The Full Monty:

Definition: The whole thing; everything that is wanted or needed.

Source: Dictionary.com

Investors in Ashford Hospitality Trust (NYSE:AHT) have struggled with severe distress. The company had long outspent its cash flow and had also leveraged itself to the maximum. The pandemic was just the event that accelerated the timeline on this lead balloon. While we had stayed away from the common on account of some very onerous numbers, we did suggest that investors consider an arbitration play. We had suggested investors go long the preferred shares namely (AHT.PD), (AHT.PF), (AHT.PG), (AHT.PH) and (AHT.PI) and short the common shares, alongside accepting the company's proposal exchange offer.

The Trade So Far

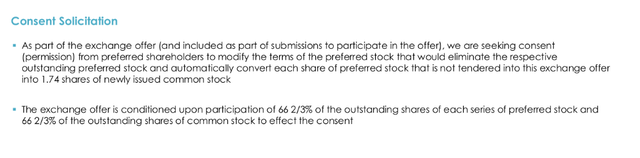

Shorting the common at the ratio suggested alongside a long on any one of the preferred classes would have resulted in very good gains.

Source: Author's calculations as of close of trade Sep 10, 2020

Note that Ashford Preferred Class D shares (AHT.PD) have been abnormally strong and if you were lucky enough to use that for your arb play, then your gains would have been even higher.

The offer has now been changed. AHT had a new SEC filing where it detailed out an even larger bombardment of common shares for the preferred.

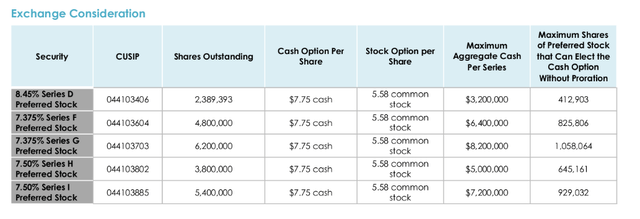

The Preferred Holders electing to tender in the Exchange Offers may elect to exchange their shares of each series of Preferred Stock for either 5.58 shares of newly-issued Common Stock (the "Stock Option") or $7.75 (the "Cash Option"). If more shares of Preferred Stock are tendered and select the Cash Option than there is cash available in the Exchange Offers, the amount of cash received by each Preferred Holder electing the Cash Option will be prorated among the number of shares validly tendered and not withdrawn according to a formula that takes into account the relative value of the Cash Option offered in each Exchange Offer. The Preferred Holders will instead receive shares of Common Stock for the portion of the Cash Option that they did not receive. The completion of the Exchange Offers requires the tender and consent of the holders of at least two-thirds of the outstanding shares of each series of Preferred Stock, and the approval by the holders of two-thirds of the Common Stock outstanding and entitled to vote at a special meeting of holders of Common Stock.

Source: Ashford

Cash offer will be offered to a maximum of about 17% of each class of preferred shares and is also contingent on the company raising $30 million of capital.

Source: Deal Roadshow

Why The Amendment?

It appears clear to us that the company was failing to get the necessary votes on the preferred shares at the ratio suggested. Hence, it is throwing the kitchen sink here and offering to pay what may appear to preferred shareholders as "The Full Monty". Remember AHT only has 10.5 million common shares outstanding. By offering over 126 million newly minted shares for the preferred shares, it is essentially giving all the upside to the preferred shareholders. This is also a desperate way of trying to preserve some value for the existing common shareholders as with the preferreds standing ahead of the common, the residual value of the common shares in a bankruptcy is guaranteed to be a big, fat zero. By consolidating everything into one class, the existing common shareholders have a chance at dividing up proceeds from hotels that don't have a mortgage. We are talking in terms of just shares, as we think raising $30 million will be very difficult and the transaction will proceed only in the form of shares.

A Look At The Deal

The long preferred/short common trade got a big boost here. With the amount of dilution being done, it is hard to see the common get any upside, even after they have dropped so substantially. But let's work through this a bit further.

Outcome 1: No deal gets done and AHT heads to bankruptcy

While the common shareholders may think there is still hope, do note that the company has not paid interest on its mortgages since April. It is burning through cash even after that at the rate of $20 million a month. It is likely losing money even on hotels it does not have a mortgage on. So a bankruptcy is highly probable.

The preferred shareholders would then be in the driver's seat for the residual non-mortgaged hotels, but as to what value one can assign to them in this market, is a giant unknown. Remember, when we initiated the trade, investors were getting more cash upfront for the shorted common shares than they spent on buying the preferred shares. So the preferred shares having zero residual value was not a risk for the trade. That applies today as well and investors can initiate another trade in the new ratio should they desire.

Outcome 2: A preferred to common conversion deal gets done

The key point here is that AHT could still head to bankruptcy court as it is still hemorrhaging cash and the conversion does not stop that. The good part though, is that the preferred shareholders will pretty much get almost all of the residual value as they will control 126 million of the 137 million shares outstanding. In other words, they will control 91% of the company versus the 100% they would have liked.

If You Initiated The Trade Previously

The new deal puts you in a no-lose situation. If shares are available, you could add to the short position as you accept the offer. Conversely, you could sell some preferred shares so that the ratio reflects the new conversion offer. In any case, your risk of losing money on this trade has evaporated.

If You Want To Initiate This Trade Today

Going long 1000 preferred shares and shorting approximately 5,580 common shares results in $7,476 in net cash. Assuming both securities in that trade visit the zero mark, that $7,476 is yours to keep. If the deal gets done, then your preferred shares get converted into the common and your account should show no residual relationship with AHT. Even then, the difference is yours to keep.

Key Risks

The key risk here again is whether you can borrow the shares to short. You could also get squeezed on one side of the trade. This actually happened immediately after we suggested this paired trade and preferred shares dropped while the common stood proud. But eventually things adjusted to the reality. The math here does not lie and if you can see the position through, investors should come out happy.

The Full Monty

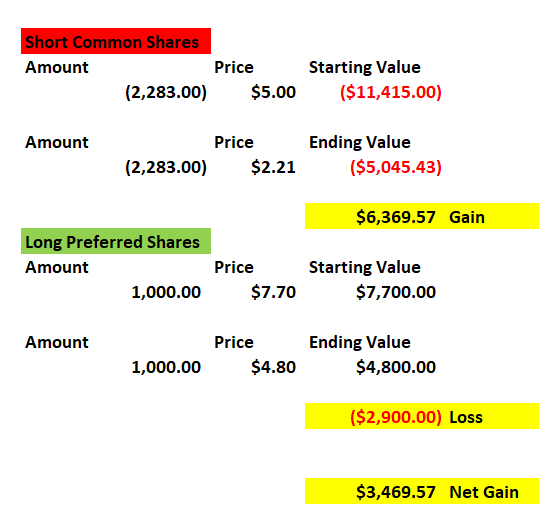

We left the best part for the end in this article. AHT is also seeking votes on diluting those that don't consent.

Source: Deal Roadshow

So those that don't get the full monty (in this case 5.58 common shares for each preferred) get to experience another form of the full monty. We would strongly recommend that preferred shareholders vote yes on this proposal.

If you enjoyed this article, please scroll up and click on the "Follow" button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the "Follow" button next to my name to not miss my future articles.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are You Looking For A High Income Portfolio Generated From Cash Secured Puts?

Join Us On High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with 4,400 members. We are looking for more members to join our lively group and get 20% off their first year! Our Option Income Portfolio generates better Risk-adjusted returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward. Learn more about our method and why it might be right for your portfolio.