FabrikaCr/iStock via Getty Images

An Englishman, even if he is alone, forms an orderly queue of one.”― George Mikes

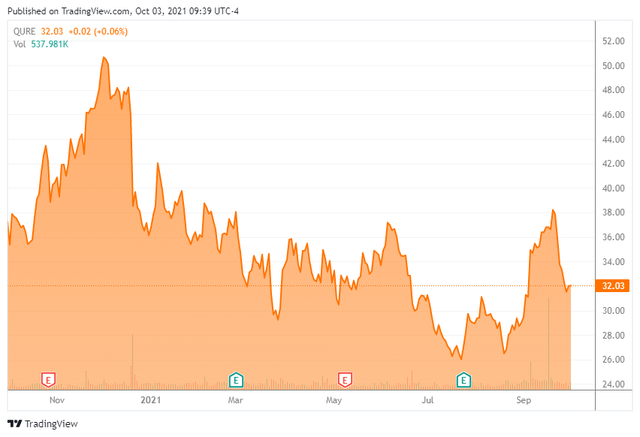

The last time we touched base around our investment theme on gene therapy play UniQure N.V. (NASDAQ:QURE), 2020 was coming to a close. As we entered the fourth quarter, it is time to circle back on this intriguing company based out of Amsterdam. Our analysis follows below.

Company Overview:

Source: September Company Presentation

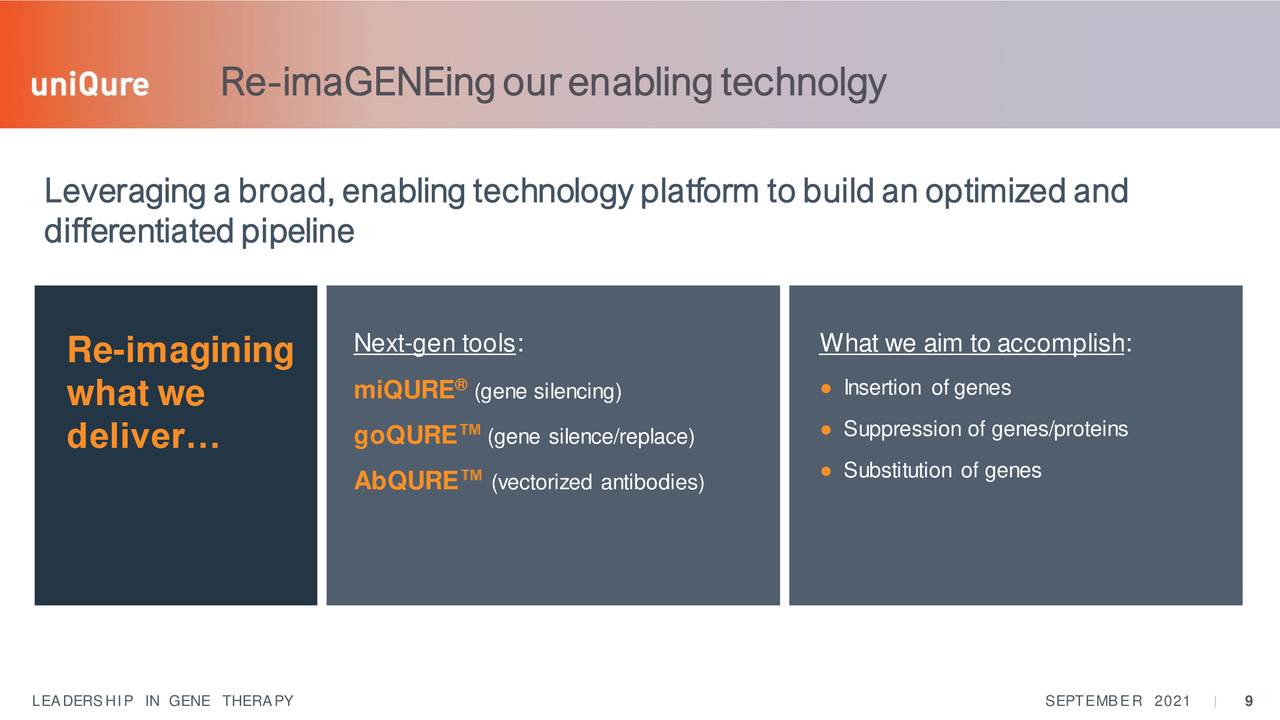

UniQure is a developmental gene therapy concern that came public in 2013. The company is developing adeno-associated virus (AAV)-based gene therapy candidates using its innovative technology platform. The stock currently trades right around $32.00 a share and sports an approximate market cap of $1.5 billion.

