J Studios/DigitalVision via Getty Images

Investment Thesis

In my search to find the best companies, I evaluate publicly traded companies in a wide variety of sectors and industries. Previously I have evaluated consumer discretionary companies like restaurants and cruise lines, however, with experience in cell and molecular biology, I can apply this knowledge to evaluate companies in biotech to see if they warrant further investment. Based on the fundamental analysis below, Halozyme Therapeutics, Inc. (NASDAQ:HALO) seems to be trading at a significant discount to their fundamentals and continued high growth rate. Recently, HALO beat their earnings estimates by a wide margin and has grown at significant year over year rates. Given this margin of safety to fundamental value and future growth prospects, I believe HALO is a buy at this price and should perform well for investors over the next few years as they continue to expand their products and licensing agreements. However, because this is a biotechnology company, there is significant risk associated with this investment and investors should consider their own risk profile and research prior to making any investment decisions.

Company Outline

Halozyme Therapeutics, Inc. is a specialty biotechnology company that researches and develops varying injectable products which are licensed out to target specific diseases and ailments. The company currently operates partnerships on some of their products, such as Darzalex Faspro where they have partnered with Johnson & Johnson (NYSE:JNJ) to produce this injectable antibody that is currently being used to treat multiple myeloma. Further, with the company’s partnerships and agreements, they have been able to meet the needs of large companies such as Bristol-Myers Squibb Company (BMY) with their ENHANZE product which they have tailored to function for specific pharmaceutical trials and disease targets as they do with each of their partnership agreements. HALO has highlighted exceptional growth over the last two quarters, and a strong demand for their products at a 30% capacity in some applications. In the near future, they expect this capacity to exceed 75% of total application based on commentary from their earnings calls, and this would indicate doubling their current revenue on the product. Moreover, in the first half of the year, they have received a good royalty rate from their licensing agreements, but this was at a discounted rate. The full royalty rate will now be in effect for the second half of the year, which should further increase their revenue.

Business Model

In my view, the current business model looks more like a subscription service that is protected from competition due to their patents. The royalties they are receiving from licensing out their products and partnering with a wide variety of companies may not be substantial right now, but management hint at expanding their licensed products portfolio with future M&A deals as well as through their own pipeline. As we have seen with other industries, mainly streaming, subscription services tend to generate cash flow well for the companies and investors year-over-year and the multiple patents this company holds may present a barrier to entry for competition even once the patent is lifted. This would be due to brand expansion based on the reliability and familiarity of the products they will build over the next decade with their current partners, while competitors are unable to make a directly competing product. This future streamline of royalties is one of the reasons I’m bullish on the company.

Fundamental Analysis

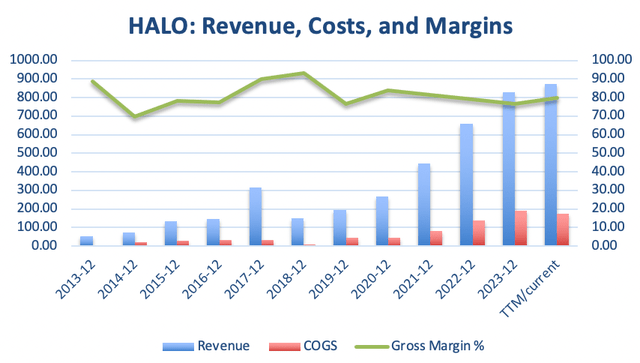

Halozyme Therapeutics, Inc. has continued to grow over the last decade and improve their overall fundamentals and business operations. Over the last ten years, gross margins have remained relatively steady while revenue has far outpaced cost of goods sold. Currently over the trailing twelve months, revenue has grown by 32% compared to 2022, 97% since 2021, and over 226% since 2020. Costs have also grown significantly over this time, however, with gross margins remaining at or above 70% over the last ten years, the company has a lot of room before it would see a material impact in returns.

