Introduction

The last couple of weeks have seen BP (NYSE:BP) announce massive write-downs of up to $17.5b as well as massive layoffs that will unfortunately see 10,000 employees lose their jobs. Following the financial pressure that they are facing as a result of this latest oil price crash, the old adage that bad luck (NEWS) comes in threes seems applicable in this instance, with their dividend almost certainly now facing a massive reduction. I have previously warned that their dividend was likely to be reduced and this article provides an update that incorporates these latest announcements and an estimated timeline before shareholders could see their dividends completely reinstated, if my warning comes to fruition.

Dividend Coverage

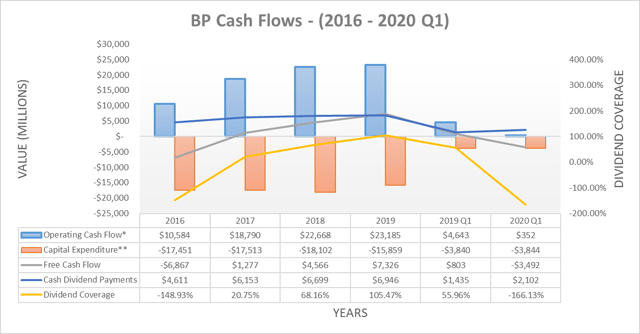

When assessing dividend coverage, I prefer to forgo using earnings per share and use free cash flow instead, since dividends are paid from cash and not from "earnings". The graph included below summarizes their cash flows from the last quarter and previous four years.

Image Source: Author.

Following their first quarter of 2020 results, my previous article provided a detailed analysis regarding their dividend coverage going forward and thus this section was primarily provided for general information for new readers. The most important bottom-line finding was that since their Gulf of Mexico oil spill payments are finally winding down, their dividend should be adequately covered by free cash flow during normal operating conditions going forward. This is primarily evidenced by their dividend coverage of 105.47% in 2019, which occurred during broadly normal operating conditions but whilst Gulf of Mexico oil spill payments were still higher than they will be going forward.

It was also found that based upon their performance during the first quarter of 2020, they would likely need to fund the entirety of their capital expenditure and dividend payments through debt for 2020. Whilst operating conditions in the remainder of 2020 could possibly improve compared to the first quarter, given that oil prices subsequently fell to negative levels and the coronavirus pandemic is not yet over, this would be a risky assumption.

Financial Position

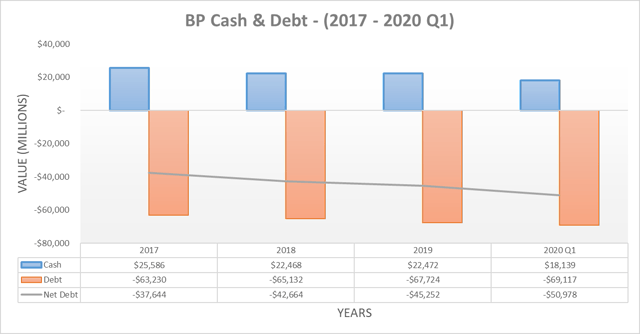

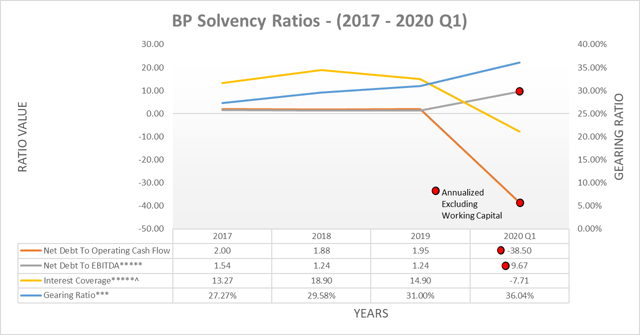

The bigger issue is the leverage of their financial position, which will only be exacerbated by these latest massive write-downs. The three graphs included below summarize their financial position from the last quarter and previous three years.

Image Source: Author.

Since my previous analysis covered their current leverage in detail, this analysis will instead focus on the impact from the write-downs and an estimated timeline before they could completely reinstate their current dividend if imminently reduced. The bottom finding was that despite being less than ideal, thankfully their leverage does not threaten their ability to remain a going concern, barring a black swan event.

Similar to many of their peers, such as Royal Dutch Shell (RDS.A) (RDS.B), they target to keep their gearing ratio under 30% in the long-term. Assuming that their write-downs are at the midpoint of their guidance at $15.25b, their gearing ratio would increase to 40.39% from 36.04%. This was assuming that their net debt remained static compared to the first quarter of 2020 at $50.978b, which is not likely given the aforementioned cash flow analysis. If net debt were to increase by $5b through the second quarter of 2020 by funding $2.102b of dividend payments and a portion of their capital expenditure, then their gearing ratio would reach 44.35%.

Whilst it nonetheless is still technically possible that they still sustain their dividend, their leverage is clearly high and also well above their target level. The only effective way to deleverage would be from reducing their dividends, as they consume the majority of their free cash flow even during normal operating conditions and with Royal Dutch Shell now providing precedence, this action is easier to justify to their shareholders.

Following any dividend reductions, it stands to reason that their shareholders will not see any material increases until their net debt and thus leverage has been reduced. Whilst I cannot see inside the minds of their management, I believe that they would likely wish to see net debt reduced back to around $40b, which was the approximate level between the end of 2017 and 2018.

Once operating conditions recover, it seems reasonable to assume that they were able to generate the same free cash flow as during 2019 at approximately $7.3b. If they follow the move by Royal Dutch Shell and reduce their dividend by two-thirds, this would leave their annual dividend payments totaling approximately $2.3b and thus providing them with approximately $5b to deleverage per year. When combined with the previously mentioned scenario whereby their net debt reaches $55b, this would take them approximately three years to reduce to $40b, which is assuming no material divestitures. When the current general economic uncertainties are combined with the fact that they recently significantly reduced the price of a divestiture, it seems too optimistic to factor these into the analysis.

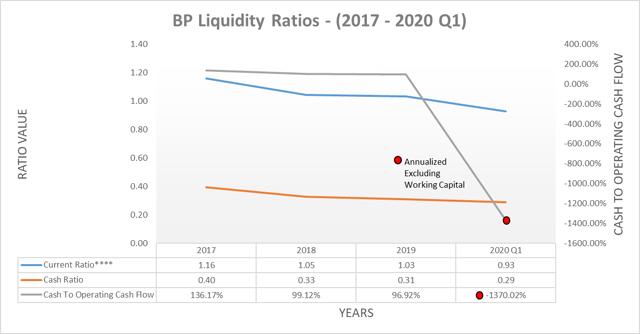

Image Source: Author.

Even though their write-downs have a material impact on their leverage, thankfully this is not the case for their liquidity. Since this was also analyzed in detail in my previous article, it would also be redundant to more than simply state the bottom-line findings. Due to their massive size, decent overall financial position and supportive central bank policy, there are no reasons to be concerned that they cannot find support in the debt markets to refinance any upcoming debt maturities and provide liquidity when required.

Conclusion

Following these write-downs, it seems increasingly likely that they will reduce their dividend by at least the same extent as Royal Dutch Shell. Thankfully there are reasons to believe that this dividend reduction will only be temporary and once operating conditions improve, they should be capable of increasing it again. Even though the size of these write-downs is rather surprising, since I have been expecting a massive temporary dividend reduction I still believe that maintaining my bullish rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from BP's First Quarter 2020, Fourth Quarter 2019 and Fourth Quarter 2017 report, all calculated figures were performed by the author.