I have recently published an extensive update of work on Seeking Alpha regarding the long-term outperformance generated by factor tilts - Size, Value, Low Volatility, Dividend Growth, Equal-Weighting, Momentum, and Quality. While some may discount these strategies as backcasting or data mining, I believe there are structural reasons why these strategies have generated outperformance over multiple business cycles.

The most common question I receive from readers is how to combine these factor tilts into a portfolio. There are challenges to publishing a piece on this topic. My readers necessarily have different risk tolerances, investment horizons, and views on the current business cycle. What I am endeavoring to accomplish in this piece - and its companion quantitative piece - is to suggest a framework to readers that can help solve this portfolio construction riddle. I am going to attack this question from two angles - qualitative and quantitative - in two separate, but related, articles.

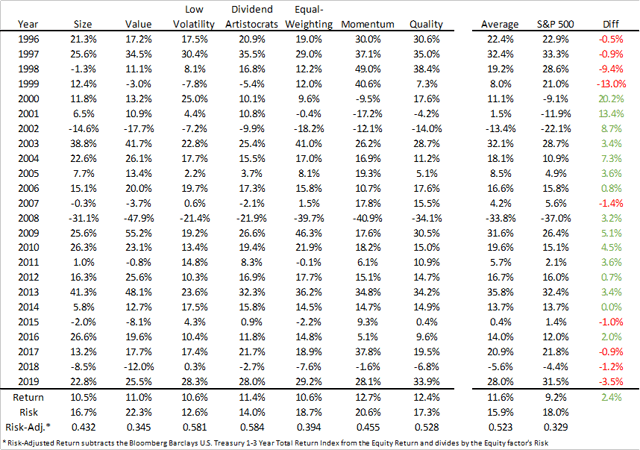

For each of the factor tilts described in my "7 Ways to Beat the Market" series, I have full year total returns dating back to 1996. Longer datasets for these factor tilts are available, but the particular return series for the factor tilts that I am using in this article are replicated by low-cost exchange traded funds, giving readers a ready opportunity to explore these strategies in a cost-effective manner.

All seven of these factor tilts have generated both absolute and risk-adjusted outperformance versus the S&P 500 (SPY) as depicted below:

Despite the myriad of numbers above, this piece is the qualitative view. As such, we begin with a pictorial demonstration of when these strategies might be most appropriately deployed over the course of a business cycle. (I am not a gifted artist, so this line below is actually a historical market period with the dates excluded).