HALO: Revenue, costs, and gross margins over the last decade. The left vertical axis represents the revenue and costs while the right is gross margins percentage. (GuruFocus)

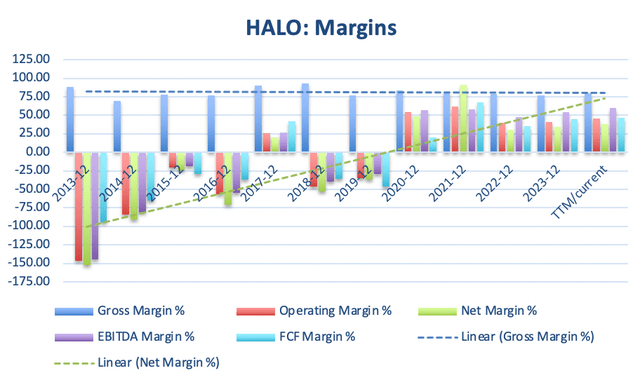

Along with gross margins remaining high, HALO currently displays high levels of net margins, free cash flow, EBITDA, and operating margins. As you can see in the chart below, net margins have significantly improved over the last ten years and are now at ~38% over the trailing twelve months. Both net margins and free cash flow margins have been consistently positive since 2020. Moreover, earnings before interest, taxes, depreciation, and amortization (EBITDA) margin has grown by 25% since 2022 and is currently sitting at 59%. However, EBITDA margin growth is relatively flat since 2020 where it was at 57% and is recovering from a near term decline in 2022 where it was 47%. The chart below further illustrates the high margin return HALO offers, and next we will focus on investment returns.

HALO: Margin expansion over the last decade with positive returns consistently since 2020. (GuruFocus)

Investment Returns

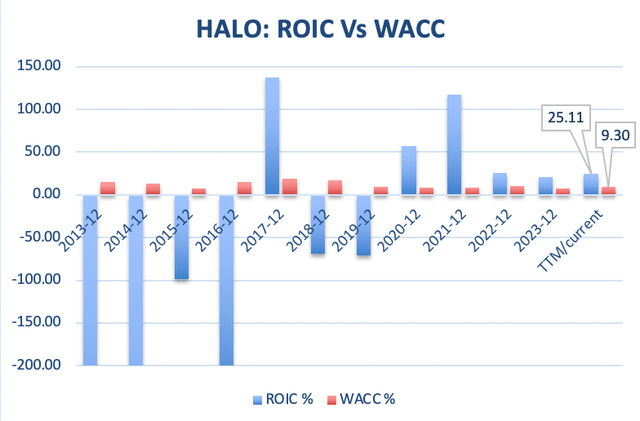

Over the last decade, HALO has significantly improved their return on invested capital (ROIC) and over the trailing twelve months their ROIC is now greater than twice the weighted cost of capital (WACC). One of the key fundamental metrics that I look for in good companies is a positive ROIC to WACC ratio, which indicates to me that the company is making smart investment decisions. Over the last 3 years, HALO has consistently had a positive ROIC to WACC ratio with a current level of 25.11 to 9.30 which represents a net ROIC-WACC of 15.81. It’s important to note that early on, this company invested significantly in their products which lead to a highly negative ROIC, and this was as high as -460% in 2014. However, as you will see with current returns on equity, this company is now providing a huge return for investors after making the large initial investments in their business.

HALO: ROIC and WACC over the last decade with the current values on a trailing twelve month basis called out. Please note for simplicity the graph was stopped at -200% and ROIC exceeded this level three times. (GuruFocus)

