Source: Style Factory

Investment Thesis

Recently, I published a modest buy rating on Shopify (NYSE:SHOP), and my detailed investment thesis can be found here and from a little earlier in the year here. In today's article, I discuss Shopify's Q2 earnings (reported on 07/29/2020) and their long-term implications for Shopify's future.

But before I dive into the numbers, allow me to share a little recap behind my thinking regarding Shopify.

In a nutshell, my bullish investment thesis on Shopify remains based on the inexorable secular growth trends in e-commerce and enterprise digital transformation. As we all know, the coronavirus pandemic has accelerated the generational shift in consumer spending patterns from physical to online stores.

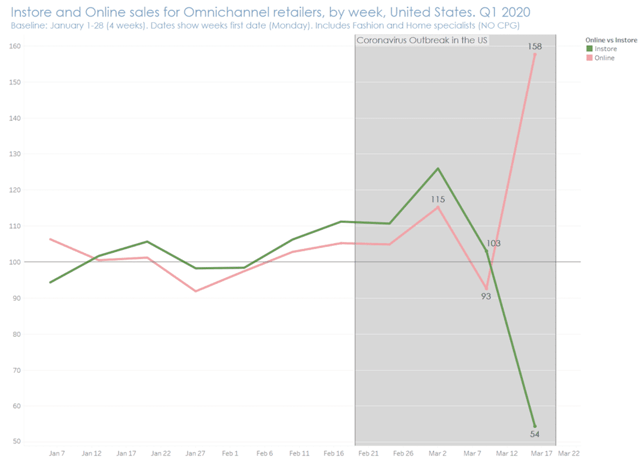

Source: www.criteo.com

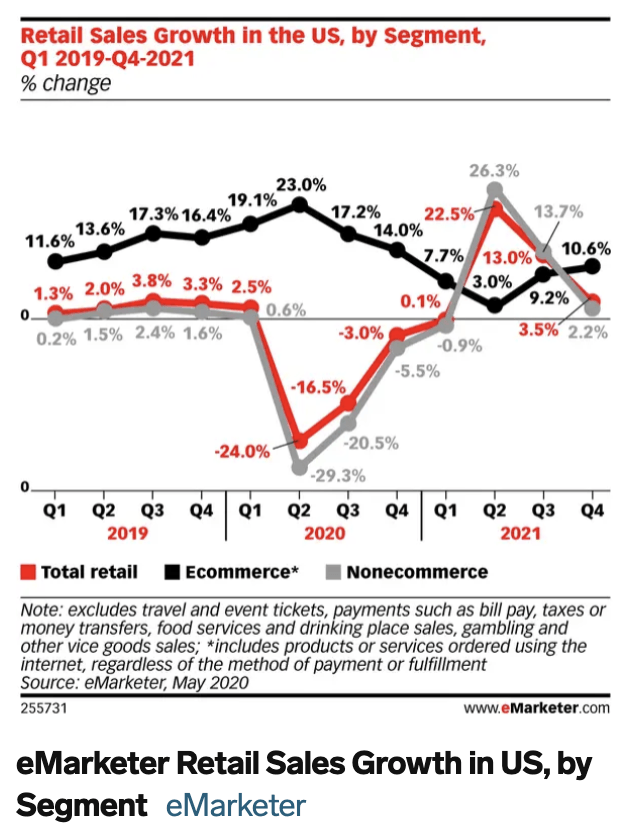

In the last few months, e-commerce penetration of the total US retail market has blasted up from ~16% to 25%, and thus Shopify's exceptional Q2 performance should come as no surprise to anyone.

Source: www.businessinsider.com

Though I don't believe traditionally brick and mortar pizza sellers will continue slinging pizzas primarily online, COVID-19 certainly did pull forward a great deal of transition to not just an online strategy, but an omnichannel strategy, at which Shopify excels more so than any of its peers.

Additionally, consumer spending patterns have been shifting towards online stores for several years. Thus, I expect the boost in e-commerce to remain rather permanent, as we march inexorably toward a reality where e-commerce accounts for over half of all retail spend.

