REIT Rankings: Cell Towers

(Hoya Capital Real Estate, Co-Produced with Brad Thomas)

Cell Tower REIT Sector Overview

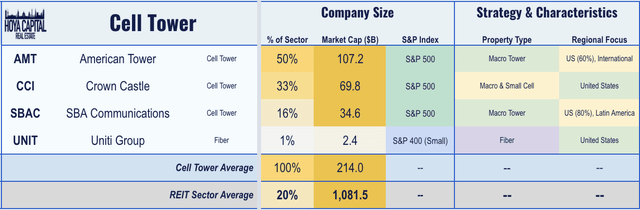

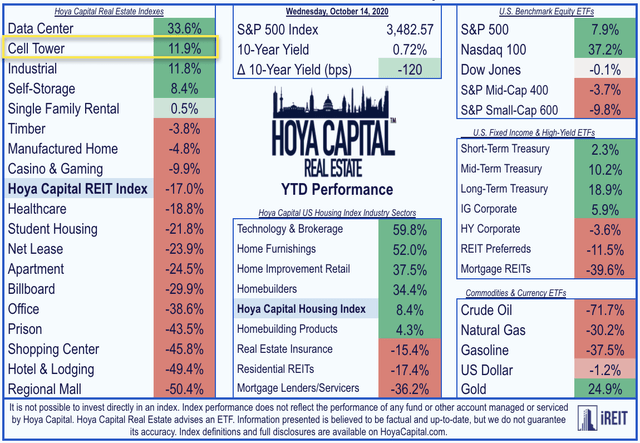

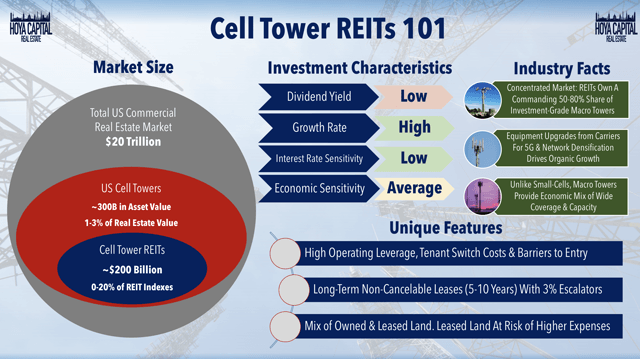

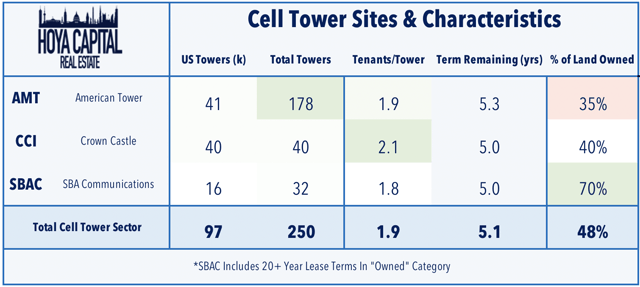

The high-flying Cell Tower REIT sector has thrived throughout the pandemic ahead of the much-anticipated launch of 5G, the next-generation mobile broadband network. Within the Hoya Capital Cell Tower REIT Index, we track the four cell tower and wireless infrastructure REITs, which account for roughly $210 billion in market value: American Tower (AMT), Crown Castle (CCI), SBA Communications (SBAC), and Uniti Group (UNIT). Cell towers are the largest property sector by market capitalization, comprising roughly 18% of the broad-based Vanguard Real Estate ETF (VNQ).

