Source: Norfolk Southern

In my opinion, the U.S. economic expansion is getting long in the tooth. When the economy falters, it could take cyclical stocks with it. The free fall in RV shipments could be the canary in the coal mine. In May, U.S. rail traffic and intermodal fell 4.1% Y/Y. Through the first 22 weeks of the year, combined U.S. traffic and intermodal units fell 2.4% Y/Y. I believe Norfolk Southern Corp. (NYSE:NSC) and other railroad stocks could be vulnerable.

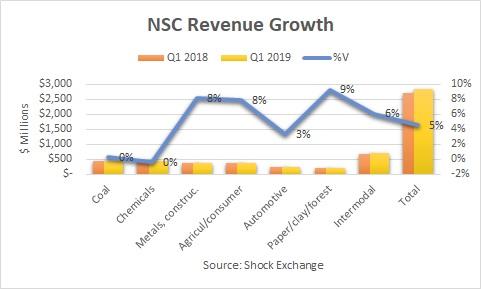

In Q1 2019, the company's freight revenue of $2.8 billion was up 5% Y/Y. Volume was practically flat while average selling price ("asp") grew just over 4% Y/Y.

Revenue from Metals and Construction, Agricultural, and Paper & Forest Products grew Y/Y by 8%, 8%, and 9%, respectively. Agricultural saw increases in shipments of corn and feed, which offset declines in ethanol. The agricultural segment could get hit hard if China continues to halt U.S. agricultural imports. Metals and Construction was buoyed by a 9% increase in ASP, slightly offset by a 1% decline in volume. This segment could be stymied by a decline in industrial production going forward. The Paper & Forest segment was aided by a double-digit increase in ASP, driven by the U.S. construction boom.

Revenue from Metals and Construction, Agricultural, and Paper & Forest Products grew Y/Y by 8%, 8%, and 9%, respectively. Agricultural saw increases in shipments of corn and feed, which offset declines in ethanol. The agricultural segment could get hit hard if China continues to halt U.S. agricultural imports. Metals and Construction was buoyed by a 9% increase in ASP, slightly offset by a 1% decline in volume. This segment could be stymied by a decline in industrial production going forward. The Paper & Forest segment was aided by a double-digit increase in ASP, driven by the U.S. construction boom.

Intermodal now represents about 25% of Norfolk Southern's total revenue. It was driven by a 2% increase in volume and 4% increase in price. The price increases could stop if the economy stalls. Overall, the company delivered solid top-line growth. The trade war with China and slowing economy growth will likely create headwinds going forward.

EBITDA Ticked Up

Over the past few years, Norfolk Southern has embarked on a cost containment program that was expected to result in hundreds of millions of dollars in efficiencies and lower its 70% operating ratio. Norfolk Southern's operating ratio was 66% this quarter, down from 69% in the year earlier period. On a dollar basis, total operating expenses fell by $8 million. The fall-off in expenses amid single-digit revenue growth drove down the operating ratio.

Compensation and benefits expenses fell 1% Y/Y while fuel costs declined 6%. Purchased services rose 6%, outstripping the rise in revenue; purchased services could be the expense bucket management cuts into if revenue growth stalls. The expense ratio is still much higher than the sub-60% ratio some of the better railroads are reporting.

EBITDA of $1.2 billion rose 13%. EBITDA margin of 44% increased 300 basis points versus that of the year earlier period. Norfolk Southern could have levers to pull vis-a-vis other railroads with much lower operating ratios. Improvements in its expense ratio could fall directly to the bottom line. This is key as NSC currently trades at nearly 13x run-rate EBITDA (Q1 2019 EBITDA annualized). It may need to deliver strong earnings growth to justify such a high valuation for a cyclical name. This could prove difficult if falling rail traffic and recessionary pressures hurt its top-line growth in the second half of the year.

Conclusion

NSC is up over 25% Y/Y. If rail traffic continues to fall, this could be as good as it gets. Sell the stock.

I also run the Shocking The Street investment service as part of the Seeking Alpha Marketplace. You will get access to exclusive ideas from Shocking The Street, and stay abreast of opportunities months before the market becomes aware of them. I am currently offering a two-week free trial period for subscribers to enjoy. Check out the service and find out first-hand why other subscribers appear to be two steps ahead of the market.

Pricing for Shocking The Street is $35 per month. Those who sign up for the yearly plan will enjoy a price of $280 per year - a 33% discount.