Shopify is continuously expanding the capabilities of its platform, and, in my opinion, the addition of a fulfillment network and its recent release of its Shop app could result in Shopify, meaningfully, competing with retail giants such as Amazon (AMZN) and Walmart (WMT). Several growth avenues like international expansion, additional lines of business (e.g., fintech, logistics, advertising), and machine learning serve as a solid basis for a long, long growth runway for Shopify.

Here's an outline for the rest of this research note:

- Analysis of the latest quarterly financials and their potential long-term impact on Shopify's business.

- Re-evaluation of Shopify's intrinsic value in such a way as to ascertain a buying range.

Let's get into it.

Shopify's Q2 Numbers Show Rapid Growth Acceleration

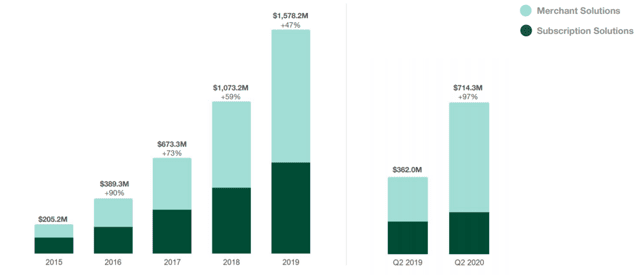

Surpassing all estimates, Shopify recorded Q2 revenues of $714.3 million (up +97%). After years of growth rate deceleration, Shopify recorded the highest revenue growth rate since its IPO on the back of a significant boost in merchant count over the last few months. The COVID-19 pandemic hurt retail businesses and forced them to go online for survival, and it looks like this transition played directly into the hands of Shopify.

Source: Shopify Q2 Earnings Slides

The reason I like Shopify's business model a lot is its ability to benefit from the success of the sellers/merchants on its platform. As you may know, Shopify charges a fixed subscription fee for its platform. These subscription revenues grew by a healthy ~28% y/y based on new merchant additions to Shopify's platform in Q2.

However, the highlight of Shopify's report is the ~148% y/y growth in Merchant Solutions segment revenue. I agree that the Merchant Solutions segment commands a lower gross margin profile of ~40-45% as compared to the Subscription Solutions segment (gross margin profile: ~75-80%), but the growth in Merchant Solutions is evidence of Shopify's ability to provide services that could yield higher revenues from existing merchant base on its platform.

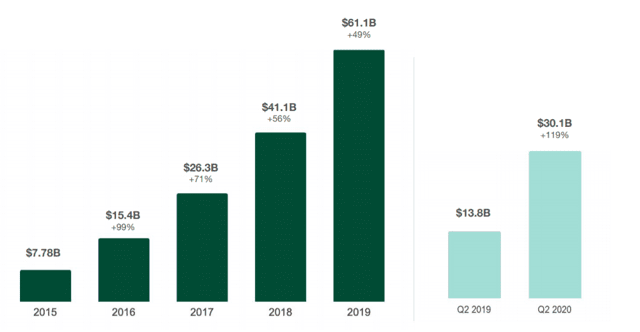

The success of Shopify's sellers (as a collective) can be measured by the gross merchandise value (GMV) processed through Shopify's platform. Furthermore, Shopify's Merchant Solutions segment revenues are positively correlated to GMV. In Q2, the GMV processed through Shopify's platform went up to $30.1 billion from the previous year figure of $13.8 billion, i.e., a rise of +119% y/y.

Source: Shopify Q2 Earnings Slides

Assessing The Long-term Impact

Source: Shopify Q2 Earnings Slides

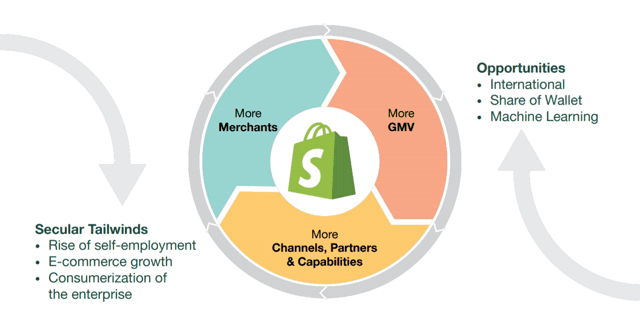

In 2020, Shopify's flywheel is rotating rapidly, which is driving the company's revenues higher and simultaneously strengthening Shopify's ecosystem and by extension moat. The influx of merchants on the Shopify platform due to COVID-19 in combination with the shift in consumer spending trends to online channels is driving Shopify's GMV higher. On top of that, Shopify continues to add channel partners (e.g., Facebook (FB), Walmart, Shop App, etc.) and capabilities (e.g., Shop Pay, Shop Balance, etc.) in order to enhance merchant (and consumer) experience on its platform.

