xijian/iStock via Getty Images

This article first appeared on Trend Investing on May 20, 2022 when the TAN ETF was at US$66.72, but has been updated for this article.

2022 Bear Market Bargains Series - Invesco Solar ETF (NYSEARCA:TAN) ("TAN")

As the 2022 U.S equity bear market continues (S&P 500 index is now at 3,674, down 22.90% YTD, PE is now 18.37), we take a look at the Invesco Solar ETF (TAN) ("TAN").

For a background on the TAN ETF you can read our past articles:

- May 2020 - A Look At The Solar Sector And Some Top Solar Companies

- Aug. 2020 - Clean Renewable Energy And Electric Vehicles Will Possibly Be The Biggest Trend/Disruption This Decade

- Dec. 2020 - Increased Global Actions To Reduce Emissions Is Very Positive For Solar, Wind And Electric Vehicles

- Oct. 2021 - Buy The FAN And TAN ETFs As We Approach The COP26 Climate Conference Starting October 31, 2021

- March 2022 - Top 5 Trends For 2022 And Beyond As The West Seeks To Gain Independence From Russia

Invesco Solar ETF

Invesco Solar ETF ("TAN") - Price = USD 70.13

Yahoo Finance

The renewable energy sector (solar, wind, hydro, geothermal etc.,) looks set to be a winner as the world accelerates its shift away from fossil fuels. Just last month the European Union ("EU") unveiled a "multi-billion Euro plan to cut red tape for solar and wind farms" to help reduce dependence on Russian fossil fuels. The Financial Times reported "EU drive for new clean energy could see solar panels on all new buildings."

The Invesco Solar ETF (to be referred to as "TAN") is a broad way to play the solar energy sector. The ETF is currently comprised of 51 global companies. The expense ratio is 0.66%pa.

Invesco defines their TAN fund stating:

The Invesco Solar ETF [FUND] is based on the MAC Global Solar Energy Index [INDEX]. The Fund will invest at least 90% of its total assets in the securities, American depositary receipts [ADRS] and global depositary receipts [GDRs] that comprise the Index. The Index is comprised of companies in the solar energy industry. The index is computed using the net return, which withholds applicable taxes for non-resident investors. The Fund and the Index are rebalanced quarterly.

Note: You can read more on the MAC Global Solar Energy Stock Index (SUNDIX) here.

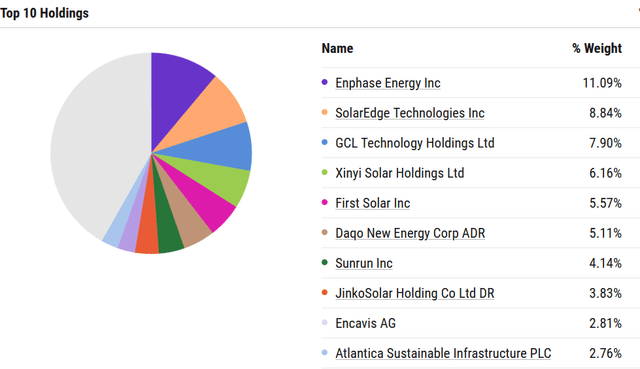

As shown below in the top ten holdings, solar inverter companies Enphase Energy (ENPH) (11.09%) and SolarEdge Technologies (SEDG) (8.84%) hold the top two positions in the fund. GCL Technology Holdings Limited [HK:3800] (formerly GCL-Poly Energy Holdings Ltd) (7.90%) produces polysilicon products and operates as a globally leading developer and manufacturer of high efficiency photovoltaic ("PV') materials. Xinyi Solar Holdings [HK:0968] (6.16%) is a manufacturer and seller of solar glass. First Solar Inc. (FSLR) (5.57%) is an American manufacturer of solar panels and a provider of utility-scale PV power plants and supporting services.

The majority of the balance of holdings are mostly solar panel manufacturers or solar materials and parts suppliers.

