In late July, I wrote a bullish article on Realty Income (NYSE:O). It received a lot of reader attention, and the stock is up 1.3% since then, the yield at 4.6%.

The following week, I wrote a bullish article on W.P. Carey (NYSE:WPC). It received about 12% of the reads that the Realty Income article received. The stock is down 9.2% since then, and the yield has expanded, from nearly 6% to 6.4%.

Both stocks swooned two days ago on the back of fears over renewed lockdowns and economic damage against a "second wave" of coronavirus infection.

All of this amounts to an 11.5% relative gain in favour of O since I wrote about these REITs a few weeks ago. The question for income investors is at what point do you start to favour WPC in your fresh money REIT allocations? The thesis of this article is that the answer to this question is "now".

(Source: Bloomberg)

A material gap in performance has opened up. As you can see in the chart, over the past five years, O has sometimes sprinted ahead of WPC, but WPC has tended to pull the lead back in over time.

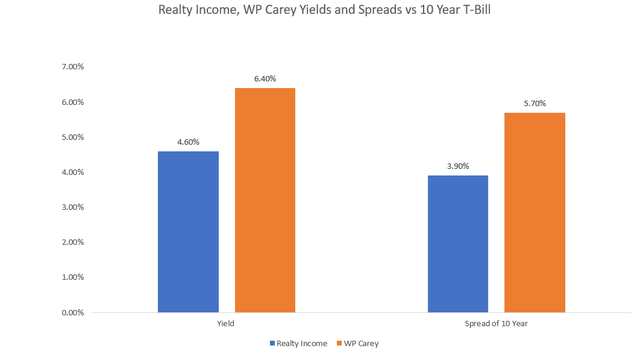

Of course, if we measure the spread between the yield on each REIT and, say, the yield available on a risk-free instrument such as a 10-year T-Bill, the yield advantage for WPC seems even greater. Against the 10-year, WPC's yield is now 2% richer than that of O. Over time, this is a significant advantage.

(Source: Google, MarketWatch)

Recent News Flow Favors Realty Income

Recent focus on these REITs has been dominated by the dynamics of the COVID-19 economy, with disruption and recovery the main macro themes and exposure and collection rates the main REIT-specific themes for investors.

It is important to remember that these REITs are both trading with higher yields than before the pandemic, and even more so in terms of their spread versus the 10-year. Both are therefore pricing in more risk to rental cash flows than usual. If the 10-year yield had somehow fallen like it has in 2020 without a recession and elevated risks to economic growth, both stocks would have moved up very significantly versus pre-COVID-19 levels. For them to be trading at their current levels, with widened spreads against risk-free rates, shows you the market is trying to price in the fundamental risks of the recession and is being fairly conservative about it.

Realty Income is more exposed to the US consumer than WPC, with a greater concentration of assets in the US economy, and within that, to the retail sector. As you would expect, early lockdown disruption at O in the form of delayed rent collections was markedly higher than that at WPC.

The following chart shows how as the economic recovery has allowed O to improve rent collections in the industrial segments where it saw shortfalls in the early phase of the pandemic, retail (by far its largest exposure) and industrial, which is now back to 100%.

(Source: Company data)

WPC, by contrast, has shown strong collections throughout the pandemic. Total second-quarter rent collections were at 96%, with 2% deferrals, both in the US and Europe. In August, these figures had moved up to 98% and 1%, and both the US and Europe have shown consistent, small improvements.

With an eye on the recent sharp moves down in these REITs, WPC has more exposure to Europe than O. Europe, and the UK in particular, is wrestling with the dilemmas of renewed lockdown measures. In the UK, these are increasingly unpopular politically, and media normally loyal to the governing Conservative party are questioning the government's wavering stance.

WPC investors, of course, knew that their REIT had strong collections back in 2Q. So, it is Realty Income investors who have enjoyed a greater sense of relief recently as its collections, while still being short of the level at WPC, improved. Incremental news has therefore been better for O.

Given that I was (and remain) bullish on O, I have been happy enough with the good news on collections since my article. As to why WPC is languishing, though, I struggle for an answer.

