REIT Rankings: Mall REITs

(Hoya Capital Real Estate, Co-Produced with Brad Thomas)

Mall REIT Sector Overview

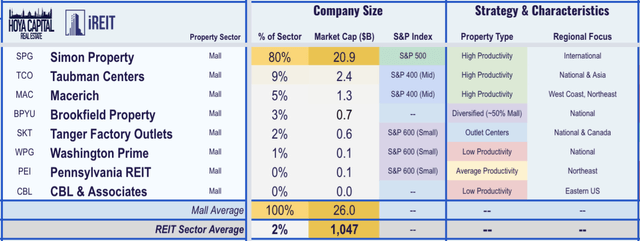

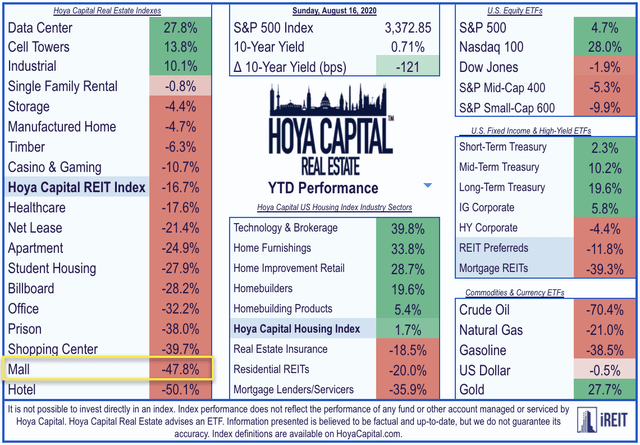

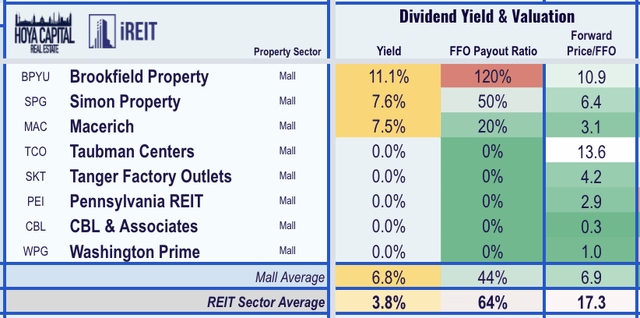

Apocalypse Now? Entering 2020 on already unstable footing following a tsunami of store closings over the past half-decade, mall REITs have been punished by the ongoing coronavirus pandemic, plunging nearly 50% in 2020. Within the Hoya Capital Mall REIT Index, we track the seven mall REITs, which account for roughly $25 billion in market value: Simon Property Group (SPG), Taubman Centers (TCO), Macerich Co. (MAC), Tanger Factory Outlet Centers (SKT), Washington Prime Group (WPG), Pennsylvania Real Estate Investment Trust (PEI), and CBL & Associates Properties (CBL), as well as one diversified REIT, Brookfield Property REIT (BPYU), which owns a portfolio comprised of roughly 50% mall properties.