Source: September Company Presentation

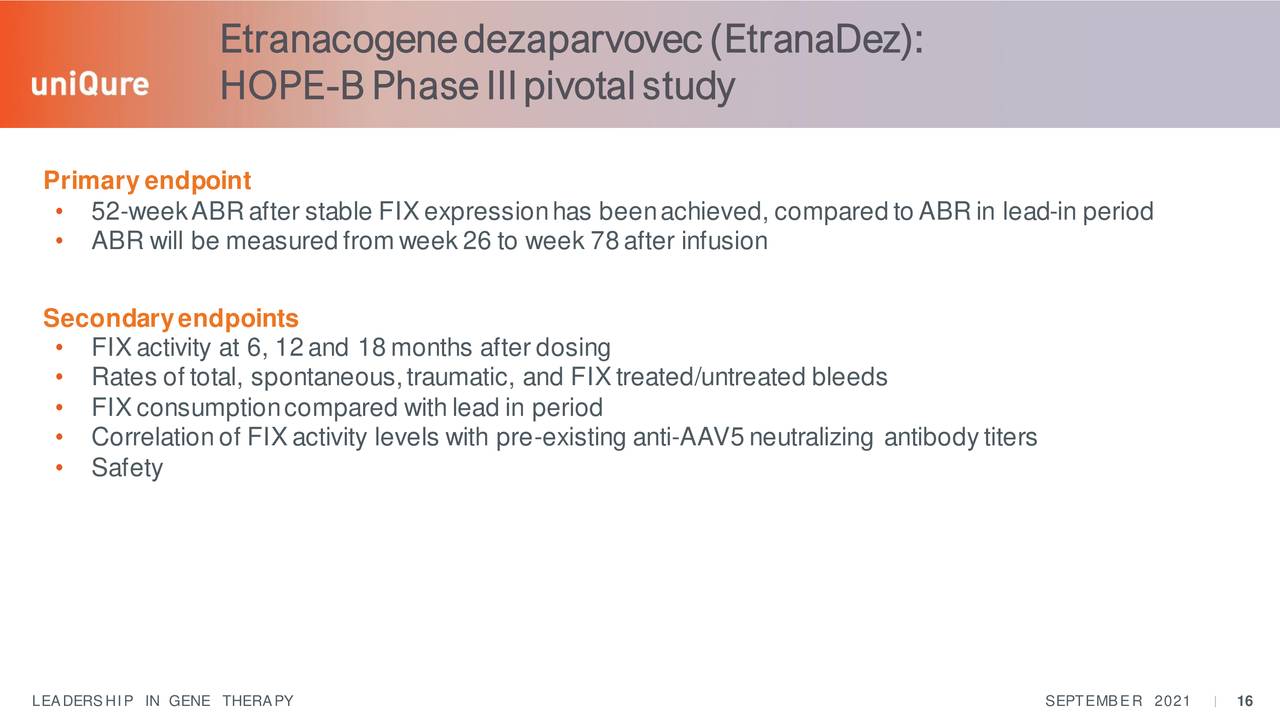

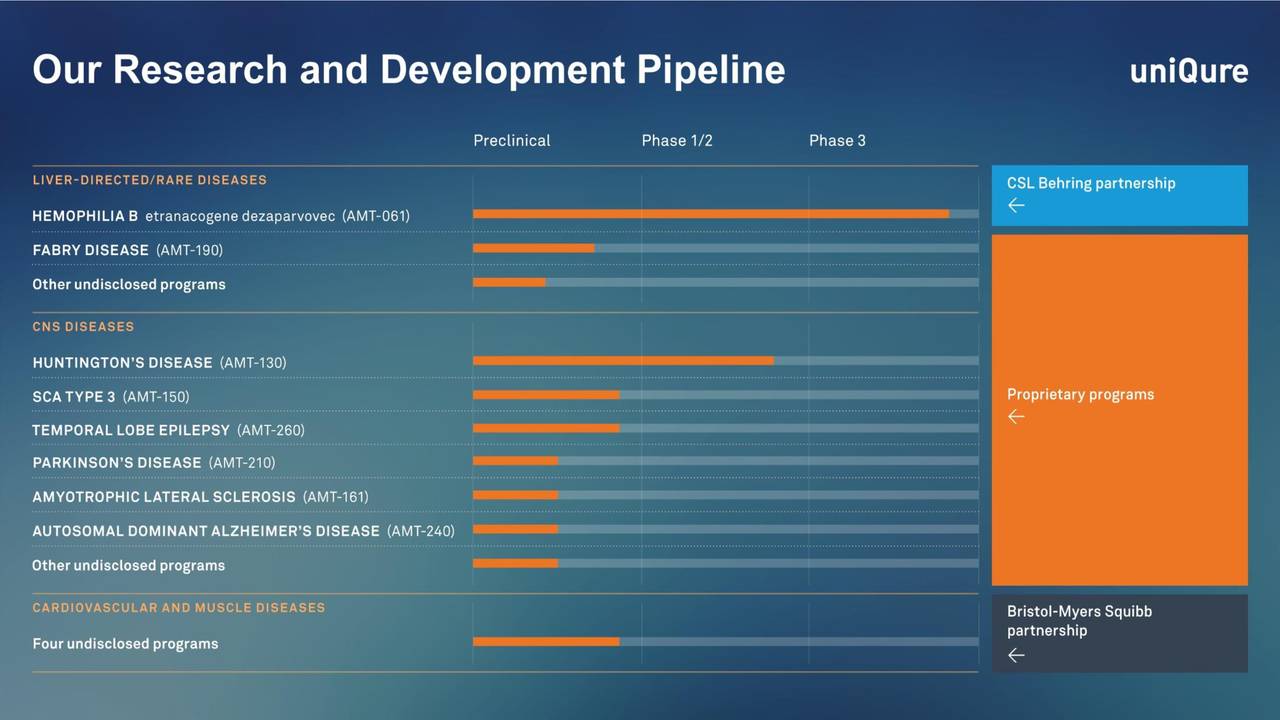

The company's most advanced candidate is etranacogene dezaparvovec for hemophilia B. That asset was licensed out CSL Behring in a global rights deal in June of 2020.

Source: September Company Presentation

As part of this agreement, and as I noted in the previous article UniQure received

A $450 million upfront cash payment and is also eligible to receive up to $1.6 billion in payments based on regulatory and commercial milestones. In addition, the company will also be eligible to receive tiered double-digit royalties in a range of up to a low-twenties percentage of net product sales arising from the collaboration. Finally, UniQure will be reimbursed for its clinical and regulatory costs around this compound."

Source: September Company Presentation

The company is currently conducting a key Phase 3 trial 'HOPE-3' in anticipation of filing for marketing approval at the successful conclusion of the trial. As of March, 54 patients were enrolled with key measurements being taken from week 26 to week 78.

Source: September Company Presentation

The licensing of its most developed asset left UniQure with a large funding infusion as well as a collection of much earlier stage gene therapy candidates.