As Shopify's flywheel motors on with immense power supplied by secular tailwinds like the rise in self-employment, e-commerce penetration, and digitalization of traditional brick and mortar, mono-channel enterprises, I expect Shopify to experience spectacular long-term growth over the next decade.

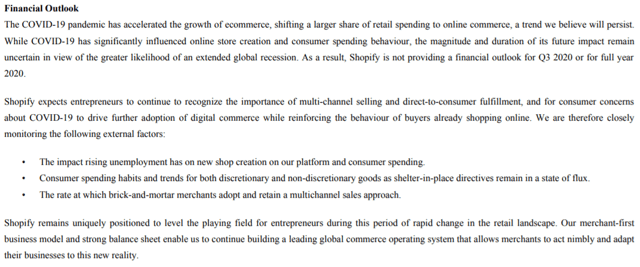

For the rest of this year, Shopify's management refrained from providing any guidance due to uncertainty related to COVID-19. However, with unemployment numbers on the rise, I expect the merchant numbers to continue to grow as more people (first-time entrepreneurs) open up brand new online businesses. Also, the shift in consumer spending trends will most likely become permanent.

With that being said, I have a feeling that even Shopify acknowledges that some of this online frenzy might abate in the event the virus vanishes faster than expected and/or a vaccine is approved faster than expected.

Source: Shopify Press Release

At the time of this writing, Shopify's stock is at $1,075 (up ~9% intraday). Clearly, the market has reacted positively to the earnings report. With that being said, the market will often price assets excessively in both directions, positive and negative. So, we must ascertain based on sober assumptions the upper and lower bounds of intrinsic value so as to determine what we should pay for a company.

Updated Shopify Valuation

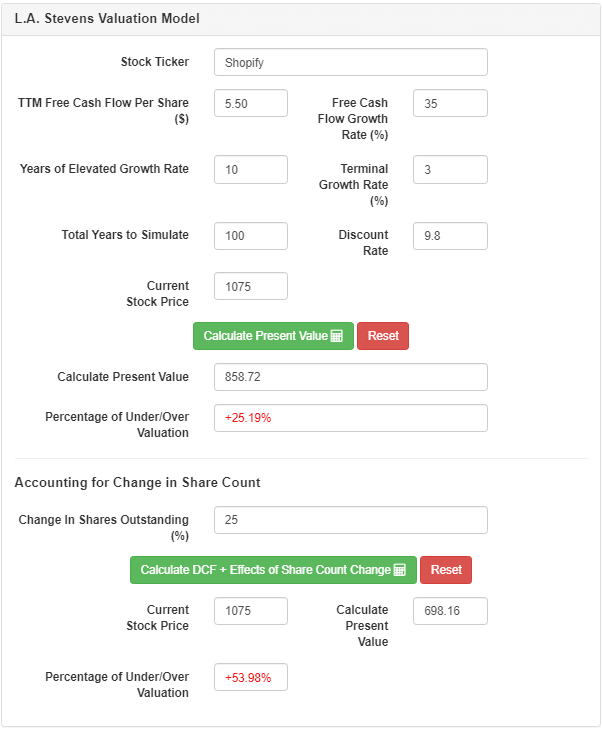

To determine Shopify's intrinsic value, I will be utilizing the L.A. Stevens Valuation Model. Here's what it entails:

- Traditional discounted cash flow Model using free cash flow to equity discounted by our (as shareholders) cost of capital

- Discounted cash flow model including the effects of buybacks

- Normalizing valuation for future growth prospects at the end of the ten years. (3a.) Then, using today's share price and the projected share price at the end of 10 years, we arrive at a CAGR. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

So, let's check out the results.

Assumptions:

Here's a little graphical depiction of how I determine free cash flow per share, which is the foundation of any valuation I perform on a company.

