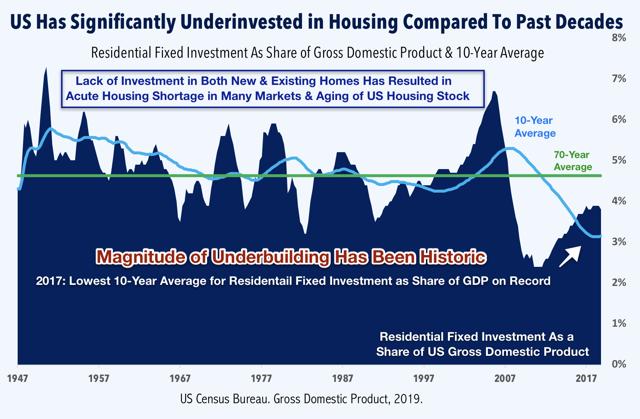

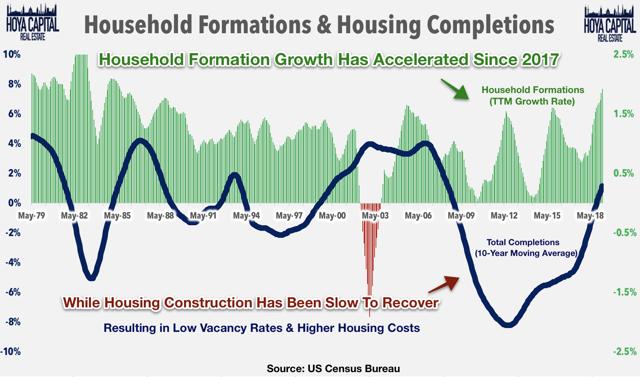

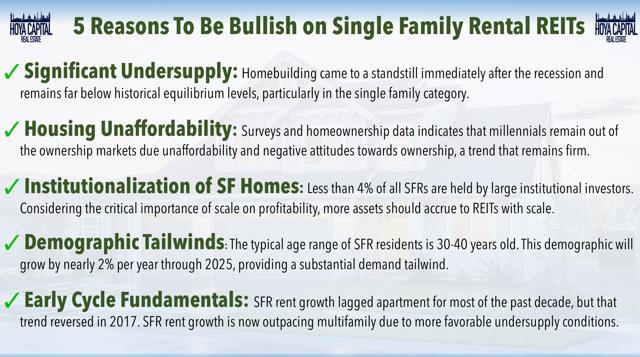

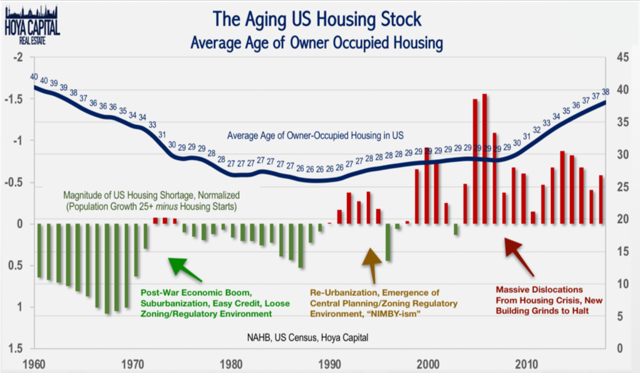

The United States is not building enough new homes, and single-family rental REITs are among the direct beneficiaries. Amid the lingering housing shortage, long-term SFR fundamentals remain highly favorable. On a rolling ten-year average, housing starts as a percent of the population and residential fixed investment as a share of GDP are both at or near historic lows dating back to the 1950s. A number of structural impediments to supply growth, including restrictive zoning, rising construction costs relative to home prices, and lingering dislocations caused by the financial crisis, have resulted in an extremely slow recovery in new home construction and, more broadly, residential fixed investment as a whole (existing and new homes).

Amid this housing shortage, demand for housing has accelerated over the past three years driving by robust job growth and rising real wage growth. 2018 was the strongest year for household formations (both renting and owning) since 1985 at nearly 2%. Below-trend household formation growth in the post-recession period suggests that there may be a substantial slack of "deferred" households - notably from multigenerational and "roommate-by-necessity" households - that could be unlocked over the next several years. Demographics remain extremely favorable into the 2020s for household formations, particularly in the single-family category, as the largest 4-year mini-generation in the United States is currently aged between 26 and 30.

