Incredibly, it’s been more than 1 year since COVID-19 started wreaking havoc on the world at large, and by extension the financial markets. While it has been a difficult year, we have also come a long way. The world has come together in an unprecedented coordinated effort to control COVID-19 and its effects.

Financial markets were significantly impacted in February and March of 2020, however due to very accommodating and responsive monetary policy by central banks, and a generally improving “we will get through this” sentiment, markets have performed exceptionally well in the past year, much better than most would have expected.

The last few weeks have been very volatile in the markets, from inflationary fears and rising rates, to concerns over high valuations of tech and the “stay at home” stocks.

One of the common narratives around this volatility is the “rotation into value”. As growth, tech stocks and the Nasdaq have broadly performed exceptionally well, this volatility (particularly in growth and tech) would suggest that money is flowing from high growth into beaten down value stocks.

While growth and tech have stolen the spotlight for much of the last year, in this piece we will see how value has performed over the period.

In Jun of 2020, I wrote about performance of value vs. growth after the bottom of the market in March of 2020. We looked at various value and growth ETFs, both large and small cap, and saw how US small cap value was starting to lead the pack out of the market bottom.

Based on some of my previous research, US small cap value has historically done well after a crisis. I covered this at length in my series Quantitative Crisis Investing, Part 1 and Part 2, which presented a quantitative strategy designed for crises. I tracked real-time performance of the strategy through COVID and provided updates here and here. As we will see, value has done well over the last year, and this strategy is no exception.

In this piece, we’ll cover off some broad value and growth indices and ETFs, and then get into some more concentrated value strategies.

Market Performance, March 2020 – March 2021

We’ll carry on from where we left off from my piece last June, and look at the following ETFs to get a good cross section of performance of the market as a whole:

IWC – Microcaps

IJR – SP600 Small Caps

IJS – SP600 Small cap value

IJT – S&P600 Small Cap Growth

SPY – S&P500 Large Caps

SP500PV – Large Cap Value

SP500PG – Large Cap Growth

QQQ – Nasdaq

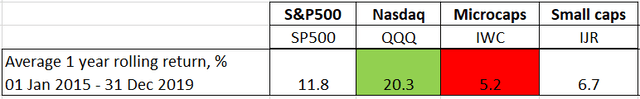

In the last piece, we looked at the previous 5-year performance of each of the indices and ETFs above, from 2015 to 2019 (just before COVID hit). The table below summarizes performance over the last 5 years for the major indices and small caps (rolling offset of 1 month):

Source: Portfolio123 data, Author Table

Not surprisingly, the Nasdaq took first place in this race. Small and microcaps trailed, with SPY in the middle.

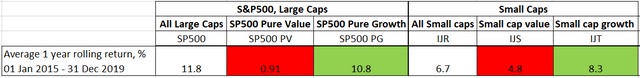

Now if we include the growth and value components of each:

Source: Portfolio123 data, Author Table

Growth has outperformed for both size classes, particularly for the larger caps.

Now we can compare the performance of each in the last year. Any market “bottom” is only really known in hindsight, so to time the bottom in real-time is incredibly difficult, if not impossible. For this reason, we’ll look at various periods and starting times in the last year to see how performance has changed.

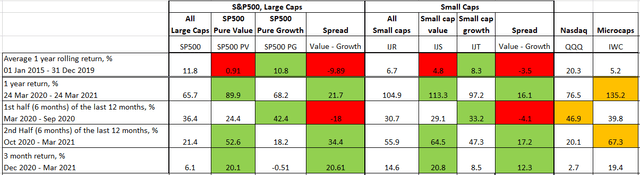

In the last year, performance was as follows for each of our benchmarks above:

Source: Portfolio123 data, Author Table

Note the spread between value and growth for the large and small caps. On balance, value has outperformed for both large and small caps, most of the outperformance from the last 6 months. My focus has been on US small cap value as we will see, however note the impressive spread between large cap value and growth, particularly in the last 6 months.

With the scene set for broad value and growth, let’s get into some quantitative value strategies.

