How do you sort through the opportunities in today's SPAC boom? Amidst hundreds of choices, I highlight just one new SPAC opportunity each day. Follow me to get them directly in your inbox. Join StW to keep getting this content after this month. You'll get sneak peeks at best SPAC ideas, weekly SPAC updates, and price alerts to make the most profitable SPAC trades. |

Action This Day

SPACs

New to SPACs? Here’s where to start. Ready to learn about today? Jump right in here:

SVF Investment Corp.

$525 million SVF Investment Corp. (SVFAU) is Softbank’s SPAC. It will start trading on the Nasdaq (QQQ) today, Friday, January 8, 2021. When you buy a unit, you get a share of equity, free upside in the form of a fifth of a warrant that you can exercise later for $11.50 and free downside protection in the form of $10 of trust value. There is a virtual certainty that they find a deal within their two year time window and a high likelihood that they find one in much less time than that. They are looking for a target in technology.

Who are those guys?

The sponsor team is affiliated with Masa Son’s Softbank (OTCPK:SFTBY). CEO Rajeev Misra runs Softbank’s Vision Fund. No one sees more deal flow. Before that, he was at Fortress and before that had important positions at UBS (UBS) and Deutsche (DB).

That's nice but… what have you done for me lately?

That's nice but… what have you done for me lately?

All the good and bad that comes with Softbank. Masa Son made one of history’s great fortunes, but also suffered some of the highest volatility when the 1999-2000 tech bubble burst. Unlimited ambition, but the chops to back it up.

Downside - how can you screw me?

Bad news first. If they fail to find a deal, it will cost the sponsors $12.5 million. Spare a thought and perhaps consider launching a GoFundMe: #1 Fundraising Platform for Crowdfunding to help them out. Outside passive minority investors will recover their $10 capital from the trust value, but warrants will be worthless. This opportunity cost could be tolerable in an equity market right around an all-time high with historically negative returns from such valuations.

I would rather work with someone who has a 130 IQ, but thinks it's 120, as opposed to someone with an IQ of 150 who thinks their IQ is 170.

- Charlie Munger

Masa is a quirky genius who gravitates to fellow quirky geniuses in a way that leaves him susceptible to getting taken in by the types that Munger warns about.

Upside - what am I in it for?

Your upside is if they find a deal that performs well. They probably will. They have the team, affiliate, scale, and intended sector.

Execution

Shares trade today in the secondary market. Really, they do. Even if you can’t find them. If your broker is baffled by SPACs, then consider another broker; my broker thoughts are here (and this post’s comment section is also the best place for comments about brokers). I wish you well. However, regarding the specific vagaries of your peculiar communications with your broker, fellow readers’ curiosity may be more finite than commenters assume.

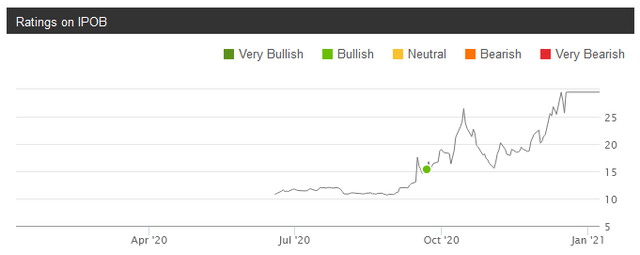

Free Sample

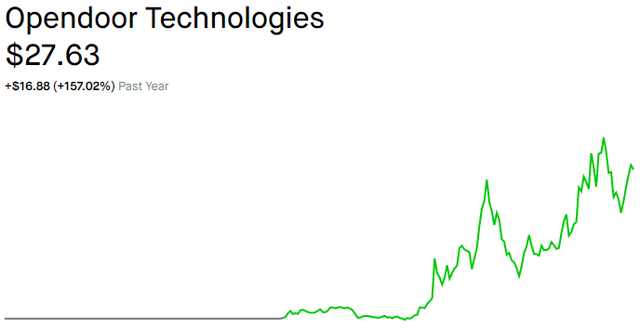

Here is a free sample of the kind of research on StW. It focused on the opportunity in Social II (IPOB) which is now Opendoor (OPEN). It also described my favorite warrants and why I owned them. Please take a moment to read it to see if this type of investment opportunity is valuable to you.

Coverage

Coverage

Here are some of my prior disclosed positions and ratings that may still be of interest.

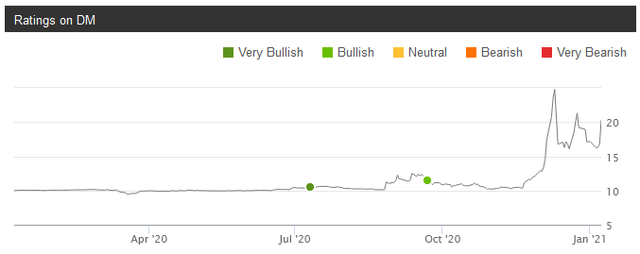

(DM)

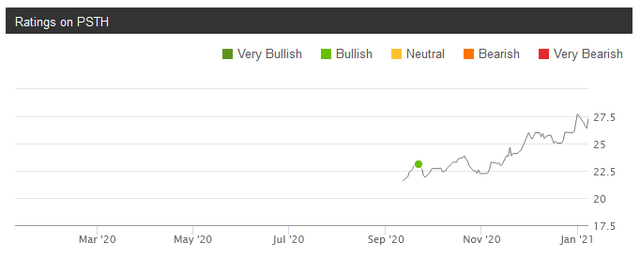

(PSTH)

(OPEN)

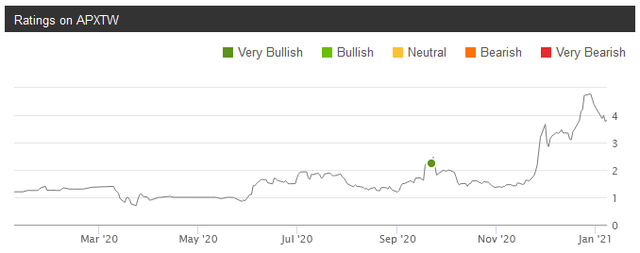

(APXTW)

(APXTW)

Conclusion - So what?

Conclusion - So what?

There is a lot of bad reporting and analysis on SPACs. It is a combination of sour grapes mixed with non-buyer’s remorse and a hope to revel in schadenfreude if our investments fail. Lovely. They love to call SPACs “risky”. They are a bit muddled. What they mean is that SPACs are volatile. Great. I am very long SPAC units and units are very long SPAC volatility. So I own (FREE) puts and calls and am being screamed at that what I own is volatile. Um… good?

No one has had a more volatile career than Masa Son. No one has lost more from top to bottom and next to no one has gained more making it back from bottom to top. No one’s performance would be more beneficial to people like me who bought SVFAU this morning. Pick a target that is worth 1% of what he paid (he’s done that before) and I’ll just take my $10 back. Pick a target that is worth 100x what he paid (he’s done that too) and I’ll go along for the ride.

Want a more sophisticated plan for the oft repeated but rarely thought through observation that SPACs are volatile? I have two.

First, the relative value of the equity and warrant often gets lost in the shuffle. There have been amazing opportunities to profitably exploit such mispricing including on Nikola (NKLA), QuantumScape (QS), AerSale (ASLE), and others.

Secondly, the implied volatility of the most popular SPAC equities is high and exploitable. One can make solid returns with little risk by writing these contracts against long equity positions. Both the cap structure mispricing and the equity derivative mispricing opportunities are made possible by the same source – innumerate retail investors with limited access to sophisticated or even competent brokers combined with a lack of attention to detail and reading comprehension. If that is you: God bless you and never change. I love a good counterparty and you are my ideal.

TL;DR - Too long; didn't read?

Buy SVFAU today and get a positive skew; you risk pennies but could make dollars in the months ahead.