In recent weeks, we discussed doubling down on two apartment REITs with a Northern and Southern California focus - Equity Residential (EQR) and Essex Property Trust (ESS). Who doesn't like a good double down?

Yeah, that's not what we meant.

In this article, we look at commentary from the summer 2020 Allen Matkins/UCLA Anderson Forecast California Commercial Real Estate Survey to provide an update on the multifamily market in that state.

But first, here’s a bit about what he had to say on EQR a few weeks ago:

The portfolio contains reasonable diversification. Nearly 60% comes from the West Coast. Most of the rest comes from the Northeast. We're comfortable with this geographic layout. The areas we are most concerned about currently are Florida, Georgia, and Texas (all have soaring rates of positive tests). No exposure to those markets in this portfolio.

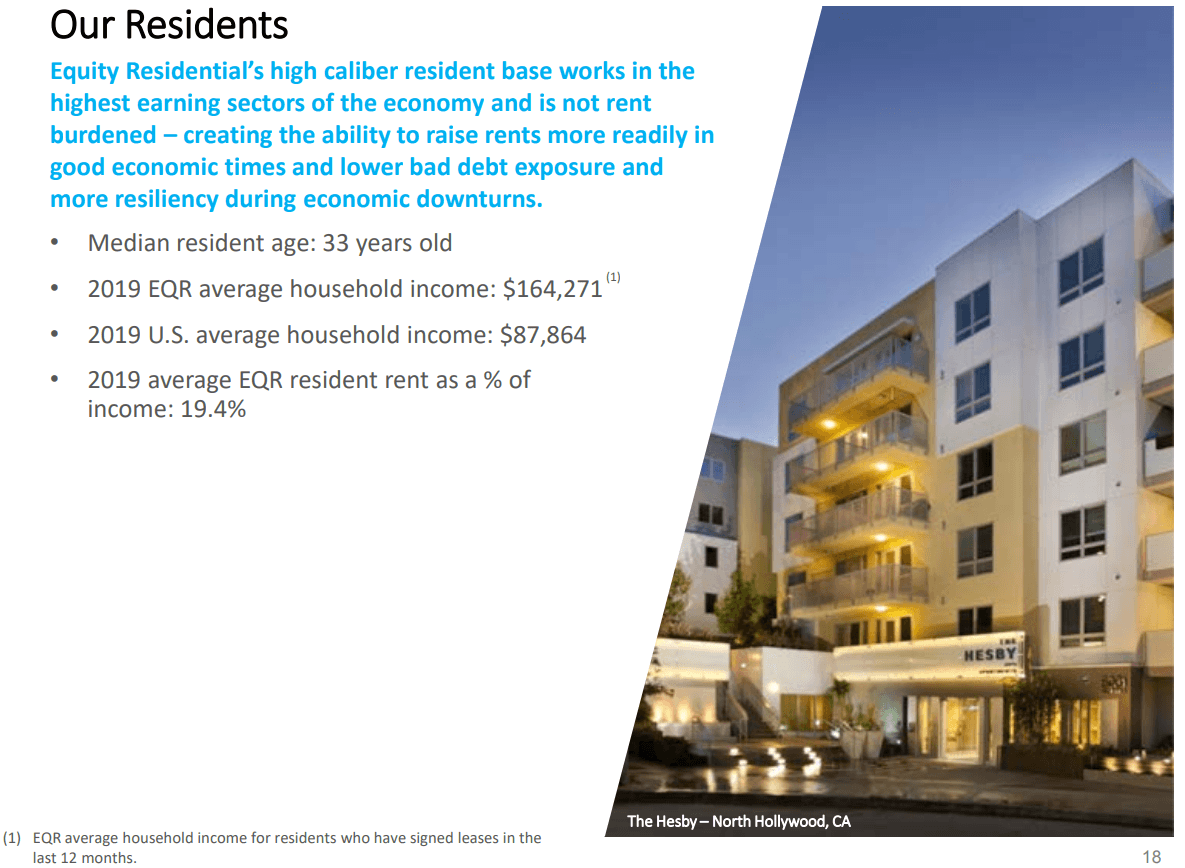

We also like the demographic profile of the typical EQR renter:

EQR isn't a slumlord. They are renting to tenants with much higher than average incomes…

These tenants are generally less impacted by the pandemic because they are far less likely to work in the "non-essential" jobs.