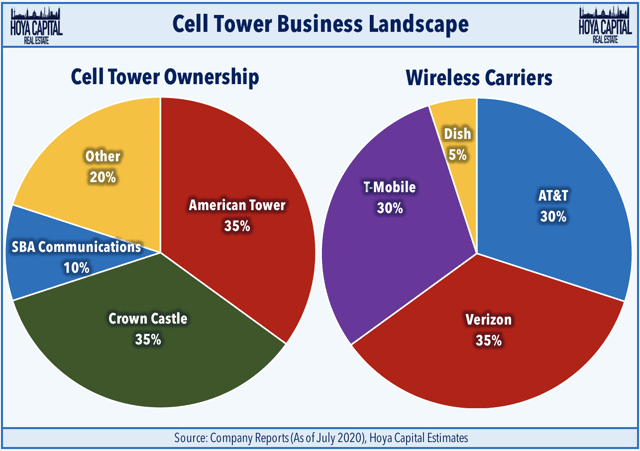

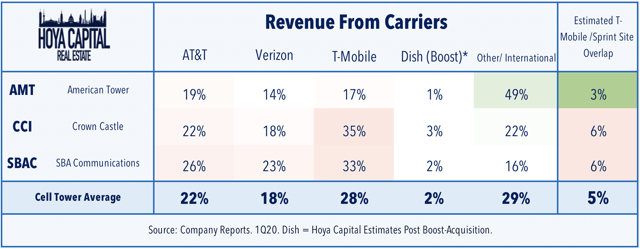

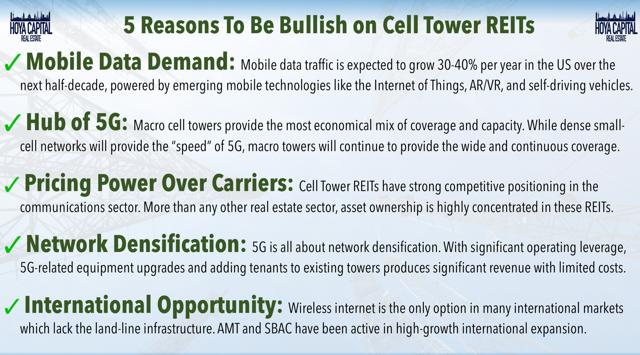

Cell tower REITs are the landlords to the United States' four nationwide cellular network operators: AT&T (T), Verizon (VZ), T-Mobile (TMUS), and DISH Network (DISH). While this tenant base is highly concentrated, the tower ownership business is even more concentrated. These three cell tower REITs own roughly 50-80% of the 100-150k investment-grade macro cell towers in the United States. This favorable competitive positioning has given these REITs substantial pricing power over the last decade amid the roll-out of 3G and 4G networks, which has translated into enviable shareholder returns. Ahead of the 5G roll-out, cell tower REITs are on pace to outperform the FTSE All Equity REIT Index for the sixth straight year in 2020.

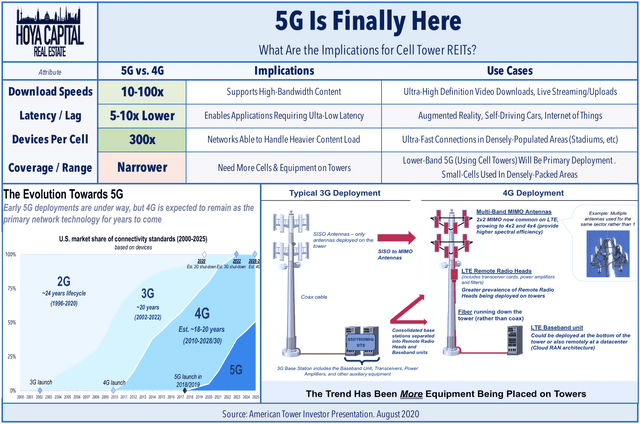

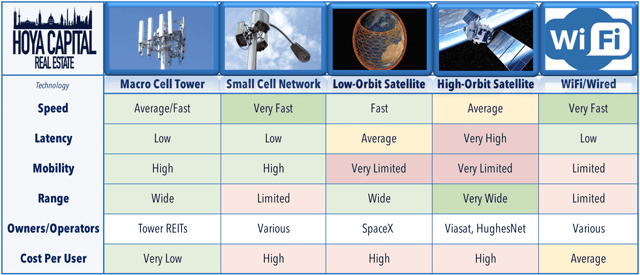

5G is the fifth-generation mobile network that powers mobile broadband, promising far-faster speeds and lower latency than its 4G predecessor that has been the standard throughout the 2010s. With network speeds that are on par or better than home WiFi, 5G networks are expected to spur a new wave of technological innovation, including fixed wireless broadband, similar to the innovation spurred by 4G networks, which enabled apps like Uber (UBER) and Spotify (SPOT) while also facilitating the dramatic growth in e-commerce and cloud computing. To get there, 5G networks not only require new devices like the Apple (APPL) iPhone 12, but they also require upgraded cellular equipment.

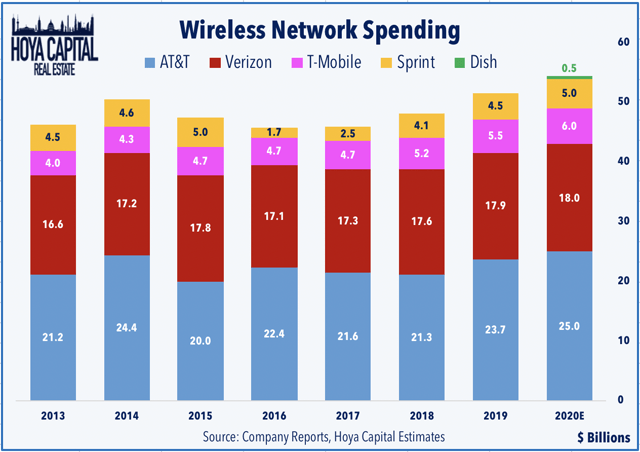

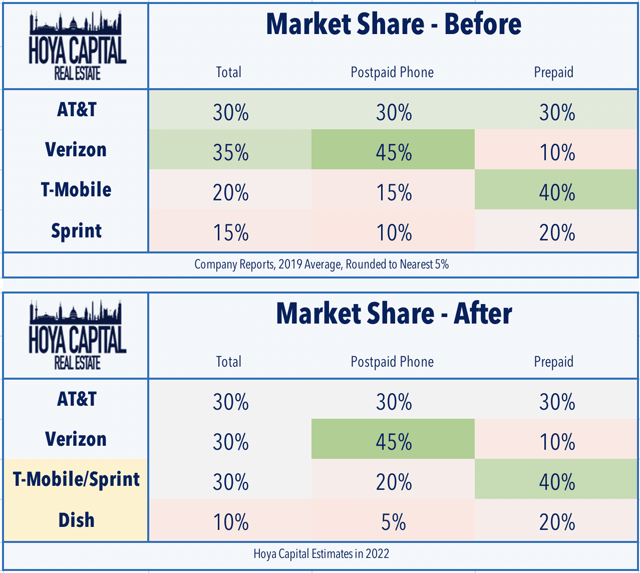

5G networks require up to 10 times more physical antennas per tower, and cell tower REITs typically negotiate higher revenue per tower after each incremental equipment upgrade. IDC estimates that only about 4 million 5G smartphones were sold in the U.S. in the first half of 2020, but Apple is expected to ship up to 50 million 5G iPhones by the end of 2020. With more 5G devices in consumers' hands, network spending is expected to rise considerably as the combined T-Mobile and Sprint consolidate their networks while market-share leaders AT&T and Verizon invest heavily in efforts to lay early claim to 5G supremacy. Meanwhile, DISH Network has emerged as the fourth competitor following the merger and is expected to spend $10 billion over the next decade as it also aims to build a national 5G network.

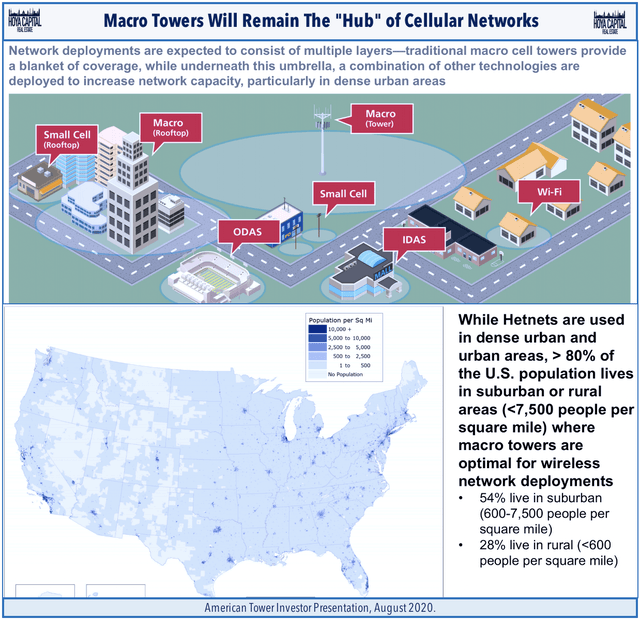

The three major U.S. carriers now boast "nationwide" 5G networks, built primarily by upgrading equipment on existing macro towers, an upgrade cycle that is expected to continue for the next half-decade, at least. Amid concerns about small-cell networks or low-orbit satellite networks making cell towers obsolete, we've continued to discuss how high-power macro cell towers provide the most economical mix of network coverage and capacity given regulatory, logistical, and economic challenges of competing technologies. Citing the favorable supply/demand dynamics, we've been bullish on cell tower REITs, and we continue to believe that these towers will be the essential "hub" of next-generation wireless networks.

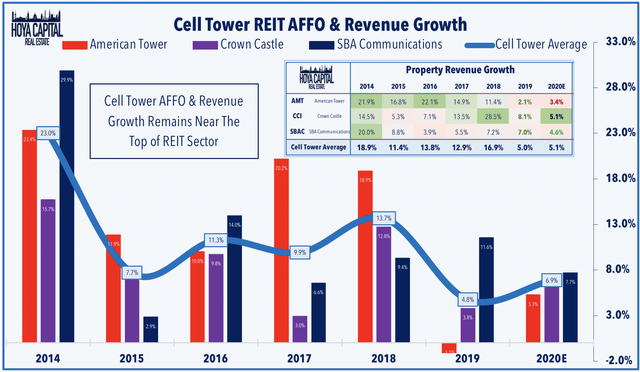

Cell tower REITs continue to be one of the few remaining growth engines of the REIT sector, and the coronavirus pandemic has done little to slow this trajectory as signs of stress in network capacity throughout the pandemic enforced the need for additional network investments. Beneath the noise of the merger frenzy and the roll-out of 5G, second-quarter earnings reports were solid and rent collection has never been a concern. American Tower and SBA Communications each boosted their full-year AFFO/share guidance outlook while Crown Castle reaffirmed its full-year 2020 guidance. These REITs expect AFFO/share growth of 6.9% this year, which would almost surely be the highest among REIT sectors amid the pandemic.

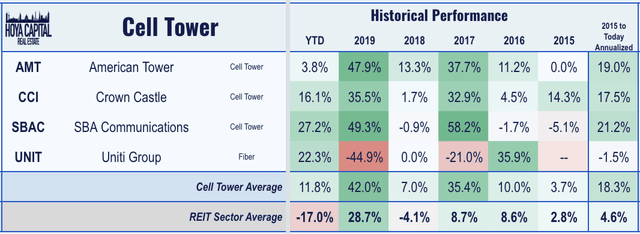

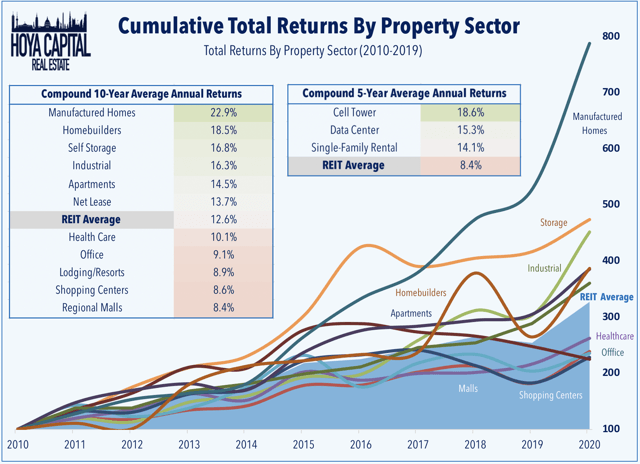

Beneath the headline figures, earnings call commentary did suggest that leasing trends in the U.S. were a bit lighter than expected due primarily to a slowdown in activity from T-Mobile as it awaited the finalization of its now-completed merger with Sprint. Despite this pullback, cell towers are one of five property sectors in positive territory this year along with the data center, industrial, self-storage, and single-family rental REITs. Cell tower REITs are higher by 11.9% this year compared to the 17.0% decline on the Vanguard Real Estate ETF and the 7.9% gain on the S&P 500 ETF (SPY). Since the start of 2015, cell towers have produced average annual returns of 18.3% compared to the REIT average of 4.6%.

Deeper Dive Into Cell Tower Industry

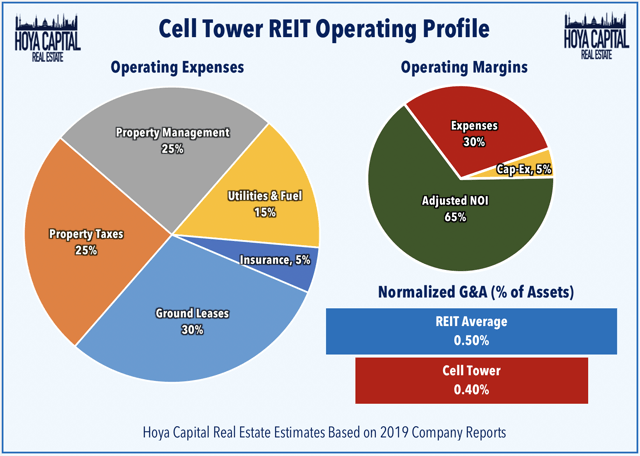

The relative scarcity of cell towers - combined with the absolute necessity of these towers for networks - has given REITs substantial pricing power even as the number of potential tenants has dwindled down to just four national carriers over the last two decades. Supply growth is almost non-existent in the US, as there are significant barriers to entry through the local permitting process and due to the economics of colocation versus building single-tenant towers. Relative to other real estate sectors and their cellular carrier tenants, cell tower ownership is a high-margin business with significant operating leverage driven by adding additional multiple tenants to existing towers.

The cellular industry has seen plenty of fireworks over the last two years, underscored by T-Mobile's now-completed acquisition of Sprint, a merger that is expected to amplify competition - and network spending - within the cellular industry. The emergence of a fourth competitor - DISH Network - as a precondition to approval was a coup for cell tower REITs, even as questions remain about DISH's viability as a national competitor. Four competitors are better than three, and three definitely beats two. Even if DISH's ambitious plans fail to materialize, the long-awaited merger gives the combined T-Mobile the ammunition and capital to compete in the 5G arms race. Revenues from the combined T-Mobile comprise 28% of total industry revenues, but the "overlap" between Sprint and T-Mobile cell tower sites is roughly 5%.

Meanwhile, sensing the competitive threat on their core wireline business from wireless broadband, Comcast (CMCSA) and Charter Communications (CHTR) have also made a push in recent years to compete in the cell business, primarily through "renting" capacity from the existing carriers as so-called "mobile virtual network operators" (MVNOs) to supplement their public WiFi networks. Meanwhile, Elon Musk's SpaceX has made headway on its ambitious low-orbit satellite network called Starlink that could eventually offer fixed broadband services. Technology companies, including Amazon (AMZN), Apple, Google (GOOG) (GOOGL), and Microsoft (MSFT), are also indirect players in the space and natural partners for emerging cell carriers.

While highly unlikely to "replace" the need for cell towers anytime soon due to the technological and economic limitations, there is always risk that competing technologies may eventually alter industry competitive dynamics. While macro tower ownership is the primary business line for the "big 3" cell tower REITs, investors should note that Crown Castle and Uniti Group also have significant investments in fiber and small-cell networks, markets that have seen mixed success. Investors should also be aware of Landmark Infrastructure Partners (LMRK), an MLP that owns real property interests that underlie cellular towers, rooftop wireless sites, billboards, and wind turbines.

The typical cell tower operates equipment from multiple carriers and rental rates based on property location and the amount of equipment on the tower or on the ground site below. Cell tower leases are typically 5-10 years with annual fixed-rate escalators with multiple renewal options. Cell tower REITs, however, only own about one-third of the land under the towers and control the rest through long-term ground leases, a source of potential long-term risk. EBITDA margins typically average around 60-65% for the cell tower REIT sector, towards the higher end of the real estate universe, with minimal ongoing cap-ex required relative to other REIT sectors.

The typical cell tower operates equipment from multiple carriers and rental rates based on property location and the amount of equipment on the tower or on the ground site below. Cell tower leases are typically 5-10 years with annual fixed-rate escalators with multiple renewal options. Cell tower REITs, however, only own about one-third of the land under the towers and control the rest through long-term ground leases, a source of potential long-term risk. EBITDA margins typically average around 60-65% for the cell tower REIT sector, towards the higher end of the real estate universe, with minimal ongoing cap-ex required relative to other REIT sectors.

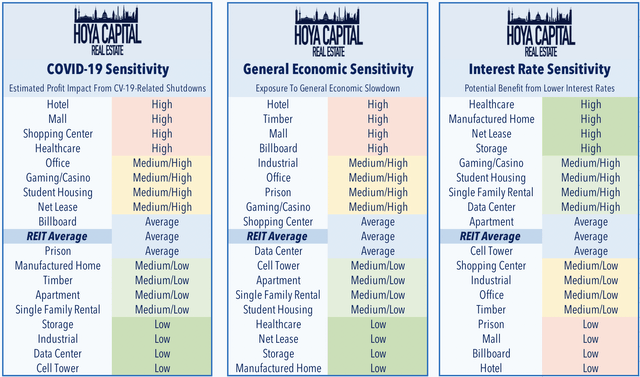

Low balance sheet leverage, high operating margins, and limited economic sensitivity of rental demand have been in-demand attributes within the REIT sector amid a time of immense economic uncertainty. Below, we present a framework for analyzing the REIT property sectors based on their direct exposure to the anticipated COVID-19 effects as well as their general sensitivity to a potential recession and impact from lower interest rates. Within the COVID-19 sensitivity chart, we note that cell tower REITs are among the four sectors with the lowest direct COVID sensitivity and are also in the medium-/low-tier of general economic sensitivity.

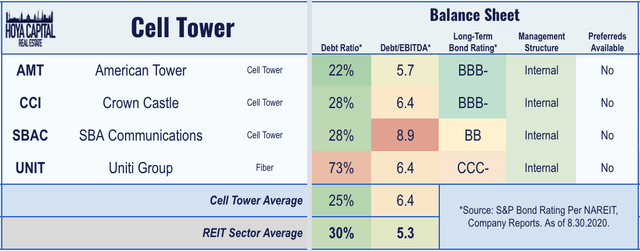

Importantly, with the exception of Uniti Group, cell tower REITs operate with some of the most well-capitalized balance sheets across the real estate sector. As discussed in our recent report, "Cheap REITs Get Cheaper," consistent with the persistently "winning factors" exhibited by the REIT sector over the last decade discussed in the prior report, higher-yielding, higher-leveraged, and "inexpensive" REITs have declined nearly twice as much as their lower-yielding, lower-leveraged, and more "expensive" counterparts. The "big 3" cell tower REITs all operate with debt ratios below the REIT sector average of 30%, while AMT and CCI both have investment-grade long-term bond ratings.

As discussed in our Real Estate Decade in Review, at the real estate sector-level, three themes dominated the 2010s: 1) The Housing Shortage, 2) The Retail Apocalypse, and 3) The Internet Revolution. Despite the long-awaited consolidation in the cellular carrier industry, cell tower REITs still surged more than 42% last year and have continued the momentum into 2020 with SBAC and CCI leading the way this year. Since NAREIT began tracking the sector in 2012 (which NAREIT labels the "Infrastructure" sector), cell tower REITs have outperformed the REIT index in every year besides 2014.

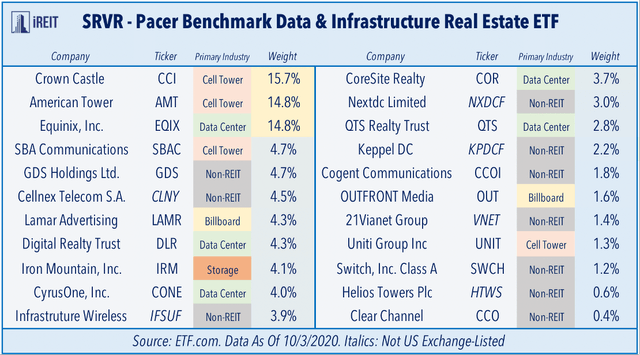

Investors seeking to capture the 5G themes through real estate can do so through the Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR), which owns a blend of cell tower REITs, data center REITs, and billboard REITs, which often host cellular equipment. Cell tower REITs comprise roughly 40% of the SRVR ETF. Investors seeking more broad-based exposure to 5G as a theme can also do so through the Defiance Next Gen Connectivity ETF (FIVG), which has roughly 3% exposure to cell tower REITs, investing primarily in the technology companies providing the equipment and cellular carriers that are expected to deliver 5G services.

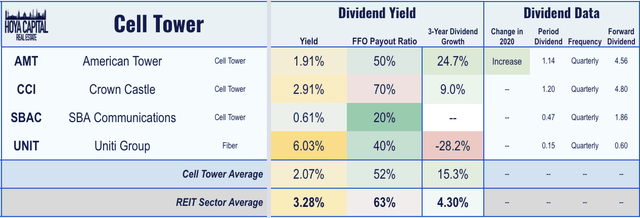

Dividends and Valuations of Cell Tower REITs

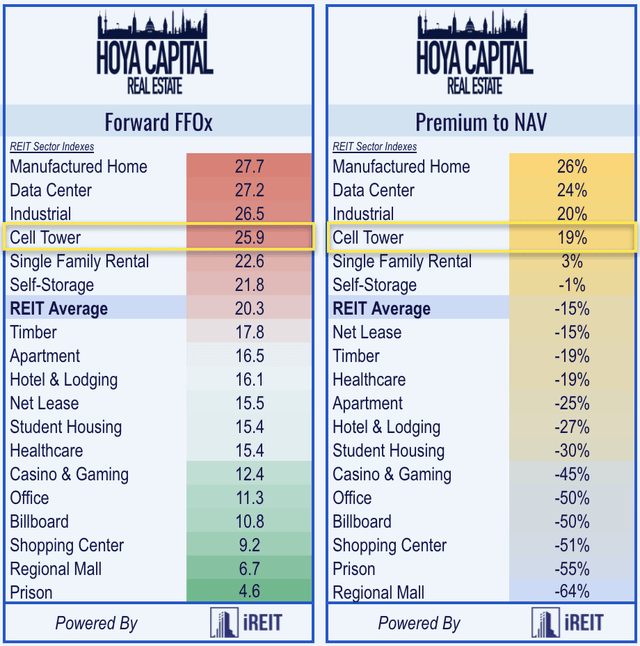

Relentless outperformance over the past five years has pushed cell tower REIT valuations to the most "expensive" end of the real estate sector, but the 10% pullback over the last quarter may be an attractive entry point for investors waiting on the sidelines. Cell tower REITs trade at a Price-to-FFO ("Funds from Operations") multiple of roughly 26x, which is above the REIT sector average of 20.3x, but below their peak multiples around 30x. The sector now trades at a roughly 15-25% premium to net asset value, one of the few REIT sectors that have consistently enjoyed an NAV premium over the past three years. A healthy NAV premium can enable accretive external growth.

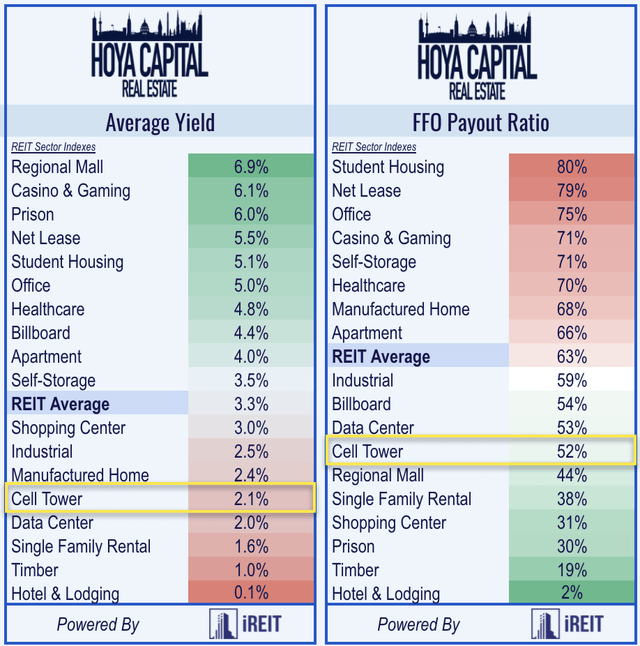

As true "Growth REITs," cell tower REITs have never been known for their dividends. That said, cell towers were one of the few property sectors that has been untouched by the wave of dividend cuts and suspensions that have hit the REIT sector over the past six months. Cell tower REITs pay an average dividend yield of 2.1%, well below the REIT sector average of 3.3%. Cell tower REITs retain roughly half of their free cash flow, however, leaving ample free cash flow for external growth and eventual dividend growth.

As true "Growth REITs," cell tower REITs have never been known for their dividends. That said, cell towers were one of the few property sectors that has been untouched by the wave of dividend cuts and suspensions that have hit the REIT sector over the past six months. Cell tower REITs pay an average dividend yield of 2.1%, well below the REIT sector average of 3.3%. Cell tower REITs retain roughly half of their free cash flow, however, leaving ample free cash flow for external growth and eventual dividend growth.

While 65 equity REITs out of our universe of 170 equity REITs announced a cut or suspension of their common dividends in 2020, American Tower was one of 31 equity REITs that has raised its dividend this year. Within the sector, we note that only Crown Castle acts like a "typical REIT" when it comes to distributions, paying a healthy 2.9% dividend yield, roughly 70% of its available cash flow. American Tower, meanwhile, pays a relatively low 1.9% yield, while SBA Communications pays a yield of 0.6%. With perfect rent collection and resilient property-level fundamentals, cell tower REITs are perhaps the most immune sector from dividend cuts.

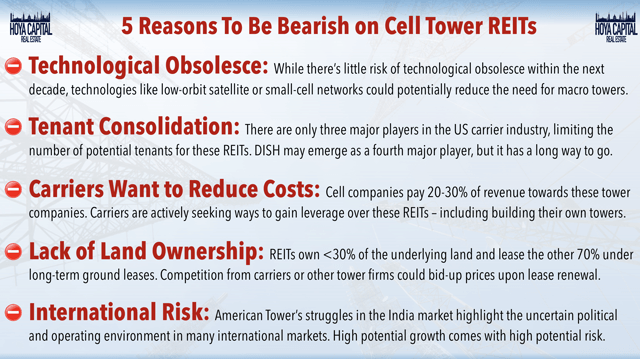

Bull and Bear Thesis for Cell Tower REITs

Below, we outline five reasons why investors are bullish on cell tower REITs.

Below, we outline five reasons why investors are bearish on cell tower REITs.

Key Takeaways: Long-Awaited Pull-Back Has Arrived

Similar to our favorable fundamental outlook on the residential and industrial real estate sectors, we see the trends of limited supply and robust demand continuing well into the next decade for the cell tower REIT sector. The three themes that dominated the 2010s - 1) The Housing Shortage, 2) The Retail Apocalypse, and 3) The Internet Revolution - look poised to continue in full force in the early stages of the 2020s amid the coronavirus pandemic. Quality and growth come at a cost, but the roughly 10% pullback in cell tower REITs over the last quarter seems to be a rare opportunity to build a position in a high-quality sector that is poised to deliver sector-leading growth in 2020.

Apple's upcoming iPhone 12 launch represents the true "arrival" of 5G, the much-anticipated next-generation mobile network that promises to usher in a new era of technological innovation. Cell tower REITs will be the "hub" of these 5G networks, as high-power macro towers provide the most economical mix of wide coverage and capacity. We continue to see fixed wireless broadband - using a cell network for home broadband - as 5G's true "killer app" and believe that cell tower REITs will continue to benefit from favorable competitive positioning within the telecommunication sector.

If you enjoyed this report, be sure to "Follow" our page to stay up to date on the latest developments in the housing and commercial real estate sectors. For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Storage, Timber, Prisons, Real Estate Crowdfunding, High-Yield ETFs & CEFs, REIT Preferreds.

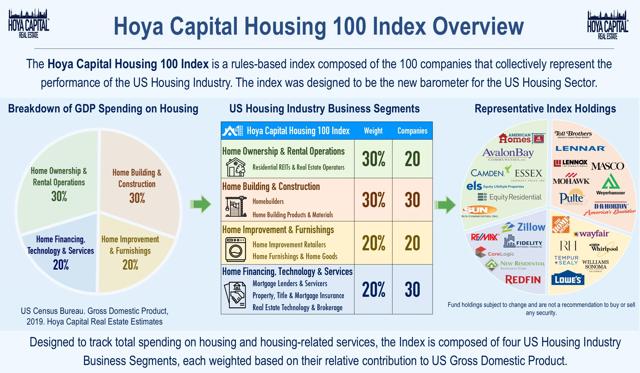

Disclosure: Hoya Capital Real Estate advises an Exchange-Traded Fund listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index. Index definitions and a complete list of holdings are available on our website.

Subscribe to iREIT on Alpha For the Full Analysis

Hoya Capital is excited to announce that we’ve teamed up with iREIT to cultivate the premier institutional-quality real estate research service on Seeking Alpha! This idea was discussed in more depth with iREIT on Alpha members. Exclusive articles contain 2-3x more research content including access to iREIT on Alpha's REIT Ratings and live trackers. Sign-up for the 2-week free trial today! iREIT on Alpha is your one-stop source for unmatched Equity and Mortgage REIT coverage, Dividend ETF Analysis, High-Yield REIT Preferred Stocks & Bonds, real estate macroeconomic research, REIT and property-level analytics, and real-time market commentary.