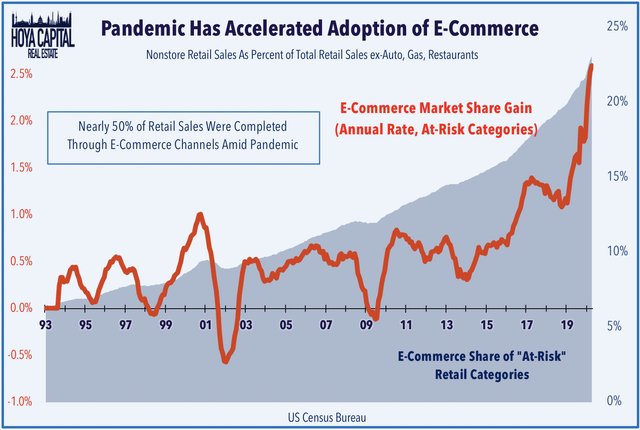

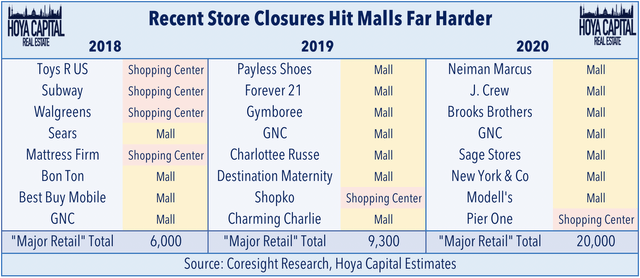

Absent a miracle, mall REITs are likely to underperform the REIT average for the fifth straight year in 2020. As we'll expand on throughout this report, we remain bearish on the mall REIT sector, as the coronavirus pandemic further amplified the significant secular headwinds facing the enclosed mall format and accelerated store closing decisions. The pace of store closings is expected to increase substantially in 2020 during and after the coronavirus fallout, adding to what was already a record year of store closings in 2019. Following a similar pattern as 2019, the market share loss and pace of store closings will likely hit the traditionally mall-based retail categories especially hard in 2020, the majority of which fall into the dreaded "non-essential" category and those that have struggled to adapt to the increasingly digital retail landscape.

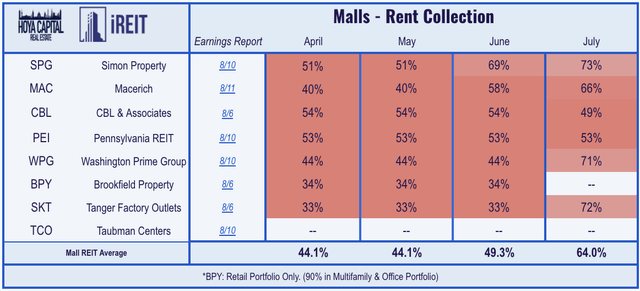

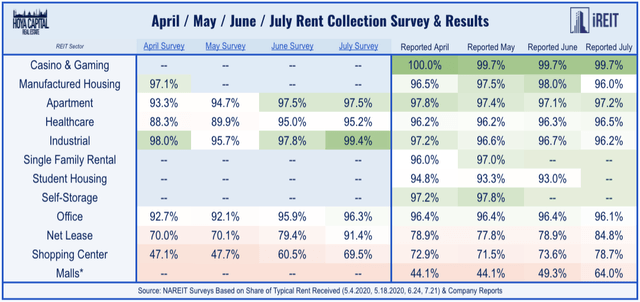

Malls reported collection of less than 50% of rents in the second quarter - by far the lowest in the real estate sector - as retail landlords struggled to collect rent from these "non-essential" tenants. By comparison, housing, industrial, and technology REITs, along with self-storage and office REITs, all reported collection of more than 95% of rents. The majority of enclosed mall properties were closed during the peak of the coronavirus shutdowns in late March through mid-May, but essentially all mall REIT properties have now reopened. Collection rates have improved considerably in July, but commentary from these REITs suggests that a sizable percentage - perhaps half or more - of missed rents in the second quarter will ultimately remain uncollected.

