FinkAvenue

Investment Thesis

I last covered GE HealthCare Technologies Inc. (NASDAQ:GEHC) in March and while the stock has corrected post that, catalyzed by the recent earnings disappointment, I believe the headwinds that GEHC is facing are transient. The company's revenue growth should recover in the second half of 2024 due to easing Y/Y comparisons and a potential rebound of Chinese sales as customers who postponed orders in Q1 2024 start making purchases again. Further, the fulfillment delays seen in the Patient Care Solutions business last quarter are expected to be resolved by mid-2024, which should contribute to sequential sales growth. Additionally, the company’s focus on new and innovative product introductions should help it gain market share and drive revenue growth in the long term.

The margins should benefit from the cost optimization measures, with the company planning to exit most of the remaining Transition Service Agreements (TSAs) by the end of 2024. In addition, the margins should benefit from price increases and operating leverage as the sales recover in 2H 2024. In terms of valuation, the stock is trading at a discount compared to its peer group. This, coupled with the company returning to revenue growth in 2H 2024 and good margin expansion prospects, makes GEHC stock a good buy.

Revenue Analysis and Outlook

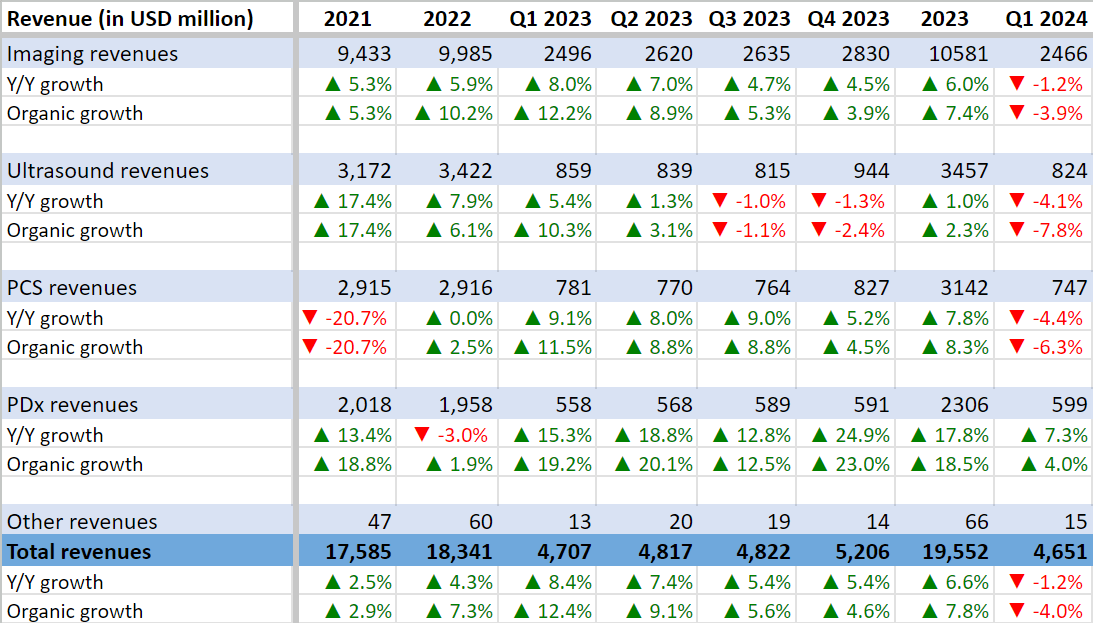

Over the last few years, GEHC has seen good growth thanks to healthy end-market demand and price increases. However, in the first quarter of 2024, the company faced difficult Y/Y comparisons against strong revenue growth in Q1 2023, which benefited from easing supply chain conditions and strong China stimulus sales. As a result, the company’s revenue declined 1.2% Y/Y to $4.651 billion. Excluding the impact of acquisitions and FX, the revenues declined 4% Y/Y organically.

Segment-wise, the Imaging segment’s revenues declined 1.2% Y/Y and 3.9% Y/Y organically due to tough comps against 12.2% organic revenue growth in Q1 2023, which benefited from improved supply chain fulfillment.

