I decided to continue going with the same theme from the last few articles I published on John's retirement where I provide a full portfolio overview that includes John and his wife Jane's Taxable and Retirement accounts. I have always written these updates as three separate articles because of the amount of information they contain and because there are enough moving factors that justify talking about John's portfolio differently than his wife Jane's because John is already retired whereas Jane is still working.

Before jumping into the tables for the month of November I want to point out that I had an error on my previously published table that gives a snapshot of Month-End Balances. On this table I accidentally had it referencing John's Roth IRA 2x which inflated the balances of the account. Secondly, I want to emphasize that John and Jane removed $137k in capital from the Taxable account to purchase some real-estate. These funds have always been held as cash or in short-term CD's which means that the removal of these funds had zero impact on their dividend income stream.

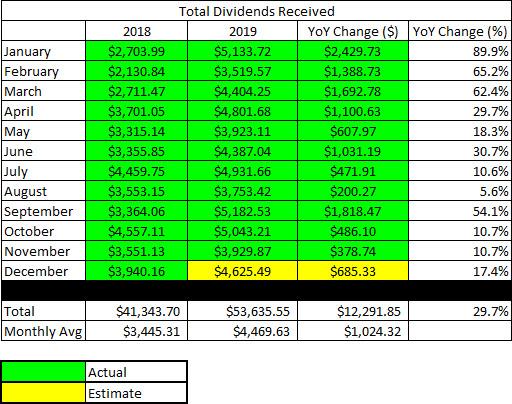

The images below are current as of November 30th when the month ended (total dividends and account balances) and the equations have been updated so that the balances shown are accurate (2018 figures we always accurate but January 2019 to October 2019 were not). Anything in yellow indicates an estimate or is information that will not be available until the November month-end statement becomes available.

Source: Consistent Dividend Investor, LLC.

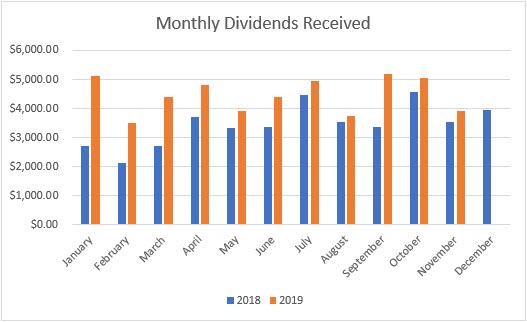

The following graph demonstrates the total amount of dividend income generated each month starting in January of 2018 and runs through November of 2019.

Source: Consistent Dividend Investor, LLC.

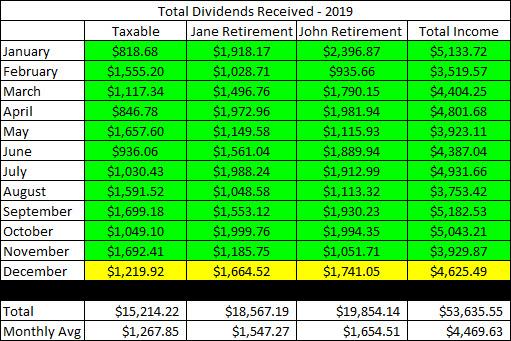

This next image gives a breakdown of dividend income by source so that readers can better understand what is driving John and Jane's income.

Source: Consistent Dividend Investor, LLC.

The following table summarizes the total month-end value of the following investment accounts:

- John and Jane's Taxable Account

- Jane's Traditional and Roth IRA

- John's Traditional and Roth IRA

Source: Consistent Dividend Investor, LLC.