1. TTM Revenue | $1,930 million |

2. Average Diluted Shares Outstanding (June 2020) | 122.75 million |

3. FCF Margin [nuanced assumption] | 35% |

TTM FCF per Share = (1)*(3)/(2) | $5.5 |

Source: L.A. Stevens Valuation Model

As can be seen above, Shopify's intrinsic value is ~$700, i.e., it is currently overvalued by ~54%.

With this being said, a DCF will often tell us one answer, and a projection of free cash flow per share into the future might also tell us another answer, hence I coded both perspectives into the LASV Model. This multi-perspective approach is what makes the model worthy of being called anything other than a DCF model!

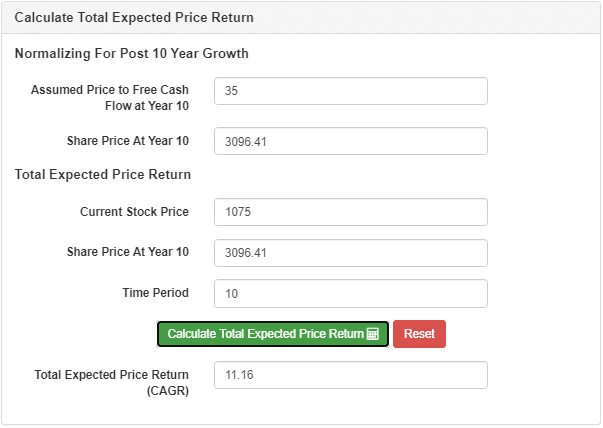

Estimation Of Total Expected Returns

To determine the total expected returns, the model grows our initial TTM free cash flow per share at the assumed FCF growth rate. The resulting figure is then multiplied by a conservative Price to FCF ratio of 35x to obtain the share price at the end of ten years. By doing this, we arrive at the following result:

Source: L.A. Stevens Valuation Model

Therefore, if one were to buy Shopify at today's price of $1,075 and hold for ten years, they could expect a return of approximately ~11%. This implies a 2030 share price target of ~$3100.

The returns are only slightly above my hurdle rate of 9.8%. Thus, Shopify is only a weak buy at this price. However, I would be adding to my long position if the stock dips to ~$700s over the next couple of years.

How The Next 6 Months May Play Out

Now, I know some of the "linear bulls" (those that believe stocks go up linearly) out there might think Shopify will never return to $700.

Well, here's a scenario for you. Let's say the market now believes e-commerce's 25% or so penetration will persist in perpetuity. The market believes that the tens of thousands of new sellers will continue devoting all of their attention to their online sales, as they did during the lockdowns.

In 3 months, Shopify finds that a reversion to the mean has occurred instead (this is what they suspect might happen, hence no guidance).

Unequivocally, the near-term-thinking segment of Wall Street will punish Shopify dramatically. I believe this scenario to be the most likely scenario to play out over the next 6 months, hence I am sitting on my hands, content with the returns Shopify has generated for me and my family heretofore.

Concluding Thoughts

In Q2 2020, Shopify's growth accelerated to pre-IPO levels as a flurry of merchants flocked to its platform, and consumer spending trends leaned towards e-commerce due to the COVID-19 pandemic. I expect this transition to become rather permanent long term (albeit with some level of reversion to the mean in the near term). Shopify is well-positioned to ride the next wave of e-commerce adoption (especially in international markets).

In the long-term, Shopify's fulfillment network (5-year plan in progress) and partnerships with marketplaces like Facebook, Walmart, and Google (GOOG), could propel Shopify closer to rivaling the retail Goliaths (Shopify might be considered a now larger David) of the world. Hence, I retain a long-term bullish view on Shopify.

Key Takeaway: I rate Shopify a modest buy at $1,075.

Please provide your feedback in the comments below.

Thanks for reading; remember to follow to get more stock ideas; and happy investing.

Beating the Market: The Time Is Now

There has never been a more important time in stock market history to buy individual stocks at the heart of secular growth trends. Mature market performers/underperformers and index funds simply will not cut it, as we face a decade during which there is absolutely no guarantee the overall markets will rise.

This is why the time is now to discover high-quality businesses with aggressive, visionary management, operating at the heart of secular growth trends.

And these are the stocks that my team and I hunt, discuss, and share with our subscribers!