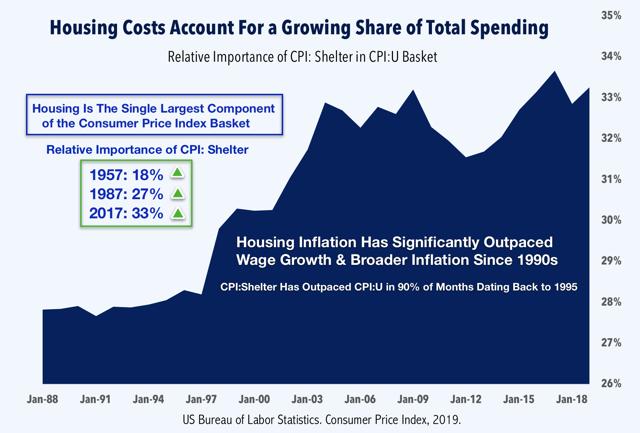

The implications of this housing shortage, we believe, will be a continued persistence of "real" housing cost inflation (rent growth) and a long runway for slow but steady growth in residential housing construction. Housing as a percent of total spending has risen from less than 20% in the 1950s to more than 33% in 2018, and it is not uncommon to hear of households in major urban markets spending upwards of 50% of their incomes towards housing. Since 1995, shelter inflation has outpaced the broader rate of inflation by more than 1% per year, fueled by a persistent supply shortage in the US housing markets.

Additionally, as we'll discuss below, we to believe that the two large SFR REITs are uniquely positioned to benefit from the broader trend of institutionalization within the single-family housing industry - a trend that we believe is in the very early innings. In a business where analysts question whether 50,000 homes constitutes “sufficient scale” for profitability, we question the viability of “iBuying” firms and funds focusing on one-off acquisitions and home flipping. Below, we outline the primary reasons that investors are bullish on the SFR REIT sector.

However, critics continue to question the long-term viability of the REIT model for SFR ownership, particularly if home price appreciation continues to outpace rental revenues. Homeownership incentives and favorable attitudes towards direct investing in residential real estate as a long-term store of value can result in inflated valuations of single-family homes relative to its implied rental value. This can create a problematic situation for SFR REITs: Future acquisitions become less accretive as REITs are forced to pay higher prices for the same cash flow. Meanwhile, property taxes and other expense items are generally tied to rising home values. Since 2015, home price appreciation has significantly outpaced single-family rent growth, but this spread has tightened in recent quarters.

It remains to be seen whether SFR REITs can continue to grow accretively given the potential persistent NAV discount and lack of distressed homes for purchase. In early 2018, supposedly "one-off" surprises to expense growth and total maintenance cap-ex costs appeared with greater frequency than many investors would like, further impairing valuations for much of the year. For now, unlike most other REIT sectors that have shown resilience through both boom and bust times, the investment thesis of SFRs owned through a REIT model is still unproven through a full business cycle. Below, we discuss the five reasons that investors are bearish on the SFR sector.

