Biotech Sector Performance

When looking at charts, clarity often comes from taking a look at distinct time frames (for both stocks and indices).

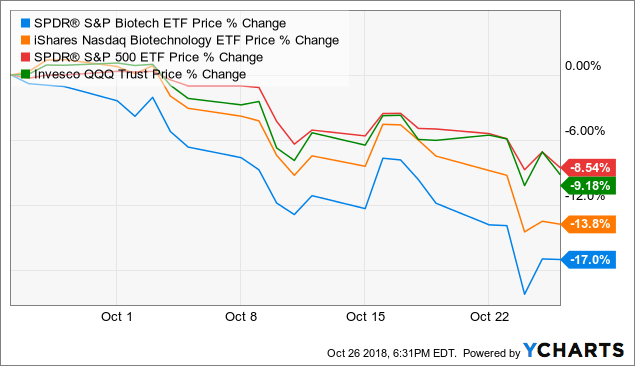

Past Week

1 Month Performance

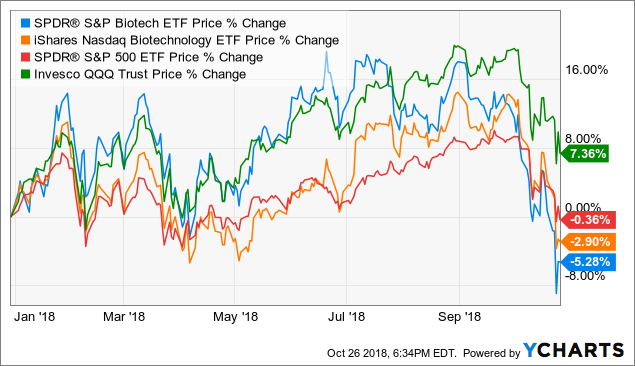

Year to Date

XBI Daily Advanced

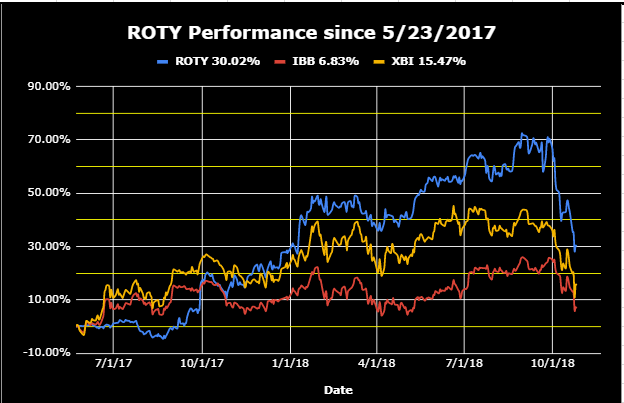

Current Performance For ROTY 10 Stock Model Account

Articles/Posts of Interest For All of My Readers

Acadia Pharmaceuticals: Continued Upside Ahead (ACAD)

Fate Therapeutics: Buy the Dip (FATE)

Intec Pharma: Lead Program Progressing (NTEC)

Current Thoughts on Biotech Sector Volatility and ROTY´s Rough Patch

Highlights From ROTY This Week

2 new ROTY editions with updates and trades, also emphasized the importance of maintaining your own personal Winners/Losers list and regularly reviewing it

2 new Contenders added (significant element of derisking via prior data), catalysts in Q4 and 2019

----------

Final Thoughts & Encouragement

Hard to believe the XBI is now negative 5% for 2018- soon (November 6th) we can look forward to abstracts for SITC being released. Likewise, ASH regular abstracts come out November 1st.

In ROTY Live Chat much of the discussion continues to be centered around which conviction holdings members are taking advantage of sector weakness to buy more of. Some long term type ideas that have perhaps gotten unfairly punished such as NVCR, VKTX, BLFS and GBT come to mind. As for near term, there are several SITC/ASH names with data events coming that have been highlighted (I touched on FATE in a recent public article).

My condolences to those who held positions in SGYP with the recent 70% plunge. Great example of company with solid product but horrible management, and a reminder to steer clear of companies with mediocre management teams (or those that outright don´t seem to care about shareholders). To be fair, in ROTY we sold NCNA for a 20% or so loss due to lack of communication from management (failure to upload presentations online, lack of response from IR for several members, etc). For the latter, I believe it will do well long term due to the promise of ProTides technology platform with several data readouts in 2019 and to be fair they are executing regarding progressing their pipeline.

Here´s to hoping we see some end of the year M&A.

JF

--

About 'ROTY or Runners of the Year'

ROTY is a 500+ member community which provides a welcoming atmosphere where due diligence and knowledge are generously shared and consists of experienced investors/traders, biotech industry veterans, physicians of various specialties and novices looking to learn.

Subscription includes access to our 10 stock model account, Contenders List, Idea Lab, Catalyst Tracker, a very active & focused Live Chat and much more for $25 monthly or $200 for annual discount (equates to $16.66/month).

While performance of the model account has been decent since initiation in May of 2017 (30.02% versus 6.83% for the IBB and 15.47% for the XBI as of 9/27/18), what´s even more important is that members are profiting, learning and enjoying their time with us (see reviews).

** TipRanks ranking from when ROTY ideas were shared in articles publicly

The biotech sector is known to be quite volatile, but with the support of a community of like-minded traders and investors it´s been an enjoyable ride so far. I hope you´ll consider joining us.