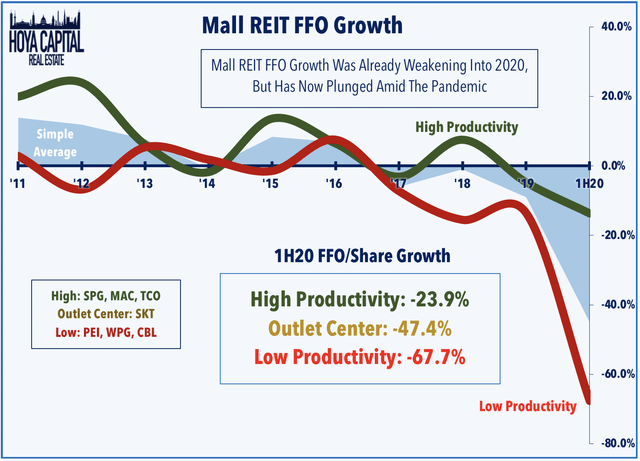

As we'll analyze in more detail below, temporary and permanent store closings and anemic rent collection resulted in a decline in same-store NOI growth of roughly 30% in Q2, while FFO per share has plunged a mind-numbing 45% through the first half of 2020. Higher-productivity mall REITs - which had expected a positive turnaround in FFO in 2020 based on initial guidance - have seen an average FFO decline of 24% so far in 2020. The deeper pain continues to be felt by the lower-productivity mall REITs which have seen a 68% in FFO per share through the first six months of 2020. We expect FFO growth to decline between 25% and 40% in 2020 on a simple average basis, down from the initial pre-pandemic guidance of -12%.

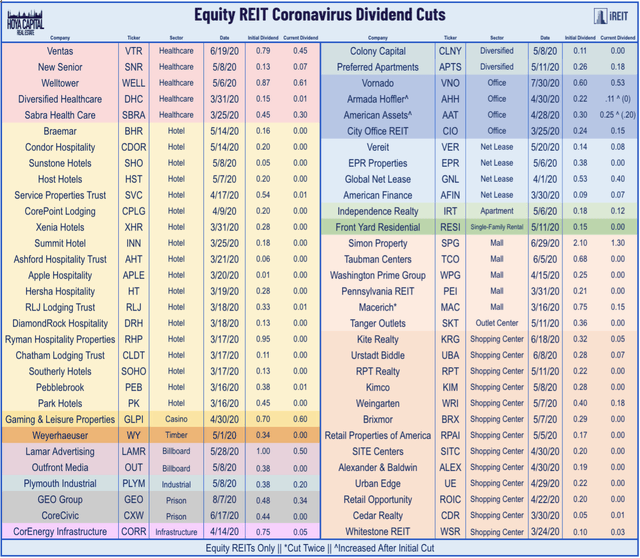

Mall REITs were a favorite of yield-hungry and value-seeking investors for much of the past half-decade, but it's tough to pay dividends if you don't collect the rent. All of the mall REITs besides Brookfield Property REIT have now eliminated or reduced their common stock dividend, and we think it'll be a long road back to the restoration of prior distribution levels. We've now tracked 62 equity REITs in our universe of 170 REITs to have cut or suspended their distributions since the start of the pandemic, including the majority of retail REITs. On the other hand, roughly 90 REITs have maintained distributions at pre-pandemic levels, while 20 REITs have announced a dividend increase in 2020, primarily in the "essential" property sectors - technology, industrial, and housing REITs.

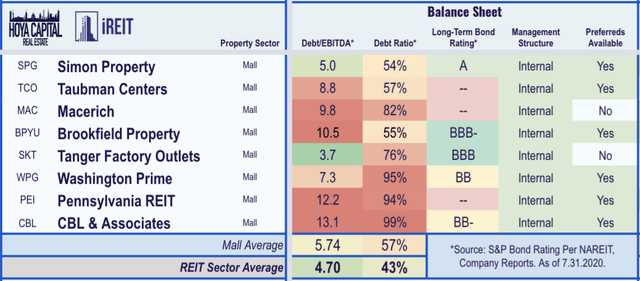

As if the retail apocalypse and coronavirus pandemic weren't big enough concerns for the enclosed mall format, these headwinds have been magnified by the sky-high leverage levels of many of these mall REITs. As of the end of July, four mall REITs currently operate at Debt Ratios above 80%, according to NAREIT, while all three lower-productivity mall REITs operate at levels over 94%, including small-cap CBL & Associates Properties, which continues to teeter on the edge of bankruptcy. As we've highlighted in various other reports including "REITs: This Time Is Different", while most commercial equity REITs entered the COVID-19 crisis on solid footing following a decade of conservative decision-making and prudent balance sheet management, mall REITs were generally the exception to the rule.

