Image Source - Is the next stock market crash just starting?

The S&P 500/SPX (SP500) is down by around 80 points this morning, now testing the key support level at 3,100. It looks like that the economic reality is not nearly as constructive as stock market optimism has been implying in recent weeks.

COVID-19 is not going away, and as mentioned in previous articles it's likely to continue to weigh on economic growth as well as on stock prices going forward.

The Second Wave

More than a dozen states are showing significant resurgences in Novel Coronavirus/CV cases. Naturally, this will likely weigh on consumer confidence, employment, other data, and overall economic growth.

However, is this really the second wave of the CV? Not likely, as this is probably just the extension of the first wave due to premature "re-openings," relaxed attitudes, densely-populated protests, and other factors. When the second wave comes it will likely be in the fall, coupled with the cold and flu season.

Please keep in mind that this could lead to a certain level of pandemonium, as many people will not be aware whether they have the flu, a cold, or the Novel Coronavirus. There will also likely be uncertainty about the outcome of the election by then, another negative factor for markets overall.

Market Outlook

We've been cautious throughout this rally, as it was artificially induced by enormous Fed stimulus, and we saw an evident disconnect between the real economy and the stock market. Furthermore, I never believed, and still do not believe, that the economy will return to "normal" any time soon. In Q2 we chose to allocate a large portion of our portfolio to the gold, silver, mining/GSM sector, as well as to Bitcoin and other systemically important digital assets. The reasoning behind this

Want the whole picture? If you would like full articles that include technical analysis, trade triggers, portfolio strategies, options insight, and much more, consider joining Albright Investment Group!

- Subscribe now and obtain the best of both worlds, deep value insight, coupled with top-performing growth strategies.

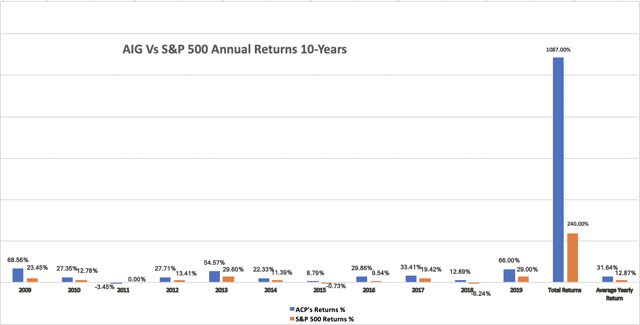

- Receive access to our top-performing real-time portfolio that returned 38.5% in H1 2019, as well as 66% in our stock and ETF segment for the full year.

- Don’t hesitate, click here to find out more, become a member of our investment community, and start beating the market today!