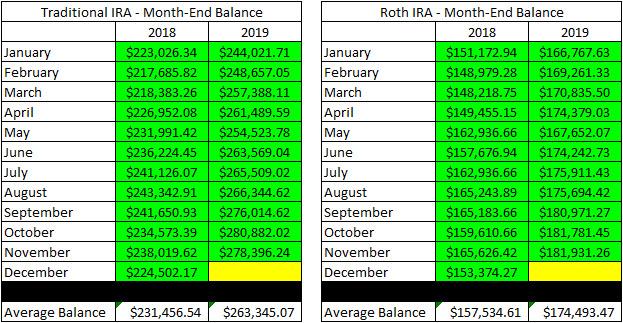

John's because John's account is more conservative, his account balances have no been increasing as fast as Jane's. The reason for this is that we want less volatility in John's portfolio whereas Jane can accept slightly more risk in hers. The figures below are accurate as of the 12/20/2019 market close.

- Traditional IRA - Current Value = $281,173.02

- Roth IRA - Current Value = $183,939.25

- Combined IRA Account Value = $465,112.27

November Dividend Article Links

The links for the other two November articles can be found using the links below:

The Retiree's Dividend Portfolio - Jane's November Update: A Reminder Why We Sold Shares Of CBL.PD

Client Background

First of all, I want to emphasize that this is an actual portfolio with actual shares being traded. This article focuses on John, who is a recent retiree (retired on January 1, 2018) who has requested my help in managing his own portfolio instead of paying a financial advisor. It is important to understand that I am not a financial advisor and merely provide guidance for his account based on a friendship that goes back several years. In this article, I will refer to John as "my client," and I do this for simplicity's sake, but I do not charge him for what I do. The only thing John offers in return is allowing me to write anonymously about his financial journey with the hope that I can potentially help others who are wanting to achieve the same thing but do not have the direct resources to make it happen!

John was able to set himself up for a comfortable retirement by eliminating all of his debt so that the only bills are the absolute basics like property tax, water, etc. John has sources of income that have provided him with a comfortable retirement outside of the investments discussed in this article, and (up to this point) he has not needed to draw funds from his retirement accounts.

John is only a few years away from needing to satisfy his required minimum distributions (RMDs) from his Traditional IRA. It is important to remember that the Roth IRA does not have this requirement, which means John can withdraw funds at will from his Roth. On his Traditional IRA, it is important to be more strategic because we want to make sure that the cash being generated by his investments outpaces his minimum distribution for as long as we possibly can.

Here are some important characteristics to keep in mind about the Retirement Portfolio:

- Capital appreciation is the least important characteristic of this portfolio. This doesn't mean we don't care about it (because all investors do to some degree), but it does mean that we are less concerned about the day-to-day fluctuations of stock prices.

- I do trade stocks in the retirement portfolio on a more regular basis because the gains are sheltered from taxes. The number of trades that take place on any given month depends on market volatility and whether or not a stock has reached the price target that I have set for it.

- Trades are not executed in an attempt to lock in "quick profits" and readers should also understand that John and Jane do not compensate me for anything I do.

Dividend And Distribution Increases

Only one stock paid an increased dividend in John's retirement accounts during the month of November.

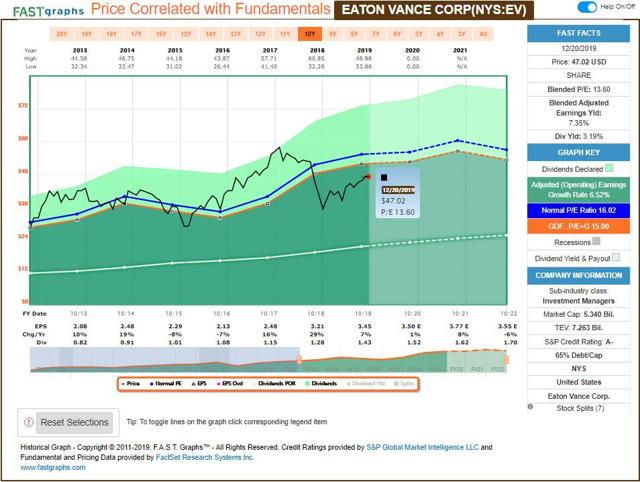

- Eaton Vance (EV)

Eaton Vance - I have covered EV a few times in the past including my most recent article Eaton Vance: Strong Q3 2019 Performance And Upcoming Dividend Increase Make This Stock A Buy. EV's funds have performed well over the short and long-term and as a result, have more than tripled the number of assets under management since 2009. EV is also very shareholder-friendly which can be seen in their share buyback policy and its 10-year dividend growth rate of 8.1%. EV's shares are not as undervalued as they were when I originally added shares to John's portfolio but I consider shares somewhat attractive but am looking to add if it dips below $45/share.