High Return on Equity

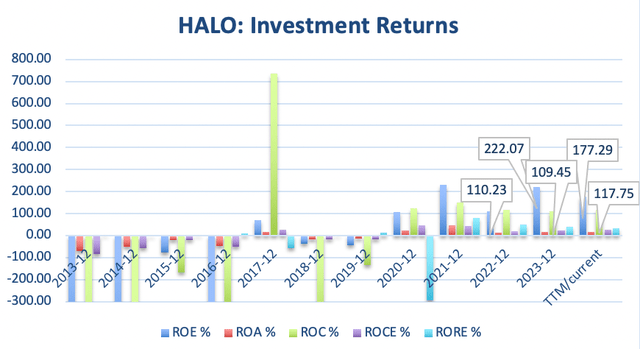

Over the last three years, HALO has really started to provide a consistently high return for investors on a fundamental basis. As you can see in the chart below, they have a return on equity (ROE) exceeding 100% since 2021, and they also have a high return on capital (ROC) which has also exceeded 100% returns. In addition to this high return, ROE has grown by 61% since 2022 and returns on assets (ROA) have also grown by 33% over this time. However, one thing to note is the company’s return on retained earnings (RORE) which is currently at a nice level of 34.98% on a trailing twelve-month basis but has declined from the 79.53% value in 2021. Declining fundamentals will indicate the company is struggling before it’s reflected in the share price, so this is something to keep an eye on as a potential risk. Finally, the company is seeing a similar trend with their return on capital employed (ROCE), however, this is also still at a high rate of 25% over the trailing twelve months.

HALO: ROE, ROA, ROC, ROCE, and RORE over the last decade with current ROE levels called out. Please note this graph was stopped after -300% which some metrics have exceeded over the course of this decade. (GuruFocus)

Risks to Investment Thesis

As this is a biotechnology company, there is significant risk with the underlying business model. If their products fail to receive FDA approval, regulatory approval, or do not meet the functional marks they were hoping for, this would pose significant risk to the company as an investment. However, as they have partnered with a few of the big companies in this space and expect to receive further approval as early as September, this is not as big of a risk as it is with other companies in this space. Another risk to this investment is the amount of debt they take on during M&A deals that help drive their product licensing business model. As with most companies, HALO is always searching for deals that would help grow their business and provide value for shareholders, however, as they mentioned in their earnings calls, they take on a significant amount of leverage to do this. Currently, they are leveraged 1.8x according to the latest earnings call, but when they acquired Antares Pharma, they were leveraged over 3x for the almost $1B acquisition announced in 2022. The company shows strong business fundamentals with the ability to pay down this debt at a rapid rate, but if the economy worsens, this is something that should be accounted for in the overall risk profile when looking at this company as a potential investment.

Finally, as this company is striving on providing a novel way of delivering therapies to patients, mostly focused on subcutaneous applications, they run the risk of other companies developing competing products once their patents are up. Most of their products are covered under patent protection for the next few years or decades as described in their most recent earnings call; however, this poses a risk to their business model which relies on licensing agreements to generate cash flow. If companies can create and produce their own line of products once this patent protection has expired, then HALO may not be able to license the products out at the same rate or lose their partnerships entirely. This risk is mitigated in the fact that HALO is still working on new products and M&A deals that will drive future growth, but it is still a risk that should be considered.

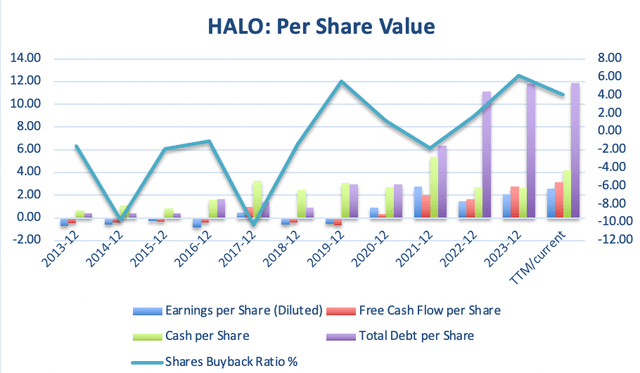

Per Share Value

On a per share basis, HALO has consistently grown their earnings per share in recent years, bought back shares, and generated free cash flow. As you can see in the chart below, the company has continued to buy back shares since 2018, indicating that they also believe the shares will provide a good return on investment compared to other investment opportunities. Further, since 2020, current EPS has grown by 184% and free cash flow has grown by over 700%. However, a negative metric to note here is the per share debt level. In recent years, HALO has more than doubled their debt, with growth of 228% since 2020. As they mentioned in their earnings call, they have the ability to become over 3 times levered to acquire a company they believe represents a good return on invested capital, however, with large amounts of debt this company may be at risk in difficult economic times or if something goes wrong with their business model.

