Source: The Hill

Investment Thesis

Amazon (NASDAQ:AMZN) just reported another solid set of quarterly numbers as the company beat analyst expectations on both revenue ($96.1 B vs. $92.7 B) and GAAP earnings per share ($12.37 vs. $7.55). To be fair, everyone already knew that Amazon's cloud business (AWS revenue up 29% y/y) would likely do well due to the pandemic-enforced acceleration in enterprise cloud migration and digital transformation. However, the broader results are just incredible, and my confidence in our Amazon investment thesis has been increased.

I have been buying Amazon throughout the year, and here's the crux of my investment thesis: "Amazon's Cloud and Ad business will continue to drive the company's revenue and free cash flow higher over the next decade. Amazon will likely be the first company to generate $1 Trillion in annual revenues, and I expect that to happen by 2030. With Amazon, we get a unique business mix that ranges from consumer staples to cloud to digital advertising to online streaming. Amazon's business will remain strong in any crisis (e.g., COVID-19, recessions, etc.), and Jeff Bezos is still at the helm running this company like its 'Day One' every single day. Hence, I like Amazon."

Today, we will look at the highlights from the Q3 earnings report and understand their long-term implications on Amazon's future. Finally, I will provide an updated valuation and projected return, which factors in the latest earnings report. I remain bullish on Amazon and recommend long-term investors to buy into the business using a dollar-cost averaging strategy over the next 6-18 months.

Amazon Reports Another Strong Quarter

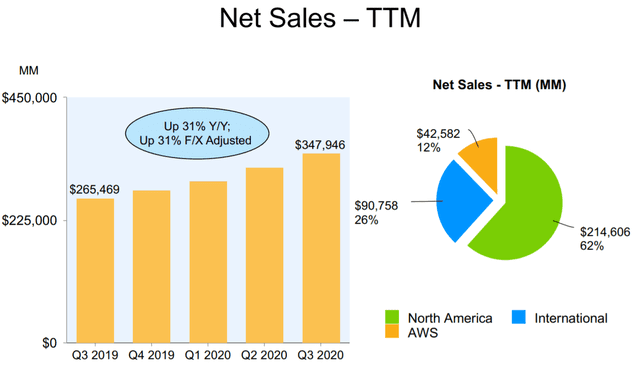

In Q3 2020, Amazon reported record net sales of $96.15 billion, representing a +37% y/y growth rate. For the last twelve months, Amazon's total revenue grew from $265 billion to $348 billion (up 31%). The strong revenue growth is primarily down to Amazon's e-commerce business, which became the lifeline for numerous households during the coronavirus pandemic.

Furthermore, AWS continues to swiftly move along its growth path (registering +29% y/y growth in Q3). Amazon Web Services contributed only 12% of the total revenue; however, it generated 57% of Amazon's operating income. Hence, AWS continues to remain crucial to Amazon's story. Cloud migration and enterprise digital transformation are multi-year secular growth trends, but COVID-19 has motivated companies to accelerate these plans, and Amazon is the leading cloud infrastructure company. Hence, I expect AWS to continue to do well over the next decade.

Source: Amazon Earnings Presentation

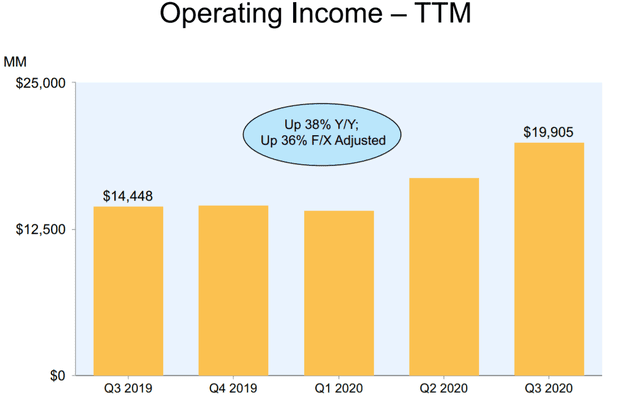

In 2020, Amazon has made incredible progress in operating performance. On a TTM basis, Amazon's operating income is up 38% y/y. However, Amazon's quarterly operating income just grew at +96% y/y (we first saw this bump up in Q2). Amazon's Q3 operating income stood at $6.194 billion, of which AWS contributed to $3.535 billion. Another positive was Amazon's international business turning profitable over the last two quarters.