Top ten holdings of the TAN ETF

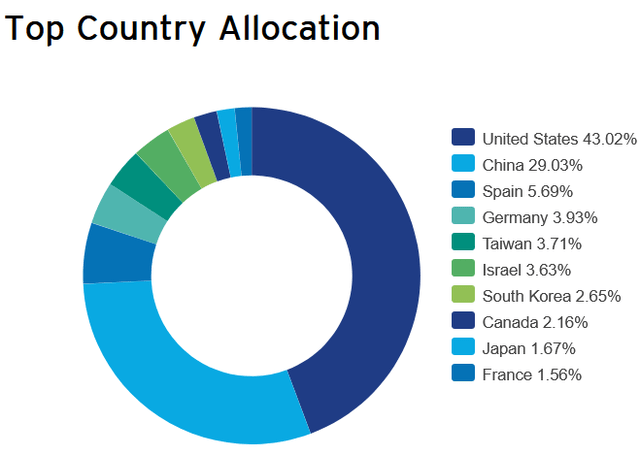

Country allocation (company headquarters) is dominated by USA (43.02%) and China (29.03%).

Country weightings (as of June 17, 2022)

Source: Invesco

Valuation

TAN's current PE is 19.43. Dividend yield is 0%. The fund is trading on a 0.09% NTA premium.

The TAN ETF is trading at US$70.13 with its 52 week low at US$55.60 and well off its 52 week high of US$101.58.

Our view is that the valuation is quite attractive given the very strong growth outlook for the solar energy sector this decade.

Peer comparison

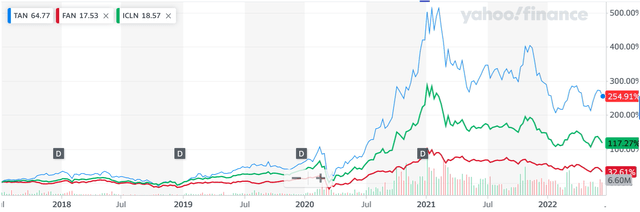

Looking at the table below TAN has a slightly lower PE than some other renewable energy funds such as the First Trust Global Wind Energy ETF (FAN) and the iShares Global Clean Energy ETF (ICLN). It should be noted, however, the TAN ETF has a lower dividend yield.

| Current PE | Dividend yield | |

| TAN | 19.43 | 0% |

| FAN | 20.13 | 2.01% |

| ICLN | 22.86 | 1.43% |

Comparison of past 5 year stock price gains for TAN [blue], FAN [red], and ICLN [green]

Source: Yahoo Finance

Comments on the TAN ETF and the solar sector

The TAN ETF offers a simple and easy way to get broad exposure to the majority of the larger listed global solar energy sector companies. It does mean taking some China exposure with the TAN fund's China allocation currently at 29.03%, many of which are Chinese American Depository Receipts [ADRs] which have their own risks (see risks section).