HALO: Per share value over the last ten years with share buyback rate. (GuruFocus)

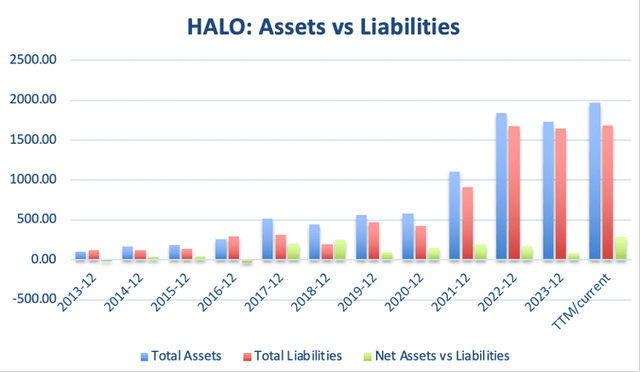

Assets Vs Liabilities

With a high per share debt level, I wanted to evaluate the growth of the company’s assets versus liabilities over the last decade to see if they would present any value if liquidated. As you can see in the chart below, HALO operates on a net asset basis, and has had higher assets versus liabilities consistently since 2017. Net assets have grown by 92% since 2020 with assets growing by 240% over this time. However, liability growth has grown by 292% since 2020, with large increases from 2020 to 2021 and 2021 to 2022. With a current Altman z-score of 4.38, I am not concerned about the company going bankrupt in the near future, but it is reassuring to see they currently operate on a net asset basis with the amount of debt they have taken on in recent years.

HALO: Net assets over the last ten years. (GuruFocus)

Current Stock Valuation

On a trailing twelve-month basis, HALO trades at a P/E ratio of 16.88 which is 15% lower than the sector and a forward non-GAAP P/E ratio of 13.95 which is also lower than the sector median by 33%. At this level, HALO is trading below their five-year average. Based on sales, HALO has a forward P/S ratio of 7.11 which is significantly higher than the sector median with a 96% difference, however this is still lower than HALO’s five-year average of 11.06. This company also trades at a forward price to cash flow ratio of 14.26 which is 13% lower than the sector medians. Now, if looking to compare this specifically to other peers in the sector, on an EV/EBITDA ratio, HALO trades at 15.94 on a trailing twelve-month basis and 14.89 on a forward basis, which are both slightly higher than the sector. Given these values, I still believe HALO represents a buying opportunity given the strong underlying fundamentals that have not been factored into the stock price, given the low P/E ratio compared to the sector, and the continued double-digit growth this company has displayed. To further my point for a buying opportunity, the current Quant rating is a 4.85 which represents a strong buy.

Conclusion

In conclusion, based on the fundamentals presented above and the future prospects for continued growth, I believe HALO is a buy and is currently undervalued. Although this company has risks such as patent expiration, industry competition from other biotechnology companies and pharmaceutical companies, and high levels of debt, management has successfully mitigated these risks so far and offers investors an opportunity to buy into this high growth company at an undervalued level. Moreover, the full value of the company at this stage has not been factored in with a large share buy-back program that will provide value to shareholders and the outlined future streams of revenue growth based on additional product application approvals that will more than double the total allowable patient applications for their products. With this outline above, and based on my own research, I am looking to build a position in this company over the next few months and hold a buy rating until something significant changes with the story. Investors should do their own research before making any investment decisions, as this article is solely based on my own opinions and research.