Source: Amazon Earnings Presentation

Amazon's "Other" segment is basically its digital advertising business, and the positive trends seen in Q2 continued in Q3 due to higher traffic on Amazon's platform and increased digital ad spending budgets. Over the next few years, Amazon's Ad business will become the primary driver of growth for the tech conglomerate and could take the baton of being Amazon's primary source of income from AWS.

I expect consumer spending patterns to further gravitate towards online shopping in the future. As the retail business scales up further, Amazon will continue to realize monetary benefits from denser delivery routes and other such economies of scale. Amazon’s cloud and digital advertising businesses are best-of-breed and positioned at the heart of secular growth trends. AWS and Ads should be enough to drive Amazon’s sustainable growth over the next decade; however, Jeff Bezos could add new businesses to Amazon’s portfolio in the future. Therefore, I am very, very bullish on Amazon as a company.

What's In Store For Q4

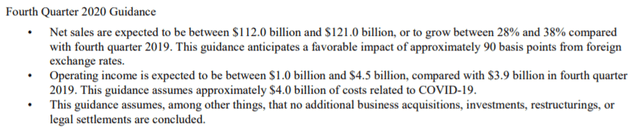

Amazon is set to become the first big-tech giant to record a $100+ billion quarter in Q4. The company has guided for $112 - $121 billion, which translates to a y/y growth rate of 28% to 38%. Hence, another great quarter is up next for my fellow Amazon shareholders.

Source: Amazon Press Release

The retail business will be boosted by the holiday season and the Prime Day sale, which happened in October this year. The trends supporting Amazon’s explosive growth are very much intact and could even get more robust in Q4. Amazon has a rich history of beating its guidance. Hence, barring any significant shocks (e.g., financial crisis, no stimulus, etc.), Amazon will register sales of more than $121 billion in the next quarter.

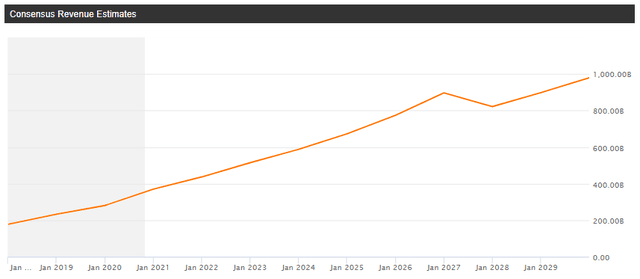

And By 2030, Amazon Could Have Annual Revenue Of $1 trillion

According to earnings estimates from Seeking Alpha, Amazon is expected to generate annual revenue of ~$1 trillion. Now the figure looks daunting on first viewing; however, it is very realistic.

Source: Seeking Alpha

Amazon is already on annual revenues of ~$350 billion, with a lot of room for growth. Let's take a look at the breakdown of the revenues to understand how Amazon can get to $1 trillion in annual revenues:

As of Q3 2020, Amazon's e-commerce revenues (online stores + physical stores + third-party seller services + subscription services) stood at $79.3 billion (up +38% y/y). We know that Amazon enjoys a ~40% share in the US online retail market; however, e-commerce penetration in the US remains below 35%. To that extent, Amazon still only has a 4-6% market share of the total US retail market. Furthermore, Amazon will have sizeable international growth opportunities over the next decade. Thus, Amazon's e-commerce business will likely continue to grow (albeit at a slower rate).

Source: Amazon Press Release

Amazon Web Services - the cloud business has been Amazon's primary source for free cash flow. The secular growth trend of digital transformation is in full swing, and the demand for AWS's offerings is likely to remain elevated over the next ten years. Microsoft Azure is proving to be a tough competitor for Amazon, but AWS still holds a 35% market share in the overgrowing cloud infrastructure market. I was expecting AWS to grow by ~30% y/y in FY-2021, so the 29% y/y in Q3 is more or less in line with my expectation. However, I think AWS growth rates will taper off over the next few years. To learn more about this trend, click here.

AWS might slow down, but Amazon's Ad business is just getting off the ground. We explored Amazon's Ad business in detail in this article, so I am not going into it today. However, the "Other" segment just grew at 51%, which is higher than my growth estimate. This outperformance is likely down to higher Ad revenue due to higher traffic on Amazon's e-commerce platform. I am now confident that Amazon's Ad business will become the primary growth driver of the company in the next decade.