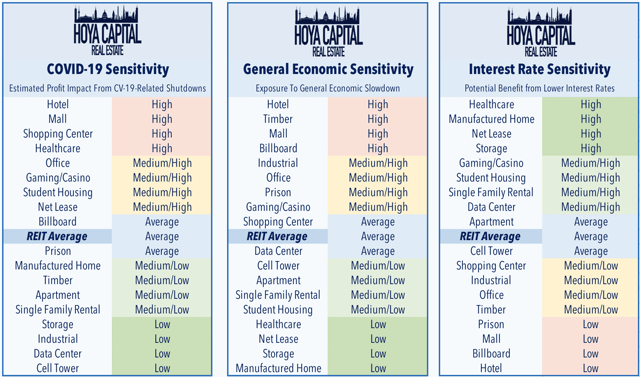

We've already seen bankruptcy filings this year from J.C. Penney, J. Crew, Neiman Marcus, and Modell's, among others, and there are likely more to come as the retail landscape continues to change and punish those who were slow to adapt. Below, we present our framework for analyzing each property sector based on their direct exposure to the anticipated COVID-19 effects, as well as their general sensitivity to a potential recession. We note that mall REITs fall into the "High" category in both direct COVID-19 sensitivity as well as general economic sensitivity. For mall REITs, however, even solid economic growth and relatively strong growth in retail sales in prior years weren't enough to avoid a fourth straight year of underperformance in 2019.

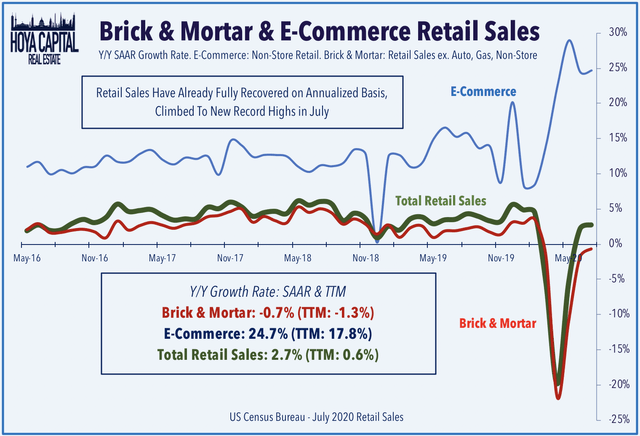

There are glimmers of hope for deep-value speculative investors, however, including the quick bounceback in retail sales to pre-pandemic levels, as well as the forthcoming post-pandemic "suburban revival" and Amazon's (AMZN) rumored interest in converting vacated department store space into distribution centers. Aided by the WWII levels of fiscal stimulus over the last several months, retail sales jumped to all-time record highs on an annualized basis in July, regaining all of the lost ground during the pandemic. Naturally, e-commerce sales have led the charge this year, with online sales now higher by nearly 25% from last year, while brick-and-mortar sales remain lower by 0.7% from last year. While there may be enough "saved-up stimulus" to keep sales rolling in August, the path forward for retail sales in months ahead becomes less certain if a fiscal stimulus agreement can't be reached.

Desperate times call for desperate measures, and we have been encouraged to finally see some "fight" and creativity from mall REIT executives over the past year after a decade of a seemingly "business-as-usual" strategy. Simon Property Group has been on a shopping spree, making investments into distressed retail brands, including Brooks Brothers, Lucky Brand, Forever 21, and, potentially, J.C. Penney. A strategy that does have successful precedent - notably the acquisition of Aeropostale in 2016 - the investments will keep many storefronts open, at least for now. Even so, retail research firm Coresight Research expects that between 20,000 and 25,000 stores will close in 2020, with 55-60% of the store closures being mall-based tenants.