The Ultrasound segment’s revenues declined 4.1% Y/Y and 7.8% Y/Y on an organic basis due to lower volumes compared to strong volume growth in Q1 2023 as a result of improved supply chain fulfillment and COVID-related stimulus programs.

In the Patient Care Solutions [PCS] segment, revenues fell by 4.4% Y/Y and 6.3% Y/Y organically due to in-quarter fulfillment delays and tough comps following higher COVID-related ventilator sales in China last year.

The Pharmaceutical Diagnostics [PDX] segment’s sales increased by 7.3% Y/Y and 4% Y/Y on an organic basis attributed to good growth in the USCAN and EMEA regions driven by increased price, continued volume growth, and new product introductions.

GEHC’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, I am optimistic about the company’s revenue growth outlook. One of the big revenue headwinds last quarter was China, down 11% Y/Y. The anti-corruption drive related to the healthcare industry and customers waiting for the finalization of the new stimulus bill before making purchases impacted China sales.

In addition, the first quarter also witnessed tough comps as the supply chain situation improving benefited company sales in 1Q23 and Chinese sales also benefited from government stimulus in the first half of last year.

As we move to the second half of this year, comparisons are getting easier, and some of the Chinese customers who postponed their orders in 1Q24, waiting for clarity around the new stimulus bill, should start placing orders. The company also witnessed some fulfillment delays in the Patient Care Solutions business, which management expects to be resolved by mid-2024. This should also help sales sequentially. The company reported a book-to-bill of 1.03x and management noted that the order funnel remains healthy. So, the company’s growth should improve as the year progresses.

In addition, the company is doing a good job in terms of R&D and launching new innovative products, which should help its growth in the long run. The company introduced six new products last quarter that include significant upgrades, platforming solutions, and new AI applications for radiology, urology, and cardiology. I expect new product innovation to help the company gain share as well as improve pricing in the long run.

Overall, while the company’s revenue performance was disappointing in the last quarter, I am optimistic about the recovery in the second half of this year as well as GEHC’s long-term growth prospects.