The dividend was increased from $.35/share per quarter to $.375/share per quarter. This represents an increase of 7.1% and a new full-year payout of $1.50/share compared with the previous $1.40/share. This results in a current yield of 3.19% based on a share price of $47.02.

The dividend was increased from $.35/share per quarter to $.375/share per quarter. This represents an increase of 7.1% and a new full-year payout of $1.50/share compared with the previous $1.40/share. This results in a current yield of 3.19% based on a share price of $47.02.

Retirement Account Positions

There are currently 26 different positions in John's Roth IRA and 30 different positions in his Traditional IRA. While this may seem like a lot, it is important to remember that many of these stocks are held in both accounts and/or are also held in the Taxable portfolio. Whether you hold 5 positions or 50 positions it is extremely important that your portfolio is set up in a way that helps you generate returns the returns you want while simultaneously reducing risk.

Traditional IRA - During the month of November, we added to the following positions:

- Cyrus One (CONE) - 25 Shares @ $64.69/share.

- Duke Energy (DUKE) - 10 Shares @ $86.86/share.

- Cyrus One - 10 Shares @ $63.13/share.

- AT&T (T) - 10 Shares @ $36.87/share.

We also made the following sales in the Traditional IRA portfolio during the month of November.

- Artis Real Estate (OTCPK:ARESF) - 250 Shares @ $8.95/share.

Source: Charles Schwab

Roth IRA - We added to a handful of positions in the Roth IRA during the month of November.

We did not sell any positions in the Roth IRA portfolio during the month of November.

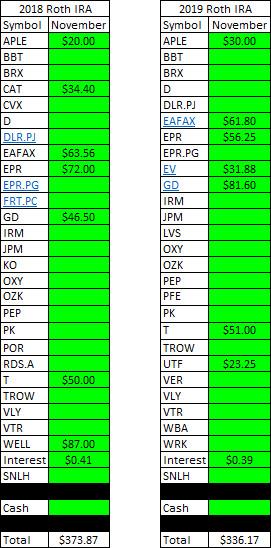

November Income Tracker - 2018 Vs. 2019

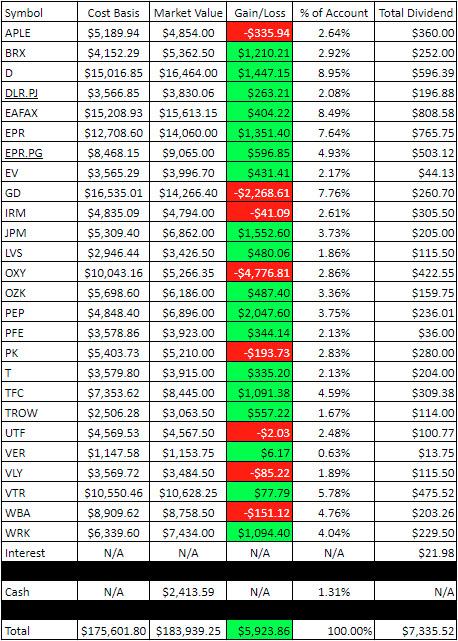

The images included in this section are intended to help give my readers a better idea of what John's portfolio looks like. The cost basis and market value numbers below are reflective of the balance at the market close on Friday, December 20th.

SNLH = Stocks No Longer Held - Dividends in this row represent the dividends collected on stocks that are no longer held in that portfolio. We still count the dividend income earned during that time period even though it is non-recurring.

On the lists provided below, it is important to know that not all stocks on that list were owned at that point in time (2018 tables represent what holdings were still held at the end of 2018). Any stocks that were sold prior to the end of the year where a dividend was received would be classified as SNLH.