Quantitative Value Strategy Performance, 2020

Value investing, as a philosophy, is quite simple: buy stocks that are priced less than their intrinsic value. The actual execution of value investing, however, includes an almost infinite number of variations. For our purposes we’ll focus on some quantitative strategies, listed below:

- Net-nets

- Low EV/EBIT

- Magic Formula (original and modified versions)

- Crisis Investing

- Piotroski F_Score

- Benjamin Graham Defensive and Enterprising Investor Screens

For our study, we will use Portfolio123 for all backtesting.

“All Stocks” refers to the universe of stocks that the given value strategy is ranked from. Unless indicated otherwise, “All Stocks” universes for the given strategy's market cap filter include all US stocks including ADRs, utilities/financials/REITs excluded, minimum share price of $1 and minimum median daily trading volume of $100k over the last 4 weeks. Stocks passing the screen at the beginning of the period are held for the duration of the period.

Net-net Investing Performance During COVID

Our first two strategies, net-nets and low EV/EBIT, rely on low valuation alone. This involves purchasing stocks with very low valuations, with the expectation that mean reversion in the market will raise their values and return them to fair value.

Our first strategy, net-nets, is the oldest strategy of those we’ll cover, first discussed by Ben Graham in his legendary book “Security Analysis”, and later in “The Intelligent Investor”. A “net-net” stocks is any stock trading for less than its net current asset value (NCAV). Broadly speaking, these stocks are worth more dead than alive. These valuations may be for good reason, or there may be a temporary setback in the company. I will write more about net-nets in the future, but for a recent academic deep dive on the subject, the paper Deep Value Investing and Unexplained Returns is a solid write-up on the history and performance of the strategy.

We will define a net-net as any stock trading for 2/3 of its NCAV or less, where NCAV is defined as current assets less total liabilities and preferred equity. In our universe, we remove REITs, financials and utilities. Stocks must have a minimum price of $1 per share, with minimum median daily trading volume of $100k over the last month. To screen out any firms at high risk of bankruptcy risk or accounting fraud, stocks must pass minimum scores of the Altman Z-Scores and Beneish M-scores respectively.

The availability of net-nets in the market is highly time dependent; typically, there are more of these stocks available in times of market crisis, after a significant drawdown. At the market bottom in March 2020, there were 16 net-nets passing our criteria (double that if we remove the bankruptcy and earnings manipulation screens).

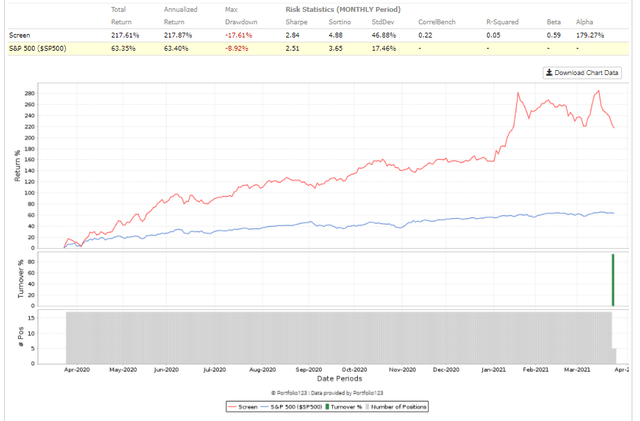

How did our net-nets perform? Below is an equity curve of the stocks passing at the market bottom and holding for 1 year:

Source: Portfolio123 data, Author Screen

This performance is nearly 4X that of the S&P 500 over the same period. Of the 17 stocks, 12 of them achieved returns of 100% or more. Two stocks notably achieved returns of nearly 900% and 800% respectively, Voxx International (VOXX) and Kaspien Holdings (OTCPK:KSPN).

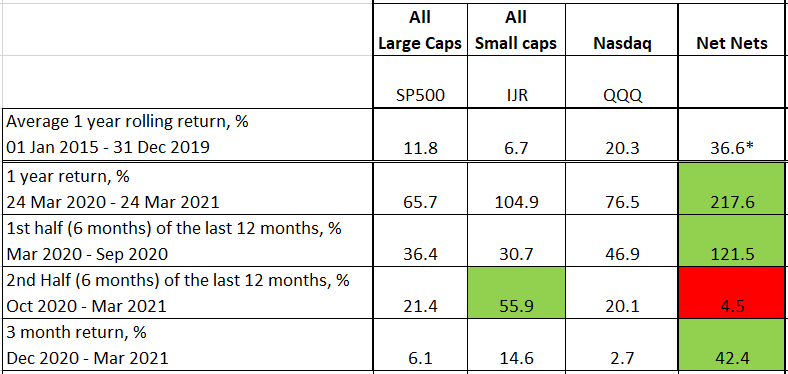

For comparison, here are results if we formed the portfolios later through the year, with historical returns added for the last 5 years:

Source: Portfolio123 data, Author Table

While these returns are impressive, there are a couple of very important caveats. While average rolling returns beat all other indices over the last 5 years, there are some significant outliers that skew this average value. A full breakdown of the net-net strategy is beyond the scope of this piece, but suffice it to say that this “average” is not as statistically significant as the returns from the other indices.

For our focus of the last year, net-nets still managed to outperform in all periods, except the last 6 months. As the year went on, there were less net-nets available. At the beginning of our Oct 2020-Mar 2021 period, there were only 3 stocks in the portfolio.

As noted, this strategy has a very small sample size, which makes it difficult to ascertain as to whether this performance will continue. Regardless, I will keep tracking this strategy in the next few months.

Low EV/EBIT Performance During COVID

Our other value strategy that relies purely on low valuation is that of the low EV/EBIT strategy. This strategy finds stocks with a ratio of low enterprise value to earnings before interest and taxes. The EV/EBIT factor is a variation on the more common price to earnings (P/E) ratio. The enterprise value looks at more than just the equity of the business (or the ‘P’ in the P/E ratio), and EBIT takes into account earnings before any tax or interest (debt payment) effects.

The advantage of this metric is that it looks more broadly at companies with different capital structures, and may be more effective at comparing companies from different industries. I have written extensively about the low EV/EBIT strategy, with various performance updates over time. There are multiple variations to this metric, including EV/EBITDA (EBIT with depreciation and amortization removed), and using operating income in lieu of EBIT(DA) as the denominator.

Like many value strategies, this strategy has outperformed over time, but has had a rough decade (with some periods of outperformance). That said, testing the thesis that value outperforms in times of crisis or market change, I started tracking this strategy in early April of 2020 “on paper”. This strategy alone was outperforming all other asset classes in real-time, so I started looking more closely at other value strategies as well (some of those included in this piece).

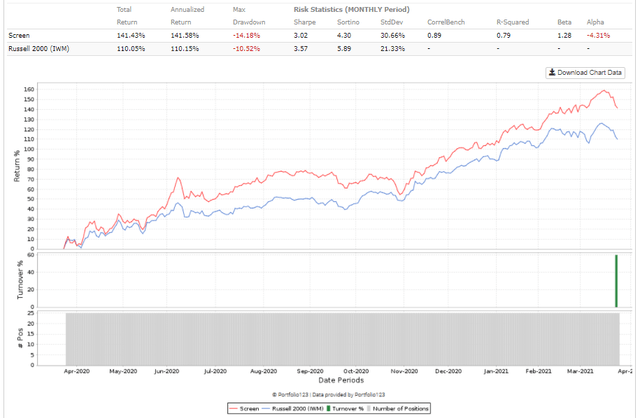

Taking the 25 stocks with the lowest valuations in terms of EV/EBIT (with market cap greater than $1B), the equity curve from the market bottom to 1 year later is as follows:

Source: Portfolio123 data, Author Screen

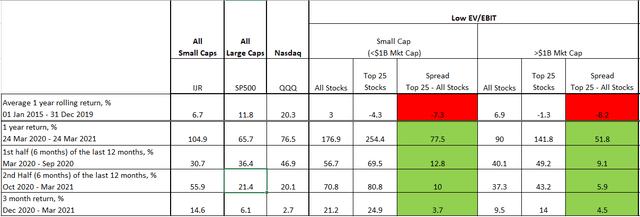

Performance is summarized below for our various time periods from the last year. Also included are results for the top 25 stocks with small cap stocks, i.e. market cap less than $1B.

Source: Portfolio123 data, Author Table

As we can see, the low EV/EBIT strategy outperformed, both small and med/large cap versions. Of particular note is the previous 5 year performance, where both classes underperformed significantly. The crisis has provided a reversal catalyst if you will, propelling these stocks with beaten down low valuations to higher returns.