Recent Fundamental Performance

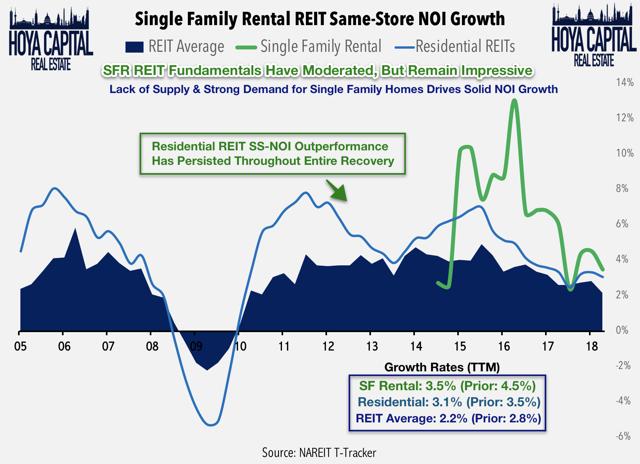

Riding the bullish trends we discussed above, residential REITs as a whole have significantly outperformed the REIT average during the recovery period. Within the residential category, SFR fundamentals continue to be among the strongest in the REIT sector as rising home values, limited supply, and robust demand has produced rent and NOI growth near the top of the REIT sector. According to NAREIT T-Tracker data, the SFR sector has seen same-store NOI outpace the broader REIT sector by a wide margin on a TTM basis, rising 3.5% in 2018 compared to the 2.2% REIT average.

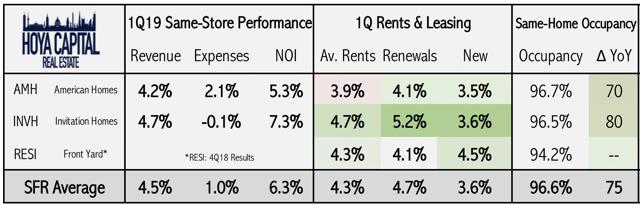

Performance in 2018 was set back by a series of surprising "one-off" jumps in expense growth and a seeming moderating in the margin improvement. First quarter results, however, were particularly strong, with same-store NOI growth surging more than 6%, driving by expense control and a 4.3% average jump in blended rent growth. No doubt helped by elevated levels of mortgage rates compared to the post-recession average, the relative "ease" at which SFR REITs have been able to push rent growth has been most impressive, highlighted by a 75-basis point rise in average occupancy during the period.

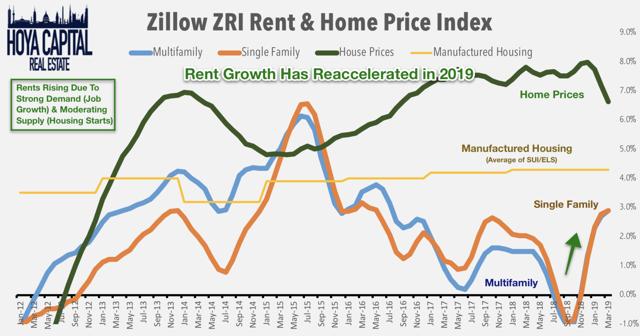

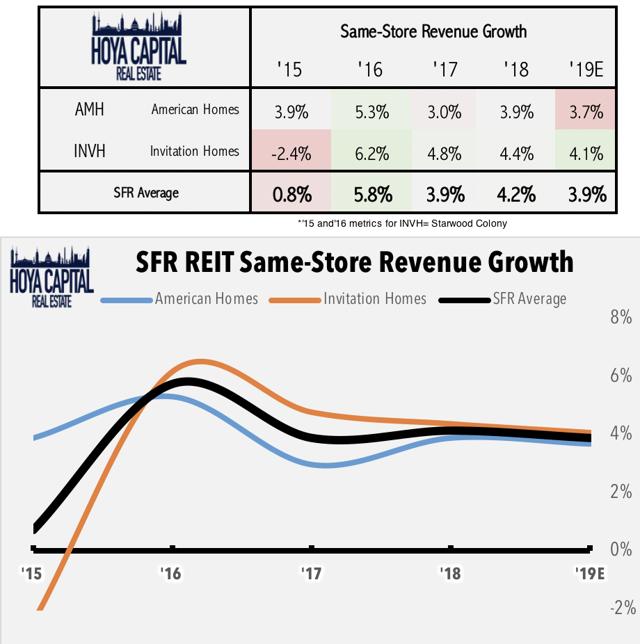

While SFR rent growth on the national level moderated in synchronicity with multi-family from the extreme highs seen in 2015, recent quarters have seen a solid reacceleration, particularly in the "growth markets" in which REITs are concentrated. Same-store revenue growth is expected to grow at around 4% for the third straight year in 2019, and first-quarter results are running ahead of estimates.