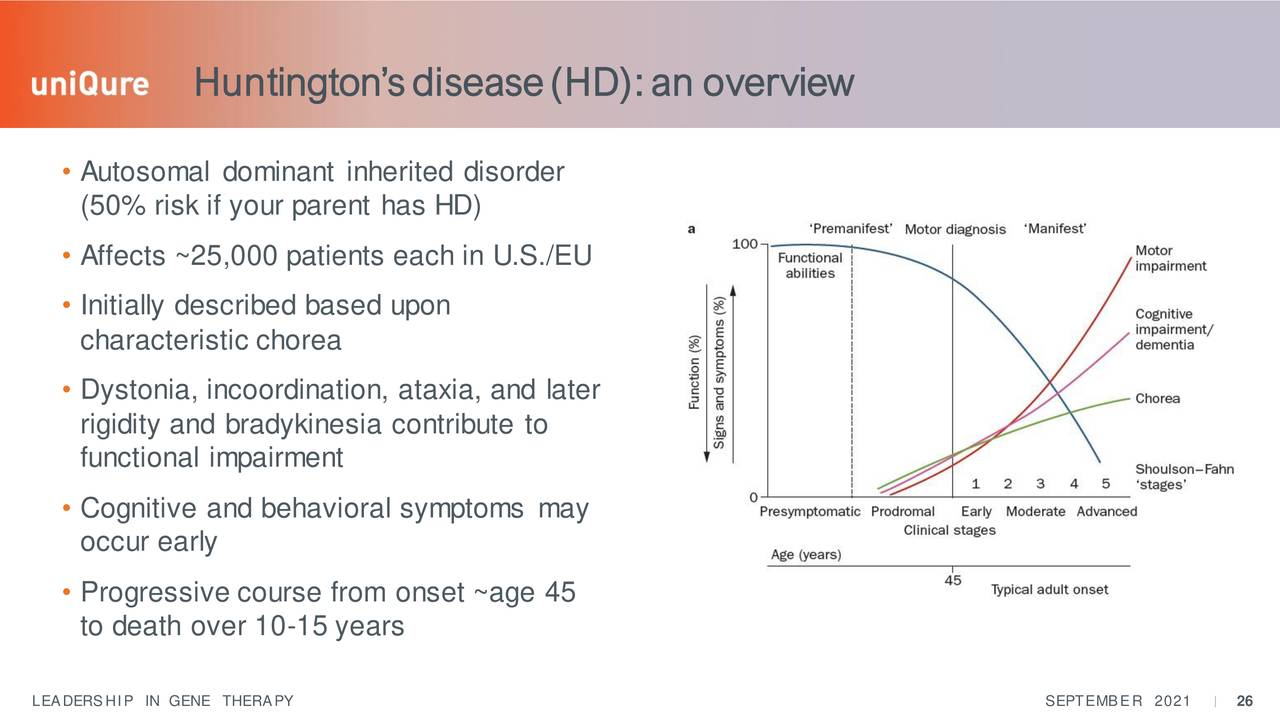

These include AT-130 which is describe as the following the company's website:

Consists of an AAV5 vector carrying an artificial micro-RNA specifically tailored to silence the huntingtin gene, leveraging our proprietary miQURE™ silencing technology. The therapeutic goal is to inhibit the production of the mutant protein (mHTT). Using AAV vectors to deliver micro-RNAs directly to the brain for non-selective knockdown of the huntingtin gene represents a highly innovative and promising approach to treating Huntington’s disease."

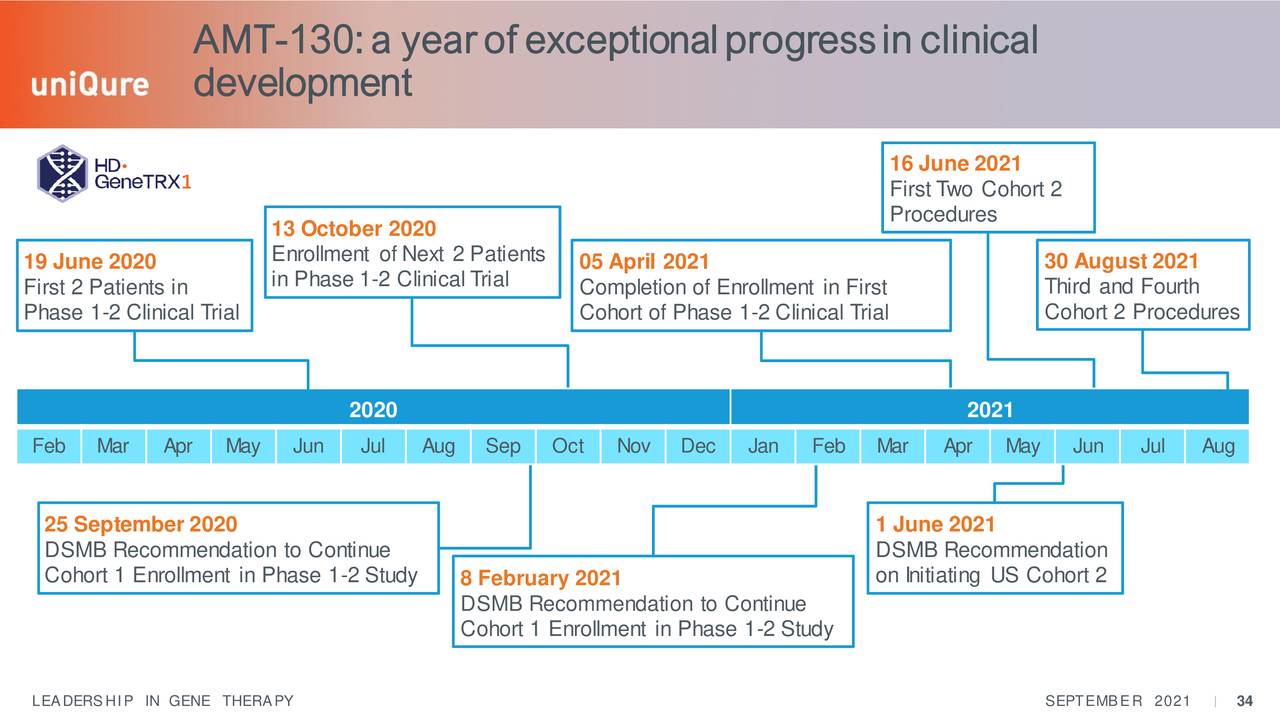

Source: September Company Presentation

AT-130 is still in the early stages of developing but the company is efficiently moving the effort forward.