There may be more to this, however. If we take stocks with the highest valuations, we also find some impressive performance:

Source: Portfolio123 data, Author Table

Stocks with very high EV/EBIT valuations included SaaS stocks Zoom (ZM), AppFolio (APPF) and Five9 (FIVN), and other big names like Harley-Davidson (HOG). For those readers familiar with my SaaS series on the Rule of 40, some names with high valuations have continued to outperform (albeit on a different valuation metric).

While performance of the most highly valued stocks generally underperformed the stocks with the lowest valuations, the spread is not as significant as one would expect. High EV/EBIT stocks still beat or essentially matched the broader index. The last 3 months has seen a drop for the largest firms with the highest valuations.

Magic Formula Performance During COVID

The Magic Formula, originally designed by investor Joel Greenblatt, takes stocks with low valuations (as measured by EV/EBIT as above), but also requires that the stock ranks high on quality (defined as return on capital employed). I’ve written about the Magic Formula extensively; see my detailed analysis here. Like low EV/EBIT, this strategy has outperformed over time, but has had poor performance in recent years.

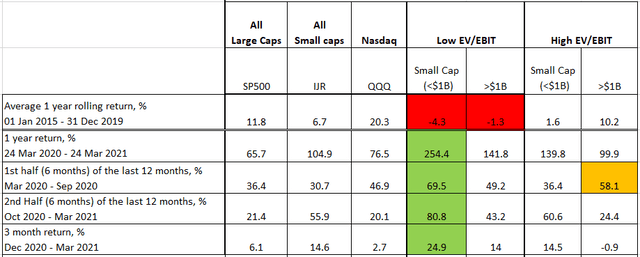

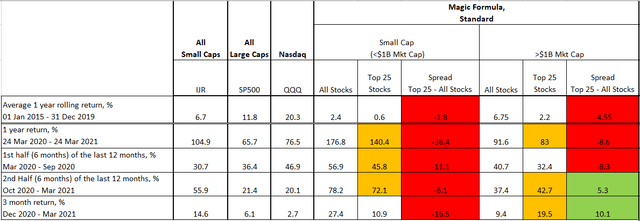

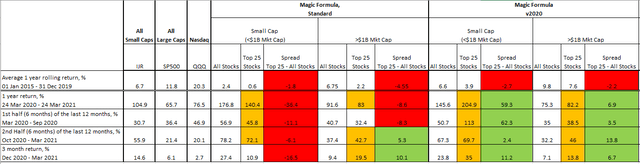

Below is the performance of the top 25 ranked stocks for each period in the last year, for both small cap stocks ($<1B) and stocks larger than $1B.

Source: Portfolio123 data, Author Table

We again see a reversal of performance compared to the previous 5 years. For the last year, performance is not as strong as the low EV/EBIT strategy, where the Magic Formula 25 ranked stocks underperformed the broader “All Stocks” universe for both market cap classes (small caps for all periods). That said, both “All Stocks” universes beat the respective small and large cap ETFs (orange cells).

The Modified Magic Formula (v.2020)

In 2020 I wrote about my variation of the Magic Formula, which is an attempt at an update on the strategy (see here for Part 1, and Part 2). Greenblatt’s version of profitability, Return on Capital Employed, was devised before the “asset light” economy came into being. My version uses the same metric, however limits the universe to those firms in technology and population growth themed industries, as this metric has been consistent through the last 20 years. Instead of using EBIT, my version uses gross profit as the earnings value. For more details, please refer to the articles referenced above.

I first wrote about this strategy nearly 1 year ago, so how has the Magic Formula v.2020 performed out of sample?

Source: Portfolio123 data, Author Table

For the last year, the modified Magic Formula has outperformed consistently in both large and small caps, against the respective “All Stocks” universe and the size related ETF (orange cells). Comparing the original Magic Formula to the modified versions, the modified outperformed the original in the earlier part of the recovery, and matched or slightly underperformed in the more recent periods.

Crisis Value Performance During COVID

In April of last year, I wrote about a unique value investing strategy devised particularly for crises. I refer to the strategy as the Crisis Composite, based on research by Verdad Capital. In summary, the strategy looks for cheap, small quality stocks that have mostly been “panic sold” in the market. The main factors included in the ranking of stocks is based on:

- High Asset Turnover

- Positive Net Income

- Low Volume

- Low valuation, based on EV/EBITDA, P/B, P/E and FCF yield

- Positive cash flow

- Highly levered, but de-leveraging

For those investors willing to stomach any uncertainty, these stocks have historically outperformed in 6 of the last 8 crises covered (those crises since 1974 to just before COVID).