Source: Consistent Dividend Investor, LLC

Source: Consistent Dividend Investor, LLC

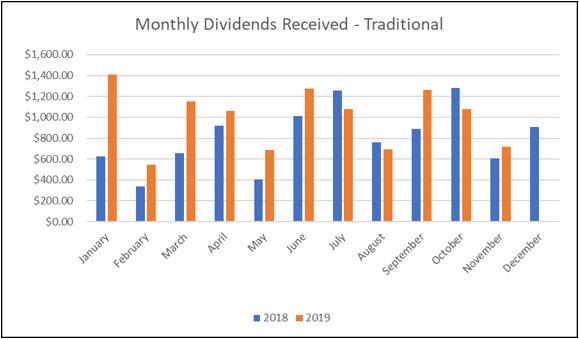

Here is a graphical illustration of the dividends received on a monthly basis for the Traditional IRA.

Source: Consistent Dividend Investor, LLC

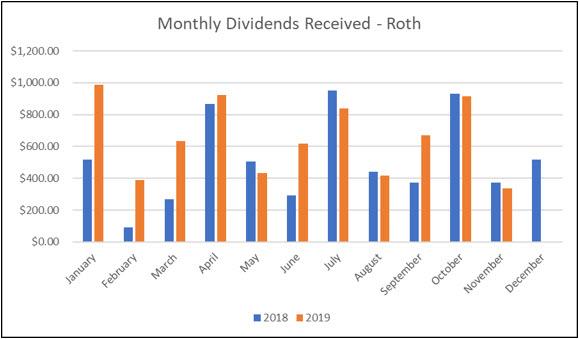

Here is a graphical illustration of the dividends received on a monthly basis for the Roth IRA.

Source: Consistent Dividend Investor, LLC

Based on the current knowledge I have regarding dividend payments and share count, the following tables are a basic prediction of the income we expect the Traditional IRA and Roth IRA to generate in FY-2019 compared with the actual results from 2018.

Source: Consistent Dividend Investor, LLC

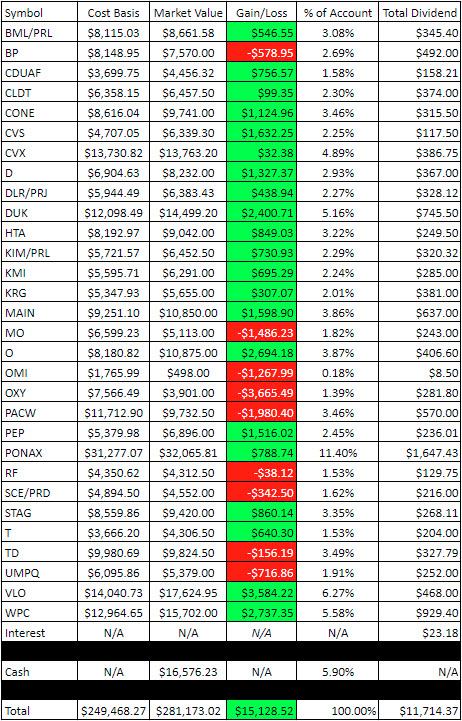

When it comes to the topic of transparency, I like to show readers the actual gain/loss associated with each position in the portfolio because it is important to consider that in order to become a proper dividend investor, it is necessary to learn how to live with volatility. All numbers below are accurate as of the market close on December 20, 2019. The images below represent John's Traditional and Roth IRAs (in that order).

Source: Consistent Dividend Investor, LLC

Source: Consistent Dividend Investor, LLC

Source: Consistent Dividend Investor, LLC

It should be noted that the dividend total in the far-right column of both the Traditional and Roth IRA isn't always accurate because these accounts are occasionally traded, and I have been guilty of forgetting to update the dividend when additional shares are added/sold.

Lastly, I created a table to demonstrate how the account balances have changed on each of the retirement accounts. The balances used are representative of the month-end account balance that shows up on the monthly statement.

