new look casting

Texas Instruments (NASDAQ:TXN) and Analog Devices (NASDAQ:ADI) are two leading companies in the semiconductor industry, known for their expertise in designing and manufacturing analog and mixed-signal integrated circuits. Both companies offer a wide range of products for various applications, from consumer electronics to industrial and automotive systems. In this article, we will compare TI and ADI, focusing on their portfolio, manufacturing and fundamentals to help you understand the similarities and differences between these two companies.

Throughout this article, I'll primarily refer to Texas Instruments as TI.

Analog - an overlooked market

If people talk about semiconductors, the first association most often is with the big, expensive and cutting-edge digital chips used to power the brains of our computers and smartphones. Names like Nvidia (NVDA), Intel (INTC) and AMD (AMD) are often the first named acting in this fast and exciting industry. On the other hand, investors often neglect a subsector hidden in devices without their logos plastered over our electronic devices. When was the last time you saw a "Texas Instruments Inside" sticker on a new laptop? I went over the advantages of analog chips in a recent article, but let me quickly summarize it:

Analog chips can be thought of as the sensory organs of digital chips. For an autonomous car to steer the road successfully, it first needs to receive inputs from sensors about the speed, its surroundings and other external factors. All of these things can't be gathered by the digital chip. This means that analog chips have to follow the growth of digital chips. Due to structural differences, the design of these chips isn't as fast-lived and Moore's law doesn't apply to it. This means there is no arms race for the smallest nodes and fabs can often be used for decades. This limited capital intensity makes it a great candidate for a shareholder-friendly capital return policy. Let's compare these analog market leaders.

Attractive end markets

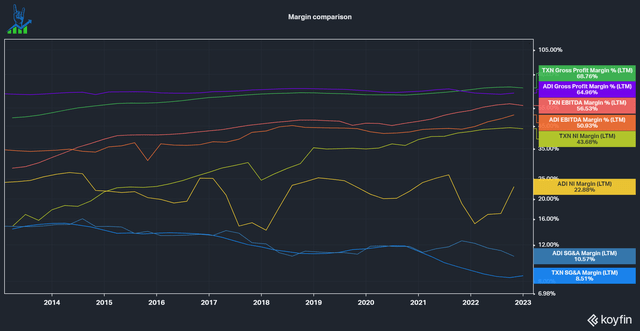

Even though the analog industry seems 'boring', it does have parts of it with significant growth rates. On ASML's (ASML) latest investor day, the company said that mature nodes are one of the driving forces behind investment in wafer capacity. Based on 300mm wafers(a lot of the analog industry still uses 200mm wafer capacity), Wafers for mature nodes are expected to grow at a 6% CAGR, far behind the 12% CAGR for digital chips, but faster than NAND and DRAM demand (Slide 19). The company also sees accelerated growth in Mature nodes, especially Analog (see the picture below).

Mature market tailwinds (ASML Investor Day)

Let's look at the portfolios of both companies:

| Expected 2030 CAGR | TI % of revenue | ADI % of revenue | |

|---|---|---|---|

| Industrial | 12% | 41% | 50% |

| Automotive | 14% | 21% | 21% |

| Personal Electronics/Consumer | 3-9% | 24% | 14% |

| Communications equipment | ~7%(midpoint between Smartphone and wireless) | 6% | 15% |