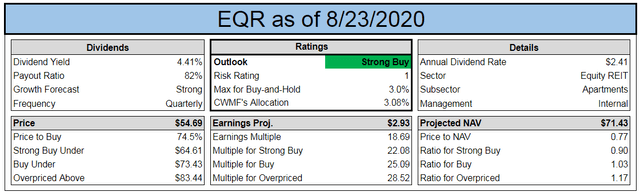

And here’s where we stood - and stand - on EQR as part of our long-term portfolio:

Our cash allocation is dropping to about 36% as our EQR allocation increases to 3.10%. This matches our defensive strategy of gradually deploying capital into high-quality REITs as the market offers them to us. The technicals here look quite scary. The entire apartment REIT sector has been trending lower. We don't know precisely where the bottom will hit, but we're happy to continue building positions at these dramatic discounts.

Our latest index card is shown below:

Source: The REIT Forum

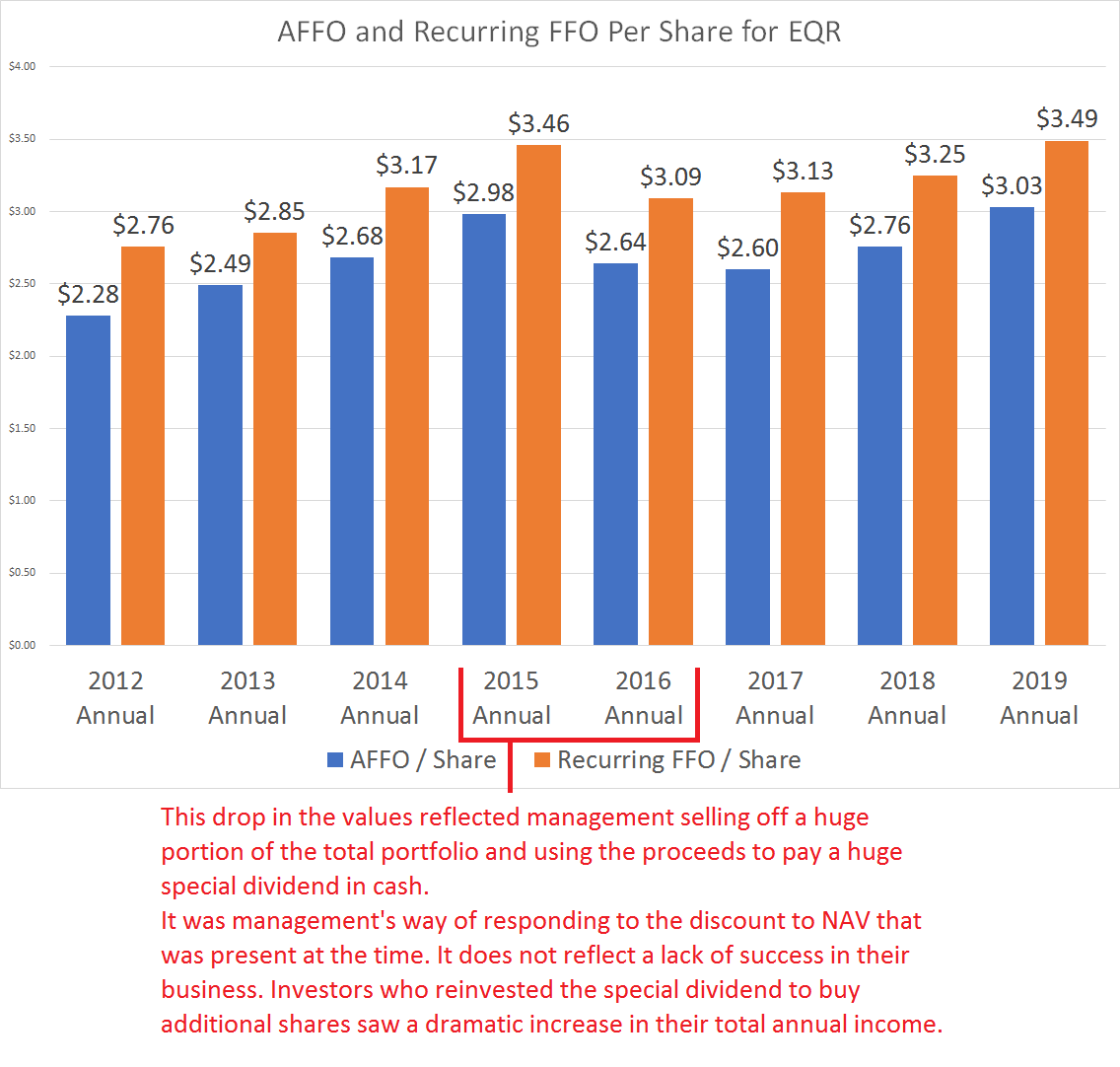

Apartment rents have risen quite steadily and that has driven steady growth in AFFO and FFO per share:

Source: Author's chart with data from REITbase.com

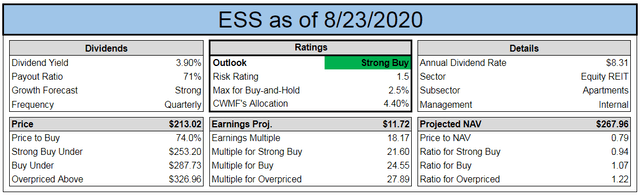

We’re bullish ESS for similar reasons. Here’s a quick summary of our position from that earlier article, which segues into the Allen Matkins/UCLA commentary:

If you'll accept our opinion that this is a great management team, then you'll agree that ESS should at the very least perform as well as apartment properties in California.

Our latest index card for ESS is shown below:

Source: The REIT Forum

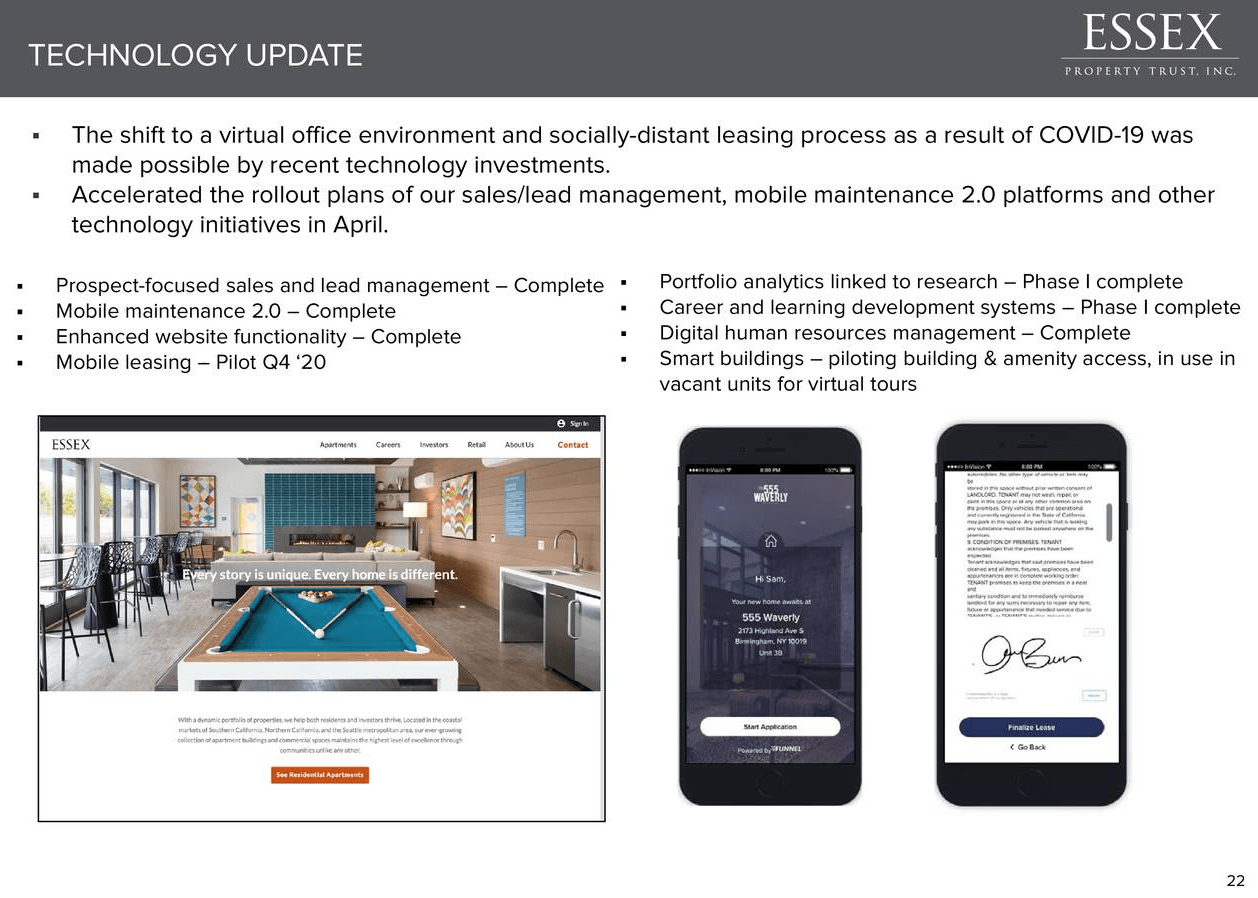

The big REITs have a few advantages over smaller landlords. One of those advantages is the ability to incorporate technology much faster:

Source: ESS

With the notion of ESS performing, at the very least, as well as apartment properties in California, let’s peek in on the health of multifamily real estate in the Golden State.

Will An Urban Exodus Hurt EQR And ESS?

One part of the bear case for these REITs is that work from home will cause renters to leave dense and relatively expensive urban centers for the suburbs in search of cheaper rent or even homeownership.

As part of the Matkins/UCLA survey commentary, Kitty Wallace, a Senior Vice President at Colliers International (a huge real estate services company), downplays this concern:

As happens during and after each market downturn or major economic event, a portion of the population will re-evaluate their living arrangements. As the market sky-rocketed over the past decade or more, residents left home to rent on their own or rented newer and nicer units to reflect their desired lifestyle. When the housing construction rate didn’t keep pace with increased demand, rental prices increased exponentially in major markets. As prices continued to escalate, some tenants were forced to move to smaller units, add roommates, or move further away from city centers in order to live in the neighborhoods and buildings in their price range. Post COVID-19, some of these residents are temporarily moving back in with family to manage unemployment or underemployment, as job prospects have dwindled. Others will move to different communities for lifestyle or financial reasons, some to less dense locations, and others to the suburbs or other markets. For each resident moving out of city centers, however, others who are faring better economically or desire to live in these major markets will continue to increase, filling in any gaps made by those who left. (emphasis added)

Timothy Hunter, a partner at Allen Matkins, echoes that bullishness on California:

For some people, working from home has inspired local interactions and a greater sense of community. Just think of how many more people have been out walking around their neighborhoods over the past few months. You might see a shift in community amenities—open-air spaces are probably getting more use right now than gyms or community kitchens—but multi-family complexes are still a great option for many people in the housing market.