Margin Analysis and Outlook

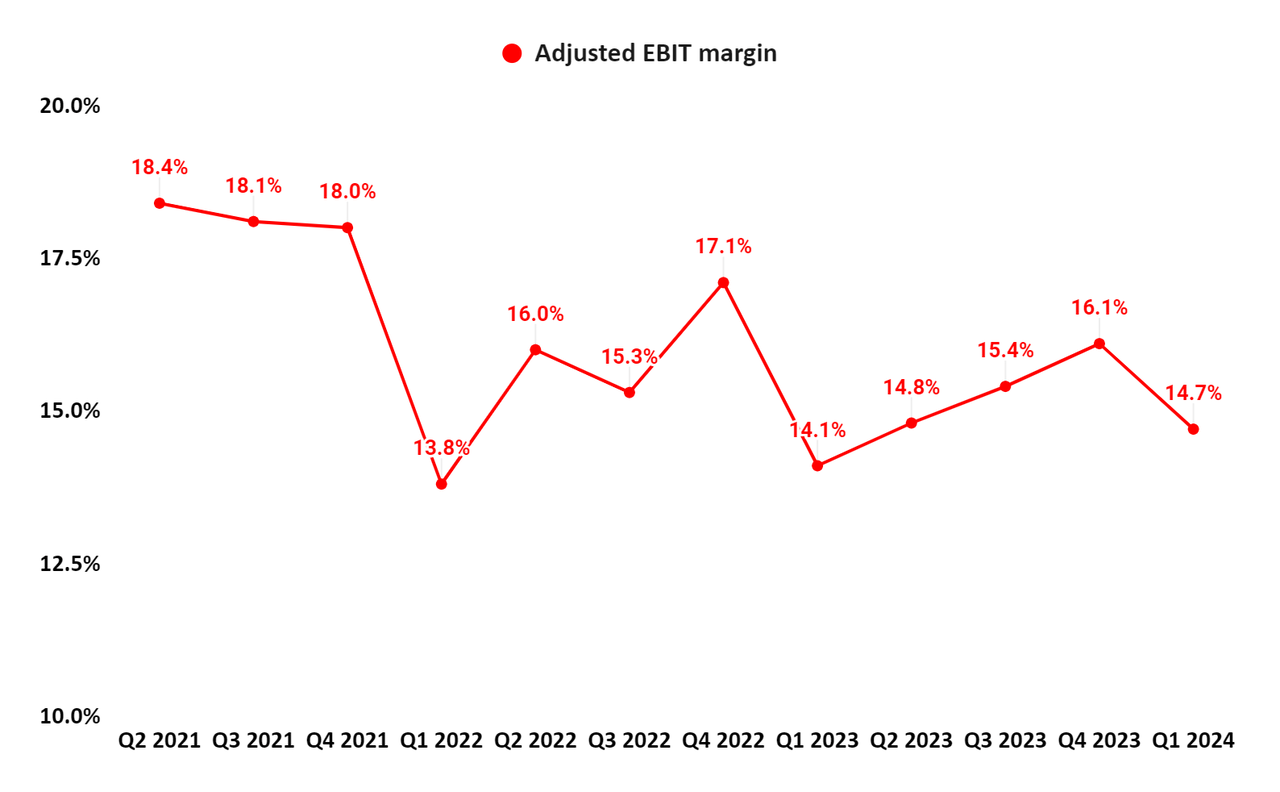

In Q1 2024, despite the Y/Y sales decline, the company’s adjusted EBIT margin increased by 60 bps Y/Y to 14.7% benefitting from price increases and productivity gains.

