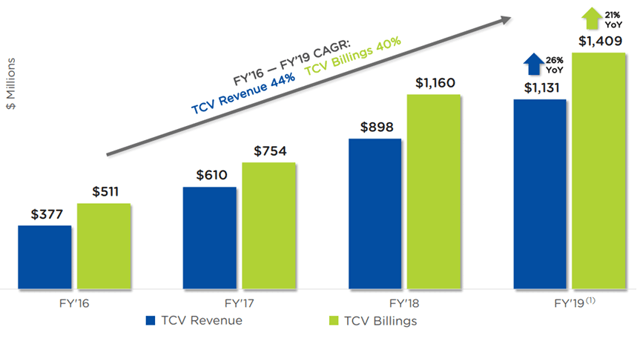

Nutanix, Inc. (NASDAQ:NTNX) once was considered a very promising high growth stock investment and a leader in the hyper-converged infrastructure market once had a CAGR in excess of 40%.

(Source: Nutanix)

But the company has embarked on its own transformation from hardware to software subscription at an accelerated pace, "clouding" its performance over the short term (Sorry for the pun). Conversion from point-of-sale to subscription gives the appearance of reduced revenue growth and compressed margins until the transformation is complete.

This is one reason why Nutanix stock has been beaten up. After reaching an all-time high of ~$60 in the summer of 2018, the stock price has been in decline ever since and now trades near $18.

(Source: Yahoo Finance/MS Paint)

While many analysts consider the stock to be severely undervalued at present, I urge investors to be cautious as the pandemic and recession play out. Below I am providing 5 reasons why you might want to hold off on investing in Nutanix this year.

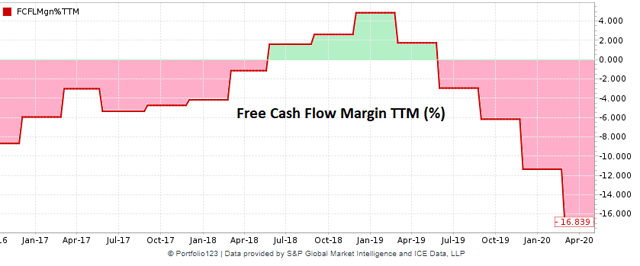

Negative Free Cash Flow Margin

Nutanix has a history of negative free cash flow. While it briefly turned positive in January of 2019, it is now plummeting. The CFO indicated in February that the company planned for ~-$250 million in free cash flow in 2020. This was before the full effect of COVID-19 was known or appreciated.

(Source: Portfolio123/MS Paint)

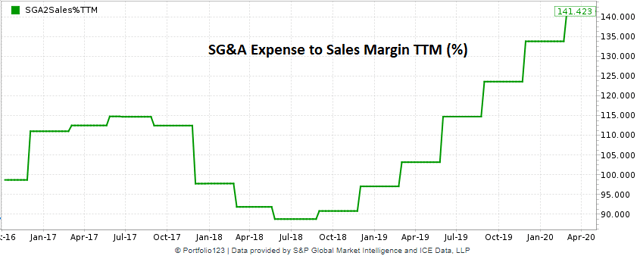

High Level of SG&A Expenses

Nutanix has an extremely high level of SG&A expenses relative to sales, 140% to be exact.

Note: SG&A expense margin includes R&D and associated stock-based compensation.

(Source: Portfolio123)

This means that the company is spending 40% more on SG&A plus R&D than its revenue intake. It is unlikely that Nutanix will have positive earnings for the foreseeable future, and given the current global environment, losses could be much higher than in the past.

The management indicated in the Q2 2020 earnings call that they would not slow down on hiring salespeople:

...we mentioned that we're not pausing sales teams. So that's very important that that comes across clearly. We'll continue to hire sales teams, because any downturn period, the worst thing in my mind you can do is halt sales teams, because -- so you have a little pause. In this case, it's completely out of our hands. I think we're being prudent.

But if you start pausing on sales teams then it takes you twice as long to get back to an accelerated growth, because then you got to go hire folks and ramp them and things like that. So we'll continue with the vast majority of our sales teams hiring there.

