Gulfport Energy (NYSE:GPOR) is coming under pressure due to natural gas prices sliding even lower in 2020. Gulfport does have a significant amount of natural gas hedges that will partially protect it in 2020, but despite the hedges it is now looking at modestly negative cash flow if it wants to maintain production in 2020.

With spot natural gas prices dropping below $2, Gulfport is now likely to reduce its capex below maintenance levels for 2020. This would help it deliver positive cash flow for the year, but falling production levels are not going to help its ability to refinance its future debt maturities.

While its share price is quite low now, that reflects its significant refinancing risk and the idea that it probably needs close to $3 natural gas in 2021 in order to undo the damage caused by 2020 gas prices.

2020 With Maintenance Capex

I noted before that after its divestitures, Gulfport's adjusted production was around 1,365 MMCFE per day. At current strip prices (including roughly $2.10 NYMEX gas) for 2020, Gulfport would be able to deliver $1.057 billion in revenue after hedges. Its natural gas hedges have around $156 million in positive value at $2.10 NYMEX natural gas. The $1.55 per Mcf realized price for natural gas that I have listed below is before hedges, and the value of Gulfport's hedges is listed on a separate line.

| Type | Units | $/Unit | $ Million |

| Natural Gas [MCF] | 458,067,000 | $1.55 | $710 |

| NGLs (Barrels) | 5,017,000 | $19.00 | $95 |

| Oil (Barrels) | 1,676,000 | $56.50 | $92 |

| Hedge Value | $160 | ||

| Total Revenue | $1,057 |

With a maintenance capex budget, Gulfport would end up with $1.081 billion in cash expenditures, resulting in an expectation of $24 million in cash burn.

| Expenses | $ Million |

| Gathering and Processing | $290 |

| LOE | $85 |

| Production Taxes | $24 |

| G&A | $39 |

| Interest | $113 |

| CapEx | $530 |

| Total Expenses | $1,081 |

Gulfport may continue to do debt repurchases with most of its bonds trading at under 60 cents on the dollar now. However, if it attempts to maintain production levels, it will be dealing with some cash burn outside of whatever it spends on debt repurchases, and thus will need to manage its credit facility borrowing levels.

