Central Bank Easing Likely To Send Stocks Higher

SPDR S&P 500 ETF Trust (NYSEARCA:SPY) is likely to move higher over the next several months due to Chinese, Fed, ECB, BOJ, and other central bank easing. The whole world is in the process of bringing their fiat currencies lower. The main objective of such monetary strategy is to delay the inevitable recession.

Yes, the scary "R" word is coming, the only question is when

SPY, the S&P 500 (SP500), and stocks in general will likely see a slow down after Q1, but until then the trend is your friend, and prices are likely to move higher. Therefore, I want to continue to keep a relatively high equity position (40-45% of portfolio) while the music is still playing.

Nevertheless, I remain aware that a slowdown in corporate earnings will likely occur due to Coronavirus consequences in China, and other factors. The question is how bad the dent will be in Q1's corporate earnings, and how low will equities go considering negative news flow if earnings and forward guidance begin to slip.

The Bright Side Of Things

The slowdown due to the Coronavirus and other factors is not likely to bring on a recession in the U.S. in the near term (6-12 months). We may have a relatively flat Q1 YoY GDP quarter in the U.S. However, we must look ahead, beyond the Coronavirus and other transitory elements. The U.S. economy has proven to be extremely resilient, and it could very well continue to outperform most other major markets.

Recent economic data suggested U.S. manufacturing is coming out of a recession (ISM manufacturing PMI above 50), the services economy is extremely robust (ISM non-manufacturing PMI 55.5), core CPI inflation ticked up to 2.3%, hotter than expected, and consumer sentiment numbers also beat expectations. With deflationary and stagnating markets around the globe, the U.S. economy is clearly "the best house" in the developed world right now.

Therefore, until a recession in the U.S. arrives, SPY and U.S. stocks in general will likely continue to move higher over the next 2-3 months (or longer) due to enormous liquidity provided by central banks and increased demand for U.S. equities.

About SPY

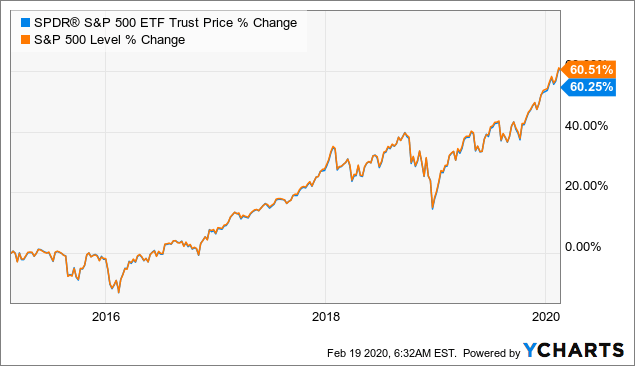

SPY is the first major and most popular ETF in the world. It's designed to mimic the exact movement of the S&P 500. The SPY index fund has roughly $308 billion in net assets, and each share in the fund represents a fraction of the holdings.

Data by YCharts

Data by YChartsSPY provides investors with exposure to the S&P 500 index, which is widely regarded as the most significant stock market average for U.S. equities. We can see that SPY's and the S&P 500's performances have been essentially identical over the last 5 years. The same applies to other time intervals as well.

Major SPY Components The U.S. economy, technology specifically, has the best market-leading mega corporations in the world. SPY’s top 5 holdings are the 5 American tech-titans. Apple (AAPL), Microsoft (MSFT), Alphabet/Google (GOOG) (GOOGL), Amazon (AMZN), and Facebook (FB). These five mega corporations alone make up nearly 20% of SPY's weight, and the technology sector in general accounts for roughly 30% of the ETF's total weight.

Most of these mega-corps are essential monopolies

Facebook is a giant social media empire like no other. The company’s diversified portfolio of social media companies essentially dominates a large portion of the global social media ad market.

Facebook remains a great growth to value story, as the stock trades at only 19.9 times forward consensus EPS estimates, and is projected to grow revenues at roughly 20% this year as well as in 2021.

Alphabet is another massive and remarkable monopoly-like structure. The company controls roughly 92.7% of the global search market. Google is by far the most popular search engine in the world, which implies it is simply the best. Moreover, Google has such a strong market position in search and in other areas that it is not under any threat of losing significant market share in my view.

Furthermore, despite its renaming, Google’s search segment brought in roughly 84% of total revenues last year. Each tech giant is unique, and Google remains amongst the top growth to value opportunity stocks in the world. Alphabet’s cloud revenues increased to nearly $9 billion in 2019, surging by 53.44% on a YoY basis. Google’s cloud business is one of the best in the world and will likely continue to produce significant growth and increased profits going forward.

