In this ongoing series, I covered five companies so far. Three of them might perform pretty stable and can rather be described as recession-proof. One of them is the pharmaceutical distribution company McKesson (MCK). The other two companies are both retail companies and while many retailers might be hit pretty hard, the grocery chain Kroger (KR) and the 8th largest retailer Target (TGT) should perform quite well. I also covered the fast-food chain McDonald's (MCD) and the coffeehouse chain Starbucks (SBUX) and both will see declining revenues due to COVID-19 and the upcoming recession.

In this article, I will cover the social media and technology company Facebook, Inc. (FB). But we should always remember, that Facebook is generating almost all of its revenue from advertisement and that is what we have to focus on in this article, when trying to assess how COVID-19 and the upcoming recession will impact Facebook's business.

(Source: Pixabay)

All these articles will follow the same structure and focus on four different aspects that seem to be very important right now:

- Impacts from COVID-19: I am trying to analyze how COVID-19 as well as the measure and political decisions (lockdowns, social distancing, closures, etc.) will affect the business model.

- Impacts from a potential recession: As a global recession seems to be inevitable, I will also analyze how a recession will impact the business model.

- Solvency and Liquidity: In turbulent times, debt levels, solvency and liquidity are especially important and we are therefore taking a closer look at the balance sheet.

- Intrinsic Value Calculation: Although I included a potential recession in the near future in almost all calculations and considered a declining free cash flow, COVID-19 might call for an update of the intrinsic value.

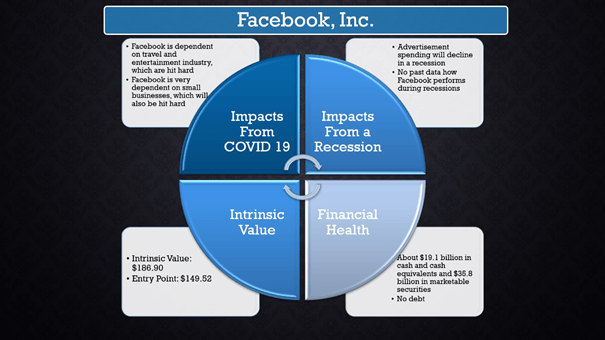

(Source: Author's own work)

In case of Facebook, it is pretty difficult to differentiate between the negative effects of COVID-19 and the upcoming recession. Nevertheless, we are looking at both aspects and start with the effects of COVID-19 on Facebook's business model.

Impacts from COVID-19

Social distancing demands, that people stay away from public places and stay at home most of the time. And while many people have to take care of their kids due to closed kindergarten and schools, the time spent on the mobile phones and watching TV will increase. And the usage of social media is also increasing as it is not only a way to kill time, but also a way to stay in touch and communicate with people as it is difficult to communicate face-to-face. In India for example, people spend more than four hours a day on Facebook, which is an increase of 87% compared to the week before the lockdown. According to the survey, people spend 280 minutes a day on social media.

On March 24, 2020, Facebook stated, that those countries, which are hit hardest by the pandemic, total messaging has increased over 50% in the last month. Also places that have been hit hardest by the virus, voice and video calling have more than doubled on Messenger and WhatsApp. In a post, Facebook said:

Much of the increased traffic is happening on our messaging services, but we've also seen more people using our feed and stories products to get updates from their family and friends. At the same time, our business is being adversely affected like so many others around the world. We don't monetize many of the services where we're seeing increased engagement, and we've seen a weakening in our ads business in countries taking aggressive actions to reduce the spread of COVID-19.

When more users are spending more time on Facebook, it is certainly good for the business, but this is not the whole story. As Facebook stated in the quote above, it doesn't monetize WhatsApp or the messaging and video services and the increased traffic and usage of messaging and video services is not really helpful for generating revenue.

Facebook's business model is relying on people using the services and therefore creating an audience for advertisement. But the business is also relying on companies and businesses advertising on Facebook. People spending more time on Facebook won't do much for the company's revenue if the businesses are buying less advertisement and there are several hints that money spent on advertisement is declining.

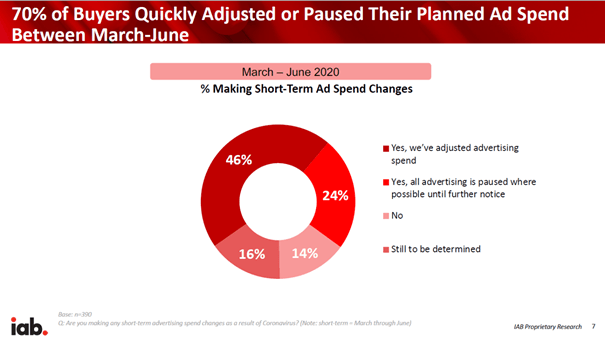

In a study, the IAB (Interactive Advertising Bureau) asks about 400 companies or agencies about their plans for ad spending in the next few months. Nearly a quarter (24%) of the respondents have paused all advertising spending for the rest of the first half of 2020. And 46% are adjusting advertising spend for the same time. In total, digital ad spending in the months March till June is down 33%.

(Source: iab. Study)

For the second half of 2020, about two thirds still haven't decided if advertising spending has to be adjusted or not. Of those 25% that already decided, spending for the third quarter will decline about 25% and for the fourth quarter spending will decline about 12%.

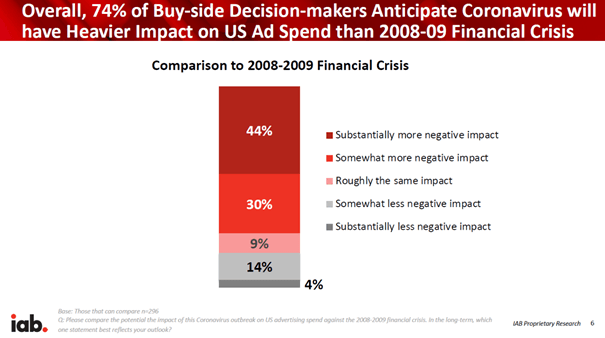

In the same study, 74% of respondents (which are 390 respondents from brands as well as agencies) are expecting either a substantially more negative or at least somewhat more negative impact from COVID-19 compared to the Financial Crisis in 2008/2009.

(Source: iab. Study)

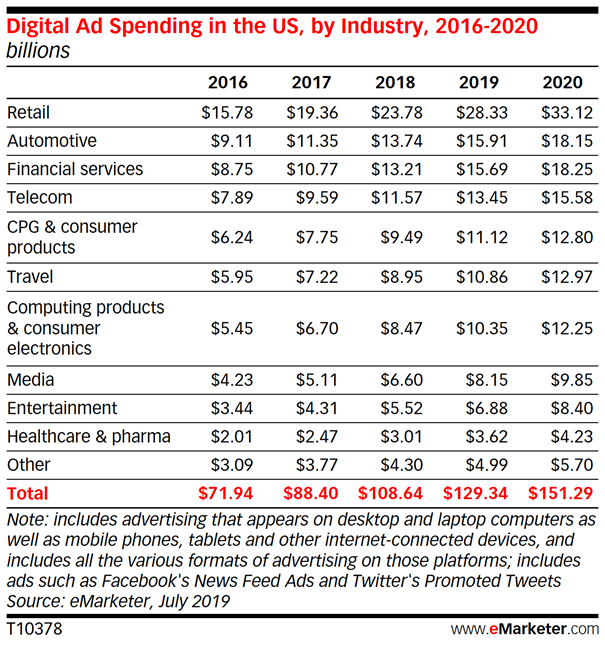

We can also look at the different industries and how much they spend on advertisement. Retail, automotive, entertainment and travel might probably be among the industries hit hardest by COVID-19 and many companies operating in these industries might cut their ad spending in the coming months and quarters. These four industries combined were expected to spend almost $73 billion in 2020 on digital advertising, which is almost half (48%) of the total expected digital advertising spending of $151 billion in 2020.

(Source: eMarketer)

Especially travel might cut back on spending. For 2020, the industry was estimated to spend $13 billion, but the companies operating in the industry might spend only a fraction of that amount. What is especially problematic is the fact that about 30% of Facebook's ad revenue stems from travel and films. According to a MarketWatch article, the postponement of the new James Bond movie alone will cost Facebook $50 million.

It is also problematic that Facebook is especially dependent on the ad revenue from small businesses. These small businesses can use Facebook (and similar social media platforms) because it is easy to advertise there with a small budget. According to different estimates, small businesses make up about 40% to 45% of Facebook's revenue, but the measurements that have been taken by governments all over the world will hit many small businesses especially hard (and several might even go bankrupt). According to Michael Levine of Pivotal Research, the failure rate of small businesses could be as high as 30% when the economy is locked down for as long as two months. If about 45% of Facebook's revenue comes from small businesses and 30% could go bankrupt, this would mean that Facebook will lose 13.5% of its revenue.

As Facebook hasn't offered any numbers so far, we can look at a statement Twitter (TWTR) - which has a somewhat similar business model - released on March 23, 2020:

While the near-term financial impact of this pandemic is rapidly evolving and difficult to measure, based on current visibility, the company expects Q1 revenue to be down slightly on a year-over-year basis. Twitter also expects to incur a GAAP operating loss, as reduced expenses resulting from COVID-19 disruption are unlikely to fully offset the revenue impact of the pandemic in Q1.

The original guidance for the first quarter was 10% revenue growth for Twitter and the real damage is expected to occur in the months to come and not in the first quarter - for Twitter as well as for Facebook.

Impact of Recession

But Facebook is not only affected by lower ad spending from companies operating in the travel or entertainment industry. The upcoming recession will also have a huge impact on the money spent on advertisement in many other sectors as well. In most cases, I am looking at the performance of a company during past recessions to get a feeling how extreme the negative effect on revenue and net income might be. The problem with Facebook is that we don't have data how the company performed during any recession. While Facebook was around during the Financial Crisis, we don't have any real data for that period as Facebook did not go public before May 2012. And even if the data from 2008/2009 was available by SEC filings, Facebook was growing very aggressive at that point and therefore the data would not have helped us in any way.

Instead we have to look at different data. According to a Forbes article, the ad spending in the aftermath of the last recession declined about 13% with newspaper ad spending suffering the most (27% decline) and online declining only 2%. However, online marketing and online advertising was still in its infancy with usually high growth rates and this time, online advertising might decline more than in 2008. Morgan Stanley is also expecting a harder hit in the upcoming recession than in 2008 for the same reason. While in 2008, online advertising represented 13% of total advertising, it is now representing 53%. However, they are only expecting ad spending to decline 2% this year, which seems very optimistic (and probably unrealistic).

In a non-rating action commentary, Fitch is also writing about the effects of the last recession on advertising revenue:

Advertising revenue rebounded relatively quickly following the Great Recession, illustrating the industry's ability to recover from recessionary shocks. Average annual organic revenue growth of the four public advertising agencies fell 8.5% in 2009 before snapping back to grow at a mid-to-high single digit rate from 2010 through 2012, despite unemployment remaining above 8% through 2012.

When looking at the estimates of analysts and the adjustments during the last few months, we still see a high level of optimism for Facebook. At the end of January 2020, analysts were estimating Q1 FY 2020 earnings per share to be $2.04 and EPS for Q2 FY 2020 was expected to be $2.14. But in the meantime, the estimates for the first quarter have been revised downwards to $1.89 and for the second quarter to $1.74. For the third quarter, estimates were revised downwards from $2.39 at the end of January to $1.96. Revenue for the full year is also expected to decline a little, but only from $85 billion (expectations at the end of January) to about $80 billion right now.

In my opinion, these estimates are way too optimistic, but I find it difficult to come up with a clear number how huge the negative impact might be.

Balance Sheet

As in all the other articles in these series, we are also looking at the financial health of Facebook and take a closer look at the balance sheet. To forestall the conclusion: Facebook has a great balance sheet and we should neither worry about Facebook's liquidity nor about solvency. On December 31, 2019, Facebook had $19,079 million in cash and cash equivalents as well as $35,776 million in marketable securities. The company has no debt on its balance sheet. The only negative aspect on the company's balance sheet is $18,715 million in goodwill on its balance sheet and although this might seem like a huge amount, it is only 14% of the company's total assets ($133.4 billion).

Whatever will happen in the next few quarters, Facebook should not run in to any financial troubles. Even if Facebook should see declining revenues and/or declining profitability and lower net income, we must not worry about Facebook's financial health. With about $55 billion in more or less liquid assets, the company has enough money to withstand troubles. This is almost as much revenue as Facebook is generating in one year and is more than the total expenses of 2019 (about $46.7 billion).

Intrinsic Value Calculation

Finally, we have to calculate an intrinsic value for Facebook in order to decide if and when Facebook could be a good investment. But calculating the intrinsic value for a rather young company, which is still in its growth phase, is a difficult task. While we have to assume that growth will slow down at some point in time, we don't know when growth will slow down and how fast growth will slow down. This makes it a rather difficult task to estimate the growth rates for the years to come. Additionally, it is also difficult to estimate the negative effect of the recession as well as COVID-19 because we don't have any data from the past.

For my calculation, I will assume a 50% decline in free cash flow compared to 2019. I honestly don't know if this number is realistic (and hopefully it won't be), but I would rather be cautious about the free cash flow this year as COVID-19 and the recession might have a huge impact on Facebook's business. For 2021, I will assume that Facebook will see a strong rebound and will come invigorated out of this recession and we assume 50% growth for 2021. From 2022 till the end of the next decade, I assume that growth is still in the double digits in the first years, but will slow down year-over-year until we have a growth rate of 6% till perpetuity. In the last quarters, revenue growth was fluctuating between 25% and 30% and as the growth rate will continue to decline, I will assume 18% growth for 2022 and then a lower number from year to year.

Using these numbers (and a 10% discount rate) leads to an intrinsic value of $186.90 for Facebook. Like with all the other companies in this series, I will add a margin of safety of 20% to reflect potential mistakes or false assumptions or simply to compensate for the high level of uncertainty, which leads to an entry point of $149.52.

Conclusion

It is very unfortunate that we don't have any numbers on how Facebook performed during past recessions, which makes it especially difficult to estimate revenue and free cash flow in the coming quarters. But even in pessimistic scenarios, Facebook seems to be fairly valued and a good long-term investment, that could come out strong after this crisis. And we don't have to worry about Facebook's liquidity as well as Facebook's solvency as the company has no debt and billions of cash to withstand even a severe recession or depression.

(Source: Author's own work)

Stay safe, stay healthy, don't panic!

If you enjoyed the article and like to learn more about wide moats, please check out my marketplace service: Moats & Long-Term Investing.

Subscribers get access to extensive background information on wide-moats, at least weekly exclusive research, a watchlist of wide moat companies and a chatroom where members can ask questions and exchange opinions about long-term investing and companies with a competitive advantage.

For investing in companies that can beat the market over the long term and create a portfolio with companies you can (almost) hold forever, please check out my marketplace service. You can also take advantage of a free trial offer.