Meanwhile, Simon Property Group's acquisition of fellow high-productivity mall REIT Taubman Centers remains in limbo after Simon attempted to pull out of its merger agreement in June, alleging that Taubman breached covenants of their merger agreement, specifically citing that TCO was disproportionately impacted by the pandemic and that it didn't take steps to mitigate the impact, an allegation that Taubman called "a classic case of buyer's remorse." Ultimately, market pricing still implies a high probability that the acquisition will eventually be completed. While we are skeptical that the lower-productivity enclosed mall format can remain viable over the next decade, we do believe that well-located high-productivity suburban malls that have the critical mass and "network effects" to offer a value-added retail experience can remain relevant.

Mall REIT Investors On A Roller-Coaster Ride in 2020

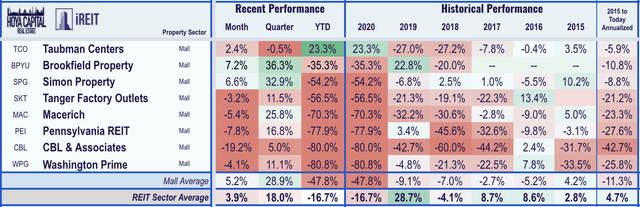

Mall REITs were slammed harder than any other property sector amid the depths of the coronavirus pandemic, plunging by as much as 60% at the lows in late March before seeing a robust "reopening rally" in April and May that saw the sector nearly double in value. This rebound proved to be a false start, as the subsequent reacceleration in coronavirus cases in the southern and western regions of the United States pushed back reopenings and pummeled the sector, before signs of life again began to emerge over the last several weeks. Despite the recent rebound, Mall REITs are the second-worst performing sector in 2020, with returns of -47.8% compared to the 16.7% decline on the Vanguard Real Estate ETF (VNQ) and the 4.7% gain on the SPDR S&P 500 Trust ETF (SPY), which has rebounded more than 50% from its lows in March.

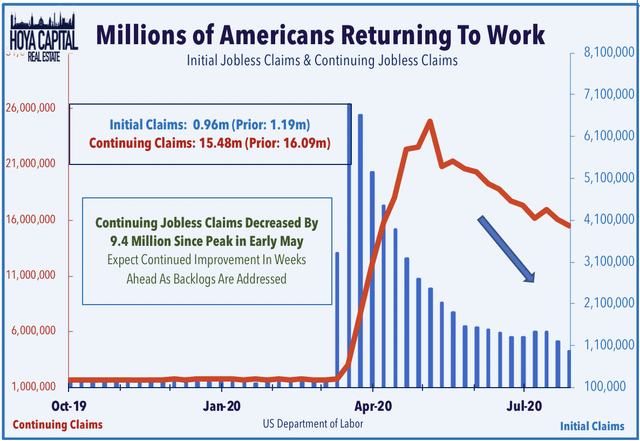

Recent signs of life in the mall sector have come amid a slow but unmistakable deceleration in coronavirus case counts over the last month and the upside surprises in economic data over the last several weeks. As discussed in our recent report, the Citi Economic Surprise Index has remained near record highs, while FactSet's Earnings Insight shows that 83% of S&P 500 companies reported a positive EPS surprise in the second quarter, which is the highest "beat percentage" since the data provider began tracking this metric in 2008. Strength in the housing market have provided the foundation for the recent recovery, while employment data has shown an encouraging retreat in Initial and Continuing Jobless Claims, no doubt helped by the reopening of these retail establishments over the last several months.

Simon Property Group and Brookfield Property REIT have rallied more than 30% over the last quarter, beating the 18% rebound for the broader REIT sector. Despite the recent rebound, however, five mall REITs remain lower by more than 70% this year. Taubman Centers remains the lone mall REIT in positive territory this year on Simon Property Group's plans to acquire the fellow high-productivity mall REIT. Since 2015, mall REITs have produced an annualized average total return of -11.3%, the worst among major property sectors during this time. Simon Property Group and Taubman Centers have been the best-performing mall REITs during this time, but have still produced negative annualized returns.

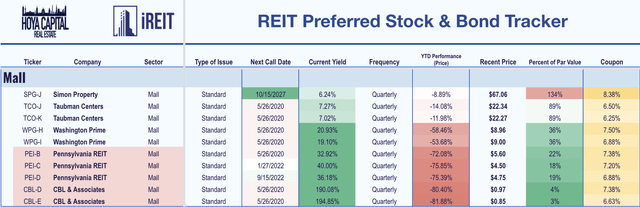

Interestingly, the preferred securities offered by these mall REITs haven't been much safer for investors in 2020. Six of the eight mall REITs offer preferred securities, including one issue from Simon Property (SPG.PJ), two from Taubman Centers (TCO.PJ, TCO.PK), two from Washington Prime Group (WPG.PH, WPG.PI), three from Pennsylvania Real Estate Investment Trust (PEI.PB, PEI.PC, PEI.PD), and two from CBL & Associates Properties (CBL.PD, CBL.PE) and one from Brookfield Property REIT (BPYUP). Among these six mall REITs, their preferred securities have outperformed their comparable common stock by just 3% in 2020, as the preferred dividends from CBL and PEI have been suspended, while those from WPG remain significantly in doubt.

Mall REIT Fundamentals Go From Bad To Worse

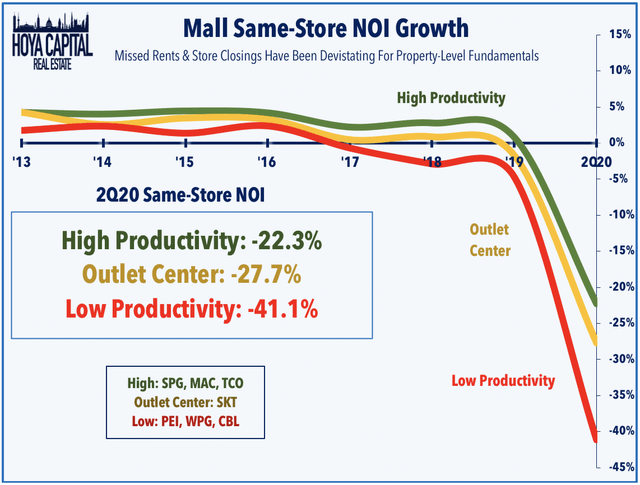

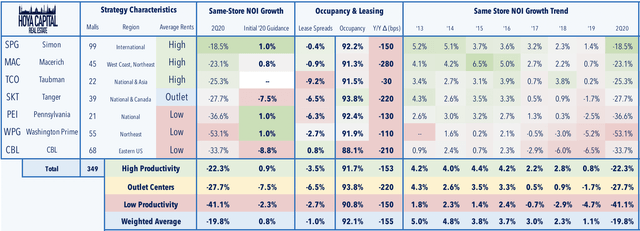

As the lone sector to record a full-year of negative same-store NOI growth at any point within the last decade, mall REIT fundamentals were the weakest in the real estate sector heading into 2020 before the outset of the pandemic. While the higher-productivity mall REITs generally managed to keep their heads above water amid the retail apocalypse, the water is clearly getting increasingly more treacherous. The three high-productivity mall REITs - SPG, TCO, and MAC - reported an average 22.3% decline in same-store NOI growth in 2Q20, by far the worst on record for any of these REITs. The lower-productivity mall REITs - PEI, WPG, and CBL - reported a devastating -41.1% average decline in same-store NOI growth. Tanger Factory Outlet Centers, the lone outlet center REIT, reported a decline in same-store NOI growth of -27.3%.

All eight mall REITs withdrew full-year guidance amid the pandemic, which had initially forecast an average same-store NOI increase of 0.8%. Occupancy declined roughly 150 basis points year over year for high-tier mall REITs and dipped another 150 basis points for the lower-tier malls, and we think we'll likely see sectorwide occupancy dip below 90% by the end of 2020 given the expected jump in store closures in the back half of 2020. As noted above, FFO per share growth was even more ugly than the property-level metrics, as the mall REIT sector saw an average decline of more than 45% in Funds From Operations in the first half of 2020 compared to the same period last year.

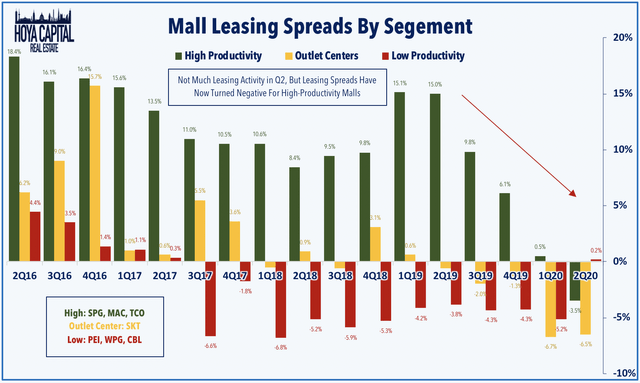

Leasing spreads, perhaps the best leading indicator of NOI growth, continue to point to declining growth in the years ahead, though these metrics didn't completely fall off the cliff quite yet, perhaps due to delays in leasing negotiations. Leasing spreads averaged -2.7% for the low-tier malls, which was actually an improvement from last quarter's rate of -5.2%. The high-productivity REITs reported an average 3.5% decline in leasing spreads, the lowest in more than a half-decade. We're watching leasing spreads in the back half of 2020 especially closely, expecting a sharp decline for the balance of the year and likely well into 2021 as market rents trend lower amid an anticipated jump in store closings, and expect to see double-digit declines in spreads for low-productivity mall REITs by the end of the year.

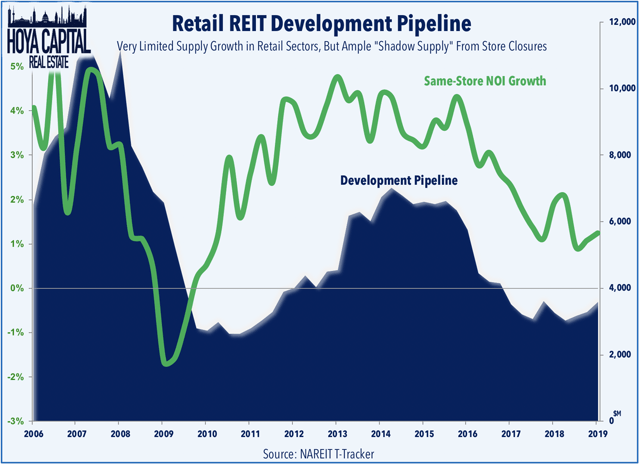

A potential saving grace for the retail sector, following a development boom during the 1990s and early 2000s, is that very little new retail space has been created since the recession. Despite that, the US still has more retail square footage than any other country in the world. Elevated levels of store closings in recent years, spurred by the rise of e-commerce and likely amplified by the coronavirus pandemic and related economic shutdowns, have created ample "shadow supply" of recently vacated space, which has negatively impacted retail REIT fundamentals. Just as the "network effects" of having a thriving ecosystem of diverse retailers was a key selling point of the enclosed mall format for tenants and shoppers alike during the rapid rise of the mall format from 1970 through 2000, investors and analysts are increasingly worried about the "death spiral" effect in struggling mall properties whereby occupancy and foot traffic falls below a level to keep the property viable.

Mall REIT Valuations and Dividends

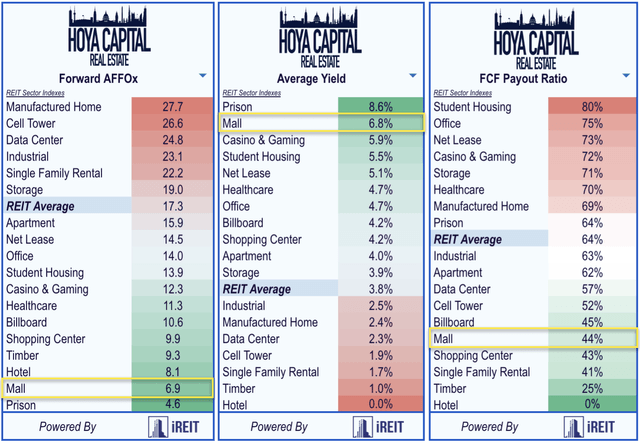

Mall REITs trade at some of the lowest valuations across the REIT sector, particularly the three lower-productivity mall REITs which trade at an average FFO multiple of roughly 2x. While value and yield-seeking investors may be attracted to these REITs, we caution that the "deep value" strategy hasn't been particularly rewarding to REIT investors over the past decade. In our recent report "The REIT Paradox: Cheap REITs Stay Cheap", we discussed our study that showed that lower-yielding REITs in faster-growing property sectors with lower leverage profiles have historically produced better total returns, on average, than their higher-yielding counterparts.

For the handful of larger REITs that have continued to pay their dividend, mall REITs have become one of the highest-yielding REIT sectors, but not necessarily for the right reasons. Helped by the large weighting to Simon Property Group, mall REITs pay a weighted average dividend yield of 6.8%, which is second only to prison REITs. As noted above, five mall REITs - SKT, WPG, CBL, PEI, and TCO - have completely eliminated their dividend in recent months while two others - SPG and MAC - have reduced their dividend, and we believe that a reduction from BPYU is imminent given the extended payout ratio.

Key Takeaways: Shop Till You Drop?

From bad to worse. Entering 2020 on already unstable footing following a wave of store closings over the past half-decade, mall REITs have been punished by the ongoing coronavirus pandemic. They have plunged nearly 50% so far in 2020. Absent a miracle, mall REITs are likely to underperform the REIT average for the fifth straight year in 2020. Rent collection averaged less than 50% and same-store NOI dipped roughly 30% in Q2, while FFO per share has plunged a mind-numbing 45% through the first half of 2020.

The forthcoming post-pandemic "suburban revival" offers a glimmer of hope for deep-value investors, as does Amazon's rumored interest in converting vacated department store space into distribution centers. While this suburban revival may be enough to breathe some life back into the high-productivity mall properties and keep stores open over the next decade, we continue to see insurmountable challenges for the Class B and C malls and believe this segment of the sector should be avoided for non-speculative investors.

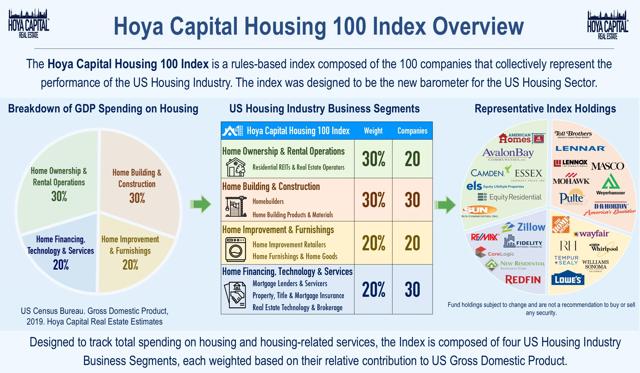

If you enjoyed this report, be sure to "Follow" our page to stay up to date on the latest developments in the housing and commercial real estate sectors. For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Storage, Timber, Prisons, Real Estate Crowdfunding, and REIT Preferreds.

Disclosure: Hoya Capital Real Estate advises an Exchange-Traded Fund listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Teams Up With iREIT

Hoya Capital is excited to announce that we’ve teamed up with iREIT to cultivate the premier institutional-quality real estate research service on Seeking Alpha! Sign-up for the 2-week free trial today! iREIT on Alpha is your one-stop source for unmatched Equity and Mortgage REIT coverage, Dividend ETF Analysis, High-Yield REIT Preferred Stocks & Bonds, real estate macroeconomic research, REIT and property-level analytics, and real-time market commentary.