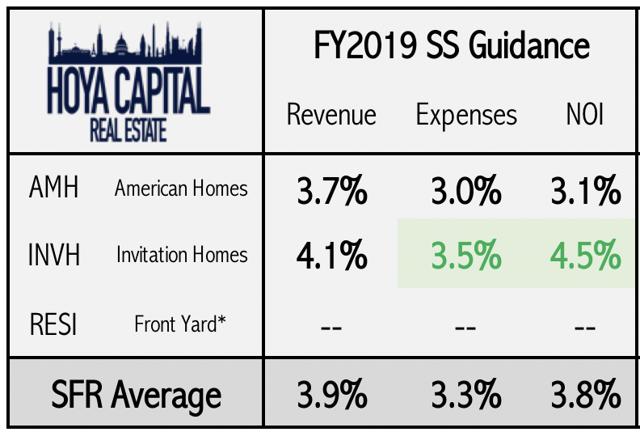

Forward guidance was generally better than expected, with Invitation Homes raising its full-year NOI estimates. Same-store revenue and NOI growth are expected to rise by nearly 4% this year. AMH and INVH see an average of 8% rise in Core FFO growth for the full year. RESI is still a few quarters away from being able to offer comparable metrics given the firm's recent shift to a fully internally managed and owned SFR REIT.

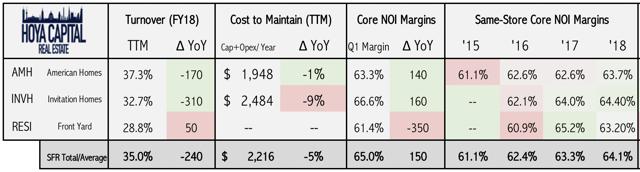

The focus for most investors remains on efficiency metrics, which had seemingly stalled out in mid-2018 after several years of solid improvement. Strong performance in the final quarters of 2018 and 2019 has been well-received by investors, and it appears that the "one-off" line items may have indeed been extraordinary. Core NOI margins averaged 64.1% last year, continuing a steady trend of improvement dating back to 2015. The average annualized cost to maintain declined 5% on a year-over-year basis in the first quarter, while core NOI margins jumped 150 bps. Continuing to drive this improvement are lower-than-expected turnover rates, a reflection of tight rental conditions but also likely a result of strong renter satisfaction.

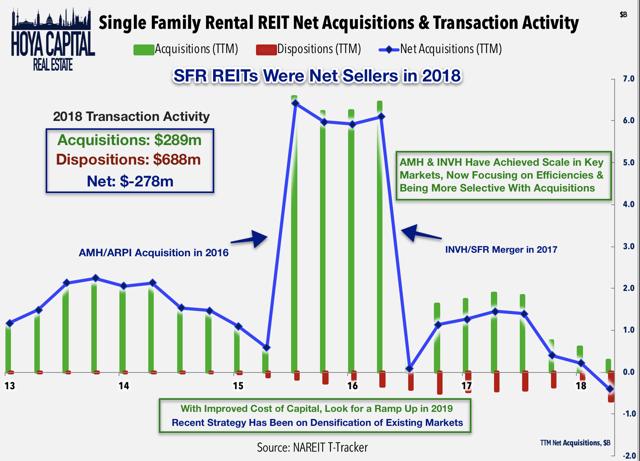

Critics of the SFR sector point out that rent growth has historically lagged home price appreciation, which, over time, erodes investment returns. As home values outpace rents, attractive acquisition opportunities become few and far between. REITs were net sellers in 2018 for the first time since the sector emerged earlier this decade. SFR REITs have turned their focus from large portfolio acquisitions to smaller, more precise acquisitions in their existing markets. With an improved cost of capital this year, we expect SFR REIT acquisition activity to increase, but believe that the activity will be focused on densification within their existing markets.