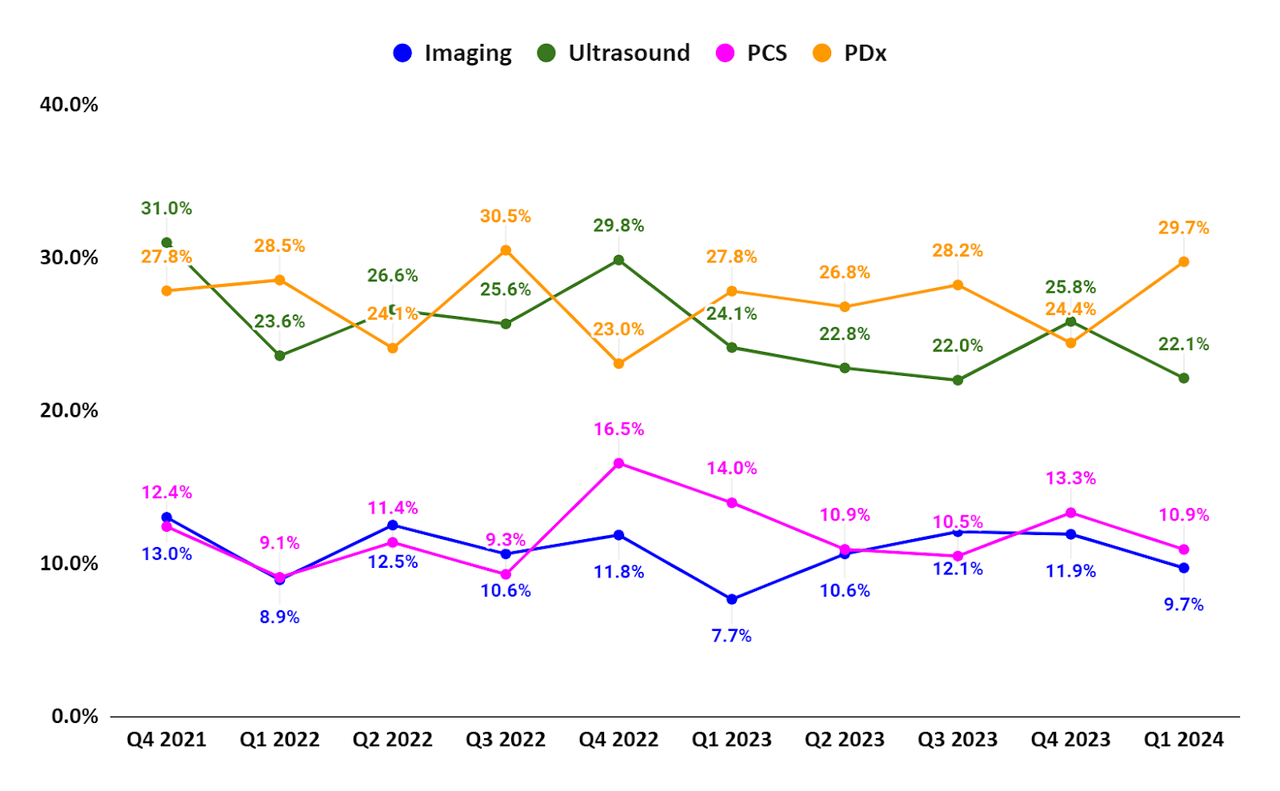

On a segment basis, the Imaging segment’s EBIT margin expanded by 200 bps Y/Y driven by pricing increases and productivity initiatives. The PDx segment’s EBIT margin increased by 190 bps Y/Y on strong pricing, volume growth, and productivity gains. On the other hand, in the Ultrasound and PCS segments, the EBIT margin contracted by 200 bps Y/Y and 310 bps Y/Y, respectively, due to cost inflation and decreased sales volume.

GEHC’s Adjusted EBIT margin (Company Data, GS Analytics Research)

GEHC’s Segment Wise EBIT margin (Company Data, GS Analytics Research)

Looking forward, I am optimistic about the company’s margin growth prospects. The company is doing a good job in terms of cost optimization and has exited 330 Transition Service Agreements (TSAs) after its spin-off. The company plans to exit the majority of the remaining TSAs by the end of this year, which should help in driving costs lower.

In addition, the company is doing a good job in terms of pricing increases, which should also help margins. Management expects the company’s pricing power to remain strong in the coming years, driven by new product introductions.

Further, with growth recovering in the back half, the company’s margin should also benefit from operating leverage.

Valuation

GEHC continues to trade at a meaningful discount versus its large-cap peer group. After the post-earnings correction, the gap has further widened. However, the factor impacting the company’s growth in Q1 2024 seems transient in nature. I believe as the growth recovers in the back half of this year, it should help the company’s P/E multiple improve.

Peers | FY24 P/E | FY25 P/E | FY24 EPS growth | FY25 EPS growth |

Danaher Corporation (DHR) | 32.60x | 28.38x | 0.53% | 14.86% |

Thermo Fisher Scientific Inc. (TMO) | 26.38x | 23.54x | 0.67% | 12.10% |

Mettler-Toledo International Inc. (MTD) | 31.39x | 27.99x | 4.88% | 12.13% |

Boston Scientific Corporation (BSX) | 31.33x | 27.71x | 13.44% | 13.06% |

GE HealthCare Technologies Inc. (GEHC) | 18.56x | 16.65x | 8.94% | 11.48% |

GEHC Relative Valuation (Source: Seeking Alpha)

GEHC has a limited history as an independent company and despite good growth prospects versus its peers, its P/E multiple is lower. I believe a couple of years of inline to better growth versus its peer group can help its P/E multiple improve. The current consensus estimates are building high single-digit/low double-digit EPS growth for the next few years, which, coupled with P/E multiple improving, should help GEHC stock deliver double-digit CAGR in the medium term.

Risks

China is one of the key markets for GEHC and in the last quarter, it was a significant headwind for the company’s growth due to factors like the anti-corruption drive and customer, delaying orders in anticipation of a new stimulus bill. My thesis anticipates a recovery in Chinese sales as the customers who had postponed orders are expected to resume purchasing. If this doesn't happen, GEHC’s revenue growth may not recover as anticipated.

The company is focused on launching new and innovative products to gain market share, improve pricing, and remain competitive. However, there are risks related to the development and commercialization of new products. Failure to address these risks may have an adverse impact on both the company's revenues and margins.

Takeaway

While the company faced headwinds related to fulfillment delays in the PCS business and China sales last quarter, I expect the company’s revenues to recover in the second half of this year, with comparisons becoming easier and China sales recovering as the customers who delayed orders in Q124 begin placing them again. Further, fulfillment delays seen in the PCS business are also expected to be resolved by mid-2024. In addition, the company’s focus on new and innovative product launches should fuel its revenue growth in the long term. The margins should also expand with the help of price increases, cost optimization measures, and operating leverage as the sales recover in the back half of 2024. The company’s valuation also looks attractive compared to its peers. Given the potential for revenue recovery in 2H 2024, good margin growth prospects, and an attractive valuation, I have a buy rating on the GEHC stock.