Alphabet trades at roughly 24 times forward consensus EPS estimates, and is projected to provide revenue growth of around 17% this year as well as in 2021. Other Tech Giants are Also Crushing

Microsoft

This is one of the most dominant monopolistic type companies in the world. Some may associate the word monopoly with something negative. However, in the current economic environment, it is extremely advantageous to be in Microsoft's position.

Microsoft is the most stable, reliable, and dominant monopolistic type structure in the world in my view. The company crushed its recent earnings and provided substantially better than expected forward guidance. Its cloud Azure unit surged by 62% YoY, beating Goldman’s estimates for 58% growth.

EPS and revenues also beat consensus figures considerably. EPS came in at $1.51 beating consensus figures by 14.4%, and revenues came in at $36.91 billion vs. expected $35.68 billion, a 3.45% beat. The company also said that it expects revenues of roughly $34.5 billion in Q1, beating estimates and implying a very healthy 13% YoY growth rate.

Amazon and Apple are not as monopolistic in nature as the other three tech giants. However, Amazon is extremely dominant in its space, as it is expected to account for roughly 50% of all online retail spending in the U.S. in 2021.

Source: Statista.com

Why the Top 3 Sectors Should Move SPY Higher

Source: ETF.com

The Tech sector accounts for about 30% of total SPY holdings and the top five tech titans account for nearly 20% of the ETF's total weight. Moreover, the next two largest sectors, financials and healthcare account for an additional 30% of the ETF's weight. Thus, just 3 sectors have enormous impact on SPY’s price action.

We discussed the tech sector and its dominant position in the global market. Several other companies with a lot of potential for global market share dominance include Tesla (TSLA), Nvidia (NVDA), Netflix (NFLX), and others.

Also, Financials represent a large portion of SPY

The financial segment accounts for nearly 16% of SPY's weight and there are a lot of inexpensive, high quality, market-leading financial names in the U.S. If a wave a defaults can be avoided, financials will likely do very well going forward. Large U.S. banks also have the enormous advantage due to nearly unlimited access to liquidity from the Fed. The Fed can simply buy treasuries in mass amounts, which essentially provides limitless liquidity for large U.S. banking institutions.

Let’s Look at Specific Names

Some of my favourite bank/financial companies include Goldman Sachs (GS), JPMorgan (JPM), Citigroup (C), PayPal (PYPL), Visa (V), and others.

While banks are not fast-growing tech companies, many are trading at extremely low multiples, which implies that rotation into this sector and multiple expansion is likely in the future.

For instance: Citigroup trades at just 8.34 times forward consensus EPS estimates. This is remarkably cheap, and Citi is not alone. Goldman Sachs trades at only 8.65 times forward EPS estimates. JPMorgan trades at around 11.8 times forward EPS estimates, and most other high quality U.S. banks trade at roughly 9-11 times consensus forward EPS estimates as well.

Central Bank Easing

Since we are on the subject of lending and financial institutions in general, let's talk about central bank easing. Easy monetary policy is likely to help support markets going forward, which should enable SPY to move higher.

The Bank of Japan BOJ started it, and now everybody is doing it. Due to massive government/national debt, and other deflationary elements, the BOJ has had its benchmark rate at or close to zero for decades now. Moreover, the BOJ is known to buy just about everything under the financial sun to support the Japanese stock market ant the country's economy.

In conjunction with Japan's now negative benchmark rate (which means that the central bank essentially pays banks to lend them money), the BOJ is a huge purchaser of Japanese stocks and ETFs as well. Remarkably, the BOJ is a major shareholder of many large companies in Japan. The central bank owns up to 19% of total shares outstanding in many companies as well as up to 70% of floating stock in some cases.

So, if Japan can do it why can't other central banks deploy similar monetary practices?

The short answer is that they can, it's just that they are not at the point of necessity, yet.

Nevertheless, China recently cut its loan rates and pumped around 300 billion yuan into its financial system. In addition to having a zero benchmark rate, the ECB has purchased corporate bonds in addition to government securities. We know about the Fed's massive QE programs which roughly quintupled its balance sheet after 2008.

What All This Means

The point is that central banks, especially the major ones have adapted to the current economic environment by implementing various unconventional monetary strategies which effectively prop up asset prices across the globe. By bringing benchmark rates close to/down to zero, or inverting them in some cases, central banks are making saving and investing in treasury bonds (for yield) essentially obsolete.

Who wants to keep money in the bank for next to nothing while inflation is at or above 2%? Who wants to own 5, 10, or 30-year treasuries for yield when the return is under 2%, while inflation is above 2%?

Sure, there are some people, but the point of this so-called monetary stimulus is to continuously introduce more money into the system. This creates more lending/borrowing, overall spending, and sparks appetite for risk assets, such as stocks in particular.

Therefore, until true signs of a real recession appear on the horizon risk assets should continue to do well, as central banks essentially flood the world with fiat currencies in order to stimulate growth and provide liquidity. SPY and U.S. stocks in general should benefit from this phenomenon as the Fed still has room to cut rates, and has plenty of easing tools it has not yet begun to implement.