| Enterprise Systems | No data found | 6% | 0% |

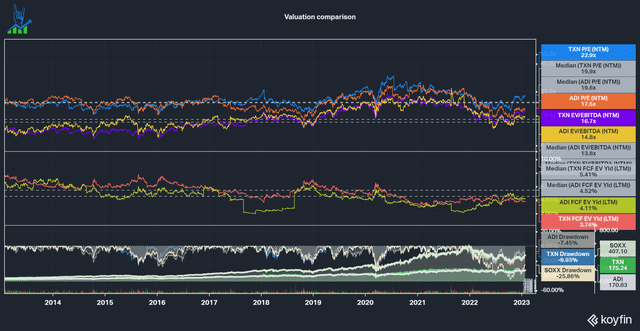

Below we can see another excerpt from ASML's Investor Day, showing the expected CAGR through 2030 for various semiconductor end markets. We can see that Industrial and Automotive are amongst the best end markets to be in, together with Datacenters. TI and ADI have done a great job developing divesting businesses in end markets without a great future and investing in growth markets. The table above shows that Industrial and Automotive make up 62% of TI's and 71% of ADI's revenue. The rest of the revenue is split between Personal electronics, Consumer and Communications Equipment, which don't have as strong of a growth expectation. Due to their excellent positioning, we can conclude that both companies are well prepared to reap these rewards in the coming years.

Semi end market CAGR (ASML Investor Day)

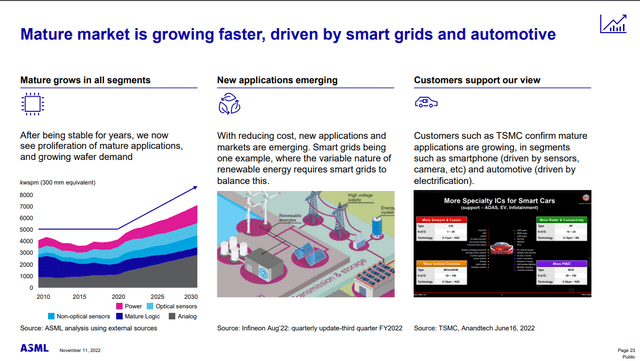

A tale of two Manufacturing approaches

While end markets are very similar for the two contenders, they vary greatly in their approach to manufacturing and reinvestment in the business: Texas Instruments has a significant focus on internal manufacturing and currently manufactures around 80% of its Wafers internally in its fabs, 40% of those internal wafers are 300mm, and 60% of Assembly is internal as well. Throughout this decade, TI aims to increase this to 90%, with 75% of wafers being 300mm and 85% of assembly done internally. On the other hand, Analog Devices outsources a lot of its manufacturing to contract manufacturers like Taiwan Semiconductor Manufacturing (TSM) or GlobalFoundries (GFS). 45% of the manufacturing is internal, while 80% of Testing and 20% of Assembly is done internally, according to their Investor Day. This is a stark difference between the two approaches. While outsourcing makes ADI more capital-light and allows for easier utilization, it also decreases its ability to optimize its business. Another difference is the customer relationship: While ADI uses many different sales channels, TI focuses on direct customer relationships (up to 64% of revenue in 2021, from just 35% in 2019). This gives TI better data and insights into their customer's demand and allows for additional margin improvements. This can also be observed in the margins. While both companies have a stellar track record of improving margins, TI does keep a lot more of its bottom line. ADI suffers from acquisition-related charges, which flow down to the net income margin, so we need to keep that in mind, which leads us to the next point of comparison.

Reinvestment strategy

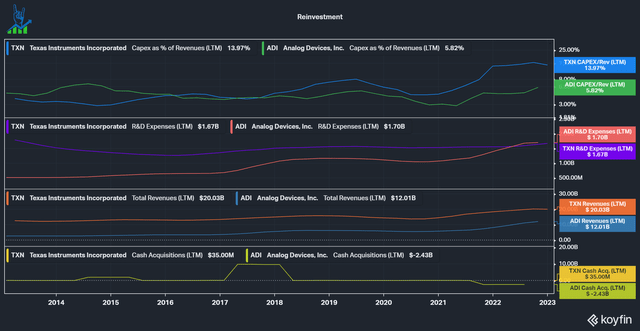

In the chart below, we can see that historically both companies used to be roughly equally capital-intensive. This changed in 2021 when TI announced its accelerated CapEx plan to double its internal manufacturing capacity with new 300mm fabs. This will further allow the company to improve the control of its supply chain and reap more efficiency in the business. Additionally, we can see that TI has had very stable R&D, while ADI's is increasing. This can be explained by the way the strategy differs: Both companies have extensive portfolios of products with tens of thousands of different products, but ADI focuses more on custom parts for single customers than TI, who can sell 75% of its products to multiple customers in varying end markets. Lastly, ADI is an acquisitive business, making several large acquisitions over the years, like the $17 billion deal with Maxim (MXIM) in 2020. On the other hand, TI hasn't acquired a full company since the aftermath of the GFC. They acquired some assets from Micron Technology (MU) in 2020.

