Introduction

Windstream (WINMQ) is a key tenant for Uniti Group, Inc. (NASDAQ:UNIT) and makes up about half of Uniti's revenue base. Its abrupt bankruptcy has sent shivers down the spines of every Uniti bull. While we have played the Uniti game from every angle in the past (long, short, ratio call spreads, ratio put spreads, long unsecured bonds), we think the time for those games is done. Today you either go short or go home. The latest development reinforced our thought process on this.

Windstream files new paperwork

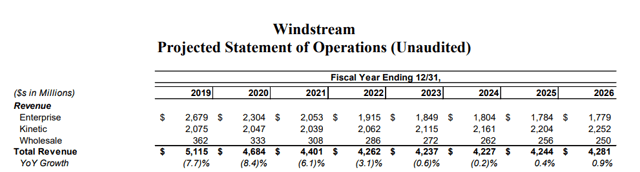

Windstream filed some additional documents related to its ongoing bankruptcy proceedings and negotiations with Uniti. While there are several interesting angles from the point of view of the different tiers of Windstream bondholders, we were most interested in the financial projections of the new Windstream. Now some of the projections will of course change depending on what is the final outcome of the bankruptcy, but there is a lot to be gleaned even keeping that in mind.

The customer on constant life support

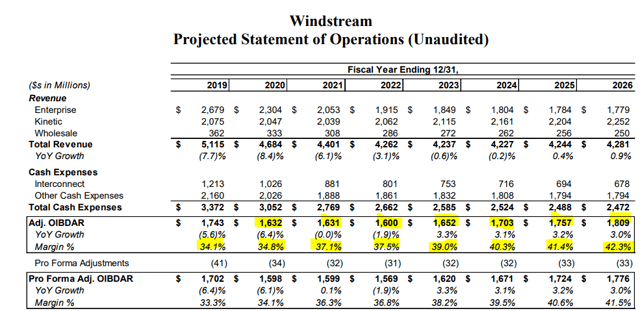

Windstream's problems stemmed from a constant revenue decline. That led to a perpetually falling OIBDAR (Operating Income Before Depreciation Amortization & Rent). What is interesting though is Windstream's projections over the next seven years.

Source: Windstream

Revenue declines don't stop till 2025, and even there, the growth is made out to be a rounding error. Fascinatingly OIBDAR starts picking up steam in 2023 and grows rather strongly year after year from there.

Source: Windstream

Windstream has made this possible through rather generous OIBDAR margins which expand from 34.1% to 42.3%. Considering the markets it is in alongside the competition, we don't think this will be remotely feasible. Even with those extra rosy projections, Windstream's free cash flow situation is extremely tenuous. To start off, even in 2021, Windstream's OIBDAR minus Capex

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with 4,400 members. We are looking for more members to join our lively group and get 20% off their first year! Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting 9-10% yield, our preferred stock and Bond portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!