In this article, we examine the significant weekly order flow and market structure developments driving NYSEARCA:XLU price action.

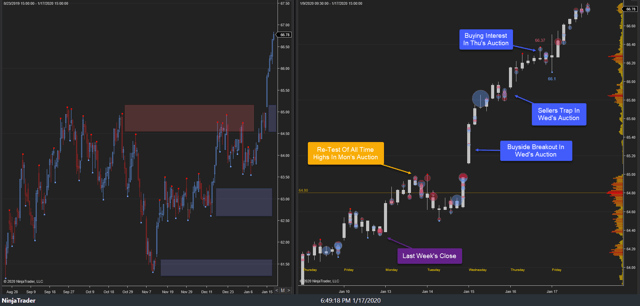

As noted in last week’s XLU Weekly, the highest probability path for this week was for price discovery higher, barring failure of 66.10s as support. This week’s primary expectation did play out as last week’s late buyers held the auction before price discovery higher developed to 68.61s ahead of Friday’s close, settling at 68.36s.

21-24 January 2020:

This week’s auction saw price discovery higher to 67.40s in Tuesday’s auction as last week’s late buyers held the auction. Buying interest emerged, 67.20s-63.37s, at/near all-time highs into Tuesday’s close. Tuesday’s late buyers held the auction as price discovery higher continued into Wednesday’s trade to 67.77s. Narrow balance then developed, 67.77s-67.54s, into Wednesday’s close as buying interest emerged, 67.57s.

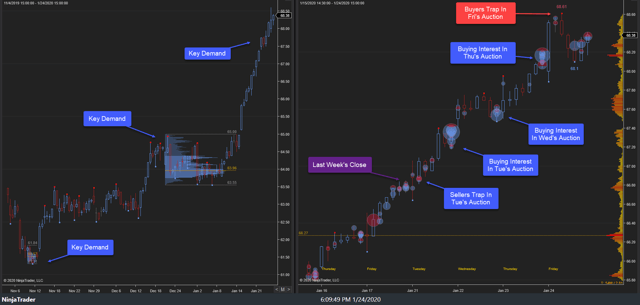

Wednesday’s late buyers held the auction despite an attempted rejection early in Thursday’s trade. Price discovery higher continued in Thursday’s auction to 68.21s where again buying interest emerged into Thursday’s close. Thursday’s late buyers held the auction as price discovery higher continued in Friday’s trade, achieving the weekly stopping point high, 68.61s, ahead of Friday’s close, settling at 68.36s.

This week’s auction did see the primary expectation play out as the buy-side grind higher continued to new, all-time highs. Within the larger context, the recent buy-side breakout above prior major resistance, 65.11s, is structurally bullish.

Looking ahead, the focus into next week centers upon response to the key demand cluster, 68s-67.50s. This area is where some two-sided trade developed, and if breached could result in a liquidation of some long inventory in this linear up move from 65s. The market continues to seek resistance in a process known as price discovery. Sell-side failure at this key demand cluster would target new, all-time highs. Alternatively, buy-side failure within this key cluster would target key demand clusters