Healthcare: Anther Great Segment

Finally, I want to discuss the healthcare segment as it accounts for roughly 14% of SPY's weight. First, healthcare is a great defensive segment, as people will always require medicines, and the sector is heavily subsidised by the U.S. government. Second, many top market-leading companies are cheap right now.

For Example:

- Johnson & Johnson (JNJ) trades at around 15 times consensus forward EPS estimates, and has a projected revenue growth rate of about 5%.

- UnitedHealth (UNH) trades at 16 times forward earnings with a projected revenue growth rate of 8%.

- Merck (MRK) trades at 13 times forward estimates with an estimated revenue growth rate of around 5%.

- Bristol-Myers Squibb (BMY) trades at just 8.8 forward EPS estimates with a projected revenue growth rate of nearly 8%.

- Gilead (GILD) trades at only 10.5 times forward EPS estimates.

These are only a few examples, but there are plenty of undervalued companies in the healthcare sector in my view.

The Bottom Line

SPY's composition essentially mirrors that of the S&P 500, and the top 3 sectors, technology, financials, and healthcare account for an astoundingly large share of the ETF's/index's weight (roughly 60%).

The technology leaders are extremely dominant global mega-corporations that should continue to attract inflows and should see multiples expand further under current extremely easy monetary conditions.

The financial leaders are extremely cheap, and should also benefit from the current central bank easing induced economic atmosphere. Many healthcare names are also relatively cheap, provide an added benefit due to their defensive nature and should also due extremely well going forward.

In general, I expect we can continue to see multiple expansion not only in the top 3 sectors concerning SPY, but in most equity names in general. Naturally, we may get a transitory pullback or a correction due to Coronavirus consequences and other factors that may contribute to a slight slowdown in H1.

Nevertheless, the U.S. economy appears extremely resilient and robust. The Fed and other central banks are proactively providing liquidity to delay a recession, and a recessionary slowdown in the U.S. does not appear likely within the next 12 months. Therefore, I would treat a correction as a buying opportunity going forward.

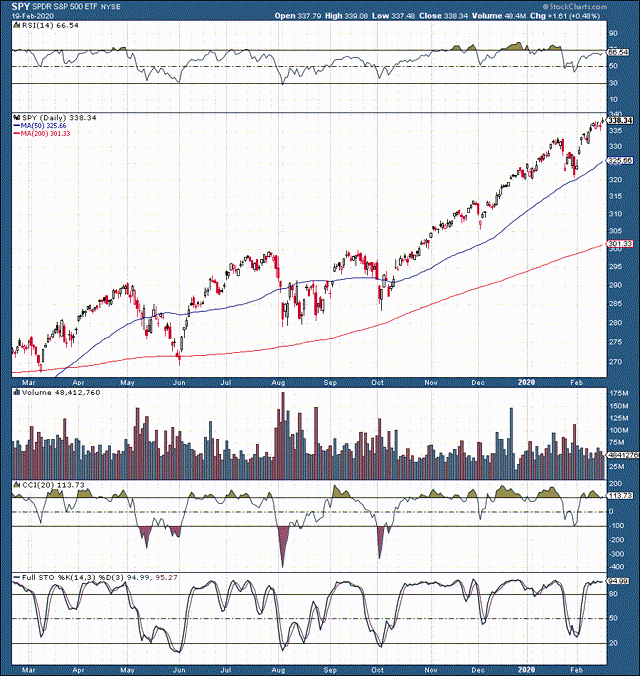

SPY 1-Year

Despite the steep run-up over the last year, it is likely that SPY, the S&P 500 and stocks in general have more upside in the short as well as in the intermediate term.

I expect SPY to consolidate around current levels, and then proceed higher into Q2. Sometime between late Q1 to mid Q2, we will likely get a correction of 5-10% due to the negative impact the Coronavirus and other elements may have on corporate earnings. Nevertheless, stocks should bounce back and finish the year higher.

My revised price target range for year-end 2020 in SPY is $365-$395, or 3,650-3,950 in the S&P 500.

A Few Stock Ideas

Facebook, Google, Microsoft, Nvidia, Goldman Sachs, Citigroup, JPMorgan, Visa, PayPal, Bristol-Myers, Gilead, and more.

Want the whole picture? If you would like full articles that include technical analysis, trade triggers, portfolio strategies, options insight, and much more, consider joining Albright Investment Group!

- Subscribe now and obtain the best of both worlds, deep value insight, coupled with top-performing growth strategies.

- Receive access to our top-performing real-time portfolio that returned 38.5% in H1 2019, as well as 66% in our stock and ETF segment for the full year.

- Don’t hesitate, click here to find out more, become a member of our investment community, and start beating the market today!