Source: Consistent Dividend Investor, LLC

Conclusion

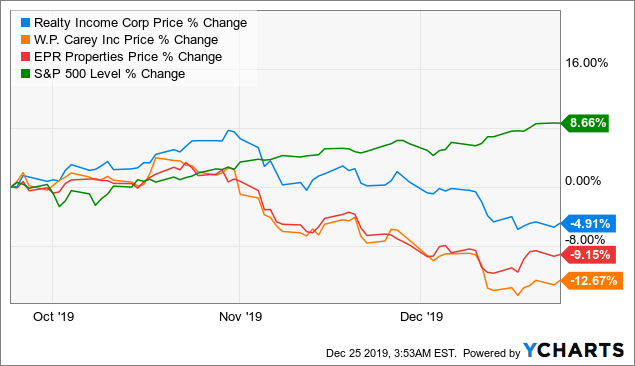

John and Jane's retirement accounts are performing well as we head into the end of 2019 with income and account balances looking strong. John's retirement portfolio has not benefited as much from the market rally due to his heavy emphasis on REITs and utilities. Across the board, REITs are down over the last two months while the S&P 500 has continued to climb.

Data by

Data byThis is part of what we plan for when we established John and Jane's retirement portfolios. For those who are familiar with the series, it wasn't long ago that John's portfolio value exceeded that of Jane's by a substantial amount and it was all because of his heavy emphasis on REITs. Since John is out retirement age, it is necessary that we focus on purchasing stocks that may have less upside (capital appreciation) but also less volatility when it comes to the downside. Additionally, REITs and utilities have demonstrated a track record of paying above average dividends which is necessary to add certainty in a retirees monthly paycheck.

During the month of November, John's average monthly income for FY-2019 now stands at the following:

- Traditional IRA - Estimated FY-2019 monthly income average of $1,006.46 compared with an average income of $804.65 in 2018.

- Roth IRA - Estimated 2019 monthly income average of $648.05 compared with an average income of $511.24 in 2018.

I'd love to hear from readers' in the comment section about your positions and also any feedback about the article in general. If you enjoyed the article let me know in the comment section and hit like or subscribe. The purpose of this article is to provide investors with an example of a real portfolio that is impacted by real changes in the market.

In John's Traditional and Roth IRAs, he is currently long the following mentioned in this article: Apple Hospitality REIT (APLE), BB&T (BBT), Bank of America Preferred Series L (BML.PL), BP (BP), Brixmor Property Group (BRX), Canadian Utilities (OTCPK:CDUAF), Chatham Lodging Trust (CLDT), CVS Health Corporation (CVS), Chevron (CVX), CyrusOne (CONE), Dominion Energy (D), Digital Realty Preferred Series J (DLR.PJ), Duke Energy (DUK), Eaton Vance (EV), Eaton Vance Floating-Rate Advantage Fund A (EAFAX), EPR Properties (EPR), EPR Properties Preferred Series G (EPR.PG), General Dynamics (GD), Healthcare Trust of America (HTA), Iron Mountain (IRM), JPMorgan Chase (JPM), Kimco Preferred Series L (KIM.PL), Kinder Morgan (KMI), Kite Realty Group (KRG), Las Vegas Sands (LVS), LTC Properties (LTC), Main Street Capital (MAIN), Altria (MO), Realty Income (O), Owens & Minor (OMI), Occidental Petroleum Corp. (OXY), Bank OZK (OZK), PacWest Bancorp (PACW), PepsiCo (PEP), Pfizer (PFE), Park Hotels & Resorts (PK), PIMCO Income Fund Class A (PONAX), Regions Financial (RF), South California Edison Preferred Series D (SCE.PD), STAG Industrial (STAG), AT&T (T), Toronto-Dominion Bank (TD), T. Rowe Price (TROW), Cohen & Steers Infrastructure Fund (UTF), Valero (VLO), VEREIT (VER), Valley National Bancorp (VLY), Umpqua Holdings (UMPQ), Ventas (VTR), Walgreens (WBA), WestRock (WRK), and W. P. Carey (WPC).