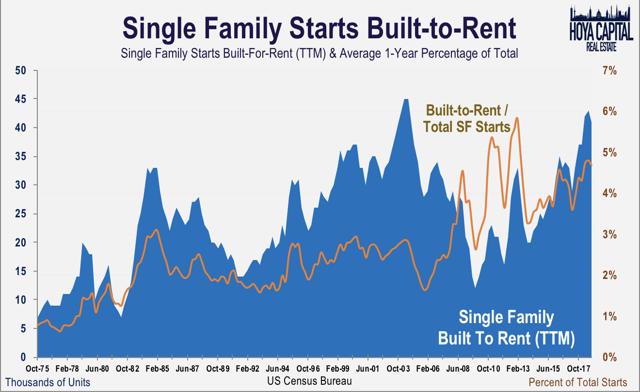

Home price appreciation has forced SFR REITs to get creative with external growth plans. AMH continues to push ahead with built-to-rent projects using internal development pipelines and partnerships with homebuilders. It sees 100 bps higher all-in yields from in-house development and 50 bps in incremental yield from built-for-rent purchases from homebuilders. We continue to note the trend of "built-to-rent" as a growing share of total housing starts. We've noted in the past the emergence of entire built-to-rent homebuilding communities, and see the lines between homebuilders and single-family rental operators as beginning to get blurred. For now, we think homebuilders and SFR REITs have a synergistic relationship and foresee more build-to-rent partnership deals between builders and SFR operators.

The average age of the American single-family home is just shy of 40 years old, according to the NAHB - the oldest on record - so AMH and INVH own a younger portfolio relative to the national average. SFR REITs have focused recent acquisitions on newer homes, generally around 2,000 square feet, that meet specific specifications. We view the expense-modeling technology used and refined by these REITs as an emerging competitive advantage.

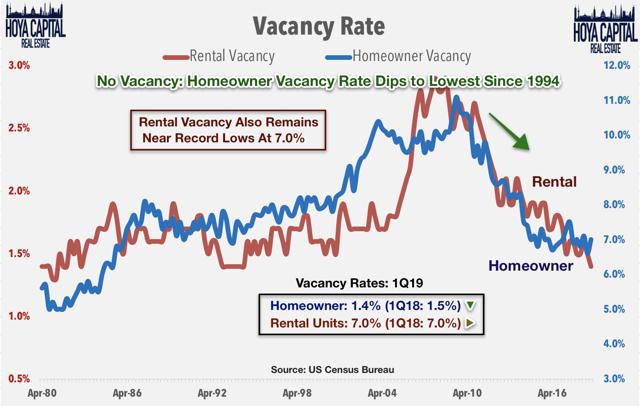

Housing markets remain historically tight as the vacancy rate for both rental and owner-occupied units remains at or near historic lows. The rental vacancy rate trended sideways from this time last year at 7.0%, while the homeowner vacancy rate retreated to just 1.4%, the lowest level in nearly 20 years. Including all vacant units (second homes, etc.), the total vacancy rate finished 2018 at the lowest level since 2002 prior to the "housing boom" in single-family construction. We believe that single-family rental REITs will continue to enjoy "early cycle" fundamentals, characterized by limited supply and rising demand.

Recent Stock Performance of SFR REITs

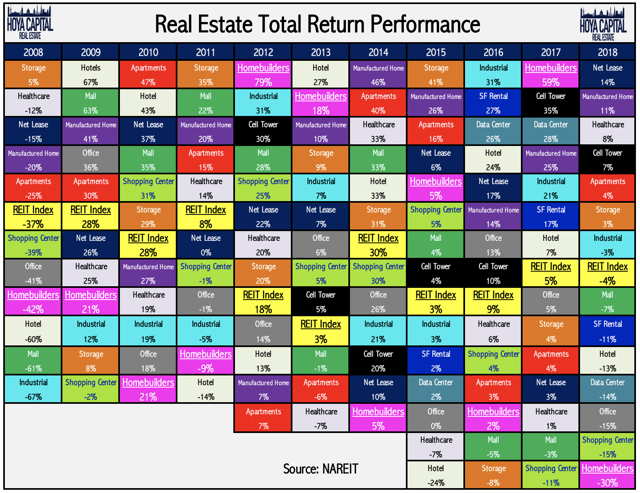

Following two straight years of strong performance between 2016 and 2017, single-family rentals had a tough year in 2018. Weighed down by operational struggles and questions surrounding the ability to grow externally given the persistent NAV discounts, the sector dipped 11% last year - the fourth worst-performing REIT sector.

