One of the best performing stocks so far this year is electric vehicle maker Tesla (NASDAQ:TSLA). Investors have sent the stock soaring to new heights thanks to deliveries holding up fairly well and GAAP profits potentially leading to S&P 500 inclusion. Interestingly enough, there is one thing associated with Tesla not rising currently, which could help to fuel the rally even further if the recent trend continues.

In early July, Tesla came out with a decent Q2 production and delivery report. However, street estimates were so ridiculously low that everyone made it seem like it was a massive blowout. The low bar continued into the earnings report, where Tesla revenues came in well above the street average, although anyone that followed my coverage knew that a sizable beat was likely. Tesla has only missed revenue estimates three times since Q3 2016, and the only major miss was in Q1 2019 when Tesla took a major one time hit to revenues from an accounting reversal.

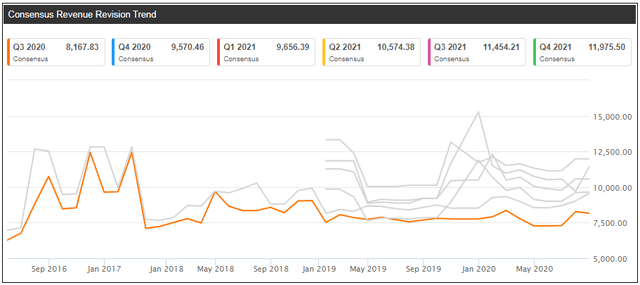

For Tesla to get to its 500,000 unit delivery guidance for the year, it needs a really strong back half of the year. As I discussed in a previous article, a moderate ramp would mean roughly 142,000 vehicles delivered during the current quarter and then 178,000 in Q4. These would both be quarterly records for the company, and likely would lead to the two best revenue prints in Tesla history. That being said, take a look at the following graphic, which highlights a history of Q3 2020 analyst revenue expectations.

(Source: Seeking Alpha Tesla analyst estimates page, seen here)

I'm not going to make a big deal of the 2016 and 2017 numbers, because that was a number of years off and could have been impacted by a very low number of estimates. In late 2018, however, the analyst average