Marc Dufresne

Investment thesis

It is no secret that the commercial real estate sector (and especially offices) has been hit hard - first by the Covid crisis and the transition to WFH (work from home) and now by increasing interest rates and a potential recession on the horizon causing companies to reduce headcount. These are significant headwinds, but we all know the saying: "It's time to buy when there's blood in the water" and I'd argue that now might be the time to add some office REIT exposure to your portfolio.

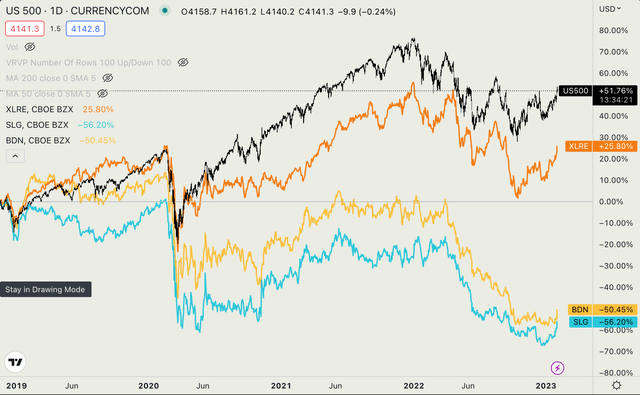

Below you can see that since 2020, office REITs such as the New York City landlord SL Green (SLG) or Philadelphia-based Brandywine Realty Trust (NYSE:BDN) have massively underperformed both the S&P500 and the REIT index, likely due to the aforementioned headwinds.

In this article I will analyse office REIT Brandywine Realty Trust and show that while there are significant risks to this stock, I believe now might be a good time to start building a position in the company.

There are a few reasons for why BDN could be in a position to outperform:

- The valuation has got too cheap to ignore so a lot of bad news is already priced in

- The company pays an 11% dividend that is well covered and likely safe

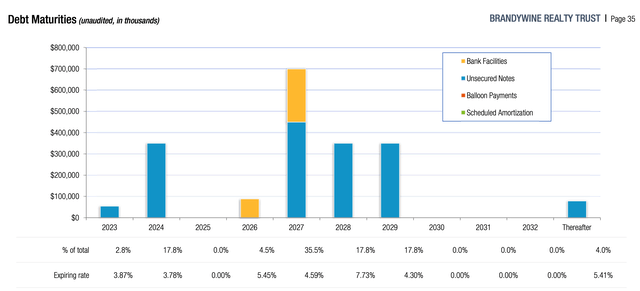

- The company has little debt that is due for repayment in the next years

- With an improving macro situation and the Fed nearing the end of its hiking cycle, REITs could benefit from the Fed either stopping to hike or even cutting rates later in 2023 if the economy softens. I believe the place to be when monetary policy loosens is REITs that have relatively longer duration (e.g. net lease) and those that have been overly punished by the market (e.g. office)

The Existing Portfolio

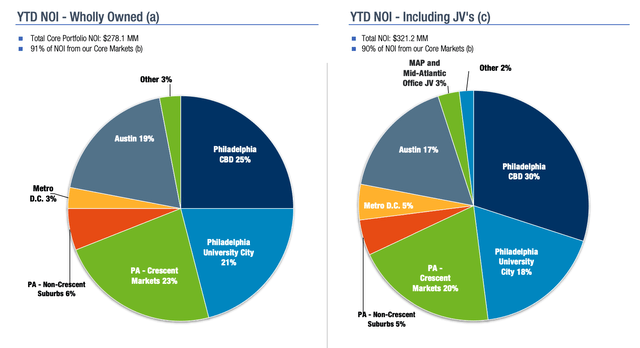

Brandywine Realty Trust is an office REIT which has been on the market since 1986 and whose properties are heavily concentrated in Philadelphia and its suburbs, in particular of their 13 mil. sft of space 63% of space and 75% of income comes from the greater Philly region. The remaining NOI is generated by properties in Austin, Texas (about 20%) and Washington, D.C. (about 3%). While I consider the company's reliance on one city a risk, it also means that they know the market extremely well and dominate it.

The company leases to a diversified mix of tenants with no one sector representing more than 20% of the total. The sectors with the largest proportions include Finance (16%), Business services (16%), Legal services (14%) and Manufacturing (8%) with notable tenants such as IBM, Comcast and Spark Therapeutics. BDN has a healthy WAULT (weighted average unexpired lease term) of almost 7 years with very few leases expiring over the next three years.