The COVID crisis, which has been an “out of sample” experience for this strategy, has been no exception.

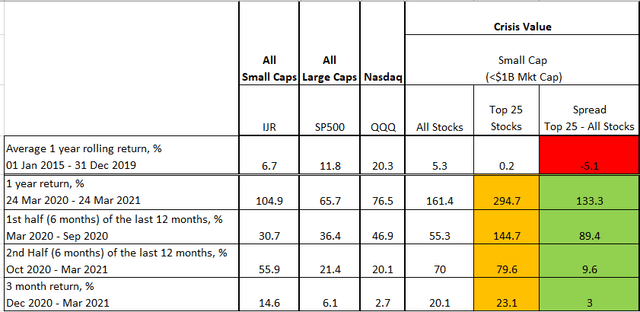

For stocks with market cap less than $1B, the 25 US stocks with the highest Crisis Value rank managed the performance below:

Source: Portfolio123 data, Author Table

With a return of nearly 300% return over the past year, it should be noted that the strategy found two stocks in particular, Tupperware (TUP) and Michael Cos Inc (MIK), which returned over 1,400% and 1,000% respectively in the period. These are outliers to a degree, however triple digit returns were common returns for stocks in this strategy, if screened earlier in the period.

Note the average 1 year rolling returns for the past 5 years. This strategy was not intended to be an “evergreen” strategy, it was designed specifically for crises. It should not be a surprise, particularly with value investing’s record prior to COVID, that return for this strategy is so low outside of a crisis.

Putting it All Together

At the beginning of this piece, we found that while the current market narrative is “rotation into value”, we have seen that value has been outperforming much sooner after the market bottom, outperforming growth in the ETFs and indices covered.

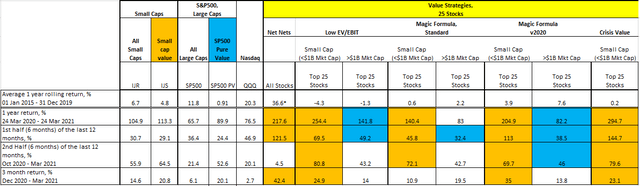

In summary, the quantitative value strategies we covered have performed as follows:

Source: Portfolio123 data, Author Table

Orange and blue cells show those strategies and periods that beat the corresponding benchmark for size and value. Small cap value strategies, on virtue of the quantity of orange cells, have been able to outperform most consistently compared to large cap value.

Not All Value has Fared Well

The strategies above are those that I am intimately familiar with, in the sense that I have performed my own quantitative research on them "out of sample," and/or I have invested in them (either earlier in my investing career or currently). As it turned out, they have performed rather well over the crisis.

There are, of course, many other value investing strategies.

This piece has focused on those value strategies that have performed well during the crisis, however I believe it would be of value to point out that not all Value strategies have had the same magnitude of success.

Those value strategies underperforming during the crisis have included:

- Piotroski F_Score,

- F_Score of 8 or higher, 1 year return 85.2% (compared to average 125% of other strategies covered in this piece)

- Note the larger universe of bottom 20% of low price to book firms returned 197% in 1 year

- Benjamin Graham's screens, as outlined in "The Intelligent Investor"

- "Defensive Investor" stock screen, 1 year return 70.6%

- "Enterprising Investor" stock screen, 1 year return 80.6%

These returns, in absolute terms are nothing to sneeze at, however they do pale in comparison to some of the performance of the other strategies. As noted, I am not as intimately familiar with these strategies, and cannot comment on why they may have underperformed. Perhaps in a future article.

The point is that while many Value investing strategies have performed well, some have performed better than others.

In Conclusion

In this piece we have looked at past performance to see how value has performed during the COVID recovery, in an attempt to understand if this trend can continue in the future. While we have only looked at a period of 1 year (which is short for assessing long term performance of any strategy), it is important to note that we are looking through the lens of a potential market shift. Historically market regimes change after a recession or crisis (as was covered in the Crisis Value articles).

We have also noted how some value strategies have not had the same success (while still doing well in an absolute return perspective). We have also seen how some value strategies have performed well on the growth side (i.e. stocks with very high EV/EBIT valuations).