2020 Plans

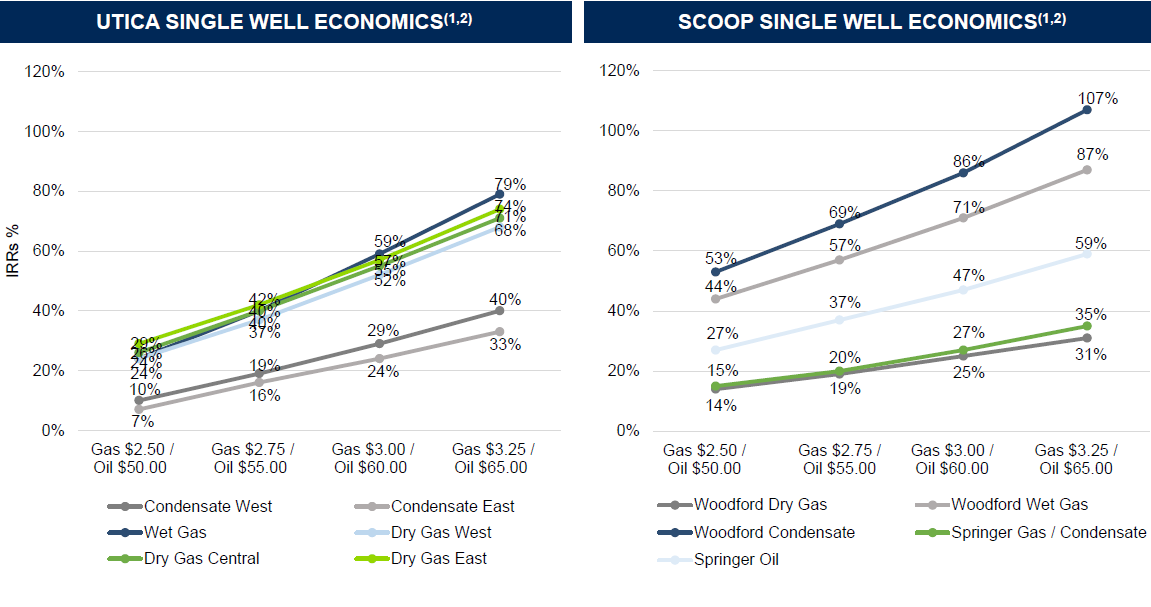

Gulfport's Utica Shale wells have poor economics under the current market conditions. It needs $2.50+ gas for its Utica Shale type curves to show okay returns, and at $2.10 natural gas the IRRs probably get reduced to close to 10%.

Source: Gulfport Energy

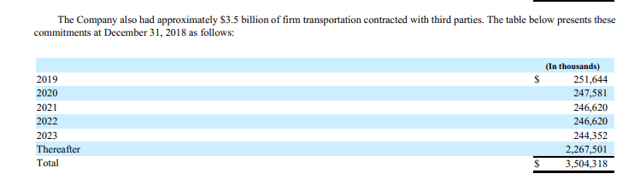

Thus Gulfport could reduce its capex for 2020 considerably below maintenance capex levels, with capital coming out of the Utica Shale. Gulfport does have close to $250 million per year in firm transportation contracts, so reduced production will increase Gulfport's differentials.

Source: Gulfport Energy

Given the weak economics at sub-$2.50 gas, it does make sense though for Gulfport to significantly reduce its Utica Shale development even if it still has to absorb fixed transportation costs.

2020 With Reduced Capex

If we assume that Gulfport reduces its budget by $200 million below maintenance capex levels, it would be projected to see its natural gas production fall by around 9.5%.

This would result in a projection of $969 million in revenues after hedges at current strip prices. Gulfport's natural gas differentials would increase by around $0.05 due to the impact of fixed transportation commitments being spread over a smaller amount of production.

| Type | Units | $/Unit | $ Million |

| Natural Gas [MCF] | 414,400,000 | $1.50 | $622 |

| NGLs (Barrels) | 5,017,000 | $19.00 | $95 |

| Oil (Barrels) | 1,676,000 | $56.50 | $92 |

| Hedge Value | $160 | ||

| Total Revenue | $969 |

With the reduced production and a $330 million capex budget, Gulfport would end up with $856 million in cash expenditures, which results in a projection for $113 million in positive cash flow.

| Expenses | $ Million |

| Gathering and Processing | $272 |

| LOE | $80 |

| Production Taxes | $22 |

| G&A | $39 |

| Interest | $113 |

| CapEx | $330 |

| Total Expenses | $856 |

This would give it some funds to repurchase its debt at a discount without incurring more credit facility borrowings. I'd also expect natural gas prices to rebound from 2020 levels since at close to $2 natural gas, primary natural gas producers will be scaling back activity significantly.

However, Gulfport would then need to increase its capex and production in 2021 since at 2020 production levels (for this scenario), it would probably need $3 NYMEX natural gas for its leverage to come down to a level that would allow refinancing.

Conclusion

While hedges should limit the damage, 2020 is still shaping up to be a wasted year for Gulfport. Natural gas prices are too low to support decent returns for Gulfport's Utica Shale assets, and it is likely to see its production fall significantly in 2020 with reduced capex. This would give it some positive cash flow in 2020 to help repurchase debt at a discount, but it would then be in a position of needing to rebuild its production after 2020.

Gulfport still has a bit of time before its next unsecured debt maturity in May 2023. It is also unhedged for 2021, giving it an opportunity to benefit from a natural gas pricing rebound, but it would then need close to $3 natural gas after the damage caused to it in 2020.

Gulfport's share price could rebound a bit as overall natural gas production falls. However, its long-term future remains challenging due to its debt, and its pathway to survival is narrowing.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.