The REITs operational metrics in their home market are very good, the same can't be said about their efforts in Texas and D.C. In particular, the properties in Pennsylvania have an occupancy of 96% while Texas and D.C. only have 84% and 75%, respectively. Management, however, seems to be dedicated to expand their efforts outside of Philadelphia, mainly through new development.

The CEO said in his annual letter:

The tech sector’s dynamic growth, combined with in-migration to Sun Belt markets positions our Austin platform to continue to attract next-generation companies who are invested in workplace innovation, brand, and culture. In the Metro DC region, we’ll embrace the astonishing growth of quantum physics research, and continue our longstanding history of partnering with revered academic institutions to realize legacy value through innovative real estate.

New Development

Management remains committed to increasing their portfolio size, although plans have understandably slowed in these uncertain times. The company sees a big opportunity in Life Sciences which according to their research in a sector that should outperform in their core markets so understandably their development plans mainly include space intended for Life Sciences tenants.

Further remarks from the CEO:

As the life science sector continues to boom in key U.S. markets, we have over 592,000 SF of lab and research space complete or under development and an additional 2.5+ million square feet planned in the high-ranking Greater Philadelphia region. We opened a new lab incubator, B.Labs at Cira Centre, in January 2022 and will begin construction on 3151 Market later this year – adding 417,000 square feet to the total 2.1M square feet of life science potential within our Schuylkill Yards development.

There are currently 1.6 million sft of space under construction in 6 projects. Of these, three properties (total of 600 ths. sft) are located in the greater Philly area and are already 82% pre-leased. The rest of the properties are designated for speculative development, meaning there has been no pre-lease. Overall, the planned development is all A-class which should attract tenants. One thing to watch is the movement of tenants from older BND properties to newer ones. So far, I have seen no indication of this, but this is a relatively normal practice amongst developers to overstate demand for new space at the expense of existing space and something we don't want to see.

BDN also holds a lot of land for development, some of it at very good central (CBD) locations. In particular it holds 215 acres of developable land - enough to build an additional 13 mil. sft of space (and essentially double their size). This is great, because it will allow the company to grow in the future and at the same time, it gives management the option to sell some this land if they need to generate liquidity.

Balance sheet

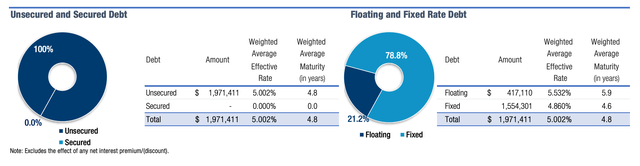

No discussion of a REIT would be done without looking at their debt. BDN has just shy of $2 Billion of debt (all unsecured), 78% of which is fixed rate.

In Q4 2022, the company has been able to refinance about 300 mil. USD of debt that was due in Q1 2023 by underwriting new notes due in 2028 (though understandably at a higher rate). This is great, because other than a small repayment of 50 mil. USD in 2023, the company has no debt due until October, 2024. This is an important point and part of the reason why I believe that the company has been unfairly punished by the market. With no debt to be repaid in the medium term, the major reason why most REITs struggle is gone. BDN doesn't have to preserve cash by cutting their dividend or significantly slowing down new development to preserve cash in order to prepare for debt repayment (in case they cannot refinance), simply because there are no repayment for the next two years. I consider this quite bullish for BDN, and it significantly reduces my perceived downside for the company.

As of Q4 2022 BDN has an LTV of 40%, which is really not that bad for an office REIT and an EBITDA interest coverage of 3.9x. EV/EBITDA stood at 14.3x over the last 12 months (compared to a sector median of 18.5x).

Operations

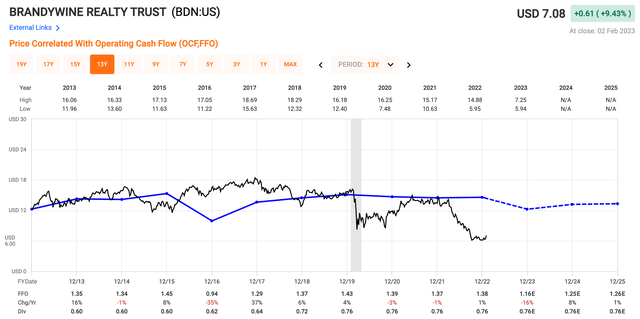

In 2022 the company generated FFO of $1.38 per share and paid a dividend of $0.76 per share. This translates to a payout ratio of just 55%, which is very sustainable. Now if we look at cash available for distribution (CAD) which stood at $0.90 per share (note: the difference vs FFO is mainly in deducting costs for maintenance and tenants space improve costs as well as leasing commissions). That brings us a CAD payout ratio of around 90%.