Source: September Company Presentation

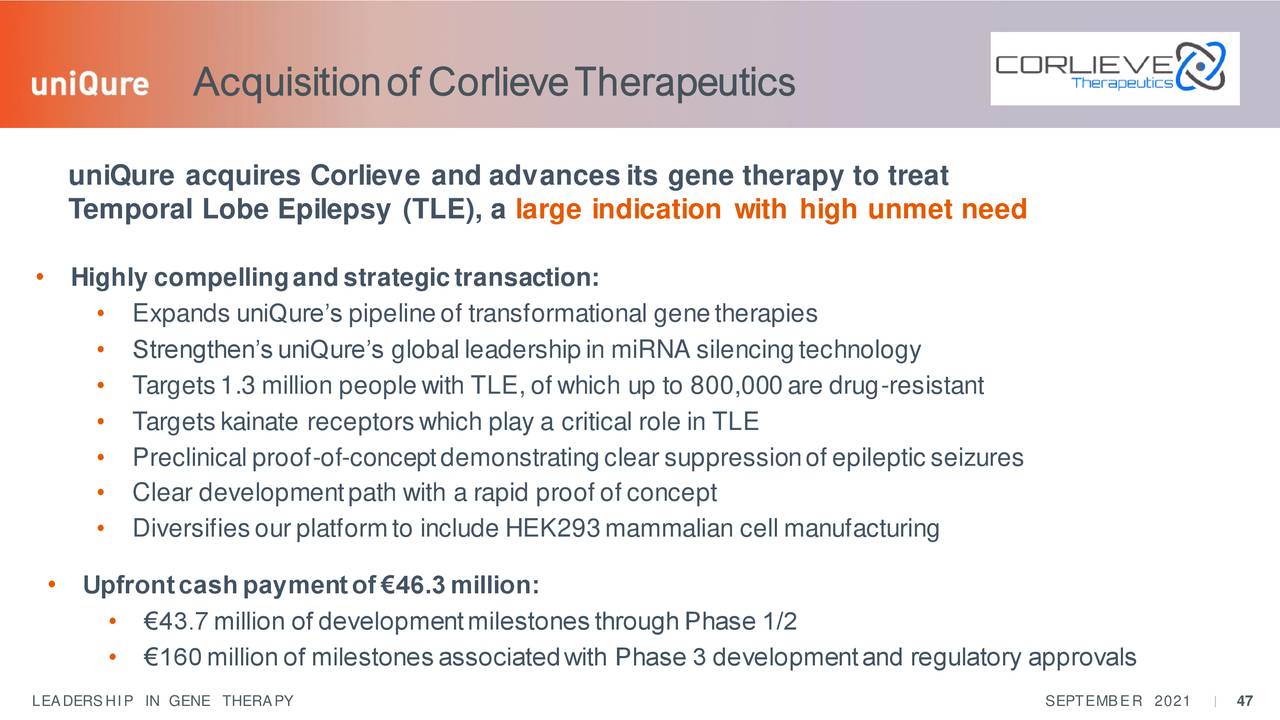

UniQure is also advancing, via performing IND-enabling studies, for AMT-191 for the treatment of Fabry disease and AMT-150 as a novel treatment for Spinocerebellar Ataxia Type 3, a central nervous system disorder. Finally, the company made a small purchase at the end of the second quarter to add to its pre-clinical arsenal.

Source: September Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community has felt more sanguine on the prospects for UniQure over the past few months. Since the end of July, nine analyst firms including Goldman Sachs and Credit Suisse have reissued or assigned Buy ratings on the stock. Two of these contained upward price target revisions and price target proffered ranged from $53 to $95 a share, all substantially higher than the current trading levels of the stock in the low $30s.

The company ended the first half of 2021 with just over $675 million (Just under half of its current market cap) in cash and marketable securities. UniQure expects its cash and cash equivalents on its balance sheet will be sufficient to fund operations into the first half of 2024. This projection does not include any milestone payouts from CSL Behring so is conservative.

Verdict:

Source: September Company Presentation

The deal with CSL Behring derisked UniQure's pipeline to a large degree in the near term and provided it with a significant influx of funding to develop its other assets while also leaving with an earlier stage wholly owned pipeline.

The company has made some progress advancing its pipeline since our last article - gene therapy candidates always advance slowly. The company is well funded and the stock is picking up more positive analyst coverage of late as well. At the conclusion of our last article on this company, we recommended using covered call orders to hold a small position in QURE as the company is some time away from potential commercialization of its late stage licensed asset and many more years away after that from seeing any approvals from its remaining wholly owned pipeline. Option premiums are lucrative and liquidity is good in these shares. Therefore, that would continue to be our recommendation around QURE and how we are positioned in this stock within our portfolio.

Note: At article submission, the April $35 call strikes on QURE were trying right at $7.00 a share.

Too many kings can ruin an army”― Homer

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.