Now, let's project the revenue growth (segment by segment):

Segment | Current Revenue | Assumed CAGR | Revenue 2030 |

E-commerce | $287.05 B | 10% | $744.53 B |

AWS Cloud | $42.58 B | 15% | $172.25 B |

Digital Advertising | $18.31 B | 20% | $113.37 B |

Total | $347.94 B | - | $1.03 T |

Using conservative growth projections for each segment, we can safely predict that Amazon will become the first company ever to register annual revenue of one trillion dollars and that too sometime within the next ten years.

Jeff Bezos is a growth-hungry CEO (just the way we like them), and I can't see him not creating new revenue streams and businesses within the Amazon umbrella. Hence, we might be underestimating Amazon’s growth rate, and the company could be raking in more than $1.03 trillion by 2030.

Updated Valuation and Projected Returns

To determine Amazon's fair value, we will employ our proprietary valuation model. Here's what it entails:

In step 1, we use a traditional DCF model with free cash flow discounted by our (shareholders) cost of capital.

In step 2, the model accounts for the effects of the change in shares outstanding (buybacks/dilutions).

In step 3, we normalize valuation for future growth prospects at the end of the ten years. Then, using today's share price and the projected share price at the end of 10 years, we arrive at a CAGR. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

In step 4, the model accounts for the effect of dividends.

Since Amazon's R&D spend as a %age of revenue remains elevated to date, I think growth remains a priority for Amazon. Hence, I am not expecting a dividend from the company in the next ten years.

Here are the model assumptions:

TTM Revenue (including Q3, 2020) [A] | $350 billion |

Potential Free Cash Flow Margin [B] | 20% |

Average diluted shares outstanding [C] | 518 million |

Free cash flow per share [ D = (A * B) / C ] | $135 |

Free cash flow per share growth rate | 12.5% |

Terminal growth rate | 3% |

Years of elevated growth | 10 |

Total years to stimulate | 100 |

Discount Rate (Our "Next Best Alternative") | 9.8% |

Here are the results from L.A. Stevens Investment Model:

Source: L.A. Stevens Valuation Model

As you can see above, Amazon has a fair value of ~$4145 per share, meaning its market cap should be ~$2.11 trillion. Hence, according to these estimates, Amazon is undervalued by ~23%. Now, Amazon will produce massive amounts of free cash flow, which I am not factoring into my buyback/dividend calculations today since there are no indications from the company that points towards a capital return program. I will explore this aspect in more detail some other time; for now, let’s keep going.

Valuation analysis is never enough to buy a stock; we need to assess the potential returns too. Let's find out the projected returns for Amazon using step 3 of the model.

Expected Price Return

To calculate total expected return, we simply grow the above free cash flow per share at our conservative growth rate, then assign a conservative multiple, i.e., 20x or 25x, to it for year ten. This creates a conservative intrinsic value projection by which we determine when and where to deploy our capital.

Here are the results!

Source: L.A. Stevens Valuation Model

Therefore, one can expect Amazon's value (on a per-share basis) to grow from ~$3,200 to ~$11,000 at a CAGR of ~13.1% in ten years. Since the total expected return is above my investment hurdle rate of 9.8% (S&P 500 60-yr annualized return), I rate Amazon a buy.

Concluding Thoughts

If you are looking for investments that will be sure-shot winners over the long term, Amazon should be high up on your buying list. With COVID-19 cases surging once again amidst political uncertainty, investors looking for a safe-haven should deploy their excess cash in Amazon. The stock is currently trading at lofty valuations; however, Amazon’s quality deserves this premium valuation, and you are very likely to beat the market over the next decade by buying Amazon at $3200.

Key takeaway: I rate Amazon a buy at $3200.

As always, thanks for reading, remember to follow for more, and happy investing!

Beating the Market: The Time Is Now

There has never been a more important time in stock market history to buy individual stocks at the heart of secular growth trends. Mature market performers/underperformers and index funds simply will not cut it, as we face a decade during which there is absolutely no guarantee the overall markets will rise.

This is why the time is now to discover high-quality businesses with aggressive, visionary management, operating at the heart of secular growth trends.

And these are the stocks that my team and I hunt, discuss, and share with our subscribers!