For 2023 management has guided towards a lower FFO of $1.12-$1.20 per share mainly due to increased debt service costs and cash available for distributions of $0.85. With these numbers, frankly the payout ratio will get tight. But since it will still be under 100% (for both FFO and CAD) I don't see a reason for an imminent dividend cut, at least not in 2023. At these levels the company will still generate enough cash to cover the $0.76 annual dividend, which translates to 11% annually for shareholders. Usually I try to stay away from yields above say 8%, but here I really feel that the yield is relatively safe (at least for 2023) and the dividend won't be cut.

Valuation

Based on a relative multiple valuation, BDN currently trades at 5.2x FFO vs its historical average of 10.5xFFO. If we assume that FFO drops to $1.20 next year and remains flat until 2025 (quite likely as not much growth is expect) and apply a multiple of 10x FFO we get an expected price of $12.00 per share. That's over a 70% upside from the current price of $7.00 per share (19% annualized return).

19% annualized return from price appreciation + 11% dividend yield = 30% p.a. for the next three years. Not bad.

As far as discount to NAV, the existing portfolio has a book value $2.6 Billion. I always like to cross-check the book value to make sure it's not overstated. Financials reveal a 2022 NOI of $274 Million. Simply dividing the two we get a yield/cap rate of 10.5% - this is a very conservative valuation for even a B-class office building in a major metropolitan area (note that the majority of BDN's space is A/A- class).

To see just how low they report their value consider this - the book value is around $200 / sft (simply the 2.6 Billion divided by 13 Million square feet). But according to a Guide to US Building it costs $599-$719 / sft to build a mid-rise building in the Eastern US. Frankly, the numbers they report feel a bit high from my real estate development experience, but I would certainly agree that actual construction costs to build a building similar to the ones BDN owns, are at least double the value at which BDN keeps their properties on the books.

With that said, personally I would apply a cap rate of 6% to the NOI they generate to get a fair value of operating properties of $4.5 Billion. I would keep construction-in-progress (reported at cost) at $220 Million and Land for development of $76 Million (reported at cost) - although arguably this is also undervalued, but since I am not familiar with the exact zoning of all of this land, I will keep it as is for the sake of this calculation. I will not include Investments in JVs of $560 Million in my calculation because BDN provides little detail on the exact breakdown of this.

Adjusted assets = $4.5 Billion + $220 Million + $76 Million = $4.8 Billion

Debt from earlier = $2 Billion

So NAV = $2.8 Billion

At the current price of $7.00 per share, BDN has a market cap of $1.2 Billion. It is trading at a 57% discount to a fair (yet arguably still conservative) NAV. In order to reach a fair valuation (from an NAV standpoint), the share price would have to increase to $16.00. This would represent an even bigger upside than suggested by the relative multiple valuation.

Risks

Frankly, there are some risks to consider. While I believe that the company is well positioned, it will not be immune to the macroeconomic environment. In particular, there is a risk that demand for office space will not pick-up any time soon as work from home becomes even more popular and/or firms transition to the hybrid working model with less people in the office.

Moreover, we still have a Federal Reserve that is firmly committed to fighting inflation. Higher rates, especially for a prolonged period of time, will put REITs including BDN under pressure. Also if a the US slips into a prolonged period of slower economic growth firms could reduce their headcount leading to a reduced demand for office space going forward.

Verdict

Those are some serious risks, but if you believe that offices in big cities are here to stay and that the Fed is close to being done, I think BDN is worth a look. I rate the company as STRONG BUY here with a price target of $12.00 per share.

The company is well positioned to continue to do well, in particular thanks to:

- a reasonable level of debt with no debt due until October, 2024

- a well covered 11% dividend yield, that is unlikely to get cut in 2023

- management's plans to grow in core markets

- a sizable land bank that can be sold to generate liquidity if needed

The valuation is also extremely enticing, with an expected total return of 30% annually over the next three years.