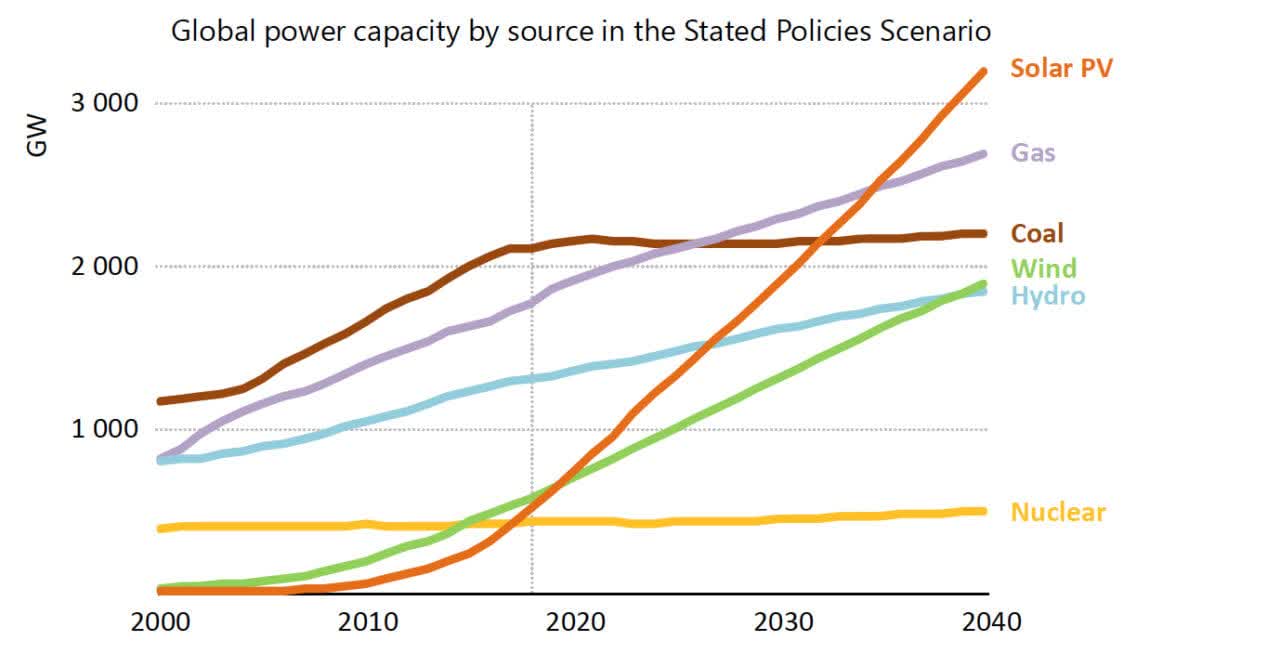

Solar energy is, in many locations, now one of the cheapest forms of energy production and one of the fastest growing sectors of new energy production globally. As shown below the IEA forecasts solar to be by far the fastest growing energy sector from now to 2040.

IEA forecasts global renewables to surge led by solar & wind

IEA

Source: PowerMag courtesy IEA

MAC Global Solar Energy Stock Index website

Risks

- A slowdown in the solar sector.

- Excess competition (Tesla (TSLA) has said it will make solar inverters and they already make solar roofs), supply chain risks (semiconductor chip shortages, polysilicon supply etc), technology change (new solar cells etc may threaten the current leaders). A lot of solar panels and solar materials are made in China where competition is intense.

- Government legislation - Solar subsidies could be reduced.

- ETF risks - Invesco management of the fund. The TAN ETF could trade below its net tangible assets ("NTA") value. More details specific to the TAN ETF's risks are here.

- Sovereign risk - Generally low to moderate for the TAN fund. Risk mostly due to its China exposure (29.03%).

- Stock market risks - Market sentiment. Liquidity looks to be ok. There has been past talk of Chinese ADRs being de-listed by 2024. Recent news linked below gives some hope for a solution.

- China's plan to save US-listed firms from delisting

- China and U.S. Negotiate On-Site Audit Checks as Delistings Loom

Note: Generally, the risk of buying into a diversified fund is much lower than buying into a single stock. There is still however the risk that the whole sector (solar energy) does poorly, or the whole stock market does poorly.

Further reading

- May 19, 2021 - "Solar, clean energy stocks surge again on Europe's planned green push. Solar stocks are sizzling in Thursday's trading, rallying for a second straight session after the European Union unveiled a plan to cut red tape for solar and winds installations in an effort to reduce reliance on Russian fossil fuels."

- Invesco Solar website

- TAN Factsheet - March 31, 2022

- Invesco Semi-Annual Report to Shareholders - Feb. 2022

Conclusion

The shift towards renewable energy such as solar and wind is a strong trend this decade and beyond. The renewable energy sector has been somewhat out of favor in recent months as many countries continued to choose the easy option of their existing energy sources, including coal and gas. However the Russia-Ukraine war is leading the EU and others to accelerate a move towards renewable energy and away from Russian oil and gas. Last month's announcement that a "EU drive for new clean energy could see solar panels on all new buildings" is potentially a huge positive for the sector if put into legislation.

Valuation looks quite attractive on a current PE of 19.43, given the sector's very strong growth outlook this decade.

Risks revolve mostly around the solar sector performing poorly. Also some supply chain and China risks, including possible China ADR de-listings in 2024. Please read the risks section.

We view TAN as a buy, suitable for a 5 year plus time frame, especially if you are positive on the outlook for solar energy growth this decade. Safer to buy in stages in case we see further falls due to the current very poor market sentiment.

As usual, all comments are welcome.

Trend Investing

If you want to sign up for Trend Investing for investing ideas, latest trends, exclusive CEO interviews, chat room access, and to join other professional investors. You can benefit from the work done, especially in the EV and EV metals sector. You can learn more by reading "The Trend Investing Difference", or sign up here.

Latest Trend Investing articles: