Muralinath/iStock via Getty Images

A lot happened in 2022, and as we enter the new year, the Fed’s tightening may prompt a U.S. recession – or with some luck – a transition to a bull market. Whatever the outcome, expect the unexpected in the new year as we bring you our Top 10 Stocks for 2023.

Will There Be A Recession in 2023 Due to The Fed?

Reflecting on the biggest stories affecting the markets plus the confusion surrounding the Fed’s tightening, it’s safe to say investors should expect the unexpected in 2023. While 2021 benefited from aggressive monetary policy and fiscal stimulus accommodations, the long-term impacts have affected corporate earnings.

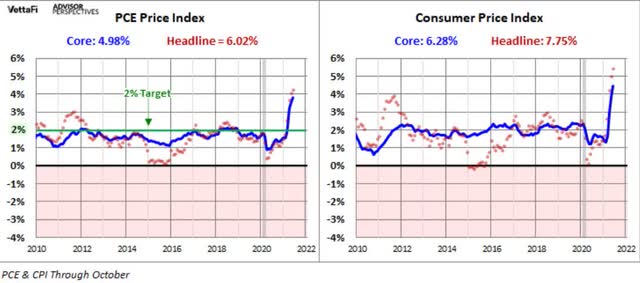

A slowing economy and corporate layoffs have riddled the news. Core inflation continues to exceed the Fed’s 2% long-term target of 4.98%, with a record number of corporate earnings misses.

PCE Price Index vs. CPI Charts (Advisorperspectives.com)

With the Fed’s preference for using the Core Personal Consumption Expenditure Price Index versus the Core Consumer Price Index (CPI) as a successful measure of managing inflation, will they be able to bring down inflation to their 2% target? Although PCE is considered less volatile and removes food and energy costs, by maintaining a hawkish stance, the Fed may cause a recession in 2023.

Consumer Spending, Savings, Debt, and Layoffs

The Fed is committed to increasing the Federal funds rate by over 5%, a decision that may result in an increased cost of capital that hasn’t thoroughly worked itself into the system to impact corporate profits. For the most part, companies have two types of debt: fixed and floating, and during COVID-19, companies took advantage of cheap financing, taking out short-term loans for 3-5 years – debt that’s coming due.

With a lot of debt coming due in 2023, companies are forced to refinance at higher rates and increase their cost of capital. As this happens, companies forecasting 2023 and 2024 realize that higher rates and inflation will eat into profit margins. One way businesses are recouping losses is through layoffs.

Mass layoffs have occurred across the tech industry and financial services, and they are just getting started. Before long, layoffs may reach other industries, adding to unemployment, which the Fed anticipates as a ‘pain’ point. Limited savings plus layoffs may result in a consumer credit bubble. David Kelly, J.P Morgan Asset Management Chief Global Strategist, says it best:

“It looks like the next two years will be very slow ones for American consumers, and this should have a significant impact on Fed policy and financial markets. Very slow growth in consumer spending should help reduce consumer inflation. However, it could also mean that the downturn that the Fed has engineered in housing, combined with weakening trade due to a high dollar and slumping overseas growth, is sufficient to push the U.S. economy into recession. Importantly, assuming that no fiscal help will be forthcoming from a now divided Congress, pressure will increase on the Fed to first end fed funds rate hikes before their now forecast peak of 5.00%-5.25% and then to cut rates by the end of 2023.”

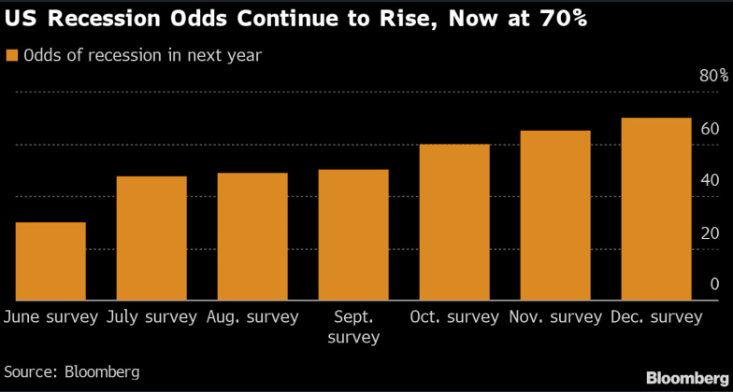

U.S. Odds of Recession Chart (Bloomberg)

If the Fed pivots, they'll have to lower rates sooner than anticipated. Given the Fed’s desire to cripple consumer demand, it may take time before the economy feels or demonstrates the impacts (typically a 3-6 month lag). However, equity markets are forward-looking, so it would not be a surprise if we experienced an equity rally amid a recession or the 2nd half of 2023. With the New Year, investors, and the markets grappling with geopolitical concerns, crypto scandals, elections, and more, could 2023 be the year of the bull market? Only time will tell, and investors want to know what sectors and industries to invest in for 2023.

Is 2023 the year of the bull market?

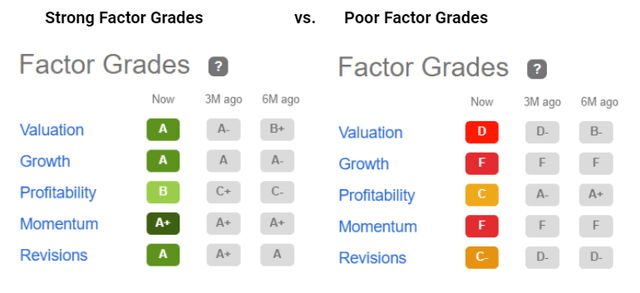

Big companies are preparing for a slowdown in the new year. Companies most dependent on consumer demand, like Amazon (AMZN), Twitter (TWTR), and DocuSign (DOCU), are participating in mass layoffs and have lackluster SA Quant Grades. Companies want financially healthy consumers, which equates to healthy profits. As companies prepare for a slowdown in the first half of 2023, we could experience an earnings recession, which may not be priced into the market, and we may see more downside to start 2023 before it gets better. The key to searching for companies to invest in for the new year is focusing on stocks with solid fundamentals, including healthy balance sheets and lower debt levels. Look for profitable companies that generate strong free cash flow and possess vital collective metrics among Seeking Alpha’s Factor Grades, which rate investment characteristics on a sector-relative basis.

Strong vs. Poor Factor Grades (Seeking Alpha Premium)

Removing emotion from investing and focusing on data can help limit some of the market volatility. Companies with products and services that can withstand some level of inflation as the economy contracts may prove beneficial for portfolios. Once the market is given clarity from the Fed with a clear path on monetary policy, that could be the catalyst needed to spur an equity rally. To prepare, we provide ten stock recommendations using a data-driven Quant Rating System to draw on the best collective characteristics of valuation, growth, profitability, momentum, and EPS Revisions.

Pick Stocks by Quant

Morgan Stanley’s Chief Equity Strategist Mike Wilson predicts one of the worst earnings recessions since 2008. In the wake of the volatile market swings of 2022 caused by inflation, rising interest rates, war, supply chain crashes, and countless other factors, Seeking Alpha offers a quantitative analysis to help prepare you for a market rally or correction by implementing an unbiased, data-driven strategy. With thousands of stocks to choose from, some with strong and some with poor investment characteristics, the goal of our industry-leading quant ratings is to instantly identify the strong companies from weak based on relative investment metric comparisons.

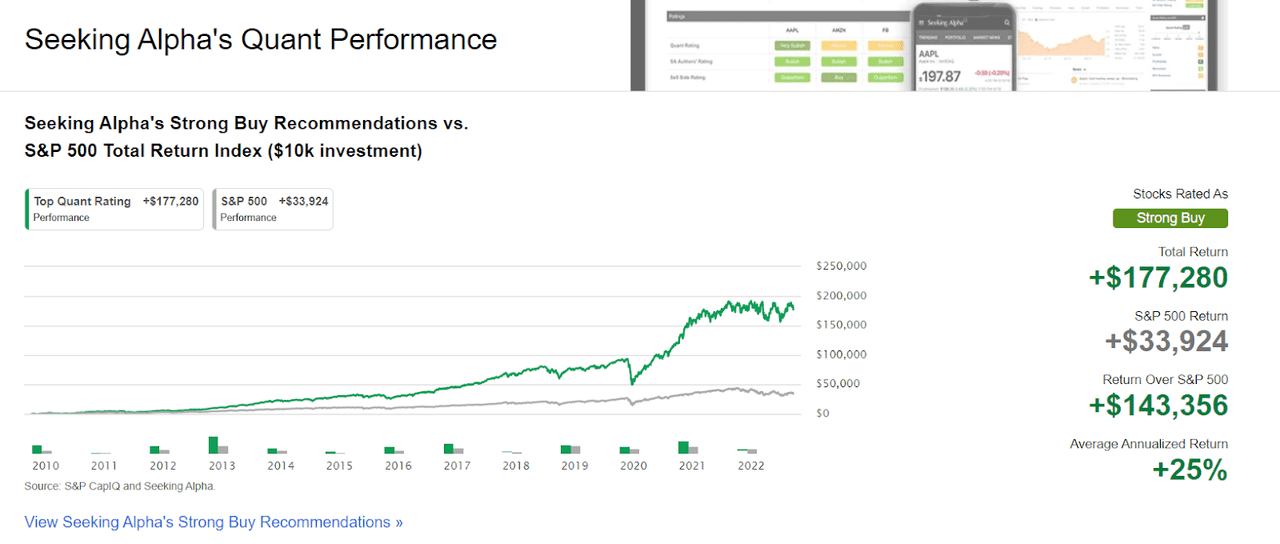

Investors want to avoid losses. Seeking Alpha’s quant model has significantly outperformed the S&P 500 for more than 12 years, measuring a stock’s financial metrics against other stocks in their sector. By assigning academic grades (A+ through F), investors can compare stocks’ investment characteristics to help them navigate some of the market volatility and meme-stock mania sweeping the globe, resulting in fallouts.

Seeking Alpha’s Very Bullish Recommendations Beat The Market 12 Years Running

SA Strong Buy Quant Performance (Seeking Alpha Backtest Quant Performance)

Inflation and tightening monetary policy have done a number on companies, especially those highly leveraged and most interest-rate sensitive. Fundamentals are critical, and our ten stock picks are best equipped to withstand a pullback, as they are in varied sectors and industries, including energy, financials, consumer discretionary, healthcare, industrials, utility, and IT. The sector diversification will help to minimize risk, maximize returns, and help weather the expected and unexpected volatility for 2023.

My Top 10 Stocks For 2023

Top Energy Stocks: Ardmore Shipping and Valero Energy

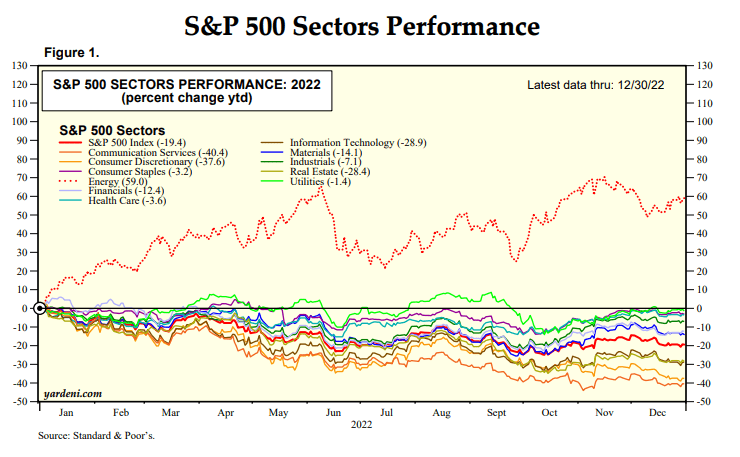

The energy sector continues to outperform, up a whopping 59% YTD, and is the only sector not in the red.

S&P 500 Sectors Performance (YTD 2022) (Standard & Poor's, Yardeni Research)

On the heels of supply chain constraints intensified by Russia’s invasion of Ukraine and surging fuel prices, energy companies have experienced tailwinds pushing them positively into 2023. But if China re-enters the global economy, post its multi-year COVID shutdown, it will apply additional demand pressures on the sector. Because energy is a robust sector in an inflationary environment, we’ve selected two of our best energy stocks for the new year, benefitting from the surge in fuel costs and ‘pain at the pump.’

1. Ardmore Shipping Corporation (ASC)

Market Capitalization: $584.30M

Quant Rating: Strong Buy

Quant Sector Ranking (as of 12/30): 2 out of 244

Quant Industry Ranking (as of 12/30): 1 out of 60

Focused on storage and the seaborne transportation of oil and gas, Ardmore Shipping Corporation has benefited from the increasing demand for petroleum and refined chemical products worldwide. Ardmore is well-positioned, regardless of any potential lockdown in China affecting shipping stocks. Up +332% over the last year with tremendous momentum and an improving balance sheet and fleet structure, ASC’s capitalized on elevated market conditions by optimizing spot trading. Following a third-quarter EPS of $1.54, beating by $0.11 and revenue of $96.45M, Ardmore Shipping is initiating a quarterly dividend policy. Ardmore CFO, Bart Kelleher, announced:

"The Company's strong performance in this sustained period of rate strength for MR product and chemical tankers has enabled us to decisively pursue each of our capital allocation priorities, and we are introducing this quarterly dividend policy on a greatly improved financial foundation."

The EU oil embargo and bans on Russian products have resulted in upside for Ardmore, with analysts' projecting 7% to 8% increases in global product tanker demand. In addition to strong financials, ASC’s valuation framework indicates a relative discount. Offering a B- forward P/E ratio of 4.03x compared to the sector median of 8.12x, ASC is undervalued and inexpensive on other metrics, including forward EV/EBIT. With continued strength from pricing competition, demand, and supply shortages throughout Europe, ASC comes at a solid price and is worth considering in portfolios.

2. Valero Energy Corporation (VLO)

Market Capitalization: $48.91B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 12/30): 8 out of 244

Quant Industry Ranking (as of 12/30): 4 out of 23

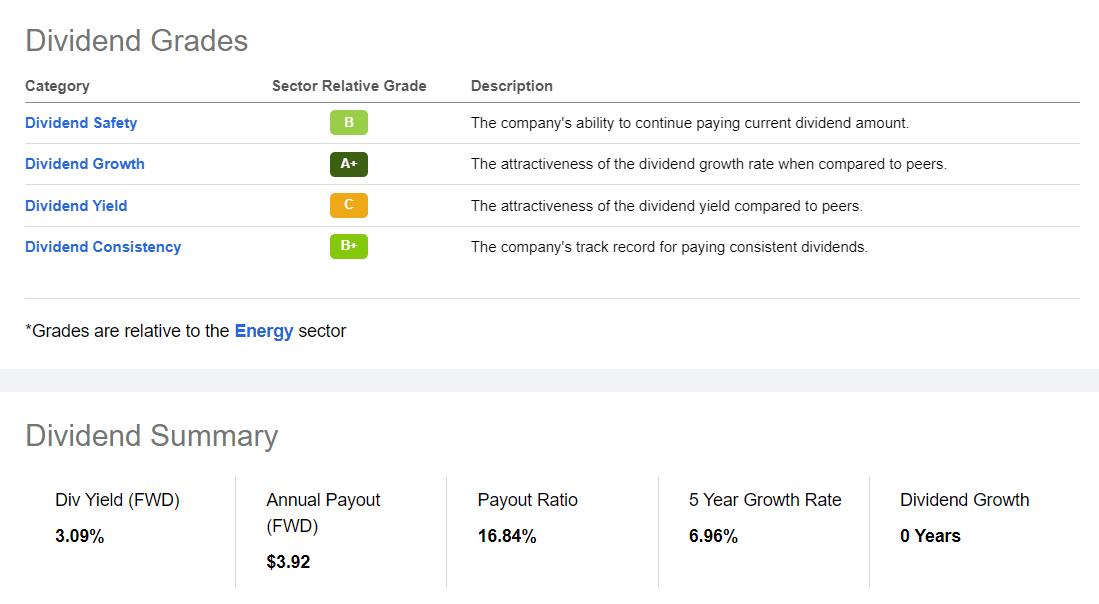

Valero Energy Corporation is a Texas-based oil and gas refining company that has capitalized on the demand and spike in energy prices. Experiencing all-time price highs in 2022, Valero shares have been on a longer-term bullish trend, offering growth, profitability, and an excellent dividend scorecard which includes a 3.09% forward dividend yield.

Valero Stock Dividend Scorecard

Valero Stock Dividend Scorecard (Seeking Alpha Premium)

With strong margins and production volumes, Valero has been focused on its stock buyback and bringing down debt. Following Q3 2022 Earnings that include an EPS of $7.14, beating by $0.20, and revenue of $44.45B, exceeding 50% year-over-year, it should be no surprise that 14 analysts revised fiscal year earnings up over the last 90 days.

As the prices of European natural gas increase, U.S. refiners are becoming more valuable, showcased in Valero’s price performance of +64% YTD and +70% over the last year. The company is undervalued with excellent momentum and a forward P/E ratio of 4.67x, a -42.44% difference from the sector. When you factor in a forward PEG of 0.11x compared to the sector median of 0.72x, this metric indicates the stock comes at a discount and adds value to our quant Strong Buy rating. Valero is a strong buy consideration for portfolios like our next pick.

Top Utility Stock: ENGIY

Lower-risk and defensive hedges against inflation are top of mind for many investors. In an environment where energy costs continue to increase, utilities can weather some of the volatility caused by inflation and geopolitical concerns around the globe. Utilities can pass costs directly to consumers with few options other than to pay, as we’re seeing with the deepening of Europe’s energy crisis. A top utility stock with excellent fundamentals capitalizing is Engie SA.

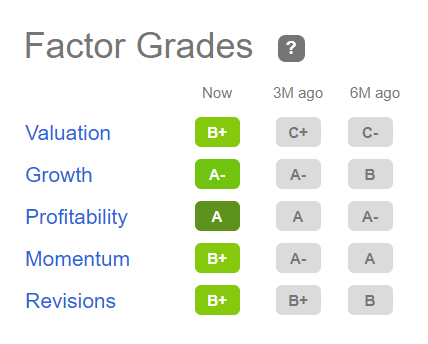

Engie SA Stock Factor Grades

Engie SA Stock Factor Grades (Seeking Alpha Premium)

3. Engie SA (OTCPK:ENGIY)

Market Capitalization: $34.73B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 12/30): 1 out of 101

Quant Industry Ranking (as of 12/30): 1 out of 20

Ranked #1 in its industry and sector according to our quant ratings, the French multi-utility company is experiencing a banner year, as illustrated in the above factor grades and its sales increase of 85% over the last three quarters. Focused on power, natural gas, and energy services, Engie has a diversified business model operating through renewables, nuclear, thermal, and other segments. Taking advantage of pricing competition and looking to the future as liquefied natural gas (LNG) has become the more cost-efficient low-carbon option, Engie has expanded its footprint. Although geopolitical factors have affected operations somewhat, Engie has shown strength.

By partnering with LNG supplier Sempra Infrastructure for the long-term sale and purchase of LNG supplies, Engie is expanding its clean energy division. Sempra Infrastructure CEO Justin Bird announced:

"ENGIE is a leader in Europe's energy transition and a great addition to our Port Arthur LNG customer portfolio…We are excited to work with ENGIE to deliver reliable energy resources like LNG and contribute to the security of natural gas supply to their clients while supporting both companies' ESG commitments."

Engie is one of the world’s top clean energy providers, according to BloombergNEF. They maintain a strong balance sheet while emphasizing various business units for solid earnings and high cash flow generation. ENGIY organically increased EBIT by +79%, had 81.26% year-over-year revenue growth, and improved credit ratios aided in its upgraded guidance. Consider Engie for portfolios and our following stocks from consumer discretionary.

Top Consumer Discretionary Stocks: PDD, MNSO, MOD

The Consumer Discretionary sector was one of the worst performing year-to-date. Over the past year, periods of downturn and recession can negatively impact stocks. Meanwhile, investors looking for bargains in the new year may find opportunities for upside in varying sectors.

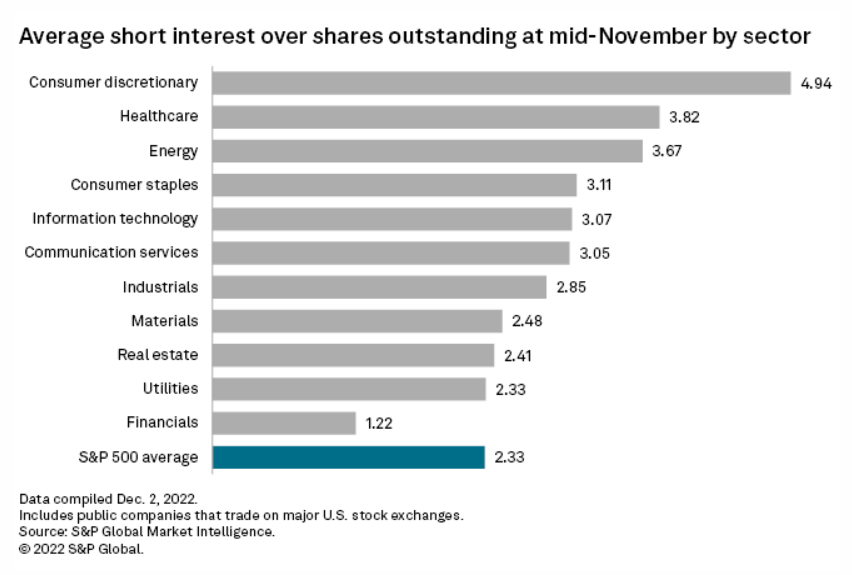

Avg. Short Interest (SPGlobal)

Short interest in consumer discretionary stocks across the major U.S. indexes averaged 5.16% compared to the S&P 500 2.2%, indicating the sector is still out of favor with investors. However, we have three top consumer discretionary stocks with strong buy ratings if you’re looking for long-term value in a beaten-down sector.

4. Pinduoduo Inc. (PDD)

Market Capitalization: $103.11B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 12/30): 2 out of 560

Quant Industry Ranking (as of 12/30): 1 out of 62

I know you’re probably thinking, why on earth would I invest in Chinese stocks given tariffs, massive protests, and a multi-year COVID lockdown? In 2023, China may open up and experience a boom as large as the U.S. Consumer sector witnessed post-Covid lockdowns. As Greenwood Investments writes in Stocks Are Stealthily Breaking Out In China, “Pinduoduo Inc. is potentially another big leader. Similar to TME, the stock has broken forcefully out of a big multi-month base.” Although there are significant implications, China offers some of the best online marketing. Pinduoduo and our next pick, MINISO Group (MNSO), offer next-level e-commerce with a global presence that has increased exponentially. With more active users than Alibaba (BABA), Pinduoduo is owned by 103 ETFs. A popular “search-based” company, PDD, is giving the likes of JD.com (JD) and Amazon (AMZN) a run for their money.

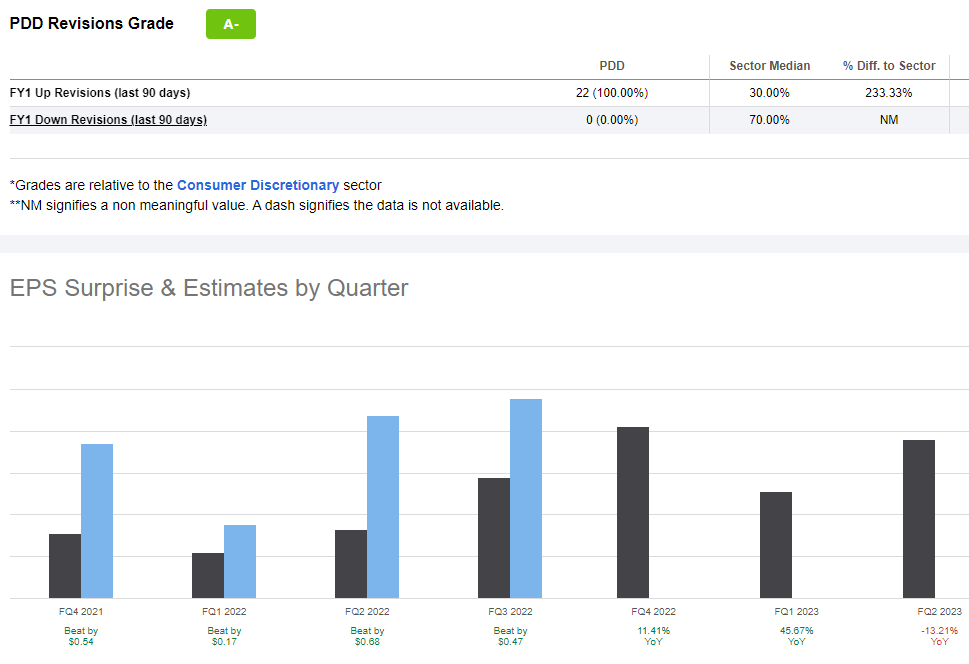

Posting Q3 earnings that resulted in a year-over-year operating profit surge of 350%, its early success launching in the U.S. is aiding its momentum. Q3 EPS of $1.20 beat by $0.47, and revenue of $4.93B beat by more than 46% year-over-year, resulting in 22 FY1 Up revisions over the last 90 days.

PDD Stock Revisions & EPS (Seeking Alpha Premium)

PDD’s business strategy emphasizes social media and is focused on user experiences, games, and Ai-driven algorithms for product recommendations and services. In an English-translated YouTube video, Pinduoduo asks:

“Shopping in real life is interactive because whether you’re grabbing the essentials or perusing the latest trends, you’re bound to interact with others, discover surprises, and maybe even enjoy some entertainment. So why can’t shopping online be just as fun and interactive?”

Despite the lackluster value grade, PDD has an A- forward PEG of 0.51x that showcases a -60.71% discount to the sector - this is an attractive valuation metric. With tremendous growth, profitability, and momentum, the stock may not come at an ideal share price, but its other fundamentals indicate opportunistic room for upside and bullish momentum, making it a great consideration for portfolios.

5. MINISO Group Holding Limited (MNSO)

Market Capitalization: $3.39B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 12/30): 4 out of 550

Quant Industry Ranking (as of 12/30): 1 out of 9

Like Pinduoduo, MINISO Group Holding Limited offers an array of general merchandise, lifestyle, and pop toy products, through direct marketing and online. The company’s success has allowed it to reward shareholders by paying a $0.043 special dividend and launching a new $100M share repurchase program. With a cash surplus on its balance sheet, tremendous growth, and recent top-and-bottom-line earnings beats, MINISO CEO Guofu Ye loves his stock so much he intends to buy up to $5M of it within the next 12 months.

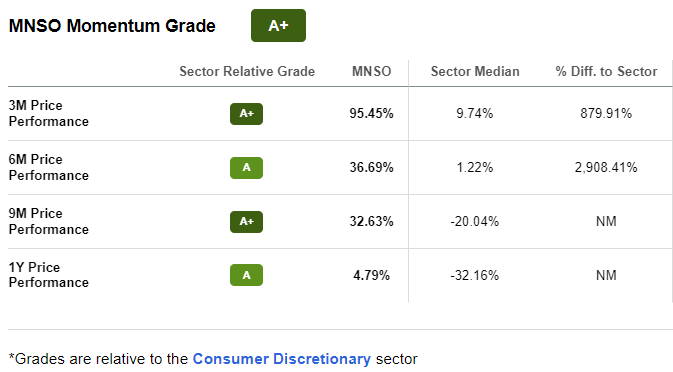

MNSO has been trending higher while trading at a relative discount. As showcased in the A+ Momentum grade below, MNSO outperforms its sector median peers quarterly.

MNSO Momentum Grade (Seeking Alpha Premium)

The stock is undervalued with an A- PEG ratio of 0.49x, a more than -62% difference to the sector. Up +6% YTD and +7% over the last year, the stock continues to showcase solid growth, as displayed in its recent Q1 2023 earnings; EPS of $0.19 beat by $0.07, and a revenue of $392.06M beat by $19.74M. MINISO’s strong product offerings and cost-cutting measures have aided in a surge in adjusted net profits by 127% YoY by offering solid margin performance despite lockdowns and regulatory headwinds. MINISO continues to see strong sales. Although some prudence is required when investing in this stock that faces geopolitical concerns, it continues to be on an uptrend with excellent fundamentals, like our final, Wisconsin-based, consumer discretionary pick.

6. Modine Manufacturing Company (MOD)

Market Capitalization: $1.03B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 12/30): 3 out of 550

Quant Industry Ranking (as of 12/30): 2 out of 36

Modine Manufacturing is a long-time player in the automotive parts and equipment industry. MOD has one of the largest markets in the U.S. and Europe, offering commercial electric vehicle parts, refrigeration, and original equipment manufacturer (OEM) parts. In the push for sustainability, MOD invested in developing EV-focused segments, helping expand its margins and stock price. MOD’s stock price has more than doubled YTD, and MOD is trading near its 52-week high of $22.13, +90% YTD, and +99% over the last year.

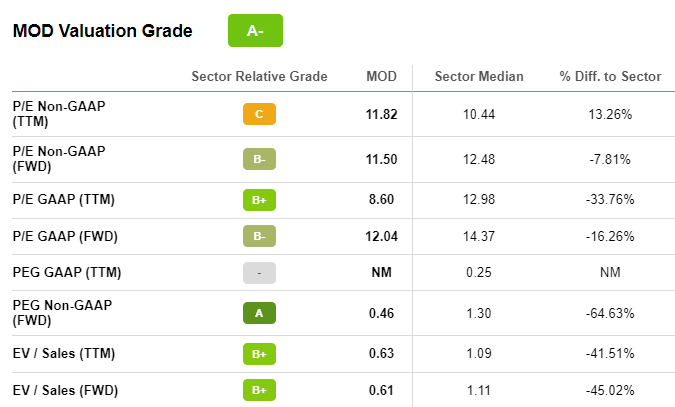

MOD Stock Valuation Grade (Seeking Alpha Premium)

MOD is trading at a discount, showcasing a forward P/E ratio of 12.04x, a more than -16% difference to its sector peers. Additionally, its forward PEG ratio of 0.46x is a more than 64% difference to the sector.

Offering five consecutive top-and-bottom-line earnings beats, MOD has benefited from pricing competition and capitalizing on its governing 80/20 philosophy that emphasizes the highest return opportunities based on its most productive and lucrative segments. MOD continues to deliver strong results, proven by its raised guidance following Q2 earnings results.

MOD increased revenue 20.86% YoY for Q2 2022, for a total of $578.80M, and EPS of $0.48 beat by $0.11. MOD’s Climate Solutions focus is helping drive revenue up 18% from the prior year. Although Modine is not the typical consumer discretionary stock, tailwinds, healthy financials, and fundamentals are helping catapult this strong buy stock into the new year.

Top Financial Stock: JXN

A leading seller of retail annuities in a market expected to grow at a CAGR of 4.7% between 2022 and 2026, annuities are designed to help grow and protect retirement assets. In the current environment with high inflation and increasing interest rates, financials tend to benefit most – especially banks or companies like our next stock pick. Offering guaranteed monthly income payments for the contract's life, consider our top Financial stock Jackson Financial, which generates a dividend yield of more than 6%.

7. Jackson Financial (JXN)

Market Capitalization: $2.89B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 12/30): 1 out of 666

Quant Industry Ranking (as of 12/30): 1 out of 6

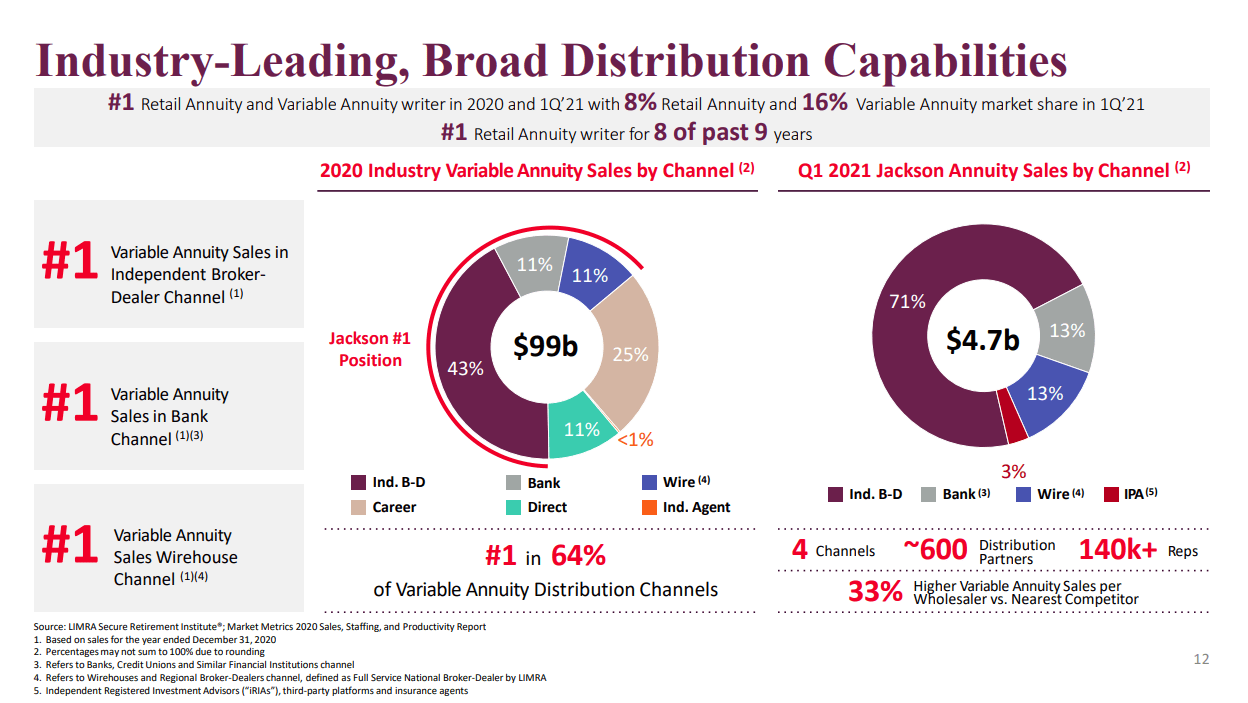

Through its subsidiaries, Jackson Financial offers investment management services, retirement income, and savings products. With diversified financial services primed to take advantage of the current environment, Jackson’s investment fundamentals are highlighted in strong top-and-bottom-line performance that has continued to improve over the last five quarters, adding to their #1 industry-leading rank.

JXN Distribution Channels (Jackson Analyst Day Presentation)

Jackson’s success can be attributed to an experienced management team, industry-leading sales channels, proven risk management, and efficient and scalable operations. Jackson’s recent Q3 Non-GAAP EPS of $4.24 beat by $1.34, and revenue of $4.02B beat by $2.59B, a +156% year-over-year increase, prompting three analysts to revise estimates up over the last 90 days. In addition to increased sales for the registered index-linked annuity (RILA) business, up $72 million (Q2 2021 to Q2 2022), and demand for annuities is anticipated to increase significantly on the heels of recession uncertainty.

Investors want investments that can generate income. In addition to Jackson’s business having upside potential as the demand for annuities grows alongside surging interest, JXN’s +6% dividend yield is helping investors curb some of the ‘pain.’

“Jackson continued its strong momentum in the third quarter, reinforcing our proven ability to successfully navigate market stresses…Our healthy balance sheet enables the ongoing execution of our balanced capital management strategy, including our continued commitment to returning capital to shareholders. We returned $88 million to shareholders during the quarter and now expect to deliver at or above the midpoint of our targeted $425-$525 million capital return range for 2022.” -Laura Prieskorn, President and Chief Executive Officer of Jackson.

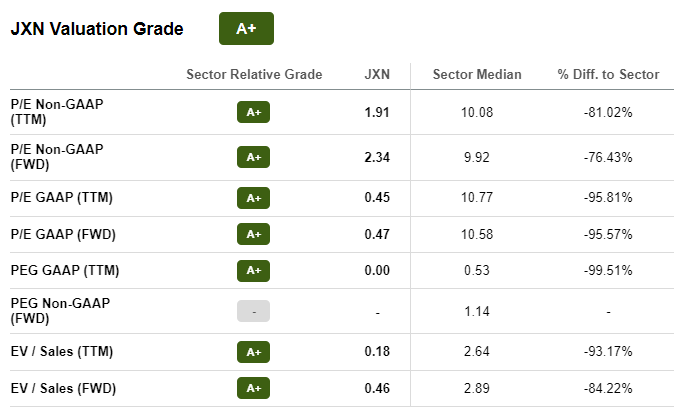

In addition to its strong financial position with tailwinds to boot, JXN comes at an extreme discount.

Jackson Financial Valuation Grade (Seeking Alpha Premium)

With A+ abounding, consider this stock whose P/E ratios and PEG are more than a -90% difference to the sector. Although Jackson Financial is -17% YTD, it's primed for upside and trading at a mere $34 per share. Given its low valuation on nearly every metric, Jackson offers some downside protection compared to stocks with substantially higher valuations, a top financial stock consideration for the New Year.

Top Healthcare Stock: VRNA

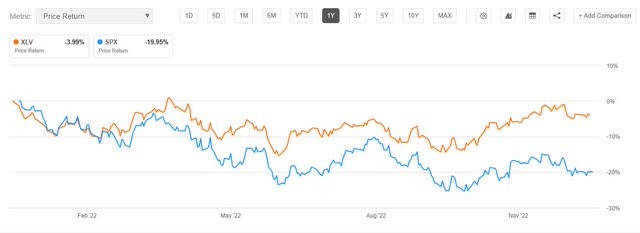

Health has been top of mind for many since the onset of the pandemic. Now more than ever, investors are looking to healthcare for investment opportunities, especially as new lockdowns and variants pose concerns. The Health Care Select Sector SPDR fund (XLV), which tracks the healthcare sector, has been on an uptick in 2022. Although its performance through December 30th was -3.99%, it beat the broader S&P 500 (SPX), which was down nearly 20% for the same period.

1 yr. Performance of Health Care Select Sector vs. S&P 500

1 yr. Performance of Health Care Select Sector vs. S&P 500 (Seeking Alpha Premium)

There are many healthcare stocks to choose. Our selection focuses on developing transformative therapies and medicines that offer an investment for the future, especially as we transition through 2023.

8. Verona Pharma plc (VRNA)

Market Capitalization: $1.98B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 12/30): 4 out of 1202

Quant Industry Ranking (as of 12/30): 1 out of 227

Verona Pharma is on an uptrend, +127%, since the writing of our October article titled 3 Small-Cap Pharma Stocks For a 2023 Melt-Up. A London-based clinical-stage biopharmaceutical company focused on treating respiratory diseases, Verona’s late-stage chronic obstructive pulmonary disease (COPD) trial recently met its goals. Following the December announcement, its stock surged 26% in premarket trading.

Verona trades at a discount with an overall B+ valuation grade. Although the visible underlying valuation metrics are less than ideal, those proprietary to the quantitative model are weighted heavily to offer an optimistic outlook on VRNA. Verona’s momentum is strongly bullish, +275% YTD, and over the last year. Not only is VRNA outperforming the S&P 500 (-19.95%) and NASDAQ (-33.89%) significantly, but it’s also outperformed its sector peers quarterly.

VRNA Momentum Grade (Seeking Alpha Premium)

Investors are actively purchasing shares which drives the price higher, prompting analysts to call the stock overbought. Its 200-day moving average is upward sloping as one of its highlights for 2022 included positive results from its Phase III ENHANCE - 2 trial of ensifentrine, which treats COPD. Following the latest results of the Phase 3 ENHANCE 1 study, the Chief of Pulmonary at South Texas Veterans Healthcare System and Professor of Medicine and Section, Antonio Anzueto, MD, said:

“These exciting results demonstrate ensifentrine’s potential to become a first-in-class bronchodilator and non-steroidal anti-inflammatory therapy for COPD. The 36% reduction in the rate of exacerbations observed over 24 weeks in symptomatic patients is impressive. Combined with the significant improvements in lung function, symptom, and quality of life measures, as well as the favorable safety profile, these data confirm ensifentrine’s potential to change the treatment paradigm for COPD patients.”

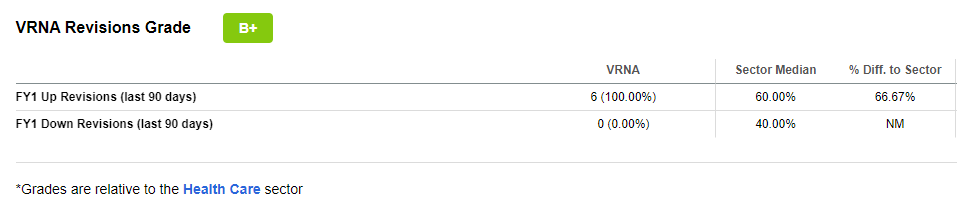

With solid overall growth and profitability metrics, Verona continues to reinvest in the company to operate and support studies while pursuing regulatory approval for products and treatments. Verona plans to submit a new drug application to the FDA in the first half of 2023. As a result of strategic capital raises, ATM Program, management, and recent trial success, it should be no surprise that six analysts have revised estimates up.

VRNA Revisions Grade (Seeking Alpha Premium)

With a new drug application on the horizon in the first half of 2023, bullish momentum, and stellar fundamentals, VRNA is a Strong Buy rated stock to consider for a portfolio.

Industrial Stock: HDSN

Despite industrial stocks being cyclical, in times of economic strength, which economists anticipate for the second half of 2023, industrials do pretty well. We’ve selected a top quant-ranked industrial stock with tremendous fundamentals in a unique industry with upside potential for 2023.

9. Hudson Technologies (HDSN)

Market Capitalization: $456.17M

Quant Rating: Strong Buy

Quant Sector Ranking (as of 12/30): 6 out of 627

Quant Industry Ranking (as of 12/30): 1 out of 42

Focused on refrigerant and industrial gas sales, Hudson Technologies is a U.S.-based company committed to climate-friendly heating, ventilation, air conditioning, and refrigeration (HVACR). Hudson has benefited from pricing competition and elevated prices. Hudson continues to reduce its debt, has a strong balance sheet, high margins, and benefits from legislative tailwinds. With strong demand for refrigerants and a political consensus of nearly 200 nations committed to reducing hydrofluorocarbons (HFCs), considered highly potent drivers of global warming, HDSN stands to benefit. Hudson has benefited from pricing competition and elevated prices. Hudson continues to reduce its debt, has a strong balance sheet, high margins, and benefits from legislative tailwinds. As Horizon Capital writes:

“When there is global political consensus that the supply of a widely used refrigerant should be curtailed significantly, there is less risk that the supply induced upward pressure on the price of refrigerants will be short-lived…For a company like Hudson that operates primarily in the U.S. and only deals with refrigerants, this press release is a reason to be bullish.”

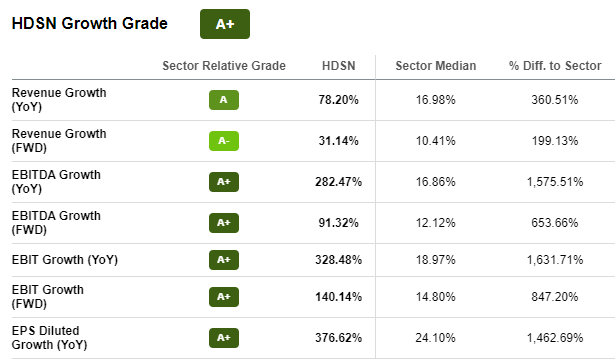

HDSN Growth Grade (SA Premium)

Third-quarter earnings showcased consecutive top- and bottom-line beats. With EPS of $0.62 beating by $0.36 and revenue of $89.50M beating nearly 50%, Hudson’s sales reflected record revenues and improved margins and profitability. With gross margins of 49% for Q3 and the leading “reclaimer” with state-of-the-art technology used to reclaim refrigerants, HDSN has continued to focus on building strategic and working relationships.

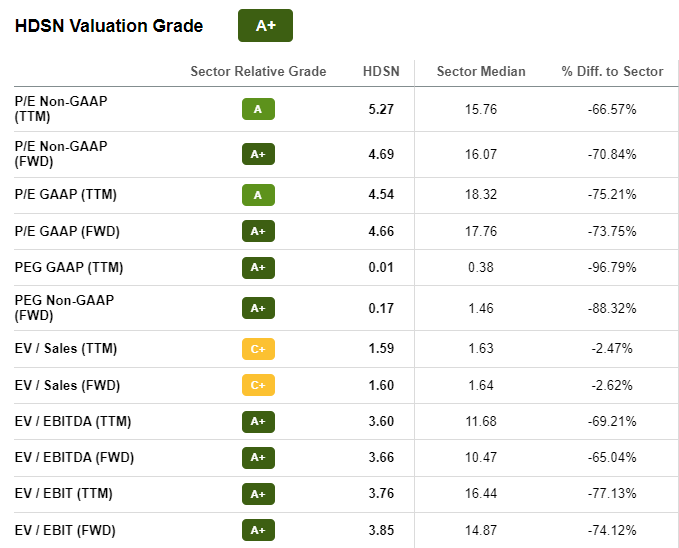

Hudson has bullish momentum. YTD, its stock price is +127%, and over the last year +133%. Trading for less than $10 per share with a forward P/E ratio of 4.66x compared to the sector median of 17.76x and a forward PEG ratio of 0.17x versus the sector 1.46x, HDSN is extremely discounted. Given its momentum and valuation multiples at low levels, there’s room for future growth.

HDSN Valuation Grade (Seeking Alpha Premium)

While supply chain shortages are hurting other industries, they serve as tailwinds for HDSN that can help its growth and profitability, serving as a solid moat. Coupled with its raised guidance and strong financials, it's no surprise that our quant ratings rank Hudson a Strong Buy.

Information Technology Stock: SMCI

Our tech pick, the most popular sector, was decimated in 2022, falling from pandemic peaks to post-pandemic lows. It's a Top Stock by Quant, an Alpha Pick, and will be added to the S&P 400 Midcap Index. Check out our tenth and final pick.

10. Super Micro Computer, Inc. (SMCI)

Market Capitalization: $4.34B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 12/30): 1 out of 661

Quant Industry Ranking (as of 12/30): 1 out of 29

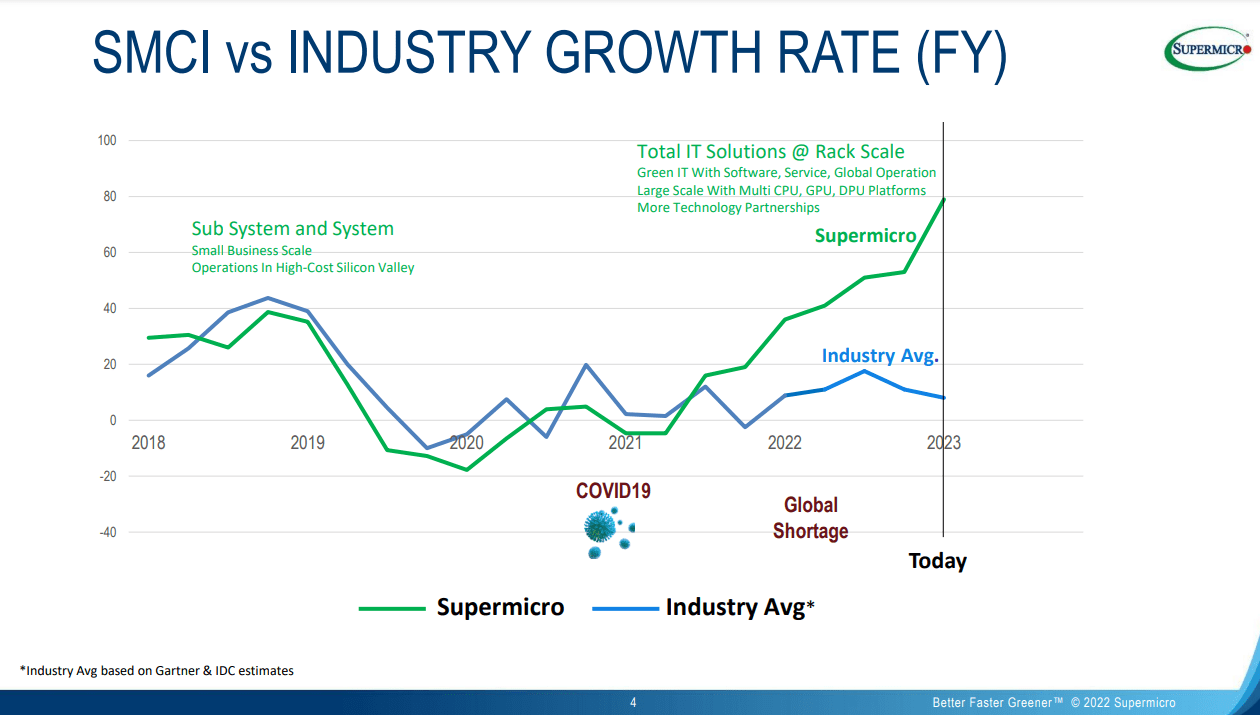

Offering record revenues and a growth rate ten times better than the IT sector, Super Micro Computer, Inc. and its subsidiaries provide high-performance server and storage solutions that are “better, faster, and greener” than their competitors. With a diversified product mix, including software and security content, SMCI crushed Tech Sector (XLK) performance for the year ending 2022. XLK was down 28%. Meanwhile, SMCI was +83.75% with bullish momentum.

Super Micro Computer vs. Technology Select Sector SPDR ETF 1yr Performance

Super Micro Computer vs. Technology Select Sector SPDR ETF 1yr performance (SA Premium)

A one-stop-shop offering comprehensive tech services, SMCI is streamlining solutions for customers, resulting in shorter lead times, better efficiency, quality, and performance; it's no surprise the company is rapidly growing.

SMCI vs Industry ( SMCI Q123 Investor Presentation)

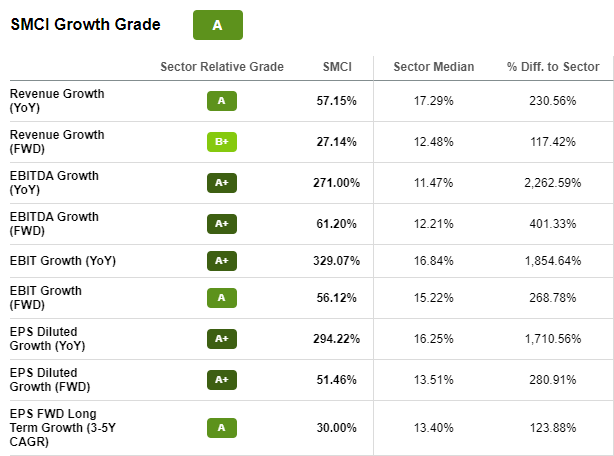

Recent earnings showcased a top-and-bottom-line beat, with EPS of $3.42 beating by $0.60 and revenue of $1.85B beating by nearly 80%, with a growth rate 10x higher than the overall IT sector.

SMCI Growth (SA Premium)

Super Micro’s one-year share price performance is +83%, and executive management anticipates 2Q23 EPS of $2.64 to $2.90 versus $2.36 and revenue of $1.7B to $1.8B versus the consensus of $1.64B. With industry tailwinds supported by a strong balance sheet, despite some macro headwinds, SMCI has a strong outlook. According to SMCI Chief Executive Officer Charles Liang:

"Looking ahead, I anticipate fiscal year 2024 revenue may reach the range of $8 billion to $10 billion, considering the current economic headwind may last for many quarters. As we continue to gain IT market share with the best rack-scale Plug-and-Play IT Total Solutions, I believe we will soon become a $20 billion revenue company. Our business model has been optimized, our engineering teams are fully ready, and our worldwide campus production capacity and efficiency are now second to none."

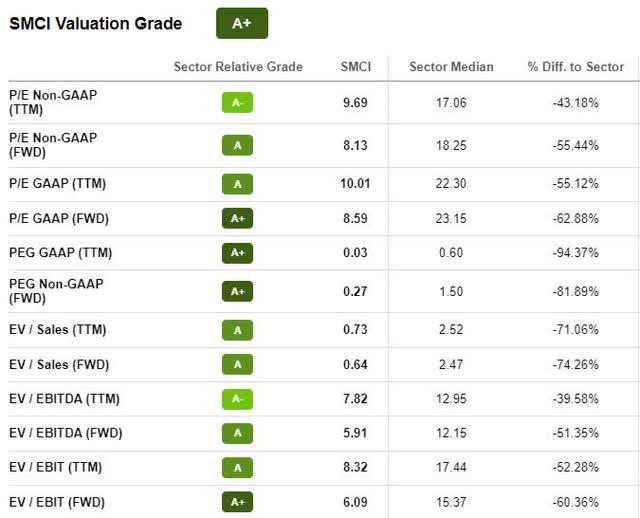

Emerging as one of the largest global suppliers of IT solutions, SMCI’s business model not only supports green initiatives while achieving significant profitability, the company continues to gain market share while trading at an extreme discount. One of our top technology stocks, with one of the most attractive valuations in the IT sector, SMCI has a forward P/E ratio of 8.59x compared to the sector median of 23.15x, and a forward PEG of 0.27x, an -81.89% difference to the sector.

SMCI Valuation Grade (Seeking Alpha Premium)

Although macroeconomic and geopolitical factors have negatively affected some stocks worldwide, our stock picks have weathered many of the biggest challenges and showcased their ability to overcome and rally through it all. Customers want stocks that offer value and potential upside despite the challenges anticipated for 2023. With recent CPI figures offering better-than-expected results and hopes of a turnaround for economies – at least for the second half of 2023 – consider our top 10 stocks for 2023 as a long-term play in your portfolio, especially as industries begin to stabilize and recession fears dissipate.

Ring in the New Year with 10 Top Quant-Rated Stocks

The New Year is bound to deliver more volatility, as the Fed and tighter monetary and fiscal policies are focal points in bringing down inflation. Many economists have indicated that there is great uncertainty going into 2023. Potential scenarios are a Fed-forced recession in the first half of 2023 to bring down inflation and a reverse reaction in the second half to cut rates or a less hawkish stance to spark economic growth if the economy spirals down from over-tightening. This move should allow equities to bottom in the year's first half, leading to an economic recovery and a potential bull market in the second half of 2023. Whether these scenarios play out, Seeking Alpha’s Top 10 Stocks for 2023 have tremendous fundamentals that should benefit in the long term. Each of my recommended stocks has outperformed the S&P 500 during 2022, and seven of the ten have double-digit positive performance.

Regardless of the economic cycle, quality investment fundamentals are the best way to choose stocks. Consider stocks like the ten we’ve pinpointed, with fair valuations backed by solid fundamentals and strong growth. Although we’re facing macro headwinds and recessionary concerns next year, the stocks we’ve selected have more positive demand factors to outweigh the headwinds. The Quant Ratings and Factor Grades help ensure you are furnished with the best resources to make informed investment decisions and instantly characterize the quality of a stock compared to its relative sector. The Top 10 2023 stock recommendations did not exactly mirror the current ranking of Top Rated Quant stocks. In light of corporate actions, liquidity, and an ample supply of underlying metrics, we added some parameters to tighten up our criteria. If you are interested in Strong Buy recommendations outside of our Top 10 2023 recommendations, here is the ranking of SA Quant Top Rated Stocks.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.