I do not have a crystal ball, however with what we have seen and comparing to the market historically, it is possible that this may be the beginning of a value renaissance as growth stock valuations are reconciled. This is only my two cents -- I’ve been investing for long enough to appreciate that what makes sense to me is not always what the market decides to do.

As always, time will tell. Look out for new articles from me on the net-nets strategy discussed in this piece, performance of our value investing strategies in the coming months, and more.

Until then, happy investing!

But before we go…

Screens or ranking systems for some of the strategies covered were provided in this article.

As of time of writing, here are the 30 top ranking Magic Formula (original version) stocks in the large cap universe:

Ticker | Name | Price per share, $ | Industry | Earnings Yield, % | Return on Capital, % |

Sage Therapeutics Inc. | 76.88 | System-Specific Biopharmaceuticals | 30.5 | 1961.0 | |

Lions Gate Entertainment Corp. | 15.57 | Media and Publishing Services | 4.1 | 36.8 | |

Innoviva Inc. | 11.96 | System-Specific Biopharmaceuticals | 20.3 | 338.1 | |

AMC Networks Inc. | 53.56 | Media and Publishing Services | 14.2 | 56.8 | |

Perdoceo Education Corp. | 12.45 | Personal Professional Services | 27.3 | 118.9 | |

SIGA Technologies Inc. | 6.62 | Non-System-Specific Biopharmaceuticals | 21.0 | 328.7 | |

Sinclair Broadcast Group Inc. | 29.93 | Media and Publishing Services | 9.9 | 60.1 | |

Smith & Wesson Brands Inc. | 18.16 | Aerospace and Defense Manufacturing | 25.9 | 84.5 | |

Quidel Corp. | 130.31 | Diagnostics and Drug Delivery Devices | 20.1 | 124.7 | |

Thryv Holdings Inc. | 24.23 | Media and Publishing Services | 13.1 | 44.6 | |

IDT Corp. | 22.87 | Wireless and Wireline Telecommunications Services | 13.2 | 52.4 | |

PROG Holdings Inc. | 45.4 | Electronics and Entertainment Retail | 12.3 | 48.6 | |

Tivity Health Inc. | 23.23 | Healthcare Support Services | 10.6 | 212.7 | |

CGG | 1.21 | Support Activities for Oil and Gas Operations | 2.2 | 4.5 | |

Coherus BioSciences Inc. | 14.55 | System-Specific Biopharmaceuticals | 13.6 | 70.6 | |

Nautilus Inc. | 16.3 | Leisure Goods Products | 20.8 | 51.8 | |

Catalyst Pharmaceuticals Inc. | 4.51 | System-Specific Biopharmaceuticals | 12.3 | 383.6 | |

William Hill PLC. | 15.04 | Hospitality Services | 8.8 | 95.0 | |

Hellenic Telecommunications Organizations OTE | 8 | Other Telecommunications Services | 12.7 | 30.3 | |

Gray Television Inc. | 18.92 | Media and Publishing Services | 12.7 | 57.4 | |

Fortescue Metals Group Ltd. | 30.79 | Metal Ore Mining | 20.1 | 47.1 | |

Supernus Pharmaceuticals Inc. | 26.72 | System-Specific Biopharmaceuticals | 12.7 | 74.0 | |

Meredith Corp. | 30.09 | Media and Publishing Services | 12.4 | 41.6 | |

Altria Group Inc. | 51 | Tobacco Production | 12.0 | 347.5 | |

Sturm, Ruger & Co Inc. | 67.72 | Aerospace and Defense Manufacturing | 11.2 | 74.5 | |

Deluxe Corp. | 42.34 | Other Professional Services | 8.4 | 58.6 | |

Collegium Pharmaceutical Inc. | 23.38 | Other Biopharmaceuticals | 6.1 | 44.5 | |

ZIM Integrated Shipping Services Ltd. | 26.48 | Cargo Transportation and Infrastructure Services | 16.0 | 33.8 | |

AngloGold Ashanti Ltd. | 22.98 | Metal Ore Mining | 14.2 | 37.6 | |

Sibanye Stillwater Limited | 18.43 | Metal Ore Mining | 19.5 | 40.4 |

Source: Portfolio123 data, Author Table