As I said above, both these REITs are pricing in greater macro economic risk due to their widened spreads against risk-free rates.

The economic recovery is stop-start in nature, but it is happening. Payrolls show recovery:

(Source: St. Louis Fed)

As does manufacturing:

(Source: St. Louis Fed)

Here is the eurozone composite PMI (more relevant for WPC):

(Source: Trading Economics)

Recent Fed signalling, that it will allow inflation to run above 2% for a period before raising rates, has also been supportive to all REITs, and the European Central Bank is reviewing its debt purchase programs in a similar vein. Even if such central bank signalling was not unexpected, it is reasonably supportive.

WPC's European diversification is a good thing

If you turn this on its head and consider residual risks to the US economy, such as the difficulties in finding a fiscal package in Washington, then WPC's overseas exposures can be regarded as a good thing. While O only has 3% of its portfolio exposure outside the US (in the UK), WPC has a long history of successful investing in Europe and significant non-US exposures.

(Source: Company Presentation)

While my own view of the pandemic is that we are over the worst of it, and many of the "second wave" reports are, in fact, first waves in areas that were not caught early on, I am attuned to the risks of this being incorrect. Europe is certainly looking at renewed, if more localised, lockdowns. WPC has already been through the fire once on this, in the spring of this year, and O remains more exposed to the kinds of businesses that are affected negatively by distancing and stay-at-home behaviour.

(Source: Company data)

To be fair to O, within that large retail exposure, it is only a limited number of sub-segments that have experienced difficulties (the blue areas in the chart below).

(Source: Company Presentation)

Still, if the lockdown causes further economic pain or if ultimate fiscal support comes into serious doubt in the market, it is O that will be seen as more exposed of the two REITs.

Is there a material structural difference between these REITs?

Both the economic recovery, halting as it is, and the Fed's pledge on interest rates, benefit O and WPC roughly equally, and both are well below pre-COVID-19 prices. Nor can we argue that O's recent outperformance of WPC is due to something structural in either REIT's track record or in the balance sheet.

Both REITs show excellent track records of "high-90s" occupancy and dividend growth

(Source: Company data)

Looking at the balance sheets doesn't help explain recent WPC weakness either. WPC is on the left of the comparison below. It uses a little more debt than Realty Income, but is conservatively structured.

(Source: Company Presentations)

Remember, the assets this financing supports at WPC are more diversified than those of O, and that includes variables like the percentage exposure to top clients, with 18% at WPC in the top ten vs. 36% exposure at O.

Differences between the two REITs such as lease renewals schedules and debt maturity ladders do not reveal material relative strength either way.

Triple-net REITs sign long leases and carry out a lot of due diligence on a site's suitability, profitability and then, behind this, the tenant's overall cash flow status on a continual basis. WPC's collections have been battle-tested as recently as spring. Renewed concerns over lockdowns need to be considered against a host of other factors, such as a more selective approach to the measure and simultaneous "back to work and school" policy initiatives, and how these REITs did first time around. WPC stands up well.

Valuation

WPC trades a 13x 2020 AFFO, O at 16.4x 2020 AFFO (your analyst's estimates). The yields, which I look at above, favor WPC by nearly 200 basis points.

The chart below uses historical yield data on both REITs and measures the difference between them - in other words, the spread. In the same way, income investors would compare a REIT's yield to an appropriate benchmark like a risk-free rate.

(Source: Yahoo Finance, market data)

From 2011 to 2015, WPC usually offered up to a 1% yield advantage over O. And this moves into the 1-2% range thereafter. O's strong performance in 2016 moved WPC's yield advantage over 2%, which then corrected to late 2019. It has generally paid over time to favor WPC around or above the 2% spread level, where it is currently.

Conclusion

Many income investors hold both WPC and O as high-quality triple-net REITs with reliable track records and well-understood approaches to achieving dividend growth. I see no reason in terms of the general economic risks both REITs face for the market to assume markedly less risk to O at the current time than WPC, and would put fresh money into WPC now and if it weakens further on a relative basis.