Reinvestment comparison (Koyfin)

A shared capital return goal

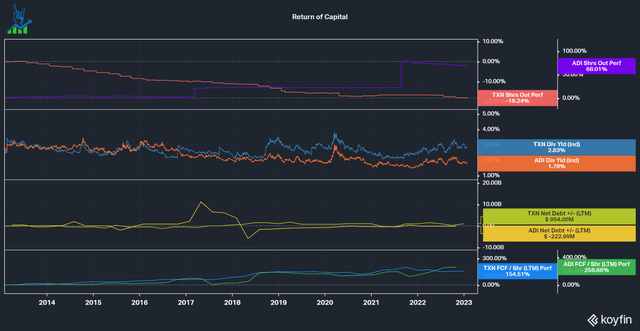

As a result of a relatively capital-light business model, which supports high margins, both companies are run very shareholder-friendly: Both aim to return 100% of Free Cash Flow to shareholders. In the chart below, both companies take part in share buybacks, pay out a decent dividend and don't load up excessively on debt. The major difference again leads us to acquisitions: As previously mentioned, ADI spends a lot of cash on acquisitions but also pays with stock. This can be seen by its increase in shares outstanding by 68% over the last decade, despite regular repurchases. TI, on the other hand, reduced shares outstanding by 18% simultaneously. The deals ultimately worked out well for ADI if we view its superior FCF per share growth over the last decade.

Return of Capital comparison (Koyfin)

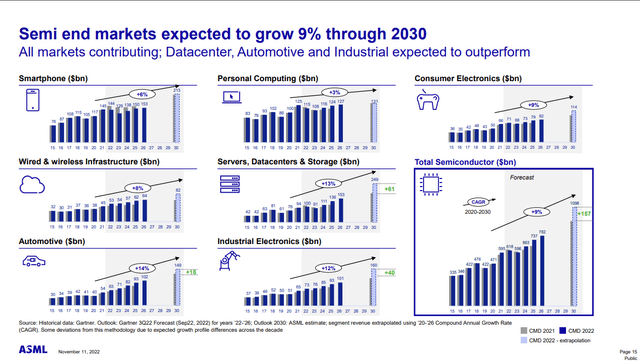

What price are we paying?

We established that both are great companies, but even the best company needs to trade at a reasonable valuation to be a good investment. We can see that both companies held up much better than the overall semiconductor space, measured with the SOXX index. Both companies currently trade below their historical EV/EBITDA and FCF multiples. TI trades above its median PE ratio, while ADI is slightly below. This may not seem very appealing, but I believe that the forward estimates have too much pessimism priced in and that we might be in for a surprise. The structural tailwinds are in place and both companies are in great positions to benefit from future demand.

To crown a king

I went into this comparison with the expectation of a blow-out victory for Texas Instruments, who I have been a shareholder of for over two years, but I was very pleasantly surprised by Analog Devices. I always knew that it was a good company, but it seems to be a great one. Both companies have an excellent positioning in attractive end markets with strong business and capable leadership, resulting in a high-margin business. I did not manage to come up with a clear winner; both companies won this competition. I personally prefer Texas Instruments' approach to internal manufacturing excellence, but Analog Devices has a great strategy as well. It wasn't enough to push me over the edge.

I hope you found value in this comparison. Who do you think won? Let's continue the discussion in the comments below.