This weekly column explains the reasons behind the movement in a selection of the largest U.S. cash merger arbitrage spreads from the past week as calculated by Merger Arbitrage Limited. We analyze the attractiveness and profitability of each spread going forward and indicate the trading position or action we have taken or intend to take based upon the analysis given.

Forescout Technologies (FSCT)

Early Monday morning Forescout Technologies provided an update regarding the pending acquisition by Advent. The statement read

On May 15, 2020, Advent provided notice to Forescout that it would not be proceeding to consummate the acquisition of Forescout on May 18, 2020, as scheduled. Forescout and Advent are engaged in ongoing discussions regarding timing to close and the terms of the transaction. There can be no assurance that Forescout and Advent will be able to reach agreement on terms.

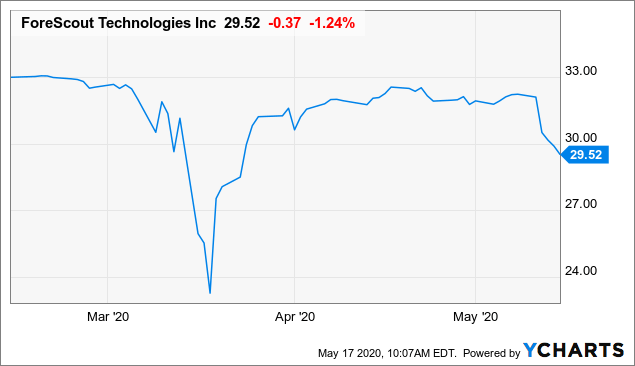

Forescout Technologies had moved sharply lower during the previous week which included worse than expected earnings results on Monday. Q1 GAAP EPS of ($1.26) missed by $0.70 and revenue of $57.15M missed by $21.73M. By the end of the week, the stock had finished down by $2.70 at $29.52, a fall of 8.38%.

This decline follows the announcement from the previous week by an Owl Rock (ORCC) executive who claimed

Owl Rock will stand by its borrower commitments despite the current macro uncertainties.

Owl Rock is backing Advent's $33.00 a share purchase of Forescout currently valuing the firm at $1.9bn.

So with this safety net in mind, and despite the recent poor results, was the sell off indicative of additional problems? Subsequent events suggests this was the case. It is not the decision of Owl Rock as to whether or not to proceed with the deal under the current terms, or at all. Advent still have to make the decision to continue with the deal if they wish to. A recent report from Spruce Point's Ben Axler highlights

We continue to see above average risk the deal fails to be completed and call on Advent to renegotiate or terminate the transaction. We could see FSCT shares being worth $13 per share.

The reason for this is a potential breach of covenant regarding borrowing on a line of credit and implementing a restructuring.

Data by YCharts

Data by YChartsWith a continued run of declining profitability and poor results, it was a very real possibility Advent would seek a renegotiation of the deal. This decline in operating performance was before the effects of COVID-19 started to bite. What may be supporting the stock from and arbitrageurs point of view however is the floor price. The stock was trading at circa $28 immediately prior to this deal announcement and had traded much higher prior to this. As at the close on Friday, simple spread was at 11.79%. To some, this may at first appear like an attractive return which masks the risks involved.

In the original draft of this article we stated "we will consider a rare short position in this stock in the near future". However, the announcement on Monday morning suggest that ship has alread sailed. We therefore continue to warn investors about the dangers on merger arbitrage investing in these extreme economic times.

Bitauto Holdings (BITA)

Either directly or indirectly, COVID-19 continues to play an ever increasing role in investment decisions. In the case of Bitauto, the concerns over the pandemic have been raised by the U.S. government and aimed at China. This in turn requires a response from the Chinese authorities and investors are bracing themselves as to how this will effect the stock market going forward. More specifically, will the mergers & acquisitions market suffer as political motivations trump economic rationality. Naturally, deals with Chinese connections continue to exhibit volatility an as always, investors are urged to examine this merger arbitrage exposure to this sub-segment of the market. Without any new deals news reported during the week, the BITA closed down at $10.66 against an offer of $16 from Tencent Holdings. A fall of $0.81 or 7.06%. This leaves the merger arbitrage simple spread at 39.491%. We remain holders of our small position in this stock and expect to continue to do so for the foreseeable future.

Merger Arbitrage and Market Data

The broader market retreated during the week following a decline on Tuesday which spilled over into the next trading session. Poor economic data such as U.S. retail sales and industrial production for April posting the largest declines on record was more than sufficient to dent investors appetite for stocks. The increase in tensions between the U.S. and China has also raised concerns about future trade negotiations. Although the initial announcement of the U.S. administration blocking semiconductor shipments to Huawei was treated with concern, the market did manage to claw back some of the losses towards the end of the week. By the close on Friday, the broader market in the U.S. as defined by the S&P 500 ETF (SPY) finished down 2.13%.

The IQ ARB Merger Arbitrage ETF (MNA) also declined on Tuesday and unable to recoup those losses by the end of the week. A fall in Taubman Centers (TCO.PK) was the main cause of this although a drop in TD Ameritrade Holdings (AMTD), amongst others, also contributed. The performance of the ETF did not appear to be affected by the broader short positons supposedly taken to hedge the value of merger arbitrage spreads. (You can read our analysis of advantages and disadvantages of investing with the MNA ETF in the "Merger Arbitrage Strategy" section at the Merger Arbitrage Limited website). By the end of the week, the MNA was showing a loss of 2.28%.

| Product | Weekly Change | Product | Weekly Change |

| T20 Index | (1.84)% | SPY | (2.13)% |

| Index Dispersion | 3.13% | VIX | 13.97% |

| Winners | 5 | MNA | (2.28)% |

| Losers | 12 | ||

| Week Ending | Friday May 15, 2020 |

Merger Arbitrage Portfolio Analysis

U.S. based cash merger arbitrage positions saw another negative performance this week as the losers triumphed over the winners by 12 to 5 with 3 non-movers. There were no cash positions last week as the index of cash merger arbitrage spreads maintains its full complement of deal constituents. The top 20 largest cash merger arbitrage spreads as defined by MergerArbitrageLimited.com lost 1.84% whilst the dispersion of returns was 3.13%. This number remained low despite some large declines. The figure is below both the 3-month medium-term and the long-term look back period. The negative performance of the portfolio was primarily attributable to the loss in RRGB with significant declines in FSCT & BITA also. A positive performance from WBC as the deal was granted regulatory clearance from the Chinese State Administration for Market Regulation (SAMR) produced the only winner of note.

The index of cash merger arbitrage spreads now offers an average of 16.93%. This is marginally lower than last week's figure of 13.76% and is due to the increase in the average expected completion date following a change in the index composition. For this coming week, the T20 portfolio has 20 deals and 0 vacant spots filled by cash which may prove to be the last full complement for some time.

For additional merger arbitrage discussion be sure to catch our exclusive interview with Seeking Alpha "SA Interview: Merger Arbitrage Investing With Mal Spink, CFA".

Merger arbitrage trading is not without risks. This strategy, although accessible to individuals as well as professionals, should be thoroughly understood BEFORE investment capital is put at risk. To assist the reader, "evergreen" content such as "how-to" & introductory guides, a reading list and much more including a list of the largest cash merger arbitrage spreads currently available can be found at the Merger Arbitrage Limited website associated with the author of this article.

Author's note: If you enjoy Merger Arbitrage Limited, please consider following us by clicking on the "Follow" button at the top of this page and hitting the "Like" button below.