On the issue of development in California, Wallace had this to say:

While Southern California has seen a slight softening in the rental market due to the COVID-19 pandemic and developers face the ever-present risk of new legislation further constraining the industry, the fact remains that there's a housing shortage, and these submarkets in California remain some of the top job markets in the country. While many economists project little to no rent growth over the short term, most expect the market to fully recover and experience similarly high rates—likely even reaching historic highs—over the next three-to-five years. After many years of rising pricing, developers are now realizing price reductions and greater flexibility with their contractors and subcontractors. An enormous amount of capital is waiting to enter the California markets, and developers and capital providers alike are more likely to engage in ground-up development that will not come online for a year or more when the expectation is that this pandemic will be in the rearview mirror, rather than acquire an existing asset in the midst of lease-up that is experiencing temporary difficulties due to the pandemic as sellers are unwilling to reduce pricing.

Our Take

We agree with the prevailing sentiment in the survey. While COVID-19 has hurt and will continue to be a headwind for apartment REITs, we think EQR and ESS are well positioned to stand their ground during the pandemic and come out stronger after that.

Many investors believe there will be a huge shift toward living in more rural parts of the country with a lower cost of living. While some of the second-tier cities may perform quite well, it's quite a stretch to believe that there will be mass migration. If people simply followed the cost of living with no other consideration, why would they pick the heartland when they could retire in Malaysia.

If the offices still expect employees to show up to work occasionally, then moving "outside the city" is viable but moving "across the country" is not. That seems like a viable compromise. However, it wouldn't enable rents to fall far enough to justify the plunge we've seen in share prices so far.

- Bullish outlook on EQR and ESS

We are the only large REIT Research service on Seeking Alpha with:

- A CPA on the team.

- A record going back to the start of 2016.

- A real-money portfolio worth over a half-million with full disclosure on every trade.

- Real-time notifications on every purchase and every sale, including exact share count, purchase price, dividends earned, and sale price.

- All of the exclusive research from Colorado Wealth Management Fund and Scott Kennedy.