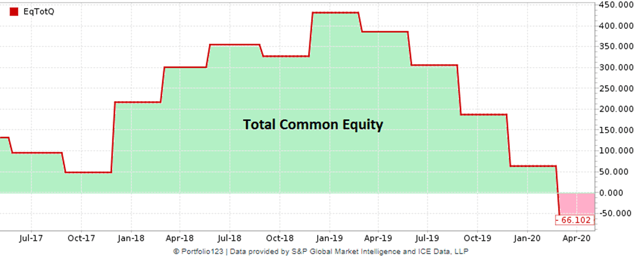

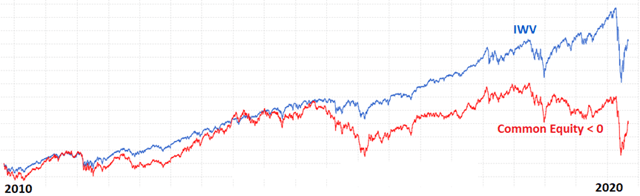

Negative Total Common Equity

I have recently started tracking total common equity as a fundamental factor, specifically looking for companies with negative total common equity. I discovered one company with negative common equity recently. Nutanix is another, turning negative in the most recent quarter.

(Source: Portfolio123/MS Paint)

This is a situation that I don't normally run across, so I decided to run a backtest of the stock performance of companies with negative common equity. Using the Russell 3000 as the base stock universe, I determined that stocks with negative total common equity have underperformed the Russell 3000 fairly significantly over the last 10 years.

(Source: Portfolio123/MS Paint)

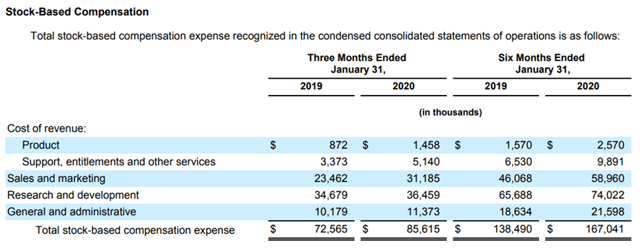

Excessive Stock-Based Compensation

Excessive stock-based compensation (SBC) is something that almost all software companies have in common. But Nutanix has much higher SBC than most companies. A typical software company will provide SBC within the range of 5-15% of revenue. For the first 6 months of FY20, Nutanix has given out $167 million in SBC whereas revenue was $662 million or SBC which amounts to 25% of revenue.

(Source: Nutanix)

While some would argue that SBC is not relevant because it is non-cash compensation, it has the effect of making both investors and employees unhappy when the stock is underperforming as is the case with Nutanix.

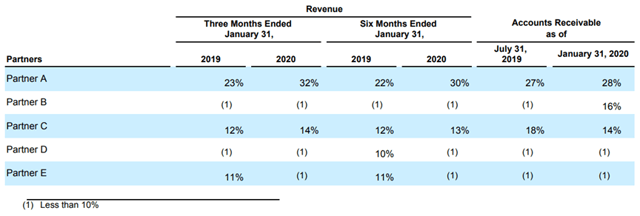

Concentration of Revenue and Accounts Receivable

The final point that I would like to make for today is that Nutanix depends almost entirely on partners for sales. And there is little diversification on this front. One partner account for 30% of revenue and 28% of accounts receivable. The second most important partner accounts for 13% of revenue and 14% of accounts receivable.

(Source: Nutanix)

In normal times, this lack of diversification may not be of concern, but in the present circumstances, the failure of a partner could cause significant harm to Nutanix's business.

Summary and Conclusions

Nutanix is a leader in the hyper-converged infrastructure market and, prior to the start of its transformation to a subscription-based business model, was growing at an impressive rate of 40% per annum. But the transformation has clouded the company's performance. It may very well be that Nutanix returns to being a high-growth company once the transition is complete and, of course, after the pandemic and recession play out.

But, I suggest that investors take a cautious approach. While the company is undervalued at present, it has negative free cash flow, negative total common equity, and an extremely high SG&A expense margin. In addition, the company's SBC is exceptionally high and revenue generation is not diversified among channel partners.