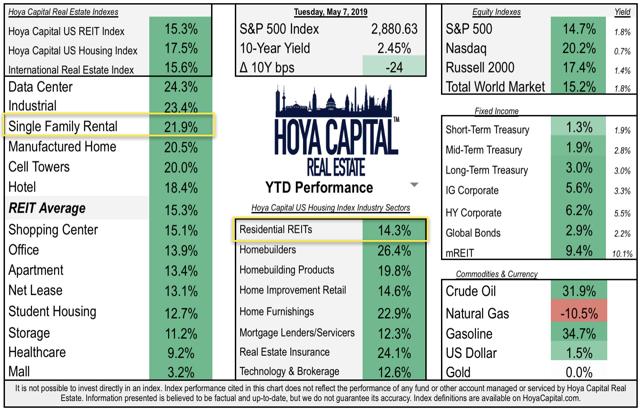

The SFR sector has bounced back strongly in 2019 on strong earnings results and solid economic data showing, among other things, that household formations - particularly in the rental sector - remain robust. SFR REITs outperformed the broader US housing sector, as measured by the Hoya Capital US Housing Index, which has surged nearly 18% so far this year, led by a recovery in the single-family sectors and renewed strength in the rental markets.

Invitation Homes has been the strongest performer so far this year, followed by American Homes 4 Rent. Front Yard Residential Corp. has lagged, particularly over the last quarter, but reports earnings results next week on May 14. SFR REITs have been particularly during Q1 earnings season over the past month.

Valuation of Single-Family Rental REITs

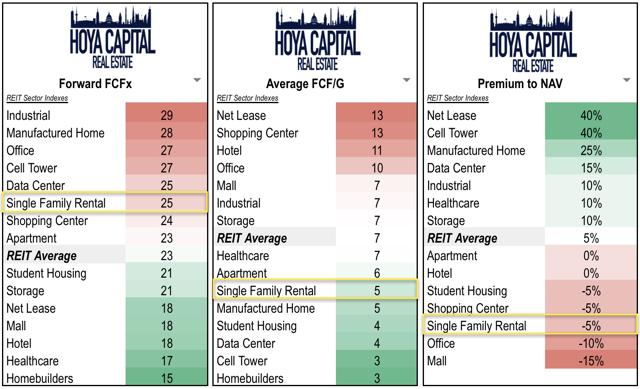

Relative to other REIT sectors, single-family rental REITs appear moderately expensive based on Free Cash Flow (aka AFFO, FAD, CAD), but more attractive after factoring in growth expectations. As it has for most of the past several years, the sector continues to trade at a persistent discount to NAV, though this discount has shrunk to a range of 0-10% across consensus estimates.

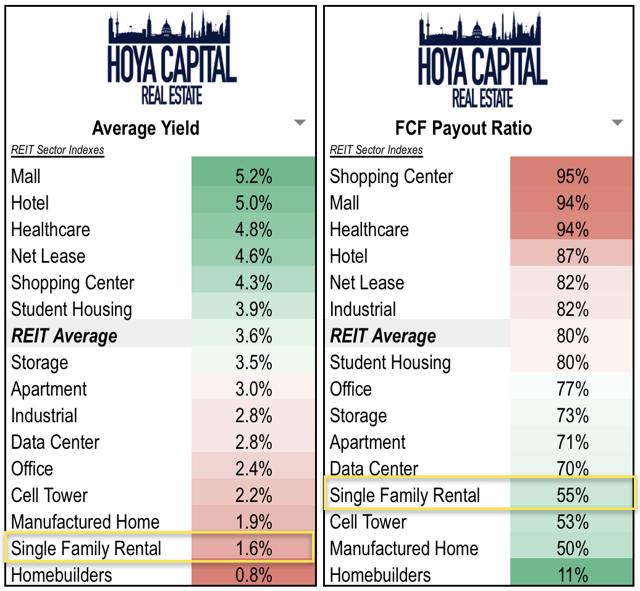

Dividend Yield of Single-Family Rental REITs

Based on dividend yield, single-family rental REITs rank at the bottom of the REIT universe, paying an average yield of 1.6%. They pay out just 55% of their available cash flow, so these firms have greater potential for dividend growth and reinvestment than other sectors.

As these REITs mature, we expect their payout ratios to rise to levels in line with other REIT sectors. Front Yard Residential Corp. is currently the highest-yielding REIT in the sector, paying a forward yield of 5.8%.

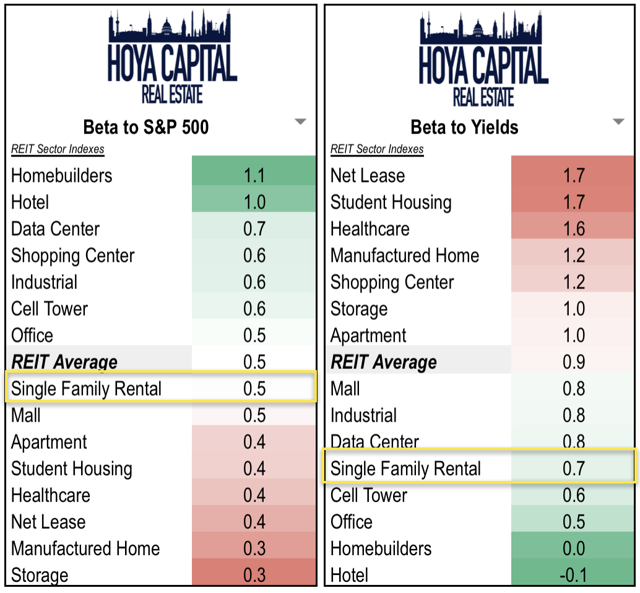

Interest Rates and Single-Family Rental REITs

SFR REITs are neither particularly sensitive to interest rates nor equity markets. These REITs can serve as an effective hedge within a real estate portfolio against rising interest rates, as potential homeowners may be encouraged to stay in the rental markets for longer if mortgage rates rise.

Within the sector, we note that the small-cap REITs are highly leveraged to a strong economy given their unfavorable leverage profile and continued need for capital. American Homes 4 Rent and Invitation Homes are classified as "Hybrid" REITs and are appropriate for either yield-oriented or growth-oriented real estate investors.

Bottom Line: SFR REITs Flex Their Muscle

Single-family renting is a tough, capital-intensive, and low-yield business. Through market-level scale and operating efficiency, however, single-family rental REITs have cracked the code to profitably manage rental homes. The institutionalization of the single-family housing market is a trend in the early innings. The home buying, selling, and leasing business is being fundamentally disrupted by technology and Big Data. In a business where analysts question whether 50,000 homes is “sufficient scale”, we question the viability of “iBuying” firms and funds focusing on one-off acquisitions and home flipping.

Technology and productivity are the wild cards that may determine the fate of the institutional SFR industry. Logistically, managing portfolios of thousands of SFR homes was impossible less than a decade ago. If SFR REITs can continue to harness and develop cost-saving technologies that streamline the acquisition, disposition, leasing, and maintenance processes and be leaders in this field, we expect the business to not only be sustainable, but for the SFR REIT model to exhibit a competitive advantage over smaller private equity players in the space.

Millennials are indeed coming to the suburbs, but they’re increasingly content with renting. Housing unaffordability, combined with robust demographic-driven demand, should continue to drive single-family rent growth. The slowdown in the single-family markets since late 2018 is a blessing for SFR REITs, clearing away competition and opening up acquisition opportunities through both existing and newly built homes.

Outside of rising costs, which have been under control over the past several quarters, the underlying fundamentals remain solid. Rising mortgage rates give SFR REITs room to push rent growth. Leasing trends have been impressive since early 2018 as turnover continues to tick lower. External growth remains slow amid the persistent NAV discount, but acquisition opportunities may emerge as home price appreciation cools.

If you enjoyed this report, be sure to "Follow" our page to stay up-to-date on the latest developments in the housing and commercial real estate sectors. For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Manufactured Housing, Cell Towers, Healthcare, Industrial, Data Center, Malls, Net Lease, Student Housing, Apartments, Shopping Centers, Hotels, Office, Storage, and Homebuilders.